|

Report from

Europe

FLEGT products biggest winners in EU tropical wood market

An analysis of EU trade data by the FLEGT Independent Market Monitor

(IMM), an ITTO project funded by the EU, shows that FLEGT licensed

products from Indonesia, particularly wooden furniture and doors, were

on course to be the biggest winners in the EU tropical timber market

last year.

Overall the EU¡¯s trade in tropical wood and wooden furniture products

was more buoyant in the first nine of months of 2019 than the same

period in 2018.

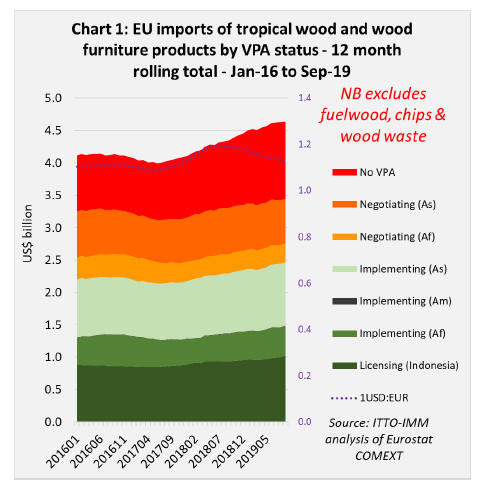

Chart 1 shows twelve monthly rolling total US$ value of imports (to iron

out seasonal fluctuations) from tropical countries into the EU of all

wood and wooden furniture products listed in HS Chapters 44 and 94

(excluding fuelwood, wood waste and chips).

The 12-month rolling total fell to a low of US$3.99 billion in June 2017

but had rebounded to US$4.35 billion by September 2018 and gained an

additional US$0.28 billion in the following 12 months to reach US$4.63

billion by September 2019.

Initially, the recovery in the US dollar value of EU imports was driven by

exchange rate fluctuations as the euro increased sharply in value

against the US dollar in 2017. However, from mid-2018 to mid-2019, the

euro was weakening against the US dollar and the rise in dollar import

value coincided with a genuine increase in import quantity.

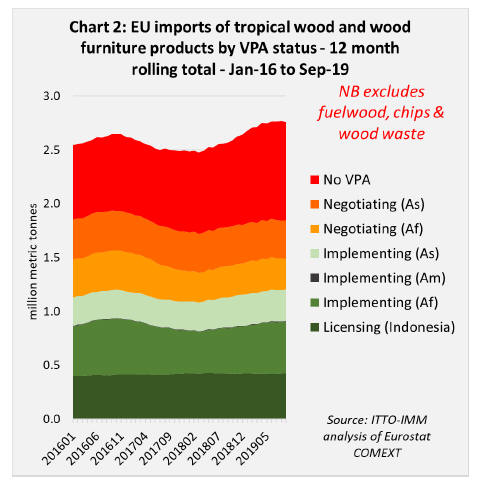

Chart 2 shows that the 12-month rolling total quantity of EU tropical

wood and wooden furniture imports dipped to 2.5 million metric tonnes

(MT) in March 2018, then increased to 2.8 million MT in June 2019,

remaining at that level through to September 2019.

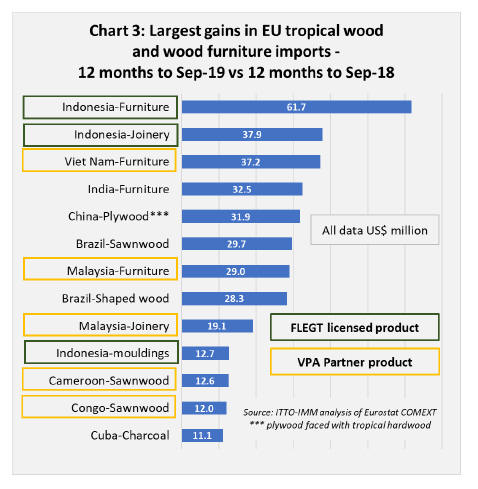

Indonesian Licensed products feature prominently in the league table of

the largest gains in EU tropical wood product imports in the year to

September 2019 (Chart 3).

Indonesian furniture led the way with imports in the year to September

2019 being US$61.7 million greater than in the previous 12-month period.

Indonesian joinery products were in second place, gaining US$37.9

million in the same period. Indonesian mouldings/decking made it on to

the list of big gainers, adding US$12.7 million.

There was also a small gain in EU imports of Indonesian plywood, which

were US$3.6 million greater in the year to September 2019 compared to

the previous 12-month period.

This occurred despite a background of intense direct competition from

Russian birch plywood products. IMM contacts with EU plywood importers

suggest that prices for Russian products are highly competitive due both

to low prices for birch logs in Russia and continuing weakness of the

Russian rouble.

Amongst VPA countries other than Indonesia, significant gains were also

seen in EU imports of furniture from Viet Nam and Malaysia, joinery

(mainly laminated wood) from Malaysia, and sawnwood from Cameroon and

the Republic of Congo.

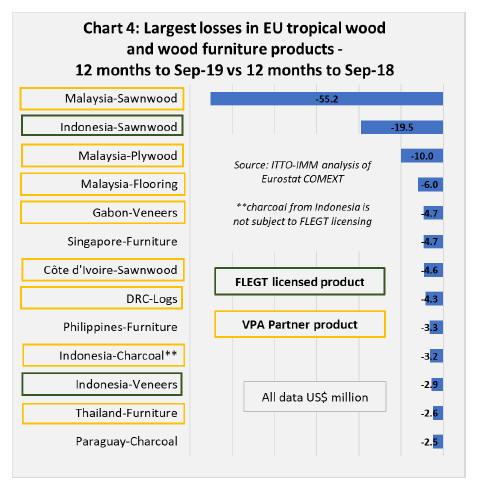

Less positive from a FLEGT perspective is that two Indonesian product

groups ¨C sawnwood and veneer - also appear in the list of the biggest

losers in the year to September 2019, although the deficits are more

moderate than for Malaysia which suffered a particularly sharp decline

in EU imports of sawnwood (Chart 4).

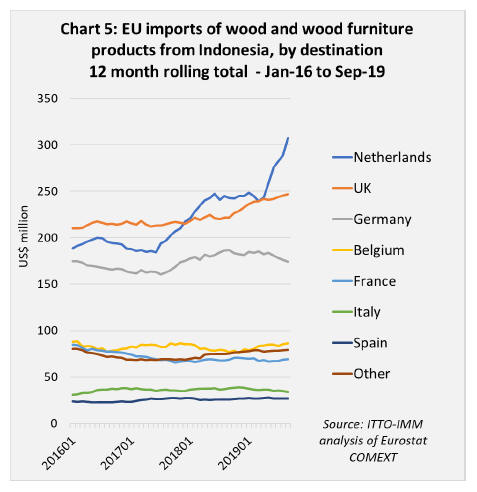

Much of the recent growth in EU imports of Indonesian wood and wooden

furniture products has been destined for the Netherlands and UK (Chart

5). Last year¡¯s surge in imports of Indonesian wooden furniture was

destined mainly for the Netherlands. The UK is the largest growth

destination for wooden doors and plywood from Indonesia. Most EU imports

of decking and mouldings from Indonesia are destined for Germany and the

Netherlands.

Campaign to promote FLEGT licensed timber

The UK Timber Trade Federation¡¯s FLEGT communication project is planning

to take installations featuring FLEGT-licensed timber around the EU in

2020. The initiative is funded by the UK Department for International

Development under its Forest Governance, Markets and Climate programme

(FGMC).

Last year the TTF project promoted FLEGT at the Brussels Furniture Fair

and several conferences and organised a Tropical Trade Forum at the

TTF¡¯s London headquarters.

It also supported an installation called Momento, designed by students

using FLEGT licensed balau as part of the London Festival of

Architecture.

The 2020 installation will be called Conversations and will feature

seating in FLEGT-licensed timber created by craft students and leading

designers, intended to stimulate discussion about FLEGT and using legal

and sustainable tropical timber. After a pilot in the UK it is intended

to set up in prominent locations across the EU.

The TTF campaign will run more seminars, develop an e-learning resource

for architects and contractors. It is also liaising on FLEGT with

Chinese timber trade bodies. Under the FGMC grant, the Federation is

also backing a timber marketing advisory programme being undertaken by

the Global Timber Forum in Ghana and Indonesia.

Indonesia loses GSP status in the EU

As of 1 January 2020, Indonesia no longer qualifies for

Generalised Scheme of Preferences (GSP) tariff rates on Wood and Wood

Products in the EU.

The GSP system has ¡®graduation mechanisms¡¯ for ascertaining a country¡¯s

eligibility for preferential duty rates. These include the value of its

exports of specific goods to the EU as a percentage of all EU GSP

imports of those products. According to the EU, Indonesia exceeded the

ceiling of 57% under this calculation for three years, so losing its GSP

status.

It remains to be seen whether removal of Indonesia¡¯s GSP status from 1st

January 2019 will have any significant impact on EU imports.

Loss of GSP status will have no effect on trade in those products like

decking/mouldings and most wooden furniture which are zero tariff for

all EU imports. However, it means higher tariffs for Indonesian plywood,

veneers, and planed, sanded and finger-jointed sawn timber.

For plywood, probably the most significant Indonesian wood product

influenced by GSP status, the tariff has increased from 3.5% to 7%.

EU imports from Myanmar continue despite EU prohibition

At their December meeting, the EU Expert Group on EUTR and FLEGT,

comprising representatives of the EC and government authorities from

across the EU, reiterated their view that it is not possible to

demonstrate a negligible risk that any timber from Myanmar is legally

harvested in line with EUTR definitions.

According to the Expert Group this is due to ¡°lack of sufficient access

to the applicable legislation and documentation from governmental

sources¡±.

This opinion of the Expert Group, which reiterates previous conclusions

made at earlier meetings in June and September, implies that any

operator placing Myanmar timber on the EU market will be liable to

prosecution for failure to undertake adequate due diligence under the

terms of the EUTR.

Authorities in several EU member states have sanctioned operators

trading in Myanmar teak. In the three years since 2017, a variety of

legal cases have been brought against importers of teak in Belgium,

Denmark, Germany, Netherlands, Sweden, and the UK, involving

confiscation of the timber or requiring it¡¯s return to Myanmar, and

additional sanctions such as fines.

The report of the Expert Group¡¯s December meeting indicated that

additional cases are now being brought in the Czech Republic and

Austria. The Expert Group observed that these enforcement activities are

leading to changes in the direction of trade around the EU.

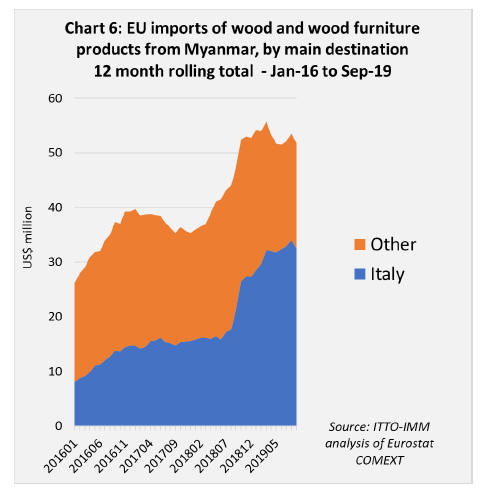

ITTO¡¯s own analysis of trade flow data confirms that there have been

significant changes in the direction of trade, but no sign of decline in

overall imports from Myanmar. EU imports of wood products from Myanmar

were valued in excess of US$50 million in the 12 months to September

2019, double that of 5 years before.

During this period imports into Italy increased four-fold to over US$30

million (Chart 6).

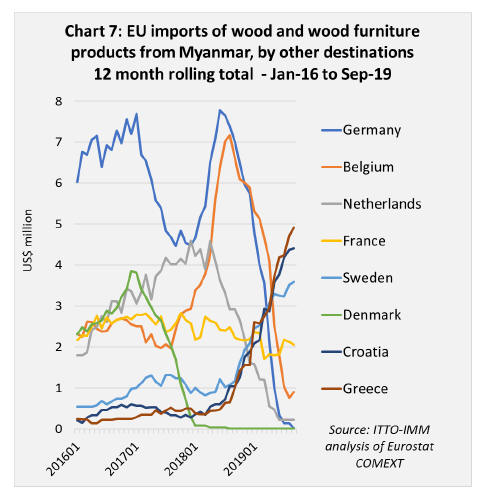

During the same period direct imports from Myanmar into Germany,

Netherlands, Belgium and Denmark fell to negligible levels. However, in

addition to Italy, there was a significant increase in imports (from a

very small base), into Greece, Croatia and Sweden. Imports into France

remained low but consistent at around US$2 million per year (Chart 7).

The continuing reluctance of EU officials to accept that negligible risk

of illegal harvest can be demonstrated in Myanmar comes despite

additional information and wide-ranging discussion of EU due diligence

requirements at a national FLEGT multi-stakeholder dialogue held in Nay

Pyi Thaw, Myanmar, in November.

According to a report on the dialogue in the minutes of the EU Expert

Group meeting in December, ¡°this multi-stakeholder group (MSG) was set

up in the course of the pre-preparatory process towards a VPA in

Myanmar¡±, although ¡°already last year it was made clear that the [VPA]

process was halted¡±.

The MSG, which operates at national level with associated regional

groups, includes representatives of government (including State-owned

Myanmar Timber Enterprise, MTE), private sector and civil society

organisations (CSOs). The dialogue meeting in November involved about

150 people.

The dialogue was funded and facilitated by the EU FLEGT facility and the

FAO-EU FLEGT Programme. The EU Expert Group minutes go on to note that

¡°although the VPA process is stopped, having the MSG as an interlocutor

is very helpful in the strife for improved forest governance and law

enforcement in Myanmar¡±.

The EU Expert Group minutes state that ¡°Myanmar applied for funding from

the FAO-EU FLEGT Programme for further multi-stakeholder meetings to

prepare a work programme for activities that could be funded by the

Programme from 2020-2021 and build capacity to submit quality project

proposals¡±.

¡°The intention is to ensure ownership of the process [in Myanmar] of all

stakeholders and at the same time avoid the pursuit of (often costly)

activities promoted by some stakeholders predominantly interested in

trade, which, in the end, do not constitute adequate measures to ensure

good forest governance and legal timber harvest¡±, according to the EU

Expert Group minutes.

The EU Expert Group meeting minutes conclude that ¡°dialogue with Myanmar

has clarified what issues must be addressed in order to outline a way

forward towards good forest governance and legal timber harvest, which

would provide sufficient transparency to enable operators to carry our

due diligence correctly and adequately mitigate to a negligible level

the risk of illegal harvested timber being placed on the internal

market. It also showed avenues for working together with IMM in this

context, without giving false expectations¡±.

The EU Expert Group also ¡°took note of the fact that the Annual

Allowable Cut (AAC) for the 2019/2020 season was made available online

in November¡±.

However, the EU Expert Group also note that ¡°other applicable

legislation is not fully accessible for EU operators within the meaning

of Article 6 (1)(a) of the EUTR, enabling operators to fully comply with

Article 5 of Implementing Regulation (EU) No 607/2012, e.g. because it

is declared internal or it only exists in Burmese.

Full risk assessment and choosing and applying adequate mitigation

measures to address each of these risks is therefore not possible¡±.

EU invites feedback on EUTR and FLEGT Regulations

The EU Commission is calling for public feedback on the functioning of

the FLEGT Regulation and EUTR, the two key legal instruments of the

FLEGT Action Plan. According to the EU Commission, this ¡°fitness check¡±

will consider ¡°the effectiveness, efficiency, coherence, relevance and

EU added value of both regulations [and] will help assess whether the

instruments are fit for purpose or need to be revised¡±.

Findings of the fitness check will also be considered in the assessment

of demand-side measures for other commodities associated with

deforestation. Commitments to this effect are embedded in a

¡°Communication on Stepping up EU Action to Protect and Restore the

World¡¯s Forests¡±, which the Commission adopted in July 2019.

Comments on the EUTR and FLEGT Regulations can be submitted until 28

February 2020 at the following link:

https://ec.europa.eu/info/law/better-regulation/initiatives/ares-2020-581028-0_en

New VPA partner profiles on IMM website

The FLEGT IMM website now features detailed profiles of all VPA

partner countries that have either reached the FLEGT Licensing stage

(Indonesia) or are implementing a VPA (Cameroon, Central African

Republic, Ghana, Guyana, Honduras, Liberia, Republic of Congo, and Viet

Nam).

The profiles include overviews of countries¡¯ forestry sectors, timber

industry and trends in global trade in timber and timber products as

well as more detailed analysis of trade with the European Union. The

profiles also contain a summary of each country¡¯s progress in VPA

implementation.

More country reports of currently still negotiating countries will be

added as soon as the VPA with the EU is signed and work to implement a

FLEGT Licensing system is underway.

More details at:

https://www.flegtimm.eu/index.php/vpa-countries

UK plans to spearhead crackdown on illegal timber

According to an article in the Guardian newspaper, the UK wants

to spearhead ¡°a major global crackdown on illegal timber and

deforestation¡± by forming a coalition of developing countries against

the trade as part of its hosting of UN climate talks in Glasgow in

November this year.

According to the article ¡°all countries are expected to come forward

with tougher plans to reduce global emissions as part of COP 26, and

experts have said this will only happen if the UK takes the lead in

forming a coalition of small and big developing countries, including

forested African nations and Indonesia, as well as major economies such

as the US, China, India and the EU¡±.

The new project, still in the planning stages, will build on the UK

government¡¯s forests governance, markets and climate programme, the

focus of which includes strengthening the rule of law in affected

countries in the developing world, influencing international partners to

increase their efforts, supporting responsible trade and helping

stakeholders on the ground to act.

The article notes ¡°in 2005, only about a fifth of Indonesia¡¯s timber

trade was legal. But today, after interventions by the UK and other

partners, 100% of exports are sourced from independently audited

factories and forests¡±.

More details:

https://www.theguardian.com/environment/2020/feb/13/uk-lead-global-fight-illegal-logging-deforestation-cop-26

France requires public buildings to be at least 50% wood

According to the newspaper Times of London, President Macron

has ordered that new public buildings financed by the French state must

contain 50% wood or other organic material by 2022 under an ambitious

government plan for a greener urban life.

The government announcement, made on 5 February, is part of a drive for

sustainability by Mr. Macron, who wants France to set an example in the

face of climate change.

Julien Denormandie the minister for cities and housing, said the plan

would promote low-carbon towns ¡°that are capable of adapting to

heatwaves and floods. To show an example by the state, I am imposing on

all the public entities that depend on me and which manage development

to construct buildings with material that is at least 50 percent wood or

from bio-sourced material.¡±

According to the Times, bio-sourced material can include a vegetable

component such as hemp or straw.

Building works covered by the new 50% rule include urban development

projects co-financed by the state and local government in Paris and 13

other cities. According to the Times, in two decades some €9 billion has

been spent on these projects, which mix housing and business premises.

The Times also reports that Paris has promised to include a high level

of wood in all new construction for its 2024 Olympic games. Olympic

buildings of up to eight storeys must be 100% wood and if higher contain

some wood in their structure.

Elsewhere in France, according to the Times, work has begun on a

16-storey 181ft all-wood building with 98 apartments in Bordeaux, which

will be France¡¯s tallest wooden construction.

EU Commission urges Romania to stop illegal logging

The European Commission issued a letter of formal notice to

Romania on 12 February giving it one month to take the necessary

measures to address shortcomings in forest governance identified by the

Commission.

The Commission is urging Romania to properly implement the EU Timber

Regulation (EUTR), which prevents timber companies from producing and

placing on the EU market products made from illegally harvested logs. In

the case of Romania, the national authorities have been unable to

effectively check the operators and apply appropriate sanctions.

Inconsistences in the national legislation do not allow Romanian

authorities to check large amounts of illegally harvested timber. In

addition, the Commission has found that the Romanian authorities manage

forests, including by authorising logging, without evaluating beforehand

the impacts on protected habitats as required under the Habitats

Directive and Strategic Environmental Assessment Directives.

Furthermore, there are shortcomings in the access of the public to

environmental information in the forest management plans. The Commission

also found that protected forest habitats have been lost within

protected Natura 2000 sites in breach of the Habitats and Birds

Directives.

FAO statistics show that Romania is the EU¡¯s second largest producer of

hardwood sawlogs, after France, producing around 4.3 million cu.m in

2018. It is also the EU¡¯s largest single producer of sawn hardwood, with

production of 1.6 million cu.m in 2018. Much of this volume is exported,

mainly to China, North Africa and the Middle East, although exports

declined last year in response to cooling global demand.

At the International Hardwood Conference in Berlin in November last year,

the European Sawmillers Association EOS reported that prices for

Romanian sawn hardwood were falling and warehouse stocks were rising.

Efforts were being made to curtail Romanian sawn hardwood production

which EOS expected to be down up to 15% overall in 2019. EOS noted that

the whole wood sector in Romania is suffering from lack of access to

finance and low levels of investment.

The EU¡¯s formal letter implies that widespread illegal logging is

another factor contributing to unstable market conditions in the

country.

|