Japan

Wood Products Prices

Dollar Exchange Rates of 10th

March

2020

Japan Yen 109.59

Reports From Japan

Bank of Japan primed for action to protect

economy

Cabinet Office data is showing that in the third quarter of

2019 Japan's economy declined almost 2% from the

previous quarter. Looking ahead at the first quarter of

2020 the Bank of Japan (BoJ) Governor has said the

corona virus outbreak has dented exports and consumption

and could inflict serious damage on the Japanese

economy. The Bank is ready to take action, he said.

The Japanese economy is already suffering the after

effects of the 2019 consumption tax increase and the

severe storms that lashed the country causing extensive

damage to homes and infrastructure. Data for January

2020 show that household spending dropped for the fourth

consecutive month, the longest stretch of contraction since

early 2018.

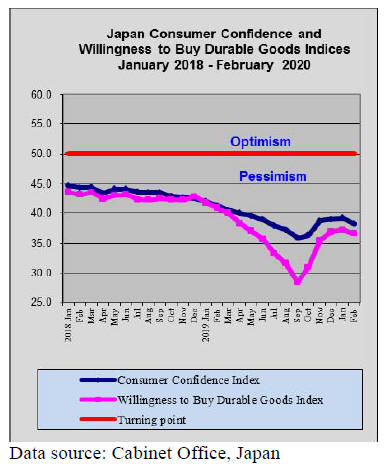

Consumer confidence ¨C virus effect muted so far

The corona virus is has greatly undermined consumer

confidence around the world as could be expected but the

impact varies. In Japan the spread of the virus has been

slow due to efforts by the public and because of measures

by the government such as school closures and public

event cancellations.

The impact of the corona virus on Japanese consumer

sentiment has been muted mainly because Japanese

households were already quite negative because of the

sluggish economy and the recent consumption tax

increase.

Bankruptcies rise for the first time in more

than a

decade

The research agency, Tokyo Shoko Research, has reported

that the number of corporate bankruptcies in Japan

increased in 2019 for the first time in 11 years. The agency

points to the combined impact of the 2019 consumption

tax hike, labour shortages and the spate of natural disasters

as drivers of higher bankruptcies.

It is reported that most companies filing for bankruptcy

were small firms with fewer than 10 employees. The

agriculture, forestry, fisheries and mining sectors were the

worst affected. Tokyo Shoko Research writes "Mediumsized

and small companies have been in a difficult

situation as the labour crunch has raised personnel costs

and squeezed profit margins.¡±

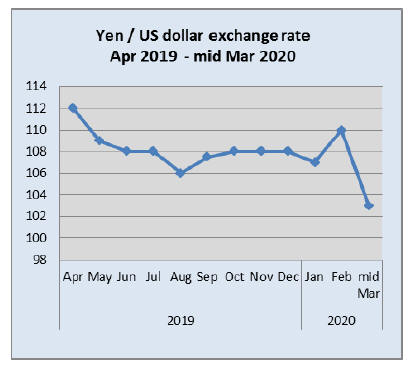

Yen see-saws, volatility could undermine export

competitiveness

The yen rose sharply against the US dollar in early March

rising to around yen 103 yen to the dollar, the highest

since November 2016.

The Ministry of Finance has raised concerns over the yen

volatility pointing out swings in exchange rates, either up

or down are undesirable. The fear among policy makers is

that a prolonged period of yen appreciation could

undermine export competitiveness.

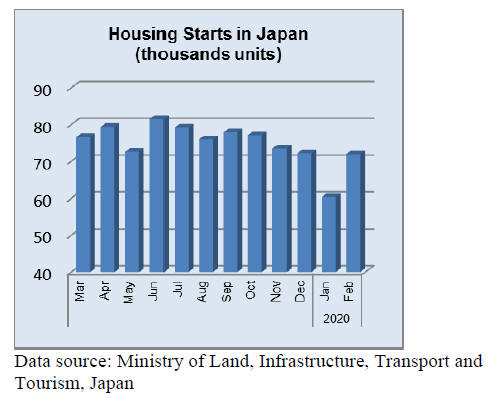

Firm demand for condos in Tokyo

Even before the corona virus outbreak construction

companies in Japan were finding it hard to attract workers

and had come to rely heavily on immigrant workers now

construction firms are faced with new problems of raw

material issues as supply chains are being disrupted by the

coronavirus outbreak.

According to the Land Institute of Japan in 2019 existing

condominium sales in Tokyo rose almost 2.5% while sales

of existing detached houses in Tokyo increased around

4.5% year on year. In contrast, housing starts in Japan

dropped in 2019.

February housing starts rose sharply month on month

largely because the weather improved allowing

construction work to proceed.

Year on year February starts were slightly higher. The

increase was driven mainly by construction of owneroccupied

homes and condominiums.

Import update

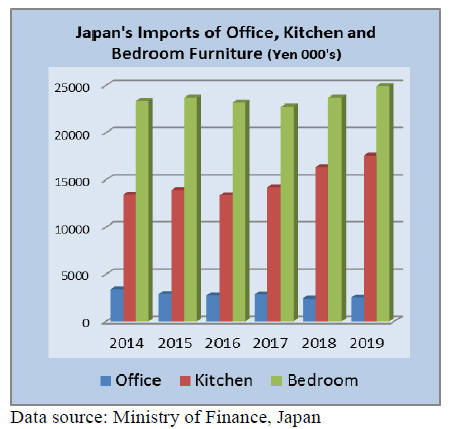

Long term furniture import trend

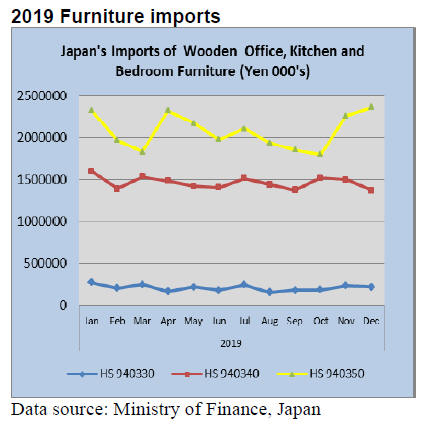

It will be seen from the graphic below that there has been

a steady decline in Japan¡¯s imports of wooden office

furniture. What comes as something of a surprise is that

the value of imports of both wooden kitchen and bedroom

furniture have shown signs of trending higher over the past

three years, even in the face of a weak housing market.

Some of the upward trend in kitchen furniture could be

explained by the growing interest in home renovation but

this does not explain the rise in imports of bedroom

furniture.

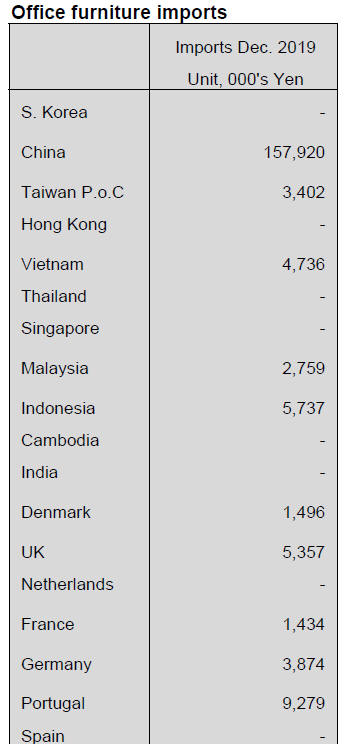

Office furniture imports (HS 940330)

Year on year Japan¡¯s December 2019 imports of wooden

office furniture (HS940330) were up 16% but compared to

the previous month December imports dropped 8%.

China, Poland and Portugal have been the top shippers of

HS940330 throughout 2019. In December shipments from

manufacturers in China accounted for over 70% of all

wooden office furniture imports.

Shipments from Poland, the second largest supplier in

December, accounted for just 6% of imports while the

third largest shipper, Portugal, added another 4%. In

December 2019 Italy was not a significant supplier.

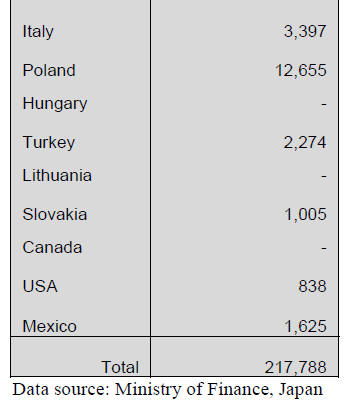

Exporters in the Philippines and Vietnam accounted

for

most of Japan¡¯s imports of wooden kitchen furniture

(HS940340) in December 2019, as they did for most of the

year. Shippers in the Philippines took 45% of import

demand in Japan with a further 37% being captured by

Vietnam.

Exporters in China accounted for just 11% of December

2019 imports of wooden kitchen furniture. The other

significant but small supplier was Thailand with a modest

3% share of December imports.

Year on year imports were down 11% and there was an

8% month on month decline in the value of imports.

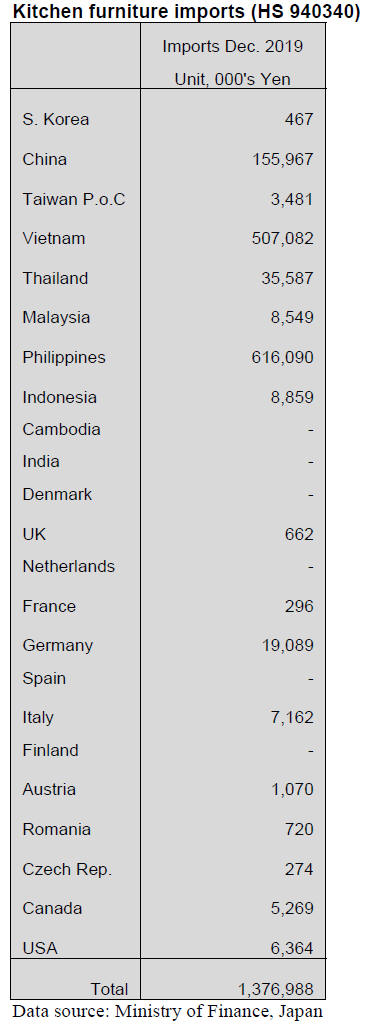

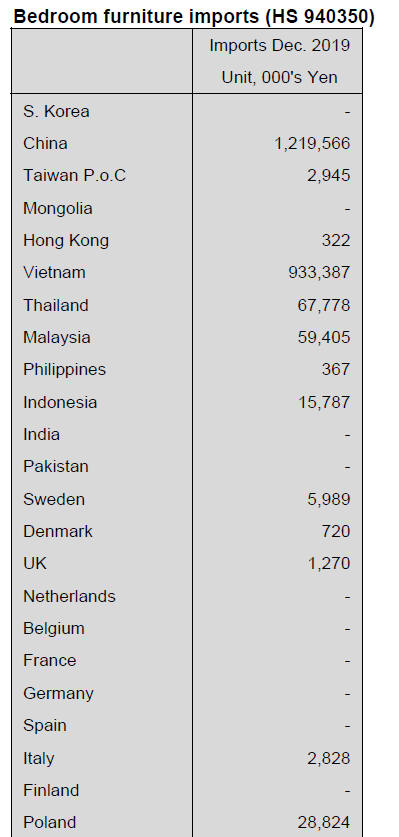

Bedroom furniture imports (HS 940350)

Japan¡¯s imports of wooden bedroom furniture continued

higher in December 2019 building on the gains in the

previous month. The surge in imports of wooden bedroom

furniture at year end is a pattern repeating itself over

recent years.

Two shippers, China and Vietnam, accouned for over 90%

of Japan¡¯s wooden bedroom furniture imports in

December 2019 with Chinese shipper taking the lion¡¯s

share at 52%. The other shippers of note were Thailand

and Malaysia with around 2-3% each.

Year on year, December imports of wooden bedroom

furniture rose 17% and month on month there was a 4%

rise.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Forest product trade of China in 2019

Despite trade war between China and the U.S.A., contrary

to the expectation that forest products trade of China drops

considerably in 2019, log import was only 0.9% less than

2018 and lumber import increased by 1.5%. This is the

second highest import.

Log imported volume was 59,133,000 cbms and lumber

was 37,165,000 cbms. Logs from New Zealand were the

highest with 17,735,000 cbms, 2.0% more than 2018 while

log import from other sources like Russia, U.S.A, and

Malaysia declined.

Russia was the top log supplying country but because of

high log export duty, it decreased by 28%. Logs from the

U.S.A decreased by 41% due to duty problem by the trade

war. Meanwhile lumber import from Russia was record

high with 18,340,000 cbms. Lumber from Canada

increased.

Plywood export by China was 10,176,000 cbms in 2019.

This year¡¯s problem is outbreak of corona virus disease,

which hampers smooth operation of wood products¡¯

supply chain by restriction of people¡¯s movement.

Delayed shipment of Chilean lumber

The second ship in 2020 of Chilean radiate pine lumber

will delay arrival to Japan by more than a month. Loading

in Chile will be middle of April so the arrival to Japan will

be late May or early June. The first ship will arrive in

March so there will be more than two months interval.

One of the reasons of the delay is restoration of stagnated

crating lumber market in Japan. The market in Japan has

been in slump since last year with stagnated movement

then the shipment to China also slowed down by recent

outbreak of corona virus.

The suppliers hope that the market in Japan would restore

and the inventories would be consumed during two

months interval. After the third ship, plan is to arrange

shipment with 50-60 days interval so total number of ships

in 2020 will be six as originally planned. The export prices

for the second ship are unchanged from the first ship with

about US$300 per cbm C&F on both thin board and

square.

As to higher ocean freight by costly low sulfur oil, the

suppliers plan to add little by little after the third ship if

Japan market recovers enough to accept extra prices.

2019 plywood supply

Total plywood supply in 2019 is 5,859,100 cbms, 4.6%

less than 2018. This is the first time that total supply

decreased less than six million cbms in three years. Both

production and shipment of domestic softwood plywood in

2019 recorded the highest. Meanwhile imported plywood

in 2019 is the lowest in last 20 years. In particular, the

supply from Malaysia dropped less than one million cbms,

the lowest in last 24 years since 1995.

Share of domestic plywood is 56.7 %, 4.3 points up. It

was 2016 when the total supply drooped under six million

cbms. In this year domestic supply exceeded 3 million

cbms and the imports was the record low and this is the

year that domestic share exceeded the imports for the first

time and the difference got larger last year.

Supply of imported plywood has been under three million

cbms since 2015 when the supply decreased from

Sarawak, Malaysia by environmental restrictions. The

supply decreased down to 2,700,000 cbms in 2016 then

over 2,900,000 cbms in 2017 and 2018 but in 2019, the

importers reduced the purchase by high export prices and

depressed market in Japan.

There are four months in 2019 with monthly arrivals are

less than 200,000 cbms so total supply dropped down to

2,535,000 cbms, 13.3% less than 2018. Supply from all

the major sources decreased. Malaysian supply was

874,900 cbms. Chinese supply was less than 600 M cbms,

the lowest in ten years. Indonesia supply was less than

900,000 cbms.

B.C. revises lumber export regulation

manufactured forest products regulation) since July 1,

2020 Maximum lumber size is changed from 17¡± square

to 12¡± square and also cross section of lumber of less than

0.2 square meters is revised to 0.1 square meters or less.

On red cedar and cypress (yellow cedar), export of only

finished products is allowed.

Purpose of these revisions is to increase more processing

and make value added products but industry people

comment that these are not realistic, particularly on red

cedar and cypress because exporting items are large

fitches, which are for re-sawing into smaller custom made

lumber in Japan.

If required condition is not satisfied, it is necessary to

acquire exemption certificate and pay compensation. This

is practically export duty.

Majority of main export items like SPF, hemlock and

Douglas fir from B.C. are satisfied with the conditions but

red cedar and cypress are hard to satisfy the condition.

Particularly cypress is processed into smaller order made

lumber in Japan from flitches so it is not practical to

export finished size.

General comment is that there is very little merit for

lumber industry in B.C. by this revision. There is more

than 20% duty for export to the U.S. market and value

added products are imposed higher duty.Also there are not

enough remanufacturing plants in B.C. and there is very

little company, which is willing to invest building for

remanufacturing facility.

Import of red cedar and cypress lumber for Japan from

B.C continues declining. In 2019, red cedar was 36,992

cbms, 13.3% less than 2018 and cypress was 33,927 cbms,

24.8% less. Together with declining demand in Japan,

supply side is also getting frail. Western Forest Products

continues more than seven months strike and Interfor

closed Hammond mill at the end of last year, which was

main red cedar lumber mill.

South Sea (tropical) logs

Supply and demand of South Sea hardwood logs are

balanced. PNG announced increase of log export duty

since February so higher cost logs will come in since

March.

Also quarantine is tightened after corona virus disease in

China and log ships need to call main port in PNG, which

increases sailing days and increases the freight. PNG log

users in Japan say that it is tough time to swallow higher

cost now. Production of Chinese made red pine free board

is practically stopped by the corona virus disease as

workers are ordered to stay home for two weeks.

Cedar lumber export to the US market

Kyowa Lumber (Tokyo) looked for a chance to export

Japanese cedar lumber to the US market since two years

ago and has shipped some to test the market since last

year. It studied quality the US market demands and

introduced special processing machines.

The orders have been increasing and now it ships about

1,000 cbms a month steadily. It intends to develop the

market in the US. with variety of items.

Japanese cedar has been used to substitute North

American red cedar, which supply keeps shrinking and the

prices are soaring. The demand has been expanding since

three to four years ago.

Japanese cedar looks the same as North American red

cedar but they are different so Kyowa has been

investigating if the substituting demand is real or not. It is

now convinced that there is certain demand and the market

should last longer.

The exported lumber is displayed at DIY stores in the

U.S.A. together with red cedar and redwood lumber.The

main size is 1x4-6 with length of 6 and 8 feet. It is rough

lumber. Kyowa introduced the same machine, which

manufactures fence lumber in the U.S.A.

The lumber is mainly used as outdoor fence and decking.

Kyowa thinks that the demand for lumber in Japan would

keep shrinking with depopulation in future so it needs to

look for outside markets.

Oshika developed lignin fenol adhesive for plywood

Oshika Corporation (Tokyo), adhesive manufacturer, has

developed lignin fenol adhesive for plywood

manufacturing. It has been testing this new adhesive at

Niigata Gouhan Shinko and has acquired JAS certificate

on January 7, 2020.

Lignin is one of ingredients wood contains with cellulose.

Softwood contains 25-30% lignin and hardwood does 20-

25%.When manufacturing paper and pulp, lignin is

removed and is used as fuel in the past. Meanwhile lignin

has function to glue fibers together.

Oshika has been studying for last ten years how to use

plant originated materials as adhesive since general trend

is to avoid using fossil fuels and it has been developing

environmentally friendly materials.

Lignin is procured from UPM Kymmene of Finland.

Kymmene has been manufacturing resin from renewable

materials like wood and anxiously developing biorefinery

business.

Lignin is blended with fenol resin and reacts with formalin

to make lignin fenol adhesive. Acquired JAS covers low

formaldehyde structural plywood, termite treated

structural plywood and standard plywood.

Review of 2019

There are two different pictures on plywood market. One

is booming domestic plywood and another is stagnant

market of imported plywood.

Total plywood supply in 2019 was below six million

cbms. Domestic plywood market continued briskness for

whole year.

Plywood market used to fluctuate so often and so much

that the manufacturers struggled to survive but in last four

years, the demand has been robust without much dip and

the plywood manufacturers have made full production.

Thus, both the production and shipment in 2019 was

record high.

Actually the shipment was so active that it often exceeded

the production and the inventory has been in very low

level like less than one month. There are two new plywood

mills started in 2019 and some feared over-supply when

they started but the market absorbed additional supply

without any problem.

Total supply of domestic plywood in 2019 was 3,324,000

cbms, 3.3 % more than 2018 out of which softwood

plywood was 3,200,000 cbms, 3.6% more while the

imported plywood was 2,535,000 cbms, 13.3 % less than

2018 so that the share of domestic plywood was 56.7%.

The market in the western Japan in the first half of the

year was busy by restoration demand for flood and land

slide damages caused by typhoons in 2018. In the Eastern

Japan, the market softened when two new plywood mills

started in fear of over-supply so the market prices

weakened.

The manufacturers¡¯ proposed prices were 1,050 yen per

sheet of 12 mm thick 3x6 panel but the prices in the

market dropped down to 1,000 yen or less so in May

Seihoku group stepped up to correct extreme low prices in

the market because the manufacturing cost has been

climbing particularly transportation cost by shortage of

truck drivers. Then the demand recovered in the second

half of the year.

In September and October, series of typhoons hit the

Eastern Japan and caused flood by heavy rain and many

houses were damaged by extreme strong wind so

emergency demand for temporary repair of roof and floor

arose so the busy demand lasted through December.

Material logs like cedar and cypress are readily available.

Domestic species used to be used for construction but

nowadays, major members like post and beam are replaced

by the European laminated lumber and KD Douglas fir

lumber so major users are now plywood mills. With

continuous full production of plywood mills, there is not

any serous log supply shortage.

Market of imported plywood in Japan has been sluggish

all through the year with the prices lower than future

purchase prices.

The arrivals were record low in last twenty years. In

particular, the supply from Malaysia was less than

1,000,000 cbms, the lowest since 1995.

Plywood manufacturers in Malaysia and Indonesia

struggle to survive with climbing log cost and labor cost.

They are forced to propose higher export prices to pass

such high manufacturing cost and many have to curtail the

production as Japan market cannot pay high export prices.

In last June, log supply increased temporarily and log

prices dropped so that the export prices of 3x6 concrete

forming panel dropped from US$680 per cbm C&F to

$630 in late August and the market prices in Japan

dropped much more than export prices.

Log prices soared in September before rainy season and in

October, Shing Yang, the largest Malaysian plywood

manufacturer reduced number of employees and curtailed

the production. This is not temporary measures but

permanent down scaling.

The market in Japan finally rebounded after bottoming out

in October but the demand of end users continues dormant

so it looks hard to bring the prices up to level of high

export prices.

Outlook of 2020, Domestic plywood

Pattern of plywood market is that the demand keeps busy

through February by carried over orders of precutting

plants then in March, the market confuses by inventory

correction as it is book closing month and the market is

not stable until the fourth quarter when the demand firms

up but there are some uncertain factors this year.

One is restoration demand for last year¡¯s typhoons¡¯

damages, which is much larger than 2018¡¯s western Japan

damages. Structural plywood should move for repair

works so it depends on how much such demand occurs in

2020.

Another factor is the Tokyo Olympic Games in summer

when there are traffic restrictions around Tokyo.

Construction works will be largely affected by this so

construction schedule may be postponed after the Olympic

Games.

On supply side, there has been strong demand for nonstructural

plywood like floor base but so far, the

manufacturers are busy to manufacture structural panels so

when the demand of structural plywood weakens, the

manufacturers reduce production of structural panels and

shift to produce more non-structural panels like floor base.

Imported plywood ¨C Market environment of imported

plywood continues severe.

The importers are not placing enough volume since the

export prices are higher than market prices in Japan so

monthly arrivals continue dropping month after month.

The manufacturers in Malaysia and Indonesia are

determined to pass high cost onto export prices and if

Japan cannot accept, they would further curtail the

production by laying off workers.

Log cost stay up high, minimum wage of workers is

increasing and ocean freight is climbing by higher cost of

fuel so further increase of export prices is inevitable.

The market in Japan is not strong enough to follow such

high prices so this year is turning point for imported

plywood in Japan market.

Due to shortage of virgin timber, the manufacturers have

started using planted species like falcate and eucalyptus

for plywood manufacturing but this is different from

traditional tropical hardwood plywood so replacement is

not easy.

|