|

Report from

Europe

EU wooden furniture imports last year at highest level

since 2007

It is ironic that in 2019, just before the market chaos

created by COVID-19, the EU recorded its strongest year

for wooden furniture imports since 2007. That was, of

course, when the last consumer boom was at its peak just

prior to the market meltdown of the financial crises.

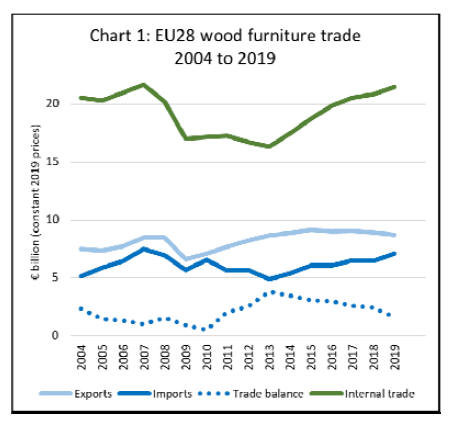

The EU imported wooden furniture from outside the bloc

with a total value of €7.07 billion in 2019, 10% more than

the previous year. Last year was only the second time in

history, alongside 2007, when annual imports of wooden

furniture into the EU exceeded €7 billion (at constant 2019

prices) (Chart 1).

Several factors on both the supply and demand side

combined to drive growth in EU imports of wooden

furniture in 2019. Last year was the culmination of a

period of slow but consistent expansion of the EU

economy which began five years before in 2014.

The slow growth in EU imports was interrupted in the

second half of 2018, particularly in the UK owing to

Brexit uncertainty, which in retrospect turned out to be an

over adjustment and led to increased imports last year.

At the same time China, embroiled in a bitter trade dispute

with the U.S. during 2019, was looking to the EU as an

alternative outlet for furniture products. Meanwhile,

several tropical suppliers ¨C notably Vietnam, Indonesia

and India - were also seeking to build on new investment

in capacity and to diversify markets by targeting the EU.

The long-term trend towards increased imports from

several neighbouring countries on the Eastern borders of

the EU, notably Turkey, Bosnia, Ukraine, Serbia and

Belarus, also continued last year.

Economic integration drives strong EU internal

furniture trade in 2019

The trade data suggests that there was a real increase in

EU consumption of wooden furniture in 2019. This is

implied not only by rising imports from outside the region,

but also by a resumption of the rising trend in internal EU

trade of wooden furniture during the year.

This last trend which also began in 2014 had slowed in

2018 but picked up again in 2019. In 2019, internal EU

trade in wooden furniture was valued at €21.46 billion, 3%

more than in 2018 and 23% greater than 5 years before.

Rising internal EU trade in wooden furniture is being

driven by increased market integration within the region,

the shift in manufacturing from higher cost countries in the

western EU to lower cost eastern locations, particularly

Poland, and the growing presence and influence of largescale

retailing chains operating at cross country level, most

notably IKEA.

More wooden furniture imports into the EU from outside

the region are also now being funneled via larger ports in

Western Europe, particularly the Netherlands and

Belgium, before being redistributed to other parts of the

EU.

The drive towards greater integration in the EU furniture

market and access to relatively lower cost manufacturing

locations in the eastern EU, explains the continuing

dominance of EU-based manufacturers in the region.

ITTO¡¯s own estimates based on analysis of Eurostat data

indicate that EU-based manufacturers account for around

85% of all wooden furniture sold in the region.

In recent years, European manufacturers have boosted

productivity and competitiveness through investment in

more advanced computer-controlled and automated

manufacturing, cutting overheads and reducing the relative

labour cost advantages of overseas producers.

There¡¯s been a particularly large investment by Western

European furniture manufacturers in Eastern European

countries, notably since their accession into the EU from

2004, and this is now maturing. From being principally

production satellites for large western European brands,

Eastern European manufacturers are now developing their

own identity and market momentum.

Furniture manufacturers in the EU area are also making a

virtue of their shorter supply chains which not only reduce

transport costs but also allow products to be delivered

more rapidly.

External suppliers face other more direct challenges to

expanding sales in the EU. Despite some recent

consolidation, there is still a relatively high degree of

fragmentation in the retailing sector in many European

countries which complicates market access. Many

overseas suppliers remain reliant on agents and lack direct

access to information on fashions and other market trends.

The progressive migration of European furniture sales

online has also tended to favour local manufacturers better

placed to meet the short lead times demanded by internet

retailers and consumers.

Another fall in EU wooden furniture exports

Nevertheless, the gradual rise in EU imports of wooden

furniture since 2014 suggests that external suppliers are

becoming progressively more competitive in this market.

Their heightened competitiveness is also suggested by the

fact that EU manufacturers have been struggling to expand

sales outside the region. Last year the value of EU wooden

furniture exports to non-EU countries fell 2.3% to €8.68

billion.

This continues a trend of flat-lining, or slowly declining

exports to countries outside the EU after reaching an alltime

high of just over €9 billion in 2015. Since then the

competitive benefits of the relative weakness of the euro

against the dollar and other cost saving efforts of EU

wooden furniture manufacturers have waned.

Competition for EU-based manufacturers has intensified

from newly emerging producers in Eastern European

countries outside the EU and from Vietnam which in the

last 5 years has rapidly overtaken all other tropical

countries in the global league table of wooden furniture

producing nations.

EU wooden furniture manufacturers have suffered in

higher-end export markets in Asia, the CIS and Middle

East from a range of factors including cooling of the

Chinese economy, the diversion of Chinese products away

from the US to other markets, a sharp fall in global equity

markets towards the end of 2018, extreme weakness of the

Russian rouble, relatively low oil prices and political

instability.

Overall, the combined effects of rising EU imports and

declining exports is that the total EU external trade

balance in wooden furniture fell 35% from €2.45 billion in

2018 to €1.61 billion last year.

Surge in EU wooden furniture imports from China in

2019

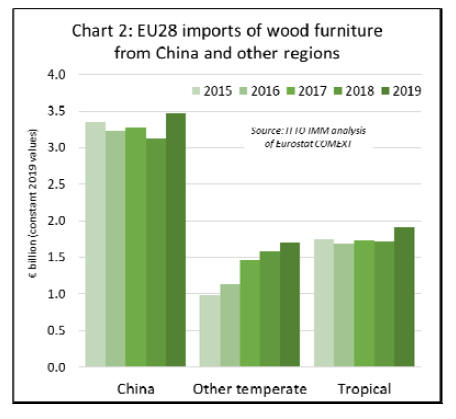

EU wooden furniture imports from China, by far the

largest external supplier, surged 11% to €3.46 billion in

2019, the highest level since 2010 (at constant prices)

(Chart 2). EU imports of upholstered seats with wooden

frames from China increased 14% to €1367 million, while

imports of wood dining room furniture were up 2% to

€515 million, bedroom furniture increased 19% to €419

million, and non-upholstered seating increased 11% to

€202 million.

During 2019, imports of Chinese wooden furniture were

particularly strong into the UK, rising 14% to €1273

million, the Netherlands, where they increased 23% to

€292 million, and Belgium with a 12% rise to €131

million.

Perhaps more surprising than for these countries which are

traditionally large furniture traders was a sharp rise in

imports of Chinese furniture last year by EU counties

which are themselves large manufacturers. Imports

increased by 20% to €130 million in Italy and by 28% to

€102 million in Poland.

Last year EU imports of wooden furniture also continued

to rise from temperate countries other than China, mainly

bordering the EU. Total EU imports from these countries

increased 7% to €1.7 billion, double the level of only five

years before. Last year imports increased 21% from

Turkey to €262 million, 5% from Bosnia to €239 million,

28% from Ukraine to €217 million, 17% from Serbia to

€159 million, and 26% from Belarus to €149 million.

Much of the rise in EU imports from these Eastern

temperate neighbours last year was destined for Germany,

France, Poland, Romania and Croatia. In contrast the UK,

which has historically been the largest EU importer of

wooden furniture from outside the region, continues to

import very little from these countries (excepting Turkey)

and has continued to be much more oriented towards

Asian suppliers.

Vietnam and Indonesia drive 11% rise in EU wooden

furniture imports from tropics

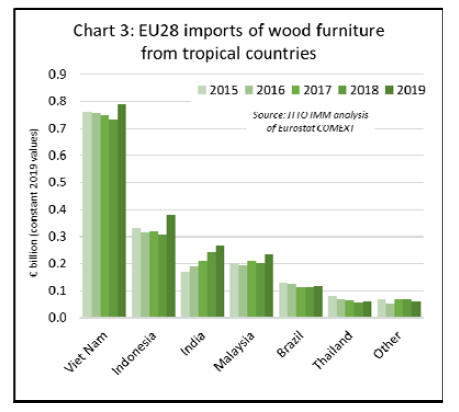

The EU imported wooden furniture from tropical countries

with a total value of €1.91 billion in 2019, up 11%

compared to the previous year. The main South East

Asian supply countries all followed a similar trajectory in

the EU wooden furniture market in the last five years. A

period of flat or declining imports between 2015 and 2018

was followed by a sharp upturn in 2019 (Chart 3).

After falling 2% to €733 million in 2018, EU imports from

Vietnam rebounded by 8% to €789 million in 2019, with

much of this growth in the UK which accounted for over

40% of all EU imports from Vietnam last year.

Around a third of EU furniture imports from Vietnam

comprise ¡°Other products not elsewhere stated¡± (i.e. not

seats or bedroom, dining room, office or shop furniture),

likely to consist largely of garden furniture manufactured

almost exclusively from tropical timber which is not

identified separately.

The second largest category of EU import from Vietnam

comprises dining room furniture, accounting for around

one quarter of total EU imports from the country.

This product group is likely to be manufactured from a

mix of temperate and tropical plantation species, such as

acacia and rubberwood.

Following a decline of 4% in 2018, EU imports of wooden

furniture from Indonesia increased 23% to €379 million in

2019. Unlike Vietnam, where other plantation wood and

imported temperate hardwoods are widely used, most

products imported into the EU from Indonesia comprise

plantation teak.

EU imports of Indonesian non-upholstered seating

increased 39% to €109 million while imports of ¡°other not

elsewhere stated¡± wooden furniture (i.e. primarily tables

and other items for exterior use) increased 30% to €154

million.

The rapid increase in imports of Indonesian garden

furniture products in 2019, a sector which has been a key

focus of environmental campaigning in the past, suggests

that FLEGT licensing may be playing an important role to

increase their competitiveness in the EU market,

particularly following efforts by EU authorities to tighten

implementation of the EU Timber Regulation in recent

years.

This is also suggested by the fact that the increased

imports from Indonesia in 2019 were destined mainly for

the Netherlands and, to a lesser extent, UK, Belgium and

Germany, all markets where certification has been

particularly important for market development.

EU imports of wooden furniture from Malaysia, which

mainly comprises rubberwood product for interior use at

the lower end of the price spectrum, increased 18% to

€236 million in 2019. EU imports for Malaysia of wood

bedroom furniture increased 27% to €96 million, wood

dining furniture was up 23% to €48 million, while nonupholstered

seating rose 13% to €48 million.

EU wooden furniture imports from India continued to rise

last year, up 11% to €268 million building on a 15% gain

in 2018. Imports from India mainly consist of products

made from local plantation species such as mango,

sheesham, acacia and rubberwood, often in rustic style

which are hand-crafted and for which formal quality

standards were not high.

Usage of sheesham for Indian furniture manufacturing has

been declining, as it is a CITES-listed Dalbergia species,

while use of mango has been rising in recent years.

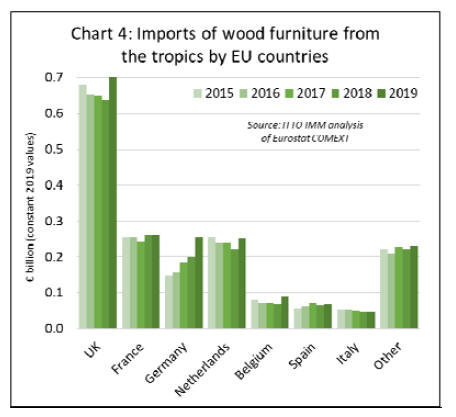

There were also shifts in the destinations for wooden

furniture imported into the EU from tropical countries in

2019. Imports in the UK, by far the largest market, were

€703 million last year, 11% more than in 2018.

There was also a particularly large rise in imports by

Germany, up 29% to €256 million, with significant gains

in German imports from Vietnam, India and Indonesia.

Imports of tropical wooden furniture into the Netherlands

increased 14% to €252 million last year, with imports

from Indonesia up nearly 70% at €117 million. Imports of

tropical wooden furniture into Belgium were up 30% in

2019, with imports from Indonesia rising 28% to €41

million. Imports of tropical wooden furniture into France

were level at €261 million last year.

Furniture sector particularly hard hit by pandemic

It is far too early to assess the full impact of COVID-19 on

EU furniture imports this year, but early signs are that the

downturn will be at least as great as during the financial

crises of 2008-2009.

With its trade fairs cancelled, showrooms shuttered and

deliveries of larger items largely curtailed due to social

distancing, the furniture industry in Europe has been

particularly badly hit by current restrictions on trade and

travel. Brands that were already in a perilous position,

such as Lombok and Laura Ashley in the UK, have started

to collapse.

According to a study quoted by Statista on the projected

impact of COVID-19 on retail sales in Europe, between

March 9, 2020 and April 21, 2020, retailers are expected

to face a loss of GBP3.26 billion (US$4 billion) due to

disruptions caused by the current outbreak. Furniture is

one sector expected to be hit hardest as consumers forego

discretionary purchases in favour of stocking up on food

and household supplies.

The larger better resourced furniture retailers, particularly

those with a large and highly evolved online presence,

have been better placed to respond to the crises. As the

world¡¯s largest furniture retailer, Ikea¡¯s range of responses

have been of a different order and scale than most of its

competitors.

Ikea has refocused on its e-commerce platform and reports

a surge in demand for many products, particularly in the

home office category. Ikea is also trying to ensure the

robustness of its supply change, offering loans and

speeding up the payment of invoices to embattled

suppliers.

However, Ikea is an outlier in this, as in so much else, and

the impact of the downturn on smaller retailers and

manufacturers worldwide will be profound, threatening

their very survival as business entities.

The challenges are vividly illustrated in a recent statement

by the Vietnam Timber and Forest Product Association

(VTFPA) that the wood industry in the country faced a

¡®disaster¡¯ with many businesses left without orders from

now until 2021 due to the COVID-19 pandemic.

¡°Many Vietnamese wood processing enterprises have had

orders cancelled of suspended,¡± said the VTFPA. ¡°Since

March, 80% of Vietnamese exporters to the US and EU

markets had received cancellations or delays until the

situation improves¡±.

The VTFPA statement also highlights that wood

manufacturing businesses are facing sharp rises in input

prices for wood and other materials while freight costs

have increased $500-1,000 per container. Some

Vietnamese furniture companies are now sitting on 100s

of containers of finished goods that cannot be shipped and

must be stored in warehouses at considerable cost for an

unknown length of time.

Unfortunately, this same situation now prevails in many

furniture manufacturing districts where the survival of

companies has become heavily dependent on the extent,

efficiency and effectiveness of government intervention to

help them ride out the storm.

Commenting on the situation in Italy at the start of April,

drawing on the experience of industry contacts, the

American Hardwood Export Council notes that

¡°everything in Italy has virtually stopped. All nonessential

factories are closed, which includes wood

distributors and their manufacturing customers (furniture,

flooring, kitchens joinery etc.). There are predictions

circulating in the Italian media that 40% of industry may

not even reopen after the lockdown restrictions are lifted¡±.

The furniture industry that eventually emerges from this

crises may be very different from that which entered it.

|