Japan

Wood Products Prices

Dollar Exchange Rates of 25th

June

2020

Japan Yen 107.157

Reports From Japan

Economy in an ¡°extremely severe situation¡±

In the period January and March the government

confidently described the economy as ¡®recovering

moderately but quickly reversed that view as infections

spread and a lockdown became inevitable.

By May the government said that private consumption was

¡°decreasing rapidly,¡± the result of the ¡®stay-home¡¯

recommendation.

The most recent pronouncement from the Cabinet Office

said ¡°The economy is still in an extremely severe situation

due to the novel coronavirus but the decline in business

activity has slowed in response to improving private

consumption¡±. However, as of June, private consumption

was well below normal and businesses are still facing the

challenge of recovery.

see

https://www.japantimes.co.jp/news/2020/06/19/business/economy-business/economics-worsening-coronavirus/#.XvVdovIzbIU

Two economic pillars, exports and tourism badly

dented

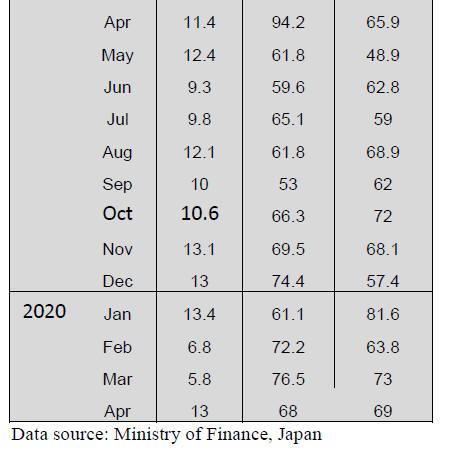

Data from the Ministry of Finance shows Japan's exports

declined almost 30% in May and imports dropped 26% as

global growth was undermined by the pandemic. May was

the second consecutive month Japan recorded a trade

deficit.

Economic growth in Japan relies on two pillars, trade and

tourism. Both international and domestic tourism has been

brought to a halt by the travel, stay-home and socialdistancing

restrictions aimed at curbing the spread of

COVID-19 and trade with major partners has fallen

sharply.

Exports to the US dropped more than 50% and to

Australia dropped 59%. Imports from the US fell around

28% while those from Australia were down 29%. In

contrast, in May trade with China had started to recover.

Retail sales slow to recover

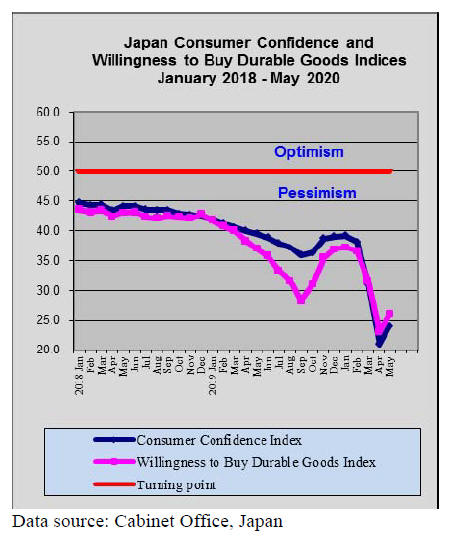

Consumer sentiment has not recovered in Japan and May

retail sales were down again illustrating the impact the

pandemic lockdown measures had on consumer

confidence. The continued downturn could result in the

economy stuck in recession longer than forecast.

Retail sales fell 12% year on year in May as consumers

shunned major purchase on items such as cars, household

furniture and even clothing. The drop in May followed an

almost 14% drop in April.

The government hoped private spending, which accounts

for more than half of the economy, would recover

especially as it is in the process of handing out Yen

100,000 to every resident in the country.

Changing work styles

The Japan Times has reported a recent survey that most

respondents would be in favor of telecommuting (working

from home) even after the coronavirus is contained. The

main reason cited was the chance to eliminate the stress

from commuting. Another reason stated was this would

allow them to live and work from places with cheaper

housing.

On the down-side, respondents said one problem with

remote work is that there are somethings that can only be

done in the office and some said they would miss the

workplace interaction. Several of the major companies

have indicated they will continue with work-from-home

arrangements even when the emergency is over.

See:

https://www.japantimes.co.jp/news/2020/06/22/business/japantelecommuting-continue/#.XvLguO0zbIU

Rising uncertainty and weakening fundamentals - the

formula for yen volatility

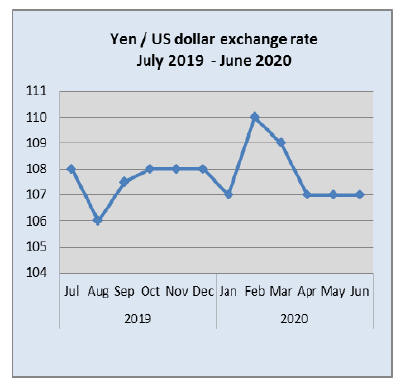

Demand for a safe haven could, once again, fuel a

strengthening of the yen driven by an unchecked rise in

coronavirus cases especially in the US and escalating

global trade tensions.

Tensions between the United States and its major trading

partners have pushed risk aversion to the fore as the

possibility of imposition of US$3.1 billion of tariffs on EU

imports is possible. Rising uncertainty and weakening

fundamentals are the formula for currency volatility and a

rush to ¡®safe-haven¡¯ yen but at present the yen/dollar

exchange rate has remained stable at around Yen 107 to

the dollar.

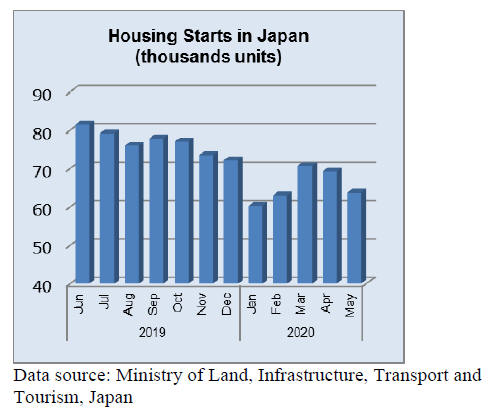

Decline in orders reported by house builders

Major house builders in Japan are seeing orders decline

while builders of low cost homes have not experienced

this according to the Japan Lumber Reports.

Immediately the corona virus outbreak emerged in Japan

almost all builders stopped their active sales campaigns

and switched to alternative promotion strategies.

May 2020 housing starts fell 20% year on year but having

achieved 80% of year on year starts at the height of the

pandemic is a remarkable achievement.

Import update

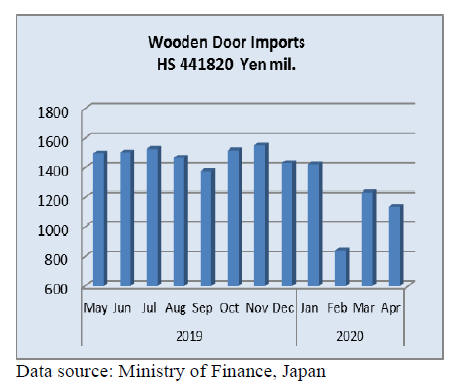

Wooden door imports

Year on year, the value of wooden door imports in April

dropped a further 16% adding to the year on year decline

seen in March. April import values for wooden doors

(HS441820) dipped 8% from March.

As in previous months shippers in China and the

Philippines dominated Japan¡¯s April 2020 imports of

wooden doors (HS441820). The main shipper, China

accounted for a massive 70% of total door imports, up

sharply from the 47% in March.

Shippers in the Philippines saw a decline in market share

in April slipping to just 11% from the 24% contribution in

March. The third largest shipper in April was Indonesia

which contributed a further 9% to all wooden door

imports.

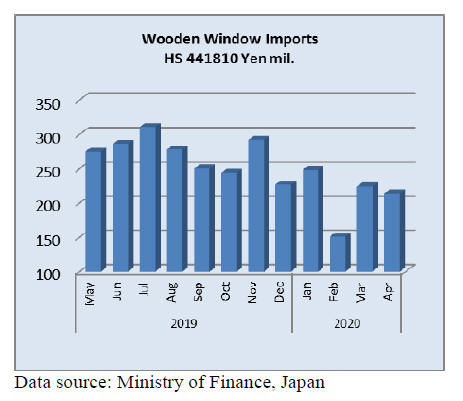

Wooden window imports

The value of wooden windows (HS441810) imports into

Japan in the first four months of 2020 mirrors the trend

seen with wooden door imports, a steep decline in

February followed by a recovery in March and then a

slight drop in April.

Year on year, April window imports continued the

downward trend observed this year. The value of April

imports was 16% below that of April 2019 and month on

moth there was a 4% decline.

Shipments from manufacturers in China took a large share

of imports in April, rising to 45% from the 39% in March.

Imports from the US, the second largest shipper in April

were at the same level as in March but it was shippers in

the Philippines which saw a sharp decline in shipments,

dropping to just 8% in April from 18% in March.

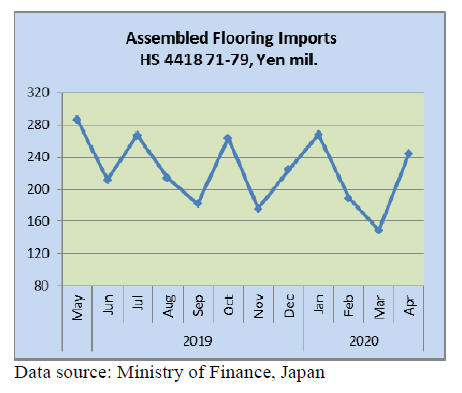

Assembled wooden flooring imports

In both February and March there was a decline in the

value of month on month imports of assembled wooden

flooring (HS441871-79) but in April there was a

correction bringing the total value of imports back up to

the levels observed of the past months. Year on year the

value of April assembled wooden flooring imports were

flat but month on moth there was a huge 64% increase.

Two categories of imports HS441875 and HS441879

accounted for most of the flooring imports. The largest

value of imports was of HS441875 (66% of imports)

followed by HS441879 (25% of imports). Manufacturers

in China accounted for most of the HS441875 while

imports of HS441879 were fairly even split between

Australia (an unexpected source), Indonesia and China.

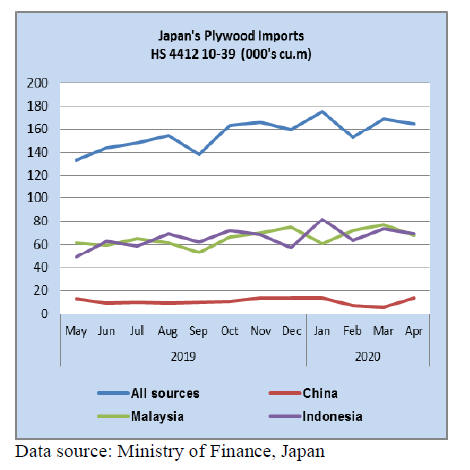

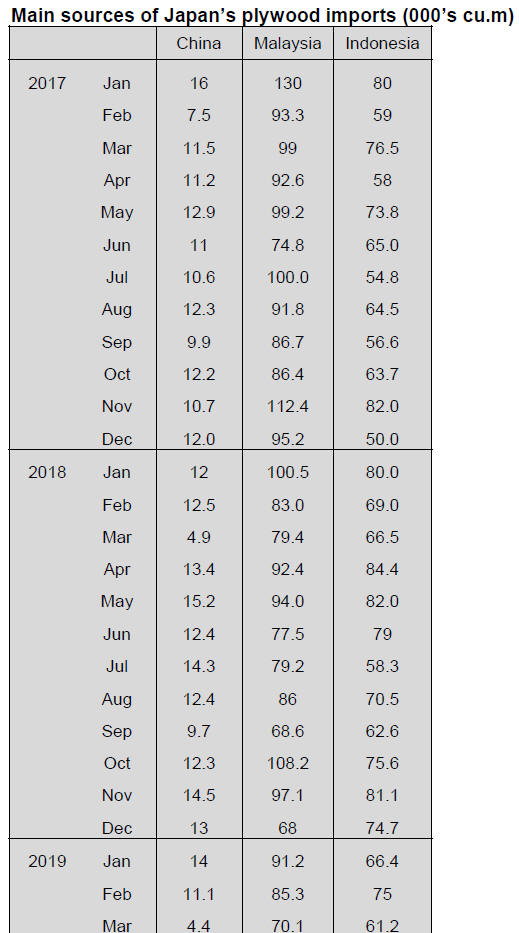

Plywood imports

Over the 12 months to April 2020 there has been a slight

increase in Japan¡¯s imports of plywood from the top three

shippers, Indonesia, Malaysia and China. However, April

import volumes were 10% less than in April 2019 but held

steady compared to the volumes that arrived in March.

Indonesia and Malaysia are the top shippers of plywood to

Japan accounting for over 80% of all plywood imports. In

April arrivals from Indonsia were at the same level as in

March but arrivals from Malaysia dipped 11%.

China is the third ranked plywood supplier to Japan and in

April shipments almost doubled. Exporters in Vietnam

have a consistent market share in Japan and in April

shipments of plywood rose around 10% month on month.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Plywood manufacturers hold prices

Softwood plywood manufacturers have been reducing the

production and try not to accept low offers.

The inventory is 1,100 cbms less to 173,600 cbms.

Trading firms and wholesalers are becoming bearish by

stagnating movement of building materials after the state

of emergency was announced to stop infection of corona

virus in April. Plywood manufacturers are considering to

reduce the production further to stop skidding of the

market.

Average monthly production of softwood plywood in the

first quarter was 257,500 cbms then April was down to

231,900 cbms. April movement was not so active but

precutting plants held the same pace of operation so orders

were normal and the prices were held up but in May,

precutting plants started reducing purchase volume with

weak outlook in coming months.

Sales activities by trading firms and wholesalers are

largely restricted of face to face negotiations so that only

means now is by telephone or e-mail.

Market prices are weaker now at about 990 yen per sheet

delivered on 12 mm 3x6 , about 10 yen lower and

wholesalers say that it is now difficult to get over 1,000

yen per sheet on 12 mm 3x6. 24 mm 3x6 panel prices are

also down by 20 yen at about 2,000 yen.

Plywood logs

Domestic plywood manufacturers had been increasing the

production for last five years, supported by active demand.

Softwood plywood production in 2019 was 3,200,200

cbms.

This is increase of 631,200 cbms in five years. Log

consumption has been climbing with increased production.

In 2019, total logs consumed for plywood manufacturing

was 5,448,000 cbms, 1,230,000 cbms increase in five

years. In this, domestic logs are 4,745,000 cbms, increase

of 1,389,000 cbms.

Imported logs used for plywood manufacturing are

703,000 cbms, increase of 161,000 cbms. Share of

domestic logs for plywood manufacturing is now 87.1%.

Logs for plywood manufacturing were South Sea

hardwood logs in 1960s then after the resources of tropical

hardwood declined, use of softwood logs such as Russian

larch became dominant in 1970s and on together with New

Zealand radiate pine logs and North American species.

Supply of imported logs fluctuated by supplying countries¡¯

situation and the cost also fluctuated by yen¡¯s exchange

rate. In these days, use of domestic softwood logs was

difficult by various technical reasons but such problems

were solved by technical advance.

Plywood plants used to locate ocean harbor, handy to

accept imported logs brought by ocean going ships but

recent newly built plywood mills are all located inland,

convenient location to collect nearby local logs.

Mills¡¯ production capacity is based on collectable log

volume from nearby timberland to save long transportation

cost. In other words, plywood mills¡¯ concern is stable

supply of logs so the mills make agreement of logs supply

with log suppliers and forest unions in an effort to

establish stable supply sources.

Another concern is stable supply of minor species like

larch, cypress and fir. Supply of these species fluctuate by

season and has high risk of natural disaster. In October last

year, strong typhoon with heavy rain hit Nagano area and

damages the forest in the area and larch supply got very

tight.

As to imported species, supply of plywood logs continues

tight. Russian larch logs are imposed high export duty.

South Sea hardwood log supply is restricted by

environmental reasons. Canadian Douglas fir logs are not

available after the major log supplier, Mosaic Forest

Management stopped harvest by low market prices of logs.

The fundamental plan of forest and forestry set by the

government requests to expand annual log consumption by

plywood mills to 6,000 M cbms by 2025. For this,

plywood mills feel that it is possible if demand of nonstructural

plywood and of thick structural panel increases.

Actually, plywood mills succeeded to expand the market

of thick 24 and 28 mm structural panels for sheathing. In

last few years, demand of non-structural panels such as

softwood floor base and softwood coated concrete forming

panel has increased. These products used to be made of

tropical hardwood plywood but the supply from South Sea

countries continues to decline year after year so the

composite floor manufacturers have to look for

substituting materials.

By unexpected incident of corona virus outbreak since

early this year, economic activities have been stagnated

and plywood mills started production curtailment since

last March so production expansion is facing difficult time.

Plywood

Both domestic and imported plywood market is inactive.

With uncertain future market, users limit purchase volume

at minimum and not to carry.

inventory. Face to face sales negotiations are prohibited,

sales keep dropping week after week. Market atmosphere

is getting pessimistic.

Domestic softwood plywood market is becoming bearish.

Sales activities became difficult after the state of

emergency was declared in April so movement of all

building materials get slow. Market prices are holding but

salesmen tend to accept low offers.

Precutting plants are losing orders of custom built units

but builders are relatively stable so amount of orders

precutting plants is not dropping so much yet but they feel

uneasiness to future orders.

Plywood manufacturers¡¯ inventory has been held down by

production curtailment since April. They try to produce

what the market demands.

The movement of imported plywood gets slower. Large

construction companies stopped construction works in

April but restarted in late May but movement of concrete

forming panels is sluggish. There is mixed information as

to actual construction works so it is hard to grasp actual

situation.

There are two different opinions as to imported plywood.

One is shortage may occur by supply tightness. Another is

surplus may occur by sharp demand drop. With such

uncertain future market, it is hard to place new orders.

Orders for house builders in April

House builders, which offer low cost houses, had more

orders in April than last year. Other major house builders

suffer declining orders so this makes clear difference

between large builders and smaller builders. Both large

builders and smaller builders stopped direct sales

campaign after corona virus outbreak but there are

difference of management of house exhibition sites, price

range and main market regions.

|