Japan

Wood Products Prices

Dollar Exchange Rates of 10th

September

2020

Japan Yen 106.16

Reports From Japan

Yoshihide Suga

elected president of the ruling party ¨C

appointed Prime Minister

The three veteran Japanese policymakers, Yoshihide Suga,

Fumio Kishida and Shigeru Ishiba were vying for the post

of president of the ruling Liberal Democratic Party (LDP).

The winner is guaranteed to be named prime minister in

the Diet, given the LDP¡¯s overwhelming strength.

Under LDP party rules, the new leader will only serve out

the remainder of the previous Prime Minister Abe¡¯s threeyear

term which runs to September 2021.

A general election will have to be called by October 2021

when the four-year term of the members of the Diet's

lower house comes to an end.

On 14 September Yoshihide Suga was elected president of

the ruling Liberal Democratic Party thus ensuring he will

replace Shinzo Abe as prime minister. Suga is expected to

announce a new lineup of the party leadership within days.

Signs of economic recovery

Despite the contraction in Japan¡¯s economy in the second

quarter of 2020 there had, by the end of August been signs

of a rebound. However, continued weakness in private

consumption and exports, the two main drivers of the

economy, along with the current second wave of

infections, means a quick recovery is unlikely and the

country will be lucky if it can avoid a double-dip

recession.

Many analysts are quoted in the domestic press as saying

that GDP may rebound by as much as 10% in the July-

September quarter as a recovery in consumer spending is

anticipated.

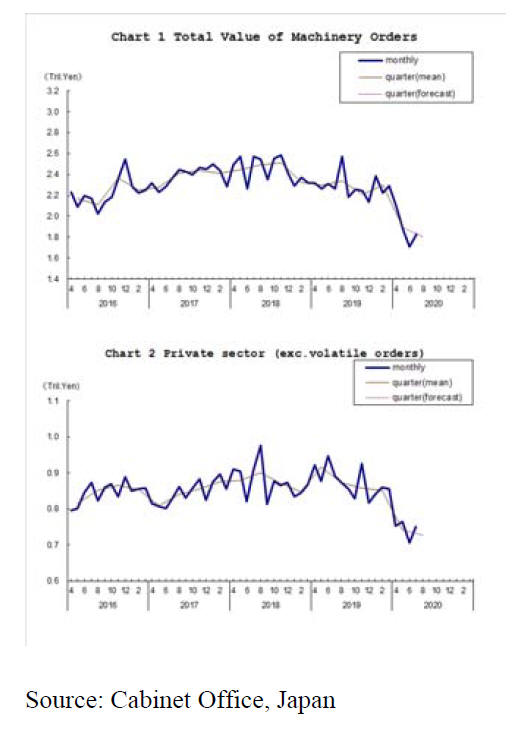

Machinery orders

Machinery orders rebounded in July from a sharp fall the

previous month which comes as relief for an economy

buffeted by the pandemic. However, the outlook for

capital spending remains uncertain due to fragile global

business conditions.

The total value of machinery orders received by 280

Japanese manufacturers operating in Japan increased by

7% in July from the previous month. Private-sector

machinery orders, excluding those for ships and those

from electric power companies, increased in July.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2020/2007juchue.html

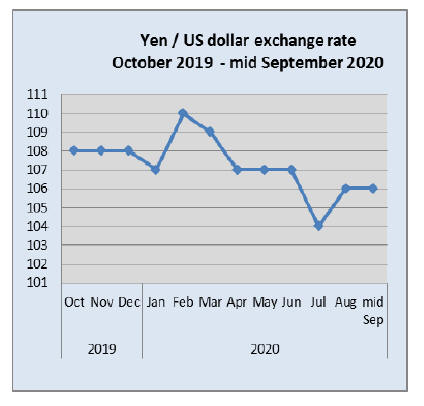

New PM commits to weak yen policy

The new Prime Minister, Yoshihide Suga a veteran

politician will face an enormous task to preserve one

aspect of Abenomics, the weak yen.

The domestic press speculates that Suga may be less

aggressive on fiscal easing than Abe, while still working

closely with the Bank of Japan to hold down the yen in

support of exports. However, at a press conference Suga

suggested the Bank of Japan still has room to expand

monetary easing.

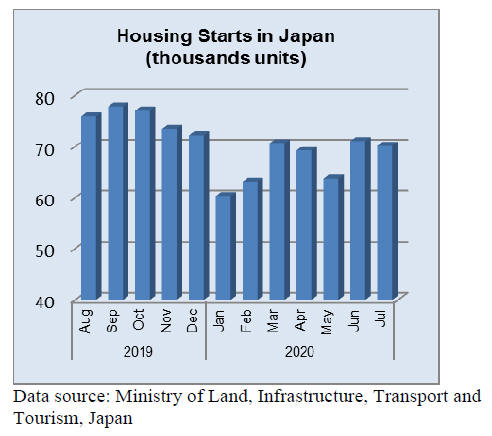

Builders report recovery in orders

The Japan Lumber Reports (JLR) has indicated that major

house builders are reporting a recovery in orders for new

homes. The JLR says ¡°Total new starts during April and

June were 12.7% less than the same period of last year and

owner¡¯s units were 18.2% less.

However, orders placed with major house builders started

recovering in June and lumber precutting plants report

orders by major house builders are increasing¡±.

Import update

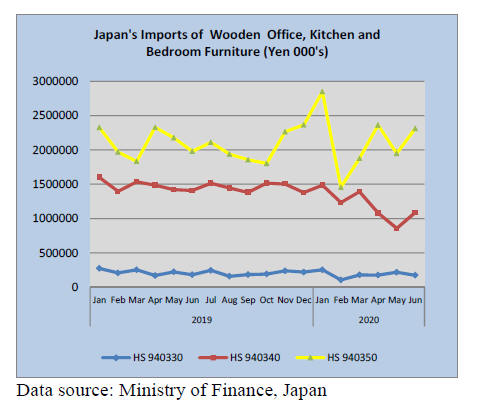

Furniture imports

The June 2020 uptick in the value of Japan¡¯s wooden

kitchen and bedroom furniture corresponds to the general

improvement in consumer sentiment and in particular the

steady rise in the consumer confidence index for

¡®willingness to buy durable goods¡¯.

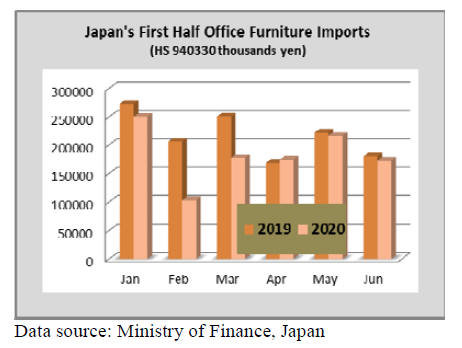

Office furniture imports (HS 940330)

The value of Japan¡¯s first half 2020 imports of wooden

office furniture (HS940330) fell 16% compared to the

value of imports in first half of 2019. Throughout the first

half of 2020 shippers in China have consistently captured

the largest share of wooden office furniture imports. It

remains to be seen if the efforts by the Japanese

government to encourage Japanese companies relocate out

of China will impact future sources of furniture imports.

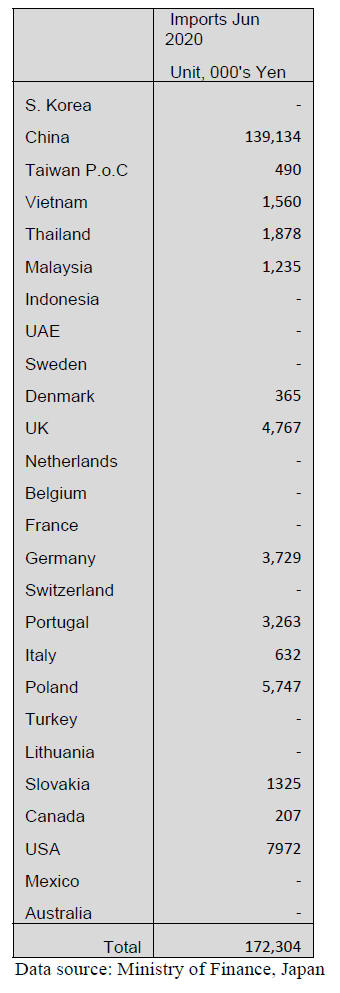

June office furniture imports

The value of June imports of wooden office furniture

(HS940330) was around the same as in June 2019 but

compared to May the value of June imports was down

20% following the sharp month on month rise in May.

The office furniture market in Japan has been feeling the

impact of the ¡®work from home¡¯ approach adopted by

many companies, some of which have already decided

¡®work from home¡¯ brings benefits and have begun to

downsize their office space requirements.

As was the case throughout the year most wooden office

furniture imports originated in China (80% in June). The

other shippers of note in June were the US (5%) and

Poland (4%). June shipments from China were around

13% down on May shipments, shipments from Poland

dropped 50% in June compared to May but shipments

from the US doubled.

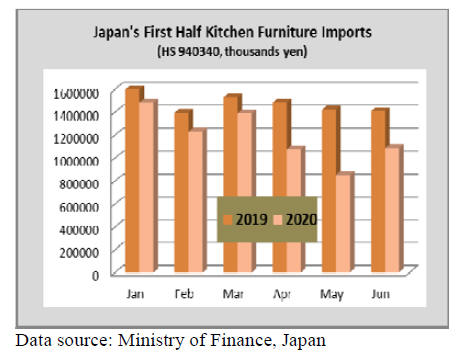

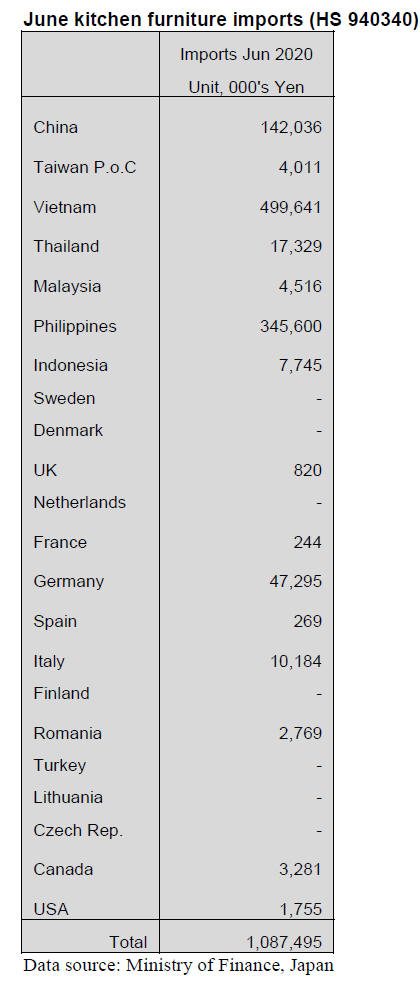

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s kitchen furniture imports in the first

half of 2020 was down almost 20% year on year.

The value of June imports of wooden kitchen

furniture

were surprisingly around 25% higher than in May and this

was during the partial lockdown.

The explanation for the increase in kitchen furniture could

be that, as in other countries when under lockdown, the

Japanese also turned to home improvements.

Each of the three main shippers, Vietnam, the Philippines

and China saw exports of wooden kitchen furniture to

Japan rise in June compared to May.

Vietnam shipped most in June (46% of June imports)

followed by the Philippines (32%) and China. Shipments

from each of the three main shippers increased in June

with a massive almost 70% increase from the Philippines.

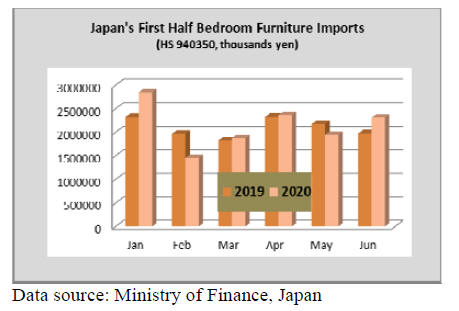

Bedroom furniture imports (HS 940350)

Compared to the first half of 2019 the value of Japan¡¯s

imports of wooden bedroom furniture in the first half of

2020 rose slightly, something of a surprise since imports

of office and kitchen furniture were down year on year.

In these unusual times the most likely explanation for this

may be found in relation to the pandemic ¡®work from

home¡¯ style of work. It could be that many families had to

rearrange their bedrooms to create a work space.

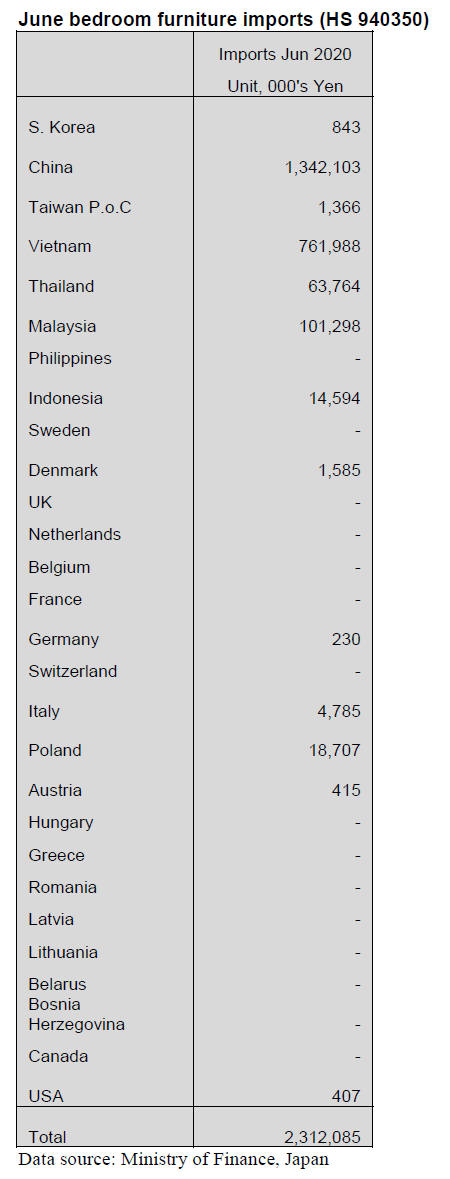

The value of Japan¡¯s June imports of wooden bedroom

furniture (HS940350) was up 17% year on year and also

up month on month (27%).

Shippers in China and Vietnam continued to dominate

Japan¡¯s imports of wooden bedroom furniture in June with

imports from China accounting for 58% of all HS940350

imports followed by Vietnam with 32% of imports.

The third largest shipper of HS940350 in June was

Malaysia was cornered a 4% of total June imports. In June

the value of shipments from China were 14% up on May

and shipments from Vietnam were up 18%.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Recovering housing orders

Since last June marketing activities by major house

builders restarted after the state of emergency during April

and May for coronavirus epidemic.

Order values bottomed in April and May and have been

increasing since June for eight major house builders,

which specialize custom ordered houses.

It is everyone¡¯s concern that how house quarantine period

of March and May would influence new housing starts.

Total new starts during April and June were 12.7% less

than the same period of last year and owner¡¯s units were

18.2% less. Orders for large house builders started

decreasing since last March. Decreasing starts during the

second quarter match declining orders for precutting plants

by 10-20%.

Precutting plants see that orders would decline from

September because of absence of housing orders during

March and May because orders for precutting plants are

about six months after house builders firm up orders from

house buyers.

Orders for major house builders started recovering since

last June and precutting plants report orders by major

house builders are increasing.

Eight major house builders¡¯ suffered about 30% less

orders from the same month in 2019 and speed of recovery

is slower than other builders because major builders take

time to firm up orders after potential buyers visit house

exhibition sites meantime builders to sell units built for

sale lost orders until last April but orders sharply

recovered. Some builders firm up orders in 40-50 days

after catching potential buyers.

Average ordered value for eight major builders (Sekisui

House, Daiwa House, Mitsui Home, Misawa Home,

Sumitomo Forestry, Panasonic Homes, Asahi Kasei

Homes and Sekisui Chemical Industry) was 77% less than

the same month last year in March, 64% in April, 67% in

May, 85% in June and 91% in July.

Meantime, for six other builders, which sell unit built for

sale and low cost models, average ordered value in March

was 80% of the same month in 2019, 99% in April, 121%

in May, 117% in June and 125% in July.

Imported lumber in depressed market

In Japan lumber market, price competition started by

sluggish demand among various products and this results

in drop of export prices of producing countries.

With pessimistic forecast, demand shrinkage seems to

come so that purchase of main items is decreasing but

some items like Russian lumber and European structural

laminated lumber supply is more than last year.

Meantime, North American lumber market rebounded

sharply by recovering housing starts in the U.S.A. and

production curtailment by sawmills so future export prices

of logs and lumber from North America would be firm.

Start of price war is domestic produced Douglas fir

lumber. The largest manufacturer of Douglas fir lumber in

Japan reduced the prices of KD Douglas fir beam by

2,000-3,000 yen per cbm in last May so KD Douglas fir

beam prices are 49,000 yen per cbm delivered, which is

the lowest in seven years since 2013.

The reason is that the prices of competing European

laminated redwood beam were 54,000-55,000 yen, 2,000-

3,000 yen higher than KD Douglas fir beam then the

fourth quarter prices of European products were about

53,000 yen and the prices got closer. Four domestic

laminated lumber manufacturers decided to compete so the

price war has started between domestic made Douglas fir

lumber and European made laminated beam.

The export prices by the European suppliers rebounded in

the second quarter but supply pressure continues.

Total supply through May of medium size laminated

lumber was 12.3% more than 2019 and small size was

11.8% more so the prices of domestic produced beam

dropped down to the same level of 53,000 yen. Drop of

KD Douglas fir beam lumber prices influenced export

prices of other Douglas fir lumber.

North American suppliers maintained the prices by

supplying proper volume to meet actual demand in Japan

and domestic lumber prices followed the export prices but

now domestic supply prices dropped first and the export

prices follow so the export prices dropped by about 3,000

yen per cbm compared to previous quarter.

However, this pattern is no longer workable after the

North American lumber market recovered steeply so it is

likely that the export prices of North American lumber

would go up in next quarter.

Russian lumber supply last year was limited but the

arrivals have been increasing since last spring and Tokyo

Bay ports¡¯ inventory at the end of June was 63,000 cbms,

2.6 times more than last year and price drop by oversupply

is feared.

Price war weakens Japan¡¯s purchasing power and it is

necessary to have certain limit of price drop to maintain

Japan¡¯s purchasing power when the market is rebounding

elsewhere in the world.

Orders for new housing in April and May dropped

considerably by the State of Emergency order, which

would impact housing starts in August and September. It

is apparent that new housing starts this year will be much

less than last year, which influences building materials

demand. Competition will be harder between imported

products and domestic, solid wood and laminated lumber.

Plywood

Movement of plywood in the market continues stagnant

but the price skidding stopped. Plywood manufacturers

decided not to accept any lower offers and the dealers and

trading firms agreed on as price reduction does not help

move any more volume so the users gave up asking lower

prices and feel that the present prices seem to be the

bottom. The manufacturers plan to produce for actual

demand only to tighten the market.

12 mm structural softwood panel prices are 900-930 yen

per panel delivered, 100-150 yen lower than September

last year.

Imported plywood supply has been very low so that some

items are short in the market so the importers and dealers

now sell cautiously with limited on-hand inventory. The

price decline has stopped but with weak demand, it is risky

to place new orders for the importers so they place orders

with absolute minimum.

Future arrivals do not seem to increase and it is hard to see

how supply and demand balance would move.

Market prices of 12 mm structural panel are 1,200 yen per

sheet delivered, 100 yen lower than September last year.

Log and lumber export for the first half of 2020

Total log export volume for the first six months of this

year is 636,356 cbms, 3.7% more than 2019. Cedar is

553,591 cbms, 5.6% more and cypress is 76,658 cbms,

10.1% more.

Lumber export is 74,068 cbms, 0.6% more. Cedar is

41,144 cbms, 8.5% less and cypress is 19,177 cbms,

27.4% more. Log export in the first quarter decreased

because of slump in China but export for other markets is

steady from the beginning of the year. Export to China

recovered in the second quarter so total log export

increased over 2019.By species, cedar export for China is

0.8% more.

The volume dropped by 29% in the first quarter by corona

virus epidemic but it increased by 23.4% in the second

quarter. For other destinations, Korea is 37.8% more,

Taiwan is 25.1% more and Vietnam 320% more.

Cypress log export for China is 6.6% more and for Korea

8.2% more and for Taiwan 26.5% more. Vietnam

increased by three times and exceeded Taiwan volume.

New market of Vietnam is increasing the volume of both

cedar and cypress but like China, cedar and cypress may

be processed and export for Japan market.

On lumber export, the volume for China and

Philippines

steadily decreasing and Korean market is not steady.

Lumber export for the U.S.A. is increasing every month.

|