US Dollar Exchange Rates of

25th September

2020

China Yuan 6.8344

Report from China

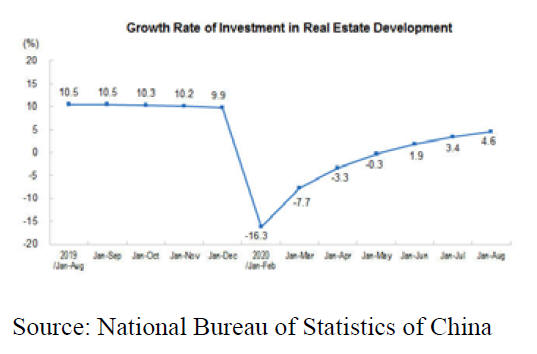

Year to August real estate development

By August this year investment in real estate development

was up almost 4.6% year on year with investment in

residential building rising over 5%. However, between

January and August this year the area of land purchased

for real estate development dropped 2.4% year on year.

See:

http://www.stats.gov.cn/english/PressRelease/202009/t20200916_1789784.html

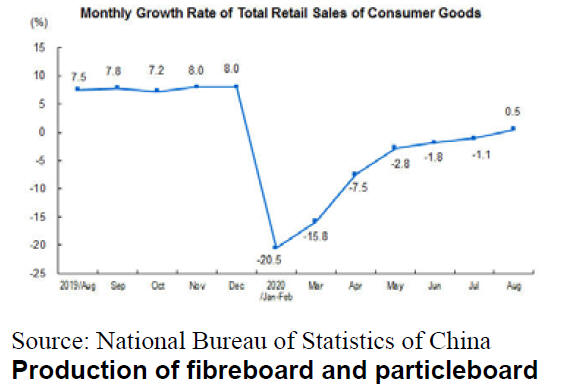

Retail sales turn positive in August

August retail sales of consumer goods trended higher, the

first positive year on year growth this year. However, sales

of furniture were still below (-11.4%) that in the first eight

month of 2019 and sales of Building and Decoration

Materials were down 8.7% over the same

period.

According to statistics on China¡¯s fibreboard and

particleboard production capacity in the first half of 2020

from Forestry Planning and Design Institute of the State

Forestry and Grassland Administration (SFGA) and China

National Forest Products Industry Association (CNFPIA),

progress in construction of additional fibreboard and

particleboard mills has slowed and there are fewer new

mills under construction compared to last year.

Fibreboard production

China's fibreboard production capacity expanded after

2018 and the 2020 production capacity is forecast to reach

56 million cubic metres annually when current

construction projects are completed.

Two new continuous flat-pressure fibreboard production

lines are operational in Anhui Province with a total

capacity of 420,000 cubic metres per year. Six new

production lines with an annual production capacity of

1.74 million cubic metres are located in Guangxi,

Shandong, Jiangsu and Jiangxi Provinces.

There are currently 32 fibreboard production lines under

construction in China with a total output capacity of 6.51

million cubic metres per year. The fibreboard production

lines under construction will come on line over the next 2

years.

Recently, the Guangxi Lelin Group and Dieffenbacher

concluded a deal for a 600,000 cubic metre formaldehydefree

fibreboard project. This, the Group claims, will be the

largest single-line production plant in the world. The

continuous press is 9 feet wide and 80 meters long.

See:

https://www.sohu.com/a/414041777_120055240

Particleboard production

Current projects under construction will have an annual

production capacity of around 42 million cubic metres and

most are likely to be operational this year.

Five new particleboard production mills with annual

output of 1 million cubic metres have recently become

operational in Shandong, Jiangsu, Anhui and Guangxi

Provinces of which 4 are continuous flat pressing lines

with annual output capacity of 950,000 cubic metres. 25

particleboard production lines were under construction in

China in the first half of 2020 with annual output of 6.96

million cubic metres.

See:

http://www.forestry.gov.cn/xdly/5197/20200821/081348635241173.html

Decline in fibreboard imports

According to China Customs, fibreboard imports were

62,235 tonnes valued at US$45.66 million, down 26% in

volume and 22% in value in the first half of 2020.

China mainly imports from New Zealand (12,408 tonnes),

Australia (11,997 tonnes), Germany (10,189 tonnes ) and

Thailand (7,191 tonnes ).

China¡¯s fibreboard imports from New Zealand and

Germany fell 27% and 21% respectively in the first half of

2020 however, imports from Thailand and Australia rose

14% and 13% respectively.

Decline in fibreboard exports

According to China Customs in the first half of 2020

fibreboard exports where 629,967 tonnes valued at

US$341.23 million, down 21% in volume and 27% in

value.

The international markets for China¡¯s fibreboard exports

are diverse with the top 10 markets accounting for just

60% of all exports.

The largest overseas market in early 2020 was Nigeria

were China exported 107,088 tonnes down 16% over the

same period of 2020. However, the US became the second

largest export market for China¡¯s fibreboard in early 2020

taking 58,018 tonnes but this was around 40% lower than

in the first half of 2019. China¡¯s fibreboard exports have

been falling due to concerns on toxic emissions.

Rise in particleboard imports

According to China Customs, in the first half of 2020

particleboard imports were 298,586 tonnes valued at

US$100 million, up 15% in volume and 8% in value and

this was despite the impact of the pandemic on trade.

The major suppliers of particleboard imports in the first

half of 2020 were Thailand, Brazil, Romania, Malaysia

and Russia. Imports only declined from Malaysia (-4%)

while imports from Thailand (+8%, 74,000 tonnes), Brazil

(+6%,48,000 tonnes) and Romania (+17%, 48,000

tonnes).

China¡¯s particleboard imports from Russia surged to

almost 32,000 tonnes because Chinese companies have

built plants in Russia and export to China.

The US is no longer a major supplier of particleboard to

China as a result of the current trade dispute. China¡¯s

particleboard imports from the US plunged 84% in the

first half of 2020.

Slight decline in particleboard exports

According to China Customs, in the first half of 2020

particleboard exports were 106,563 tonnes valued at

US$58 million, down 1% in volume and up 27% in value.

The major overseas markets for China¡¯s particleboard

exports were Mongolia, UAE, Saudi Arabia, Vietnam and

South Korea in the first half of 2020.

China¡¯s particleboard export to Mongolia and Saudi

Arabia rose 25% and 79% to 25,074 tonnes and 6,706

tonnes respectively. However, China¡¯s particleboard

export to UAE, Vietnam and South Korea fell 2%, 40%

and 22% to 11,350 tonnes, 5,413 tonnes and 5,156 tonnes

respectively in the first half of 2020.

The US is no longer a major market for China¡¯s particle.

Particleboard exports to US fell 27% to just 1,552 tonnes

in the first half of 2020.

Heilongjiang (Mudanjiang) timber distribution center

It has been reported that recently a timber and wood

products distribution center had been established in

Heilongjiang (Mudanjiang).

The Center will handle panels imported from Russia,

Ukraine, Belarus and some other European countries. The

Mudanjiang Huasheng National Transportation Logistics

Center (inland port) will facilitate trading, bonded

warehousing, Custom clearances, duty payments and

distribution. This Center will also handle production from

the 23 existing wood enterprises in the area for export.The

establishment of the Heilongjiang (Mudanjiang) timber

and wood products import and export distribution center

will strengthen the distribution, transit, sales and logistics

to domestic and international markets and will increase the

opportunities for exports from Mudanjiang.

See:

http://zwgk.mdj.gov.cn/bmxxgk/swj/202008/t20200831_305745.html

|