|

Report from

North America

Vietnam¡¯s currency practices and timber imports to be

investigated ¨C IWPA issues statement

The United States has announced that it will investigate

Vietnam¡¯s acts, policies, and practices related to the

import and use of timber that is illegally harvested or

traded, as well as Vietnam¡¯s currency practices to

determine whether these actions are causing harm to US

businesses.

The deadline for public comments is November 12. It is

expected that these investigations will continue into 2021.

International Wood Products Association Executive

Director Cindy Squires issued the following statement:

¡°The International Wood Products Association (IWPA)

supports effective, sensible means of addressing illegal

logging and promotion of sustainable forestry worldwide.

We intend to fully participate in the 301 process as it

unfolds and look forward to the opportunity to engage

with the administration.

¡°IWPA encourages active discussions between Vietnam

and the United States so that a resolution to this matter can

be achieved quickly to provide certainty for businesses.

Vietnam is an important trading partner for wood products

and a significant growing market for US hardwoods.

¡°It is important to keep in mind that if any illegally

harvested products are exported to the United States, the

Lacey Act and US obligations under the Convention on

International Trade in Endangered Species of Wild Fauna

and Flora (CITES) currently provide effective and targeted

tools for the US government to take action.

¡°IWPA has been active in international engagement to

combat illegal logging and has trained hundreds of

industry professionals on Wood Trade Compliance. IWPA

supports and will continue to provide businesses the tools

they need to stay compliant with all trade rules.¡±

The International Wood Products Association is an

international trade association for the North American

imported wood products industry, representing 220

companies and trade associations engaged in the import of

hardwoods and softwoods from sustainably managed

forests.

See:

https://www.iwpawood.org/news/529434/IWPAStatement-Regarding-USTR-Sec.-301-Investigation-of-Vietnam-Trade-Practices.htm

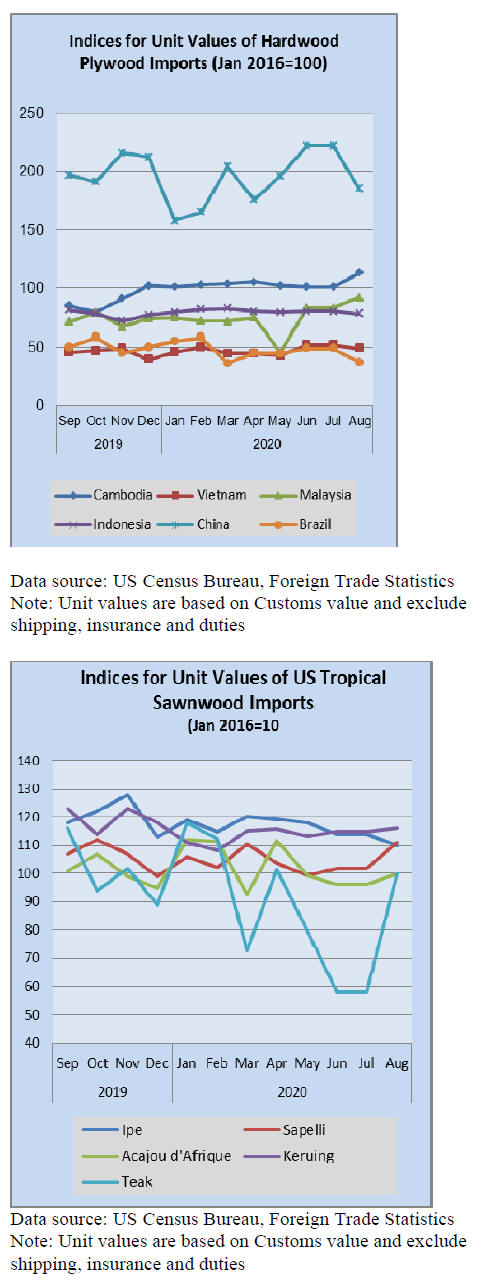

Tropical sawnwood imports rise for third straight

month

US imports of sawn tropical hardwood by volume gained

18% in August to notch a rise of more than 10% for the

third straight month. At 14,861 cubic metres, the volume

of tropical hardwood imported was down less than 7%

from August 2020, after trailing by large margins the past

few months. Year-to-date imports are down from last year

by 36% through to August.

Imports from Brazil fell by 5% by volume in August and

remain 20% behind 2019 year to date. Imports from

Ecuador rebounded in August, gaining 76% from a weak

July number, despite the rise, August volume was still

20% lower that August 2019 and imports are down 69%

year to date.

Imports from Malaysia dropped by 45% in August and are

down 41% year to date. Imports from Cameroon, Congo

(Brazzaville) and Ghana all gained in August but remain

well behind 2019 volume year to date.

Imports of jatoba rose 3% in August while ipe rose by 5%.

The volume of sapelli, cedro and acajou d¡¯Afrique all rose

sharply, yet imports for each of the three remain behind

2019 year to date totals by around one third. Imports of

balsa rose 51% in August but are down more than two

thirds year to date.

Canadian imports of tropical hardwood fell 29% in

August. The August total was down 62% from the

previous August volume, bringing year to date totals down

18% through August.

Hardwood plywood imports fall

US imports of hardwood plywood held somewhat steady

in August, with import volumes declining 4%. Year-todate

volumes are up 3% through August. Imports from

China fell 5% and are now about half of 2019 totals yearto-

date.

Imports from Russia and Indonesia both fell by nearly one

third in August, but both remain well ahead year-to-date.

Import volumes from Vietnam grew by 34% in August

and are ahead by 17% year-to-date.

Veneer imports stagnated in August

After two strong months of growth, US import volumes of

tropical hardwood veneer fell 7% in August. Imports from

Italy, by far the leading supplier for the US, also fell by

7% for the month and are down 37% year-to-date.

Similarly, Import volumes from India were down by 9%

and are behind 20% year to date.

Imports from Ghana and Cote d¡¯Ivoire improved in

August but are both down by nearly two-thirds year-todate.

Total US imports of tropical hardwood veneer are

down 28% year-to-date.

Imports of assembled flooring stay near peak levels

After reaching a 10-year high last month, US imports of

assembled flooring panels fell a modest 3% by volume in

August. Despite the dip, imports for the month were

nearly 41% higher than the previous August, pushing yearto-

date totals for 2020 ahead of last year (up 3%) after

trailing badly for most of the year. Imports from China

rose 45% in August while imports from Thailand were

down 45%.

US imports of hardwood flooring rose for the third straight

month, gaining 8% by volume in August. However, yearto-

date imports are down by 30% through August and are

more than 10% behind for each of the top supplying

countries (Brazil, Indonesia, China, and Malaysia).

Despite a gain of 66% in imports from Malaysia in

August, year-to-date totals remain well behind, down

63%. Imports from China fell by 41% in August and are

down 56% year to date.

Moulding imports drop back to March level

After an encouraging July, US imports of hardwood

mouldings fell 28% in August, dragging numbers back to

where they were in March. August imports were 30%

below those of August 2019, bringing year-to-date totals

down 14% from last year.

Imports from China fell by 78% in August, overshadowing

a very strong rebound in imports from Brazil. Yet, despite

more than doubling in August, imports from Brazil are

down 60% year-to-date though August.

Wooden furniture saw strongest imports of the year in

August

US imports of wooden furniture rose by 10% by volume in

August to reach the highest level of the year at over

US$1.77 billion for the month. Imports are down 12%

year-to-date through August, but three straight months of

solid growth has brought imports to a pre-pandemic level.

Imports from Vietnam rose by 11% in August and are up

21% year-to-date. Imports from China are off by 46%

year-to-date but grew 3% in August. Imports from

Malaysia gained 18% in August and are ahead 40% yearto-

date.

Cabinet sales increased in August

According to a press release from the Kitchen Cabinet

Manufacturers Association¡¯s monthly Trend of Business

Survey, participating cabinet manufacturers reported an

increase in overall cabinet sales of 4.2% in August 2020

compared to July. Custom sales increased 3.2%; semicustom

sales increased 0.1%; and stock sales increased

7.2% compared to the previous month.

Cabinet sales were also ahead of numbers from a year ago.

Sales were up 5.5% for August 2020 compared to the

same month in 2019. Custom sales are up 1.7%, semicustom

decreased 0.5%, and stock sales increased 10.5%.

Overall year-to-date cabinet sales are down 1.8%. Custom

sales decreased 3.3%, semi-custom sales decreased 7.1%,

and stock sales are up slightly at 2.2% year-to-date.

https://www.kcma.org/news/press-releases/august-2020-trend-of-business

|