|

Report from

North America

Economy grew at record pace in Q3

The US economy grew at a record pace in the third quarter

of 2020, bouncing back from an unprecedented COVID-

19-induced collapse early this year but activity has slowed

agian as the infection rate rises.

GDP increased at a seasonally adjusted annual rate of 33%

in the July-September period as consumer and business

spending soared according to the Department of

Commerce and consumer spending jumped 41% and

business investment increased 20%. Forecasts suggest

growth will slow to 2.5% in the fourth quarter.

See:

https://www.bea.gov/news/2020/gross-domestic-productthird-quarter-2020-advance-estimate

Wooden furniture imports buoyant, strong demand for

residential furniture

US imports of wooden furniture rose by 7% in September,

marking the fourth straight month of growth. At nearly

US$1.9 billion for the month, imports are more than 29%

higher than the previous September as furniture remains a

bright spot in the 2020 US economy.

Imports from Vietnam grew by 14% in September while

imports from Malaysia rose 15%. Year-to-date imports

from Malaysia are ahead 47% and imports from Vietnam

are up 26%.

Demand for residential furniture remained high during the

summer months and into autumn according to the Smith

Leonard Furniture Insights report. The report says August

orders were 51% higher than August 2019 orders,

following a 39% increase reported for July and 30% in

June. Orders were reported to be up for about 88% of the

participating companies, about the same as last month.

See:

https://www.woodworkingnetwork.com/furniture/furnitureorders-jump-august-smith-leonard

Cabinetmakers cry foul

A bipartisan coalition of US senators and representatives

sent a letter to the US Commerce Department and to

Customs and Border Protection expressing concern over

alleged fraud on kitchen cabinet imports from China. The

letter says ¡°There is evidence that Chinese cabinet

manufacturers have sought to undercut the US industry by

circumventing antidumping and countervailing duties.¡±

The US industry was provided with protection in the form

of antidumping (AD) and countervailing (CVD) duties in

April 2020 ranging from 13.33% to 269.91%. Since that

time, the cabinet makers say evidence suggests Chinese

producers may be engaged in transshipment,

circumvention and evasion of the AD/CVD duties.

The industry has taken steps to combat customs fraud and

as a result, filed a series of e-allegations and an allegation

through the Enforce and Protect Act to end these

fraudulent practices and restore a level playing field for

the domestic industry. These allegations remain pending at

Customs.

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/cabinetmakers-say-china-committing-customsfraud-pursuit-response

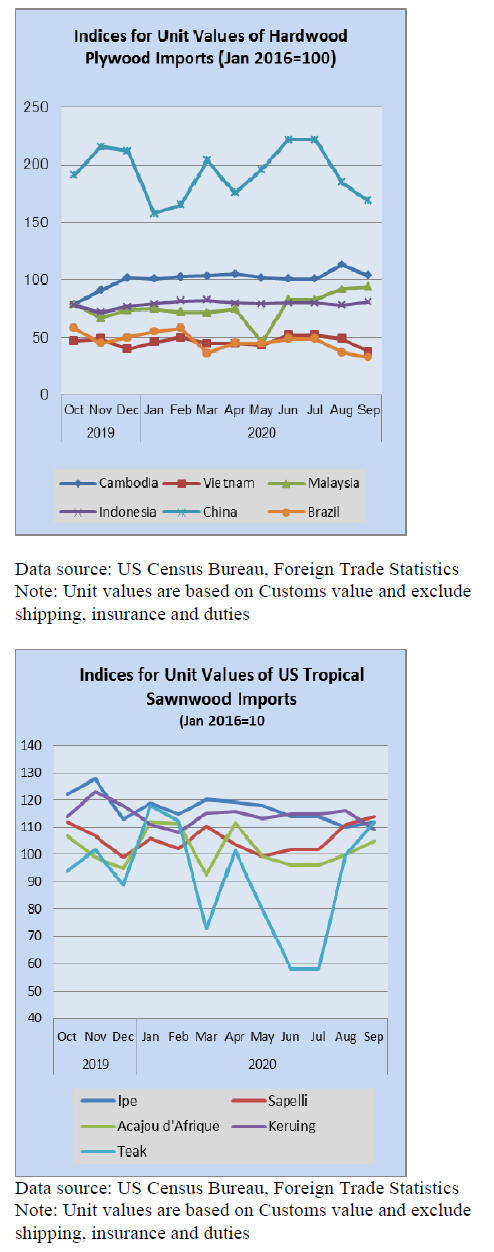

US tropical hardwood imports hit slowdown in

September

US imports of sawn tropical hardwood slowed in

September, falling by 11% from the previous month after

steady gains throughout the summer. The 13,384 cubic

metres imported was nearly 30% below the volume

imported in September of last year. Year-to-date imports

remain down 36% from last year.

Imports from Brazil jumped 41% in September and were

ahead of imports from September 2019 by more than 15%.

Imports from most other trading partner state were down

this September and are down year-to-date between 13%

(Ghana) and 68% (Ecuador).

Imports of nearly every type of tropical hardwood are

below 2019 levels year-to-date, the exceptions being

Iroko, which is up by 170% and Mahogany, which is up

1%. Balsa imports fell by 16% in September and are down

67% year-to-date while Teak imports fell 40% in

September and are down 61% year-to-date.

Canadian tropical hardwood imports surge

Canadian imports of tropical hardwood more than doubled

in September over the previous month to reach their

highest dollar amount of the year. The majority of the

gain appears to come in the form of Sapelli from

Cameroon, as imports from Cameroon more than tripled in

September and Sapelli imports rose 134%.

Despite the gain, overall imports as still down 16% yearto-

date with most woods other than Sapelli down much

sharper than that.

See:

http://www.ic.gc.ca/eic/site/tdo-dcd.nsf/eng/Home

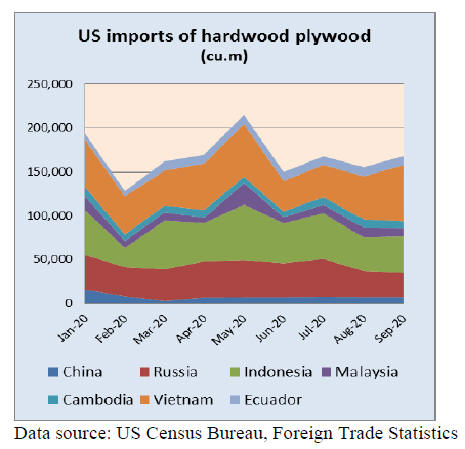

Surge in hardwood plywood imports from Vietnam

US imports of hardwood plywood rose by 10% in volume

in September making it the strongest month of 2020.

Imports from Vietnam were especially notable for the

month as volume rose by 31% yet unit values of its

plywood fell sharply, resulting in import dollar amounts

rising by only 2%.

The US is importing from Vietnam more than of any other

country and volume is up 17% year-to-date through

September. Imports from Indonesia gained 8% in

September and are ahead 28% year-to-date. Total US

hardwood plywood imports are up 3% year-to-date.

Veneer imports fall sharply in September

While US imports of tropical hardwood veneer usually

decline late in the year the 52% drop from August was

even steeper than in previous years. Year-to-date imports

are down 29%. September saw absolutely no imports from

Italy and Cameroon.

Despite there being no imports in September, year to date

imports from Cameroon are up 114%. Imports from Ghana

were up 406% in September but are still down 65% from

2019 year-to-date.

Imports of hardwood flooring continue steady growth

US imports of hardwood flooring rose 7% in September,

the fourth monthly gain. Yet the gains are still not enough

to catch last year¡¯s imports as the monthly total was still

more than 20% less than that of the previous September

and year-to-date totals remain down nearly 30%.

Imports from Indonesia, for example, rose 51% in

September but were still not half that of the September

2019. The bump in imports from Indonesia accounted for

much of the month¡¯s growth as imports from most other

countries were relatively flat.

Imports of assembled flooring panels fell for a second

straight month, dropping 5% in September. However,

even with the modest step down, import levels for the

month were 23% higher than the previous September and

remain near the 10-year high reached in July. Year-to-date

totals are ahead by 5%.

Imports from China fell 41% in September while imports

from Vietnam rose 12% for the month and are ahead 45%

year-to-date.

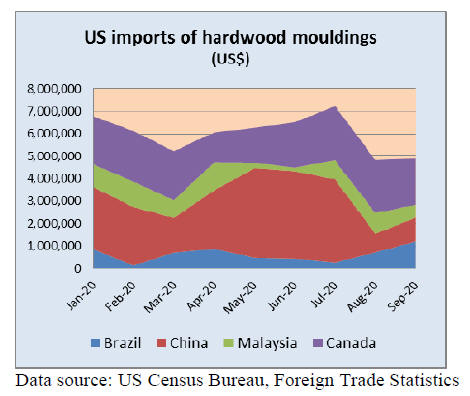

US moulding imports continue to slide

US imports of hardwood mouldings fell below US$8

million in September, an 8% drop from August that

dragged imports below the worst months of the pandemic

and to the lowest totals in more than 10 years.

Imports were down more than 35% from the previous

September and year-to-date totals are off by 17%.

Imports from Brazil are down 52% year-to-date despite

rising 69% in September. Imports from China also gained

considerably while imports from Malaysia and Canada

declined.

Industry not impacted as much as feared

According the latest survey results from Woodworking

Network the impact of the COVID-19 pandemic on the

woodworking industry is diminishing even as there seems

to be a new surge in infections.

When Woodworking Network first surveyed the

woodworking industry about the pandemic in March,

some 36.5% predicted it would have a major impact on

their businesses. Today, that number has dropped to

21.3%.

The number who predicted the impact would be serious

but not major is relatively unchanged, going from 35.8%

in March to 34.7% in the October survey. By contrast,

respondents who predicted a minor impact in March

(23.7%) swelled to more than one-third (34.7%) in

October. Similarly, the percentage who saw no impact

from the pandemic in March (4.1%) has more than

doubled to 9.4% in the October results.

When it comes to specific impacts from the pandemic,

disrupted schedules were cited the most by respondents in

March (69%) and in October (61.8%). More respondents

cited disrupted supply as an impact in October (53.7

percent) compared to March (46.8%).

While more than half of respondents reported loss of

business in March (55.1%), for October, that number has

dropped to 47.8%. Similarly, the impacts of mandated

shutdowns (39% in March) dropped to just 26.5% in

October. Cancelled orders plagued more than a third of

respondents (34.5%) in March but have dropped to 26.5%

in October.

See:https://www.woodworkingnetwork.com/news/woodworkingindustry-news/updated-survey-charts-pandemic-impactwoodworking-industry

|