|

Report from

Europe

Unexpected rise in EU27 tropical timber imports in

November

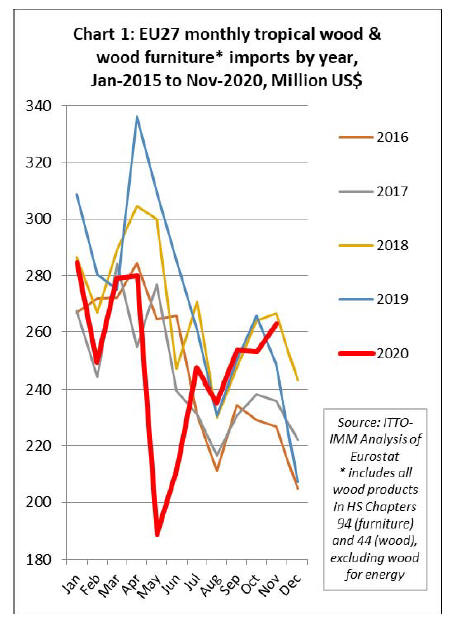

Total EU27 (i.e. excluding the UK) import value of

tropical wood and wood furniture products was US$2.75

billion between January and November last year, 10% less

than the same period in 2019. This is a significantly higher

level of import than forecast earlier in the year when the

first waves of the COVID-19 pandemic hit the continent.

Total import value in November was US$263 million, a

4% gain on the previous month and 6% more than the

same month in 2019 (Chart 1).

The high level of EU27 tropical wood product imports in

November is encouraging and was unexpected as it

coincided with signs of severe stress in the EU market in

the last quarter of 2020. According to the EU¡¯s Winter

2021 Economic Forecast published on 11th February,

GDP in the EU increased by 11.5% in the third quarter of

2020 before contracting by 0.5% in the fourth quarter as

the second wave of the pandemic triggered renewed

containment measures. According to the Forecast, EUwide

GDP is estimated to have declined 6.3% in 2020.

The Forecast notes that ¡°Europe remains in the grip of the

coronavirus pandemic. The resurgence in the number of

cases, together with the appearance of new, more

contagious strains of the coronavirus, have forced many

Member States to reintroduce or tighten containment

measures¡±.

According to the latest data from the Oxford ¡°stringency

index¡±, which records the strictness of ¡®lockdown style¡¯

policies to limit the spread of COVID-19, in mid-February

strict lockdown conditions were still in place throughout

most of Europe. These measures are now expected to be in

force in many European countries at least until mid-

March.

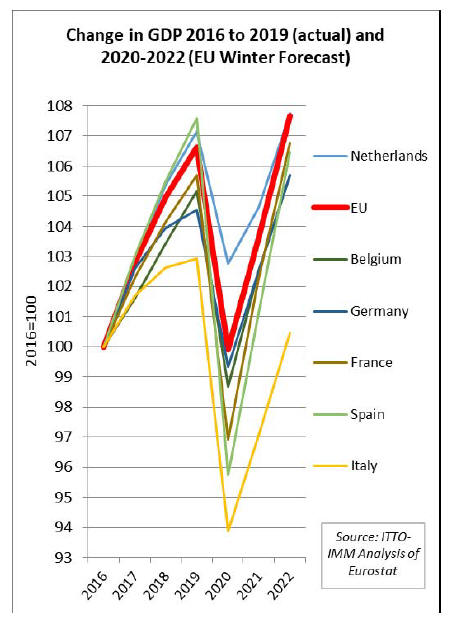

According to the EU Winter forecast, the EU economy is

expected to contract in the first quarter of 2021 but

economic growth should resume in the spring and gather

momentum in the summer as vaccination programmes

progress and containment measures gradually ease. An

improved outlook for the global economy is also set to

support the recovery. The EU economy is projected to

grow by 3.7% in 2021 and 3.9% in 2022.

The economic impact of the pandemic remains uneven

across Member States and the speed of the recovery is also

projected to vary significantly (see GDP chart below). In

Germany, the EU¡¯s largest economy, GDP declined 5% in

2020 and is projected to increase 3.2% in 2021 and 3.1%

in 2022. The depth of economic decline and speed of

recovery is projected to be greater in several EU countries

including France, Spain and Belgium.

Italy, which suffered a particularly sharp decline in GDP

in 2020, is expected to recover more slowly than all other

EU countries. In contrast, the fall in GDP in the

Netherlands in 2020 was less severe than in other western

European countries and the recovery in 2021 and 2022 is

also expected to be stronger.

The EU Winter Forecast notes that ¡°risks are more

balanced since the autumn, though they remain high. They

are mainly related to the evolution of the pandemic and the

success of vaccination campaigns. Positive risks are linked

to the possibility that the vaccination process leads to a

faster-than-expected easing of containment measures and

therefore an earlier and stronger recovery¡±.

It goes on to suggest that ¡°NextGenerationEU, the EU's

recovery instrument of which the centrepiece is the

Recovery and Resilience Facility (RRF), could fuel

stronger growth than projected, since the envisaged

funding has - for the most part - not yet been incorporated

into this forecast¡±.

On the downside, ¡°the pandemic could prove more

persistent or severe in the near-term than assumed in this

forecast, or there could be delays in the roll-out of

vaccination programmes. This could delay the easing of

containment measures, which would in turn affect the

timing and strength of the expected recovery. There is also

a risk that the crisis could leave deeper scars in the EU's

economic and social fabric, notably through widespread

bankruptcies and job losses. This would also hurt the

financial sector, increase long-term unemployment and

worsen inequalities¡±.

Forward looking indicators show that economic

momentum in the EU27 is unlikely to increase in the first

quarter of 2021. The IHS Markit Eurozone Composite

Purchasing Managers Index (PMI) declined from 49.1 in

December to 47.8 in January. Any score below 50

indicates that a majority of those surveyed recorded a

decline in purchasing during the month.

Services were the principal drag on economic output, with

activity here falling for a fifth successive month in

January. Manufacturing remained the principal bright spot

of eurozone economic performance, expanding for a

seventh successive month in December, albeit at the

lowest rate in this growth sequence.

The latest PMI data for eurozone construction activity is

also not encouraging, falling from 45.5 in December to

44.1 in January, to signal a sharp and accelerated decline

in eurozone construction activity. Notably, the rate of

contraction was the quickest recorded since last May and

stretched the current sequence of reduction to 11 months.

Underlying data signalled reduced construction output

across each of the three sub-sectors monitored by IHS

Markit; housing, commercial and civil engineering. At the

national level, German and French firms reported further

declines in construction activity, with the latter recording

the sharpest contraction since last May. Moreover, Italian

firms signalled a renewed, albeit marginal decline in

activity in January.

That said, according to IHS Markit, construction firms in

the eurozone appeared optimistic regarding the outlook for

activity over the coming 12 months. Confidence turned

positive for the first time since July 2020, as hopes for a

broad recovery in the construction sector were

underpinned by positive vaccine news.

Rebound in EU27 tropical wood product imports

gathered pace in November

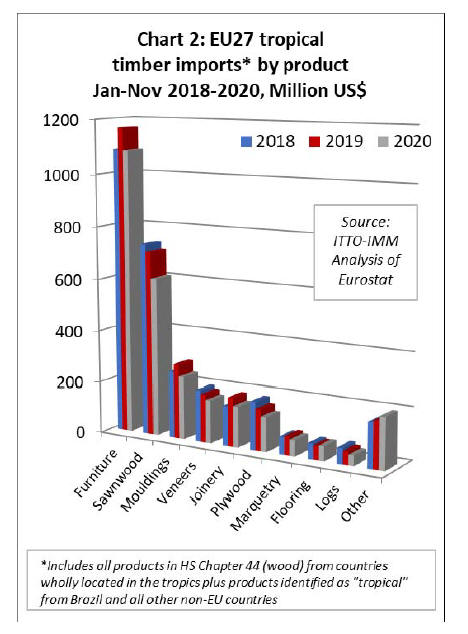

Unsurprisingly, EU27 imports of all the main tropical

wood products fell in the first eleven months of 2020, but

in each case the decline was less dramatic than expected

earlier in the year when the scale of the pandemic and

associated lockdown measures was just becoming

apparent. The recovery in imports also strengthened in

November for all product groups and in all EU countries,

with the exception of Italy.

In the year to November, EU27 import value of wood

furniture from tropical countries declined 7% to US$1080

million, while import value of tropical sawnwood declined

14% to US$608 million, tropical mouldings were down

16% to US$241 million, veneer down 10% to US$165

million, joinery down 16% to US$157 million, plywood

down 16% to US$133 million, marquetry and ornaments

down 13% to US$63 million, and logs down 22% to

US$40 million. Import value of tropical flooring actually

increased slightly, up 4% to US$57 million (Chart 2).

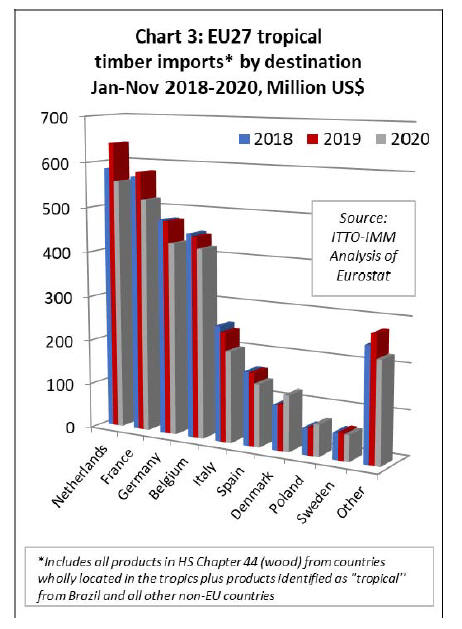

Import values fell into all six of the largest EU27

destinations for tropical wood and wood furniture products

in the first eleven months of the year. Import value was

down 13% to US$557 million in the Netherlands, 10% in

France to US$519 million, 10% in Germany to US$427

million, 6% in Belgium to US$420 million, 17% in Italy to

US$203 million, and 14% in Spain to US$139 million.

However, import value increased in Denmark, by 21% to

US$125 million, and in Poland, by 15% to US$71 million.

Import value in Sweden declined, but by only 5% to

US$58 million (Chart 3).

EU27 wood furniture imports from Vietnam close to

last year¡¯s level

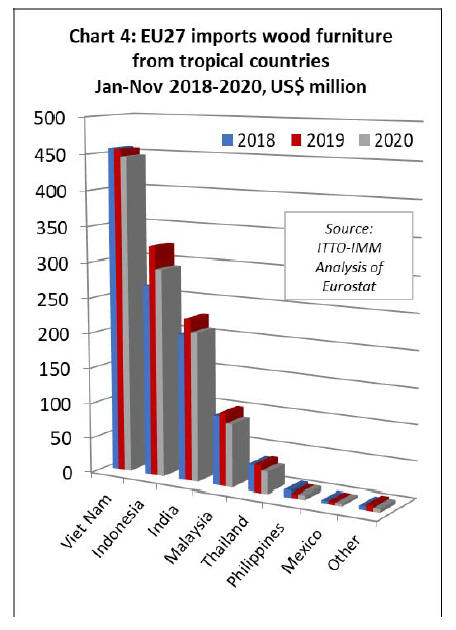

In the furniture sector in 2020, EU27 import value from

Vietnam almost matched the previous years¡¯ level in the

first eleven months, down only 2% to US$446 million.

Imports from Indonesia were down 9% to US293 million

in the first eleven months of 2020, although this compares

with a relatively strong performance in 2019 and imports

were still higher than in the same period during 2018

(Chart 4).

EU27 imports of wood furniture declined sharply from

Malaysia and Thailand in the first eleven months of 2020,

respectively down 14% to US$89 million and 21% to

US$30 million. However imports from the Philippines

increased 5% to US$6.4 million.

EU27 imports of wood furniture from India were down

8% to US$210 million in the first eleven months of 2020.

Partly due to supply side issues, imports from furniture

from India almost came to a complete halt in May last year

but rebounded very strongly in the second half of 2020

when they were at record levels for that time of year.

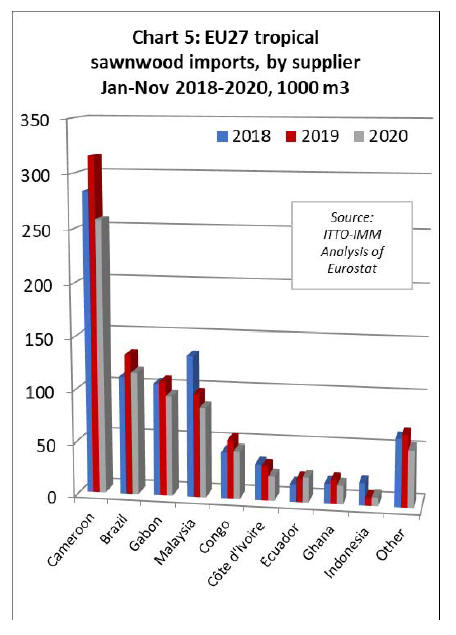

EU27 tropical sawnwood imports fall 16%

In quantity terms, EU27 imports of tropical sawnwood

declined 16% to 726,200 cu.m in the first eleven months

of 2020. Imports fell sharply from all major supply

countries; down 18% from Cameroon to 257,700 cu.m,

13% from Brazil to 116,000 cu.m, 13% from Gabon to

94,700 cu.m, 13% from Malaysia to 85,100 cu.m, 18%

from Congo to 45,600 cu.m, 28% from Côte d'Ivoire to

23,300 cu.m, and 22% from Ghana to 17,700 cu.m.

However Ecuador bucked the downward trend, with EU27

imports of sawnwood from the country rising 10% to

23,900 cu.m, much destined for Denmark and driven by

booming demand for balsa for wind turbines. Imports of

sawnwood from Indonesia also increased slightly, by 14%

to 8,130 cu.m, but this follows a 66% reduction in 2018

(Chart 5).

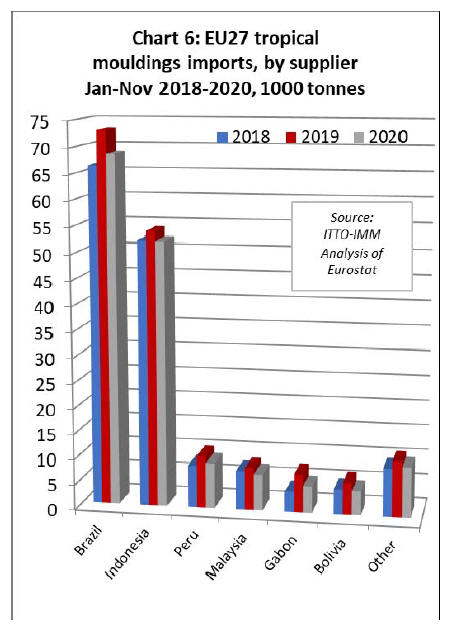

The decline in imports of tropical sawnwood in the first

eleven months of 2020 was mirrored by a similar decline

in EU27 imports of tropical mouldings/decking.

Imports of this commodity were down 8% overall at

156,800 tonnes, falling 6% from Brazil to 68,600 tonnes,

4% from Indonesia to 52,100 tonnes, 14% from Peru to

8,900 tonnes, 14% from Malaysia to 7,200 tonnes, 30%

from Gabon to 5,300 tonnes, and 25% from Bolivia to

4,800 tonnes (Chart 6).

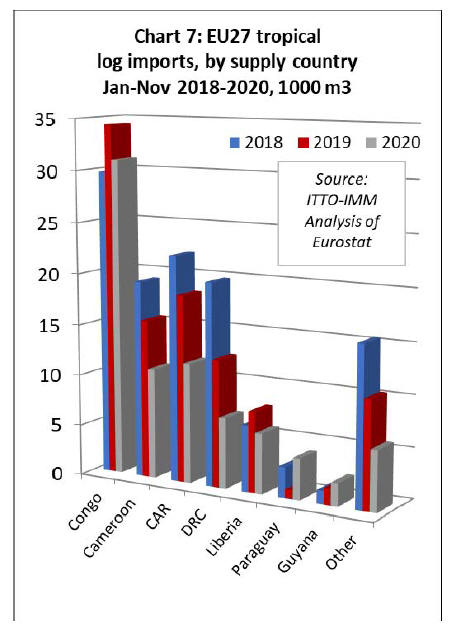

EU27 imports of tropical logs were down 23% to 78,700

cu.m in the first eleven months of last year. (Chart 7)

Imports held up reasonably well from the Republic of

Congo, down only 10% to 31,000 cu.m, but fell sharply

from all other leading African supply countries including

Cameroon (-31% to 10,800 cu.m), Central African

Republic (-36% to 11,800 cu.m), DRC (-44% to 7,000

cu.m), and Liberia (-25% to 5,900 cu.m).

However, there was a significant in imports from two

smaller suppliers in South America; Paraguay (+347% to

4,100 cu.m) and Guyana (+38% to 2,200 cu.m).

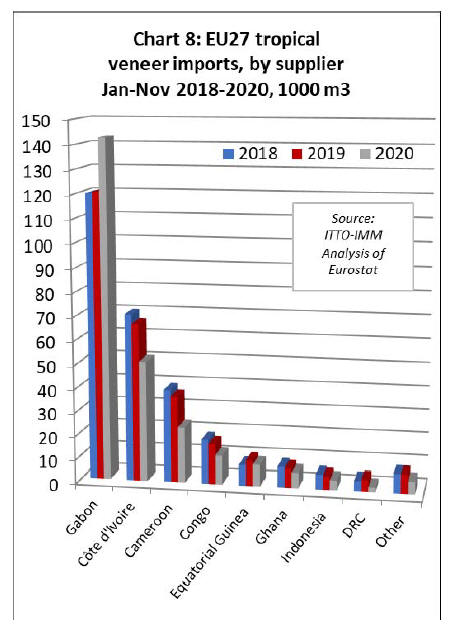

EU27 tropical veneer imports from Gabon on the rise

despite pandemic

EU27 imports of tropical veneer declined 8% to 256,200

cu.m in the first eleven months of 2020. Imports from

Gabon bucked the wider downward trend, the EU27

importing 148,800 cu.m from the country between January

and November last year, 18% more than the same period

in 2019, mainly destined for France.

Veneer imports declined from all other major tropical

suppliers, including Côte d'Ivoire (-24% to 50,800 cu.m),

Cameroon (-36% to 23,500 cu.m), Equatorial Guinea (-

15% to 9,200 cu.m), Ghana (-20% to 6,500 cu.m),

Indonesia (-26% to 4,200 cu.m) and DRC (-62% to 1,900

cu.m). (Chart 8).

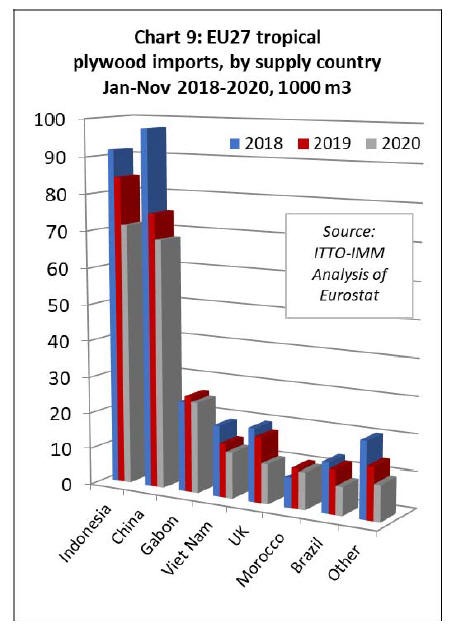

Although there were signs of an uptick in the pace of

EU27 imports of tropical hardwood faced plywood

between September and November last year, total imports

of 223,600 cu.m in the first eleven months were still down

15% compared to the same period in 2019.

Imports fell from all the leading supply countries

including Indonesia (-15% to 71,400 cu.m), China (-9% to

68,000 cu.m), Gabon (-5% to 25,000 cu.m), Vietnam (-

15% to 12,600 cu.m), Morocco (-7% to 10,100 cu.m) and

Brazil (-35% to 7,900 cu.m). EU27 imports of tropical

hardwood faced plywood from the UK ¨C a re-export since

the UK has no plywood manufacturing capacity - declined

39% to 10,800 cu.m (Chart 9).

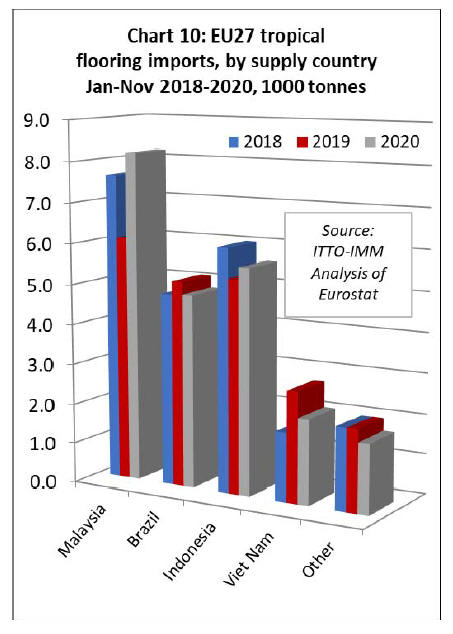

EU27 tropical flooring imports rise while other joinery

imports decline

Given the situation in the wider market, one of the least

expected trends in EU27 import data was a slight recovery

in imports of tropical flooring products in the first eleven

months of last year. (Chart 10)

This follows a long period of continuous decline. Imports

increased 5% to 22,400 tonnes, with the gain due to a 35%

rise in imports from Malaysia to 8,200 tonnes, mostly

destined for Belgium. Imports from Indonesia increased

slightly, by 5% to 5,600 tonnes and declined moderately

from Brazil, down 6% to 4,800 tonnes. Imports from

Vietnam fell more rapidly, by 23% to 2,100 cu.m.

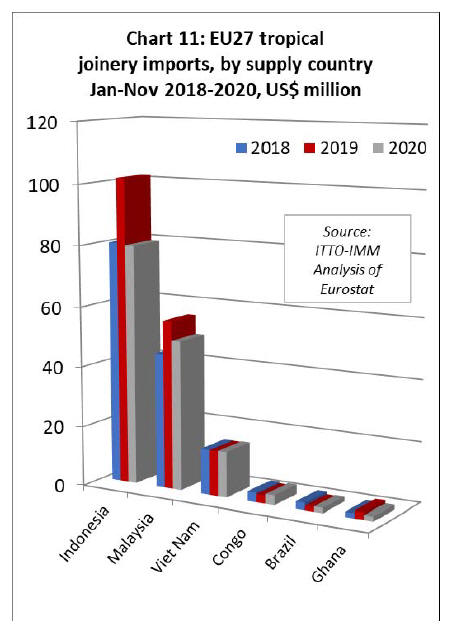

EU27 import quantity of other joinery products from

tropical countries, which mainly comprise laminated

window scantlings, kitchen tops and wood doors, declined

16% to 157,000 tonnes in the first eleven months of 2020.

Imports were down 22% to 79,600 tonnes from Indonesia,

11% to 49,600 tonnes from Malaysia, and 40% to 1,500

tonnes from Ghana. However imports increased by 1% to

15,100 tonnes from Vietnam and by 18% to 3,200 tonnes

from the Republic of Congo. (Chart 11).

|