US Dollar Exchange Rates of

10th March

2021

China Yuan 6.5066

Report from China

Particleboard and fibreboard production capacity

trends

The National Planning and Design Academy for the Forest

Products Industry under the State Administration of

Forestry and Grassland and the China National Forest

Products Industry Association has released an analysis of

China¡¯s particleboard and fibreboard industry.

Particleboard

The report says an additional 16 particleboard production

lines with a production capacity of 3.09 million cubic

metres per year were in operation nationwide in 2020.

There were 329 particleboard production enterprises and

348 particleboard production lines distributed in 24

provinces, municipalities and autonomous regions in

China by the end of 2020 with a total production capacity

of 36.91 million cubic metres per year, down 3.5% from

the end of 2019. The average single-line production

capacity further increased to 106,000 cubic metres per

year.

The top 10 provinces in terms of particleboard production

capacity are Shandong (7.41 million cu.m per year),

Guangdong, Hebei, Guangxi (3.25 million cu.m per year)

and Jiangsu, Anhui, Henan, Hubei, Sichuan and Fujian

provinces.

The total production capacity of particleboard in China

experienced rapid growth for four years in a row and then

decreased slightly as the number of enterprises fell.

About 92 particleboard production lines nationwide were

closed or suspended production in 2020 eliminating some

5.8 million cubic metres of production capacity.

By the end of 2020, a total of 1,123 particleboard

production lines had been shut down, dismantled or

stopped production and some 27.72 million cubic metres

of production capacity had been eliminated.

China had in production 3 new production lines for

oriented particleboard in 2020 with an additional

production capacity of 850,000 cubic metres per year. By

the end of 2020, China had 26 oriented particleboard

production lines with a total production capacity of 4.16

million cubic metres per year, an increase of 18% from the

end of 2019. These mills are distributed in seven provinces

and regions, including Shandong, Hubei, Guangxi, Anhui,

Jiangsu, Guizhou and Yunnan provinces.

25 particleboard production lines were being built in early

2021with total production capacity of 6.75 million cubic

metres per year. There are particleboard production lines

under construction in the 7 main regions (east China, south

China, central region, southwest, north China, northeast

and northwest regions), including 18 continuous flatpressed

production lines with the total production capacity

of 5.72 million cubic metres per year, accounting for 84%

of the particle board production capacity under

construction.

The particleboard production lines under construction will

be put into operation from 2021 to 2022 and it is estimated

the national particleboard production capacity could

exceed 40 million cubic metres per year by the end of

2021.

See:

http://www.cnfpia.org/sf_6EB6F5386E324C31B3D1A22300903ECC_297_9E5BA0FB363.html

Fibreboard

China¡¯s fibreboard sector is characterized as follows:

15 fibreboard production lines were built in 2020 adding

2.76 million cubic metres per year of capacity.

There were 392 fibreboard manufacture enterprises, 454

production lines in China distributed across 25 provinces,

cities and regions by the end of 2020. Total production

capacity was 51.76 million cubic metres, down 1.3% from

the end of 2019. The capacity per production line rose to

114,000 cubic metres per year.

The top 10 provinces in terms of fibreboard production

capacity are Shandong (7.98 million cubic metres per

year), Hebei (5.66 million cubic metres per year), Guangxi

(5.35 million cubic metres per year), Jiangsu, Guangdong,

Anhui, Henan, Hubei, Sichuan and Yunnan provinces.

The total production capacity of fibreboard in China

declined slightly after two consecutive years of growth

showing a general trend of the number of enterprises, the

number of production lines.

China shut down, dismantle or stopped production in

about 118 fibreboard production lines in 2020 eliminating

about 7.88 million cubic metres of production capacity

per year.

A total of 781 fibreboard production lines had been shut

down, dismantled or stopped production by the end of

2020 eliminating 33.16 million cubic metres of production

capacity per year.

There were 136 continuous flat-pressed fibreboard

production lines in China by the end of 2020 with a total

production capacity of 26.92 million cubic metres per

year, accounting for 52% of the national total fibreboard

production capacity. Mills are distributed in 19 provinces

(regions). The top seven are Shandong, Guangxi, Hebei,

Hubei, Anhui, Guangdong and Henan.

22 national fibreboard production lines were being built in

early 2021 with the total production capacity of 4.86

million cubic metres per year, fibreboard production lines

are under construction in the East China, south China,

central China, northwest, north China and Northeast

regions except southwest region. The fibreboard

production lines under construction will be put into

operation from 2021 to 2022 and it is expected that the

national total fibreboard production capacity will reach 55

million cubic metres per year by the end of 2021.

See:

http://www.cnfpia.org/sf_233C8F4BD30B4BB285003D512B8D711E_297_9E5BA0FB363.html

Changsha City - the main border crossing for Russian

timber

Construction of the Container Center at the Central and

Southern Land Port to serve the China-Europe Railway

Express (Changsha) is being accelerated in Changsha City

of Hunan province.

The construction will provide the foundation for expansion

of the China-Europe Railway Express (Changsha) to meet

the international logistics needs of the large number of

small and medium-sized enterprises in the region.

Statistics show that the China-Europe Railway Express

(Changsha) saw an explosive growth in 2020with a total of

530 trains shipped exceeding the total number during a

four year period from 2014. The value of cargo

transported was US$2.06 billion, a year-on-year growth of

99%.

At present, Trains from Changsha City have gone to

Russia, Minsk, Malaszewicze, Budapest, and Central Asia

and returned from Hamburg, Budapest, Central Asia and

Russia. 9 to 12 trains operate weekly in Changsha City

serving 27 cities in 12 countries.

A large volume of Russian timber has been shipped to

Changsha City via the China-Europe Railway Express

(Changsha) and distributed across the country. Changsha

City is the main entry point for Russian timber at present.

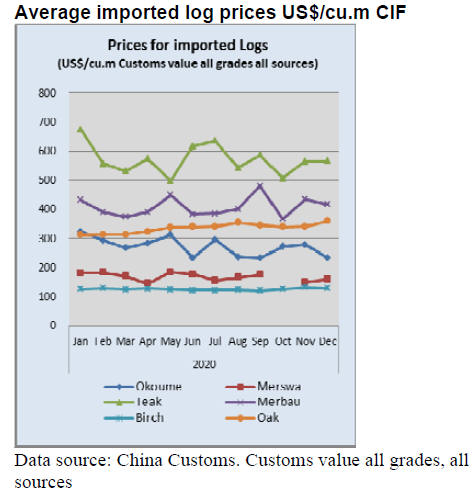

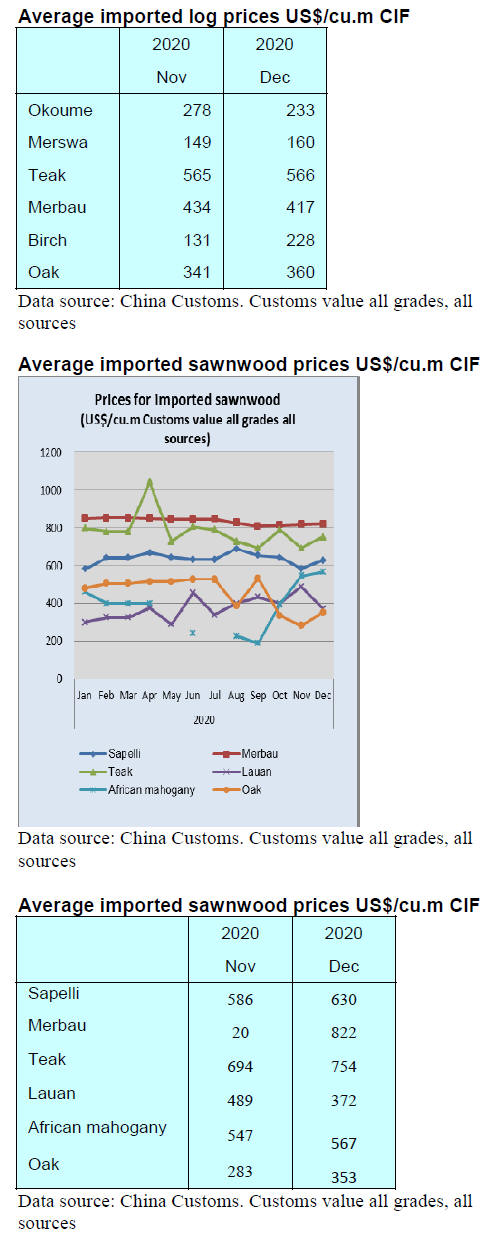

Analysis of current timber market prices fluctuations

Many members of China¡¯s timber associations have

reported increases in timber prices are of concern as they

impact production costs. The most serious price

fluctuations have been for softwood logs, At present prices

for hardwood logs are relatively stable.

The secretariat of the China Wood Protection Industry

Association (CWPIA) undertook an analysis and this is

summarised below.

The first cause of price increases is the pandemic. Demand

for wood products in the United States, Canada and parts

of Europe has increased. Raw material suppliers to China

see an opportunity to raise prices on the back of growing

demand.

Second is the impact of land and sea freight. The

pandemic has had a significant impact on international

trade. Port inspections and quarantine have become stricter

and the flow of containers has been disrupted and shipping

companies have raised container shipping costs.

The third is the impact of supply and demand. In 2020,

China's timber imports totaled 108.02 million cubic

metres, down about 5% year on year. The main suppliers

of timber such as Russia, New Zealand and Canada saw

demand fall. Stocks in supply countries and in China have

fallen leading to a temporary imbalance between the

supply and demand of timber which has pushed up prices.

The Association suggests that eventually the pandemic

will gradually be controlled and production and exports

will gradually recover in the main timber production

countries.

See:

http://www.cwp.org.cn/vip_doc/19836251.html

|