Japan

Wood Products Prices

Dollar Exchange Rates of 25th

March

2021

Japan Yen 109.82

Reports From Japan

State of emergency lifted

across country

On 21 March the Japanese government announced an end

to the current state of emergency in the Tokyo region as

the rate of corona infections had declined. This will bring

some relief to the stricken economy and lay the ground

work for preparations for this summer's Tokyo Olympics.

There is concern, however, that easing restrictions now

could result in a resurgence of infections. The spread of

the virus fell during the latest state of emergency but

recent data suggest the decline has bottomed out and is

even rebounding in some prefectures including Tokyo.

Bank of Japan confirms continuation of stimulus

policy

The Bank of Japan (BoJ) announced changes in its

approach to maintaining growth and at the same time

trying to generate inflation.

After the latest BoJ policy meeting the Bank governor said

they will aim to balance support for stimulus over the

longer term while avoiding the impression that the Bank is

cutting back on easing measures.

While leaving its main policy rates unchanged the bank

said the range of its 10-year bond yield would now be

plus/minus 0.25%. Until January the range had been

around 0.2%.

The Bank said it would offer lending incentives if it

lowered its target rates a move aimed at changing the

perception it cannot lower its negative rate due any further

without undermining the viability of struggling regional

banks.

At the end of last year prices in Japan fell sharply and this

made the Bank search for ways to keep its stimulus efforts

running for longer. Inflation still looks a long way off as

prices fell for a seventh consecutive month in February.

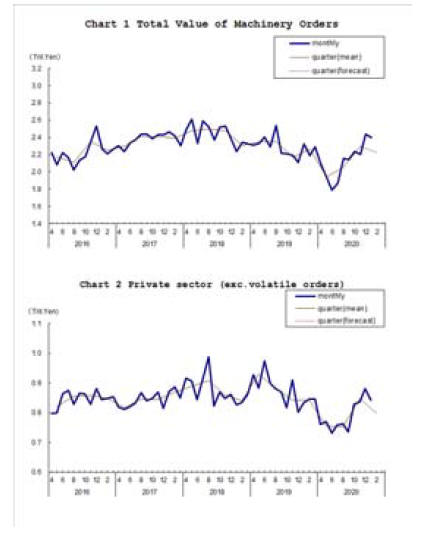

Machinery orders tilt lower

According to the Cabinet Office private-sector machinery

orders fell 4.5% in January compared to December 2020.

Machinery orders are seen as a leading indicator of capital

spending. The January decline was the first in four

months.

Companies rethinking overseas investment

strategies

A Japan External Trade Organization (JETRO) survey has

found that most Japanese companies which were

considering pursuing overseas operations are rethinking

business strategies and almost 70% of companies with

overseas operations said they had seen sales drop in fiscal

2020.

The survey found that 36% are concerned that over the

next two to three years China and the US will introduce

tough trade regulations which will dent global trade.

While the mood among firms looking to expand existing

overseas operations has fallen the JETRO survey says

there is still considerable interest among Japanese firms to

establish overseas operations.

Other points from the JETRO report include:

Business confidence fell to the lowest level due

to the COVID-19 pandemic, while deterioration

in China was mild.

The intention of business expansion in the next

one to two years is at a record low.

70% of Japanese affiliated companies in China

expect to recover from the negative impact of the

pandemic in the first half of 2021, earlier than

other countries.

COVID-19 accelerated the digital shift of

companies.

The negative impact of changes in the trading

environments lingers with significant

deterioration in Hong Kong and Australia.

In Vietnam changes in the trading environments

had a positive impact on business performance.

See:

https://www.jetro.go.jp/ext_images/_News/releases/2021/69b41fe59a5b2299/rp_firms_asia_oceania2020.pdf

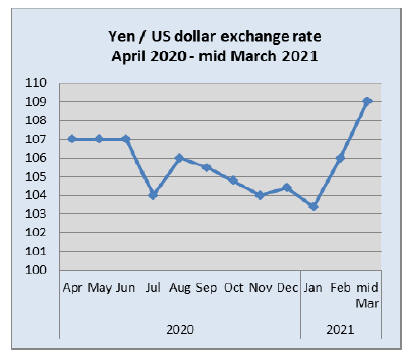

Yen continues to weaken but this may not last

Following the Bank of Japan¡¯s decision to widen the target

range for the 10-year Japanese government bond yield the

yen weakened past 109 to the US dollar. This boosted

sentiment among exporters but analysts signaled the yen

has the capacity to recover some of its weakness as, at

present, it is starting to look increasingly cheap.

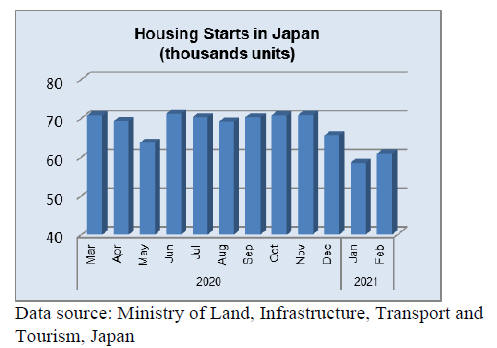

Residential housing oversupply

Data from the Land Institute of Japan suggests Japan's

housing market remains steady despite the economic

repercussions from the pandemic.

e index rose by

about 0.8% during the first three quarters of 2020

following year on year rises of 0.6% in 2019, 2.1% in

2018, and 2.4% in 2017.

However, residential construction activity continues to fall

due to the country's massive over-supply. In the first

eleven months of 2020 housing starts fell by 10%

following three consecutive years of declines.

Sales of existing detached house sales increased 3.6% in

the first three quarters of 2020 and it has been suggested

demand could rise after the pandemic as Japan is an

attractive investment destination for foreign buyers mainly

from Singapore, Malaysia, Thailand, Hong Kong, and

mainland China.

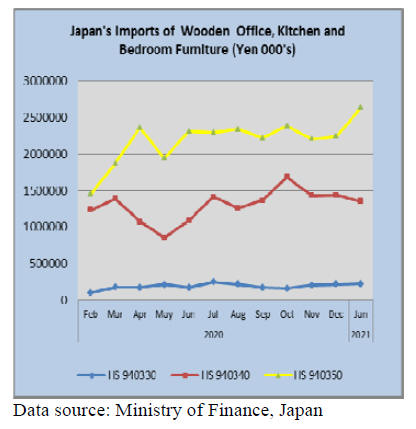

Import update

Furniture imports

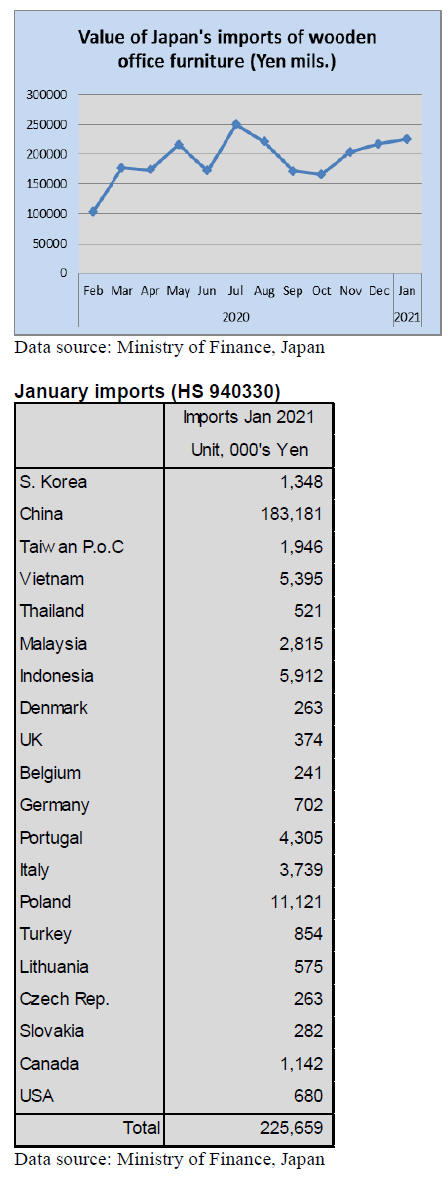

Clearly the pandemic has been good for sales of kitchen

and bedroom furniture. Japan¡¯s imports of both items have

risen over the past 12 months with the value wooden

kitchen furniture import rising the most. This fits with the

observation that households have, during the various

lockdowns, turned their attention to home improvement.

The scale in the graphic below on wooden furniture

imports disguises the substantial increase in the value of

wooden office furniture which it can be assumed is linked

to the work-from-home style which created demand for

home office items (see graphic under office furniture).

Office furniture imports (HS 940330)

The value of Japan¡¯s imports of wooden office furniture

(HS940330) rose 4% from a month earlier but year on

year the value of imports was down 9%.

Throughout last year shippers in China dominated the

supply of wooden office furniture to Japan and this

continued into 2021 with some 80% of all arrivals coming

from China. Polish wooden office furniture acouted for

5% od January imports and a new comer to the list of top

20 shippers, Vietnam, secured around 2% of the value of

January imports.

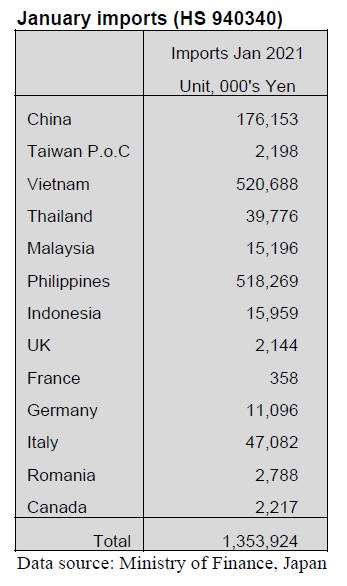

Kitchen furniture imports (HS 940340)

Consitently over the past year suppliers in three countries,

the Philippines, Vietnam and China accounted for most of

Japan¡¯s imports of wooden kitchen furniture, this

continued into January 2021 with shippers in Vietnam and

the Philippines accounting for almost 40% each of imports

with a furthet 13% coming from manufacturers in China.

Less than 5% was supplied from European makers.

Year on year the value of Japan¡¯s imports of wooden

kitchen furniture dropped 9% in January and compared to

arrivals in December 2020 there was a 6% decline in

January 2021.

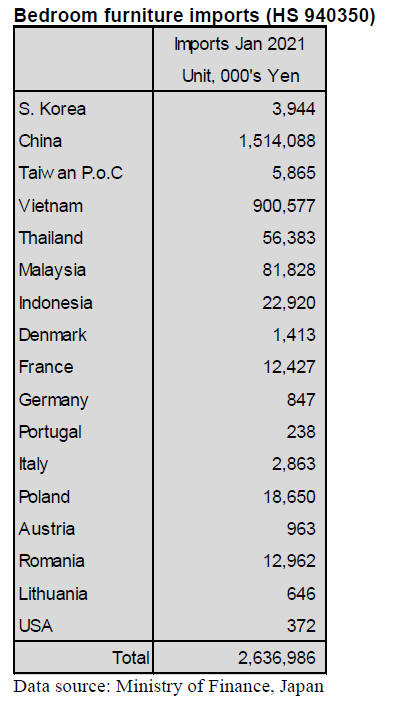

Bedroom furniture imports (HS 940350)

The value of Japan¡¯s January 2021 imports of wooden

bedroom furniture (HS940350) was up a massive 17%

compared to December 2020 imports. However, year on

year, January 2021 imports dipped around 7%.

China and Vietnam shipped wooden bedroom furniture

accounting for over 90% of the value of Japan¡¯s January

2021 imports. Manufacturers in Malaysia and Thailand

together contributed another 5% to the value of January

2021 import values.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Orders taken by major house builders

Average ordered values by eight major house builders in

January is 1% less than January last year, first decline after

three months.

Visitors to the house exhibition sites dropped after the

second state of emergency was declared but request of

advertising materials through web site doubled.

Demand for detached units seems to be increasing and

major house builders are establishing new marketing style.

Sending out marketing information to potential buyers

then first interview at model house at the exhibition site,

which leads to conclude the deal.

Sales value by other listed house builders has been

exceeding last year¡¯s record for nine straight months.

Inquiries are strong for suburban areas. Demand is active

to have house in suburban areas of Tokyo like Chiba and

Saitama prefecture where commuting is possible and can

have more spacious house.

Number of visitors to house exhibition sites had been

increasing since last fall until January but people are now

used to behave with COVID-19 prevention measures and

potential buyers are serious to act despite various

restrictions.

House builders have been introducing new models with

new specifications to cope with new life style after the

market is changing rapidly. Particularly having work space

at home is necessary to deal with demanding remote teleworks.

March is normally busy month for house buyers as it is

month of school graduation and transfer of working areas.

The state of emergency is now extended to March 21 and

after this is lifted, potential buyers get active.

Domestic log supply in 2020

At the beginning of 2020, housing starts were expected to

decline because of consumption tax increase in October

2019 so log demand would be less than 2019 then came

unexpected COVID-19 pandemic so the demand dropped

down to 2015 level..

Weather in January and February was very mild all over

Japan so that log production was smooth. Recent tendency

is that sawmills build up log inventory in the first half of

the year to prepare tight log supply in summer so log

purchase was active through March then in April, the state

of emergency was announced so log purchase slowed

down rapidly with uncertain future market.

In July, log shipment to sawmills was 28.6% down and to

veneer plants was 29.2% down and the log prices plunged

to record low level. After mills¡¯ log inventory started

decreasing, log purchase got active but log production did

not recover by heavy rain and low prices so by fall, log

prices took off and soared.

Log inventory at the end of the year was less than

December 2019. After all, sudden brake of log purchase in

the second quarter resulted in sharp drop of log prices then

decrease of log inventory and price escalation.

In 2020, domestic log shipment to sawmills was 11,550 M

cbms, 11.6% less than 2019 and to veneer and plywood

plants was 4,130,000 cbms, 8.3% less. Domestic log

shipment to sawmills was bottom in 2015 with 11,910,000

cbms when log prices dropped record low then it had

increased for four years since 2016 and it was 13,070,000

cbms. Reasons are construction of new large sawmills and

plywood mills assisted by the government subsidy and

shift to domestic logs after imported log cost increased.

Plywood

Movement of softwood plywood is getting quiet after

orders from wholesalers started decreasing since last

month and precutting plants show difference of demand by

how much orders they have from large builders. After all,

the market is not as active as last December and January.

Supply shortage problem is largely solved and in

particular, in Kanto and North, orders from heavy snow

area are slowing so generally, the supply becomes

smoothly now. In Western Japan, the supply is still tight as

some plywood mills experience lower production which is

normal in cold winter time. The market prices are stable

after the mills raised the sales prices.

The softwood plywood mills need to increase the prices

more because cedar log prices have been climbing after

January but with the movement getting slower, it is not

time to push the prices. The prices of imported plywood

continue climbing in both supply side.

and market in Japan. Plywood suppliers continue raising

export prices because of higher log prices and ocean

freight. There is no optimistic view that log supply should

increase after rainy season is over in April.

In Japan, by continuous escalation of export prices, the

market prices are climbing since the inventory in

distribution channels drops down to record low but the

dealers are afraid of loss like 2019 because of poor

demand.

Import of wood fuel in 2020

Import of wood fuel in 2020 increased again. Wood pellet

import increased to 2,027,662 ton, 25.6% more than 2019.

By source, Vietnam is the top with 1,168,629 ton, 31.8%

more than 2019, Canada is second with 592,886 ton, 0.5%

more and Malaysia is third with 159,773 ton, 206.3%

more.

Vietnam can provide forest certificate the Japanese buyers

demand. Canada did not grow much but large long term

contracts are waiting for start of large FIT power

generation plants on coastal areas after 2022 so it will

increase in future.

Supply from the U.S.A. was only 31 ton, 91.2% less but

large wood pellet supplier, Enviva shipped out about

28,000 ton in last December to Iwakuni from Panama City

of Florida and the supply will increase in future. Enviva

can supply several million ton a year.

Import of PKS is 2,221,489 ton, 35.6% more. 1,662,333

ton from Indonesia, 30.2% more and 558,452 ton from

Malaysia, 54.5% more. The supply situation was unstable

in early 2020 by COVID-19 pandemic and lockdown in

Malaysia.

|