|

Report from

Europe

European wood furniture production down 5% last

year

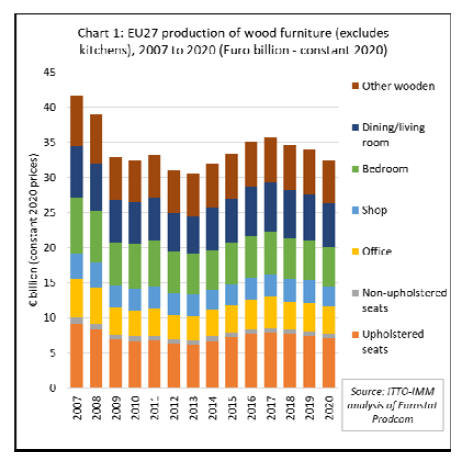

The latest Eurostat PRODCOM data reveals that the total

value of wood furniture production in the EU27 declined

5% to €32.4 billion in 2020. This performance for the year

is significantly better than initially anticipated at the start

of the pandemic.

It is also an improvement on the 8% decline in total EU27

furniture production in 2020 implied by the Eurostat

furniture production index published earlier this year.

Nevertheless, the decline was a major setback for a sector

that has been sliding since 2018. Production value last

year was the lowest since 2014 when the EU27 was just

emerging from the depths of the Euro Debt Crisis in the

aftermath of the 2007-2008 global financial crash (Chart

1).

The production downturn in 2020 was particularly

dramatic for shop furniture which saw a decline of 13% to

€2.8 billion. This was the result of widespread closure of

retail outlets and increased reliance on online shopping as

much of Europe went into lockdown early in the

pandemic.

The decline was much less severe in other sectors

including upholstered seating (-5% to €7.0 billion), office

furniture (-1% to €4.0 billion), bedroom furniture (-3% to

€2.8 billion), dining/living room (-4% to €6.3 billion), and

"other wooden furniture" (-6% to €6 billion). Production

value of non-upholstered seating was flat at €0.6 billion.

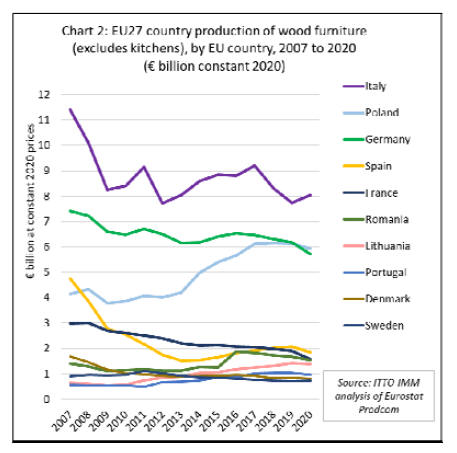

Wooden furniture production value in Italy, the largest

producer in the EU27, increased last year, rising 4% to

€8.0 billion and recovering ground lost in 2019.

Production was down in all other leading supply countries

including Poland (-3% to €5.9 billion), Germany (-8% to

€5.7 billion), Spain (-11% to €1.9 billion), France (-17%

to €3.2 billion), Romania (-9% to €1.5 billion). Lithuania

(-2% to €1.4 billion), Portugal (-7% to €1.0 billion), and

Denmark (-5% to €0.8 billion) (Chart 2).

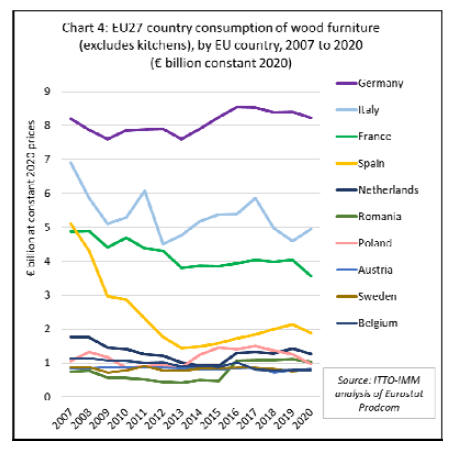

The value EU27 wooden furniture consumption fell 4% to

€28.3 billion in 2020. As for production, the consumption

downturn was most pronounced for wooden shop

furniture, down 10% at €2.4 billion. The total value of

EU27 consumption of wooden office furniture increased in

2020, rising 1% to US$3.6 billion, probably a result of

workers purchasing office equipment for their own homes

during the lockdown.

Consumption of all other furniture types declined in 2020

including upholstered seating (-6% to €6.0 billion), other

seating (-5% to €0.7 billion), bedroom furniture (-4% to

€5.0 billion), dining/living room (-4% to €5.7 billion), and

"other wooden furniture" (-4% to €5 billion).

Wooden furniture consumption in Germany, by far the

largest single market in the EU27, was relatively stable in

2020, as it has been for the last 4 years, falling only 2% to

€8.2 billion. Italy, again surprising given the severe effects

of the pandemic in the country during the year, recorded

an 8% increase in wood furniture consumption value in

2020, to €4.9 billion.

Gains in consumption were also recorded in Austria (+5%

to €0.8 billion) and Sweden (+7% to €0.8 billion).

Elsewhere there were large falls in consumption in France

(-12% to €3.6 billion), Spain (-12% to €1.9 billion), the

Netherlands (-11% to €1.3 billion), Romania (-7% to €1.0

billion), and Poland (-22% to €1.0 billion).

Consumption in Belgium was flat at €0.8 billion during

the year (Chart 4).

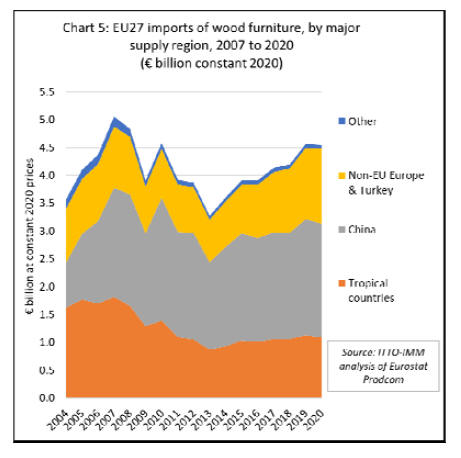

EU27 wood furniture imports from tropical countries

hit by freight problems

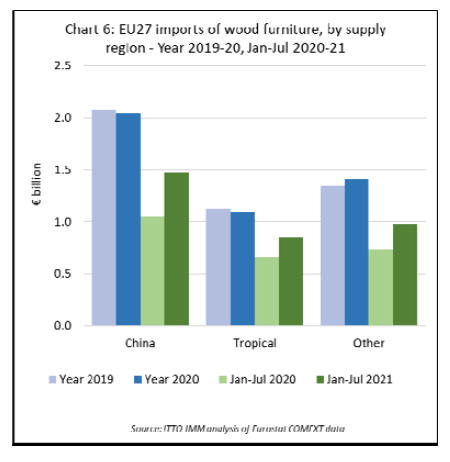

In 2020, the EU27 imported €4.5 billion of wooden

furniture from outside the bloc, only 0.3% less than the

previous year. Imports of €1.1 billion from the tropics

were down 4% at €1.1 billion, while imports from China

fell 2% to €2.0 billion.

In contrast imports from other countries outside the tropics

increased 5% to €1.4 billion. The large decline from

tropical countries was partly due to the severe shortages of

containers and sharp rises in freight rates for shipments

from Southeast Asia to Europe during the year.

However, this is also a continuation of a long term trend of

rising share of EU27 wooden furniture supplies being

sourced from other temperate countries, particularly in the

European neighbourhood, notably Turkey, Bosnia

Herzegovina, Ukraine, Belarus and Serbia (Chart 5).

In recent years, tropical countries have made some slight

gains in the EU27 market for wooden furniture, with their

total share of consumption value rising slowly from 3.5%

in 2014 to 3.8% in 2019, a level maintained into 2020,

despite pandemic-related problems.

Vietnam's share crept up from 1.4% to 1.6%, Indonesia's

from 0.9% to 1%, and India's from 0.5% to 0.7% during

this period.

However, these gains came only after a long period of

decline between 2007 and 2014. Before the global

financial crises, tropical countries accounted for around

5% of all wooden furniture consumed in the EU27.

The long-term shift away from tropical suppliers in the

EU27 wood furniture market was due particularly to loss

of share for tropical wood in the outdoor sector, both to

other wood products and, more significantly, to non-wood

materials.

Furniture manufacturers in tropical countries have so far

been relatively unsuccessful in accessing EU markets for

interior furniture - unlike in the United States where

tropical countries, particularly Vietnam, are rapidly

increasing share.

To put EU27 wood furniture imports from tropical

countries into perspective, it can be noted that the total

value last year ¨C in dollar terms around USD1.24 billion

from all tropical countries - was slightly less than

USD1.26 billion of US wood furniture imports just from

Vietnam in the month of July this year.

Meanwhile, in recent years, larger gains in the EU27 wood

furniture market were made by Chinese suppliers, whose

share of EU27 consumption increased from 6.7% in 2014

to 7.2% in 2020, and by other temperate suppliers, rising

from 3.3% to 5.0% over the same period.

These gains were at the expense of domestic producers,

but only around the margins without at all threatening the

overwhelming market dominance of EU27 manufacturers.

Domestic production in the EU27 accounted for around

84% of all wood furniture consumption in the EU27 in

2020, a decline from 87% in 2014.

EU27 imports of wooden furniture have picked up pace

this year, although again suppliers outside the tropics have

benefited more than tropical suppliers (Chart 6).

The total import value in the first seven months of 2021

was €3.3 billion, 35% more than the same period in 2020

when much of the continent was operating under strict

lockdown conditions. However, import value during the

seven month period was also up 22% compared to the

same period in 2019.

While it is a positive sign that EU27 importers are willing

to spend more on wooden furniture from tropical countries

this year, these gains in import value must be seen against

the background of a five-fold increase in freight rates from

Southeast Asia to Europe between September 2020 and

July this year. Many tropical manufacturers are probably

benefitting very little in terms of improved sales value.

EU27 wood furniture import value from China in the first

seven months this year was €1.47 billion, 40% and 21%

more than the same period in 2020 and 2019 respectively.

The equivalent figure for import value from tropical

countries was €850 million, up 28% and 19% compared to

2020 and 2019 respectively.

Import value from other countries (almost all neighbouring

countries in Europe outside the EU) in the first seven

months was €970 million, up 33% and 26% compared to

2020 and 2019 respectively.

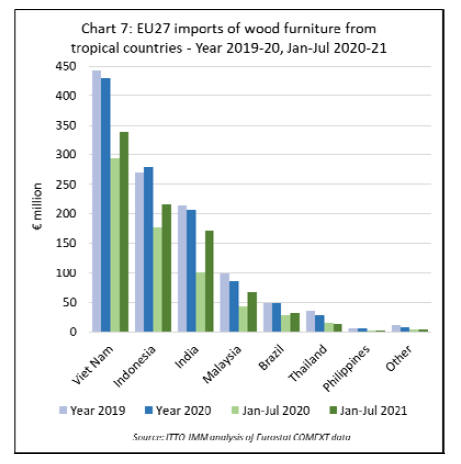

Of the main tropical suppliers of wooden furniture to the

EU27, import value from Vietnam was €340 million in the

first seven months of 2021, 16% and 15% more than the

same period in 2020 and 2019 respectively. Import value

from Indonesia was €216 million, up 23% compared to

2020 and 25% compared to 2019.

India made even more spectacular gains, import value of

€171 million in the first seven months this year being 71%

and 36% more than the same period in 2020 and 2019

respectively.

Growth in import value of €67 million from Malaysia was

more modest, up 53% compared to 2020 but only 14%

more than 2019. Import value of €32 million from Brazil

was just 10% and 16% more than the same period in 2020

and 2019 respectively.

The import value from Thailand, at €15 million, was still

3% down compared to the first seven months of 2020 and

34% less than the same period in 2019 (Chart 7).

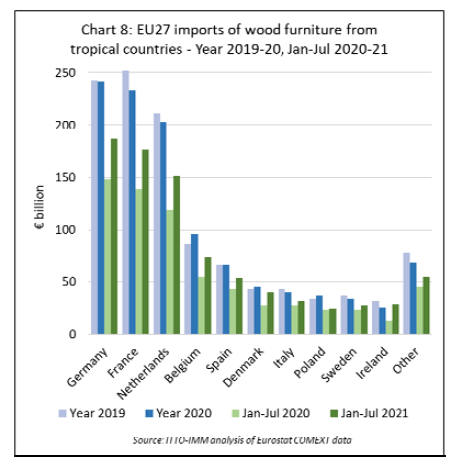

There were universal gains in import value of wooden

furniture from tropical countries across all the leading

EU27 markets in the first seven months this year

including:

Germany (€187 million, +26% on 2020 and

+19% on 2019),

France (€177 million, +27% on 2020 and +15%

on 2019),

Netherlands (€151 million, +27% on 2020 and

+13% on 2019),

Belgium (€74 million, +35% on 2020 and +48%

on 2019),

Spain (€54 million, +24% on 2020 and +25% on

2019),

Denmark (€40 million, +43% on 2020 and +48%

on 2019)

Italy (€32 million, +14% on 2020 and +6% on

2019)

See Chart 8.

Procedures for assessing effectiveness of EUTR are

inadequate - European Court of Auditors

In a report published 4 October, the European Court of

Auditors concluded that EC procedures for assessing

effectiveness of the EU Timber Regulation (EUTR) are

inadequate.

In the Special Report 21/2021: EU funding for

biodiversity and climate change in EU forests: positive but

limited results", the Court of Auditors conclude that:

"Reporting under the Timber Regulation does not provide

the information with which the Commission can analyse

the quality of Member States¡¯ monitoring activity, the

national rules defining illegal logging or the procedures

used for checks. Nor does it require Member States to

substantiate their replies with supporting documents that

would allow it to verify the accuracy or completeness of

the information¡±.

The Court goes on to note that ¡°we reviewed the national

procedures for checking domestic logging in Germany,

Spain and Poland in order to assess the content and extent

of the checks and confirm the importance of the

Commission¡¯s role in monitoring. We found that

procedural weaknesses and missing checks reduce the

Timber Regulation¡¯s effectiveness in practice¡±.

As background, the Court of Auditors note that the EUTR

prohibits the placing of illegally harvested timber and

timber products on the EU market. In general, illegal

logging means any illegal practices relating to the

harvesting or trading of timber and timber products.

The rules in place in the Member State define whether

timber is illegally harvested. To minimise the risk of

illegally harvested timber reaching the market the Timber

Regulation requires operators to exercise due diligence. To

this end, they must collect information on timber type,

country of harvest, supply chain and compliance with the

rules, assessing any risk and, where necessary, taking

remedial action.

According to the Court of Auditors, in 2020, the European

Commission (EC) published a report on Member States¡¯

checks under the Regulation. According to the EC report,

all Member States were compliant with the formal

requirements of the Regulation.

The Commission concluded that, despite progress,

continuous efforts were needed to ensure that the

Regulation was put into practice consistently and

effectively in all Member States. It found that the number

of checks remained low compared to the number of

operators and doubted that these low frequency checks

would have a dissuasive effect.

According to the EC report, there were an estimated

3,042,884 domestic operators in 21 Member States, and

checks were made on 13,078 (0.43 %) during the two-year

reporting period. The next review of the effectiveness of

the Timber Regulation, together with a fitness check, is

due in December 2021.

The Court of Auditors go on to explain that the EC is

responsible for reviewing the functioning and

effectiveness of the Timber Regulation. Member State

reporting is the main source of information for its reviews.

The Timber Regulation requires Member States to make

available information on the application of the regulation

and leaves it up to the Commission to establish a format

and procedure by an implementing act.

The Commission has not issued an implementing act but it

has set up an online reporting system to collect

information on Member State checks in a standardised

way.

According to the Court of Auditors, ¡°Reporting focuses on

the risk criteria for selecting operators, the number of

checks, the time taken for checks, the type of information

recorded, and penalties.

Reporting under the Timber Regulation does not provide

the information with which the Commission can analyse

the quality of Member States¡¯ monitoring activity, the

national rules defining illegal logging or the procedures

used for checks. Nor does it require Member States to

substantiate their replies with supporting documents that

would allow it to verify the accuracy or completeness of

the information¡±.

The Court of Auditors report is available at

https://www.eca.europa.eu/en/Pages/DocItem.aspx?did=59368

The Court¡¯s analysis of EUTR is in paragraphs 33-39 starting at

page 23 of the report.

|