|

Report from

Europe

EU27 tropical wood imports still

high but beginning to

slow

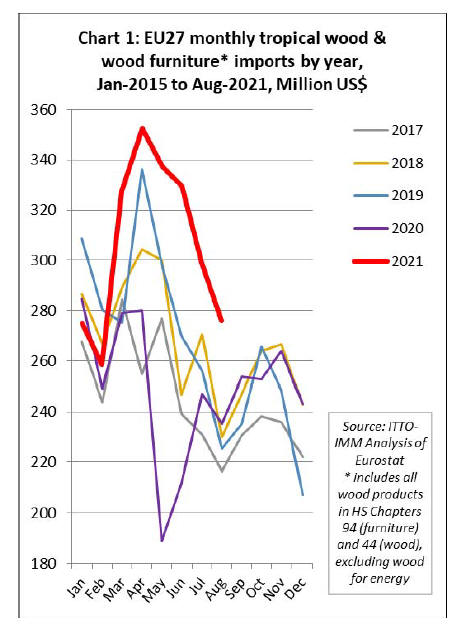

After reaching the highest level for nearly a decade in the

first half of this year, the US$ value of EU27 imports of

wood and wood furniture products from tropical countries

declined sharply in July and August. However, import

value during the summer months was still higher than is

usual at that time of year (Chart 1).

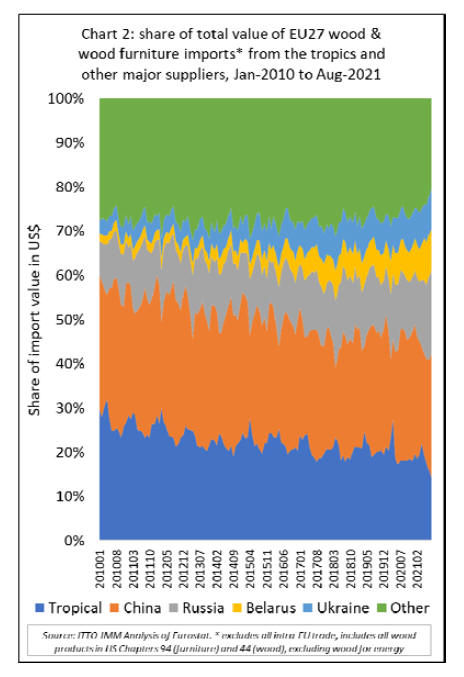

While the value of EU27 imports from the tropics has

strongly rebounded this year, imports from other parts of

the world have risen at an even faster pace so that the

decline in market share for tropical countries has

continued (Chart 2).

The extraordinary market conditions that have emerged

during the COVID-19 pandemic have driven total EU27

imports of wood and wood furniture products from all

non-EU countries this year close to the record levels of

2007 and 2008, just prior to the global financial crises.

Total EU27 import value of wood and wood furniture in

the first eight months of this year was US$13.53 billion,

40% more than in the same period in 2020. Import value

of tropical products was US$2.46 billion, 24% more than

the same period in 2020. However import value from nontropical

regions was US$11.08 billion, a 44% increase.

Imports were up by 39% from China to US$3.44 billion,

by 65% from Russia to US$2.15 billion, by 76% from

Belarus to US$1.16 billion, and by 57% from Ukraine to

US$1.11 billion.

The 40% increase in EU27 import value from the tropics

this year is not mirrored by an equivalent increase in

import quantity. In quantity terms, imports from tropical

countries in the first eight months were 1.17 million

tonnes this year, only 7% more than in 2020 and still 9%

down compared to 2019.

A large part of the gain in import value of tropical

products is due to a significant rise in prices. Freight rates

have been at unprecedented levels this year.

The Drewry World Container Index indicates that global

rates for a 40 foot container peaked at over US$10000

dollars in the middle of September this year compared to

US$2000 in the same month in 2020.

FOB prices for tropical wood products have also been

driven up this year in response to the sharp increase in

global demand at a time when supplies are scarce and

tropical producers continue to operate under extremely

challenging conditions during the pandemic. This in turn

has led to EU27 importers buying more from more

accessible suppliers in the European neighbourhood and a

continued loss of market share for tropical suppliers in the

EU market.

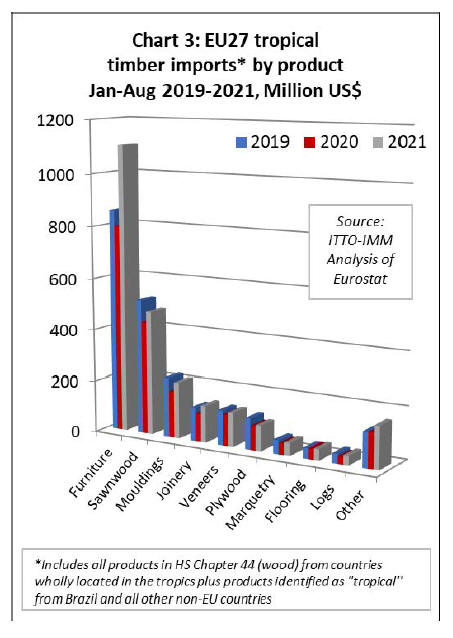

Highest tropical import value into the EU27 since 2012

The increase in the value of EU27 imports from tropical

countries this year is heavily concentrated on wood

furniture products. Although import value of most other

wood products from tropical countries has made up some

of the ground lost in 2020, it is still below the level

prevailing before the COVID pandemic in 2019 (Chart 3).

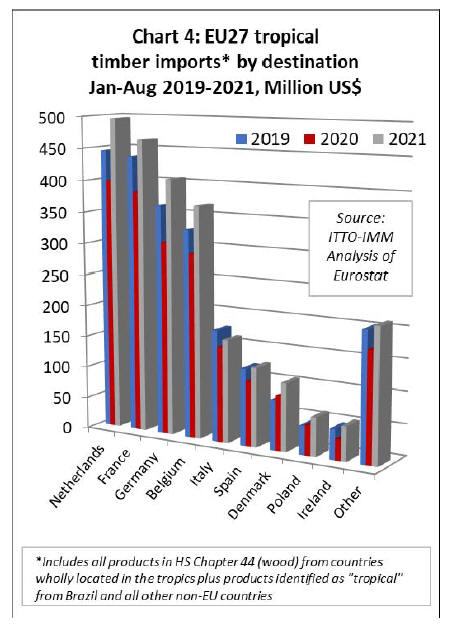

In the first eight months this year, import value into all the

largest EU27 destinations for tropical wood and wood

furniture products was significantly higher than in the

same period in 2020. Furthermore, of the largest markets,

only in Italy was import value in the first eight months of

this year less than in the same period in 2019 before the

pandemic (Chart 4).

EU recovery expected to continue but significant

downside risks are emerging

Longer term market prospects in the EU27 look

reasonable as the economic expansion in the region is

expected to continue, although there are significant

downside risks emerging, according to the EU Autumn

2021 Economic Forecast published on 11 November.

According to the Forecast, the EU economy is set to grow

by 5% this year and to keep a solid pace of growth of

4.3% next year before easing to 2.5% in 2023. A strong

rebound in the second and third quarters of this year lifted

the EU economy back to around its level of the last quarter

of 2019. This happened one quarter earlier than the EU

expected in the Spring Forecast issued in May.

Disruptions in global logistics and shortages of several

raw and intermediate inputs have been increasingly

weighing on activity in the EU this year. Manufacturing,

in particular, is being held back by production input

shortages, delays in input delivery and increased strains on

available production capacity. Surging energy prices, most

notably for natural gas and electricity, are also expected to

dampen the growth momentum in the short term.

Still, strong domestic demand is expected to continue

fuelling the economic expansion in the EU. The

Commission's October business surveys indicate that

economic sentiment increased slightly in all main sectors

except construction.

An improving labour market, falling household saving

rates, favourable financing conditions and full deployment

of the "Recovery and Resilience Facility" (RFF), are

expected to drive the economic expansion and fuel

domestic consumption. Foreign demand is also expected

to be supportive of growth.

The global economy is expected to strongly rebound this

year and to continue expanding in the next two years,

albeit at a more moderate pace and with quite divergent

paths.

The RFF is the EU €723.8 billion stimulus package -

comprising €385.8 billion in loans and €338 billion in

grants ¨C in support of Member State Covid recovery

measures which extends until 2026, with two thirds of the

money expected to be allocated before the end of 2023.

Model simulations conducted by the Commission indicate

the package could increase EU GDP by up to 1.5% during

its years of active operation. RFF support measures are

particularly targeted at southern and eastern Member

States and at green investments to help achieve the EU

2050 net zero carbon commitment.

According to the EU Forecast, while the RFF is being

rolled out to support the most indebted Member States,

many governments have started to phase out emergency

support measures at national level and budget deficits are

being reduced. Employment levels are also expected to

increase above pre-pandemic levels and the

unemployment rate should decrease to 6.5% in 2023.

The Forecast suggests that strong demand following the

re-opening of economies, combined with supply

bottlenecks and higher energy prices, have contributed to

higher levels of inflation. This situation is expected to be

largely transitory. Inflation in the EU is expected to peak

at 2.6% this year before easing slightly to 2.5% next year

and 1.6% in 2023.

However, the Forecast also notes that uncertainty remains

substantial, and the risks to the outlook are tilted to the

downside. The recovery continues to be heavily dependent

on the evolution of the pandemic, both within and outside

the EU.

The improving health situation, which allowed the

economy to bounce back, is now being challenged by

rising infections across the EU. Since the beginning of

October, the 14-day average incidence of infections in the

EU has recorded the highest level since mid-May.

The strongest increases are reported in countries with

below EU-average vaccination rates. For now,

hospitalisations and deaths associated with COVID-19

infections remain low compared to previous waves. But

they are slowly rising, posing a risk to economic

prospects.

Economic conditions vary widely between Member States,

according to the EU Forecast. Germany's GDP rebounded

in the second and third quarters as the easing of

containment measures spurred spending on services.

However, supply bottlenecks are slowing down

manufacturing and putting a lid on the rebound of exports

and investment. So growth is projected at a modest 2.7%

this year and is set to reach 4.6% in 2022 before

moderating to 1.7% in 2023.

In France, economic activity is forecast to rebound by

6.5% in 2021, reaching its pre-crisis level by the end of

this year. The third quarter growth rate was particularly

strong thanks to largely eased restrictions. Growth is

expected to remain solid in 2022 and 2023 at 3.8% and

2.3% respectively.

For Italy, real GDP is projected to increase by 6.2% this

year. The economy rebounded strongly in the second and

third quarters thanks mainly to consumer services. Growth

is set to continue at a robust pace of 4.3% in 2022 thanks

to easing supply shortages and RRF-supported

investments and reforms. GDP is set to expand by 2.3% in

2023, a growth rate still sizeably above the long-term

average.

In Spain, growth is projected at 4.6% this year, below the

EU's Summer expectations. However, Spain's GDP is

expected to remain on a very strong growth path over the

next two years, also thanks to the implementation of the

RRF. Growth is projected at 5.5% in 2022 and at 4.4% in

2023.

In Poland the economy is expected to embark on a solid

expansion after a mild recession last year. GDP growth is

expected at 4.9% in 2021, 5.2% in 2022 and 4.4% in 2023.

EU construction sector still fragile

The fragile position of the construction sector in the EU, a

key driver of timber demand in the region, is revealed by

the IHS Markit Eurozone Construction Index. The index

increased from 49.5 in August to 50.0 in September and

then to 51.2 in October. The trend is positive but, with

50.0 being the dividing line between contraction and

growth, the index implies that sentiment in the sector is

very mixed.

Where construction activity rose, companies often cited

stronger demand growth, although this was offset by a

lack of raw materials which halted work on site.

Underlying data indicated that growth was centred around

house building, while commercial construction was steady

but infrastructure activity was still slow.

Overall the IHS Markit reports that construction firms are

still confident that activity will increase over the next 12

months amid forecasts of strengthening economic

conditions, improved supplier performance and new

projects.

Strong recovery in EU27 wood furniture imports from

tropical countries

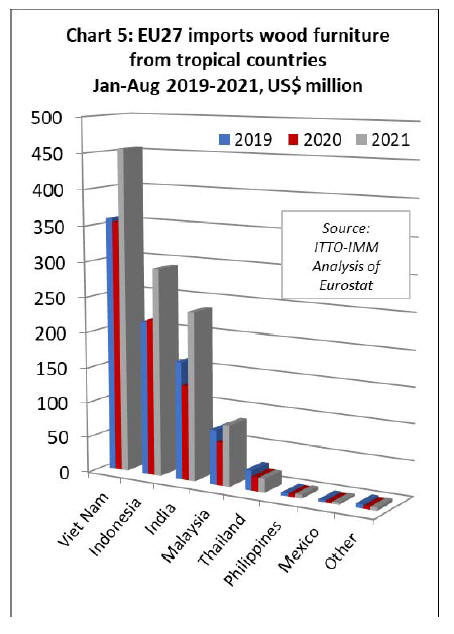

In the first eight months of 2021, EU27 import value of

wood furniture from tropical countries was US$1.1 billion,

38% and 29% higher than the same period in 2020 and

2019 respectively. After a slow start to the year, the value

of EU27 wood furniture imports from the two largest

tropical suppliers ¨C Vietnam and Indonesia ¨C increased

sharply from the second quarter onwards. By the end of

the first eight months, import value was up 29% from

Vietnam to US$455 million and up 33% from Indonesia to

US$293 million.

Meanwhile EU27 imports of wood furniture from India

and Malaysia, which were very strong in the first half of

this year, slowed a little during the summer months. After

eight months this year, import value from India was

US$237 million, 78% greater than the same period in

2020, while import value from Malaysia was US$85

million, a gain of 42%. For all four leading tropical

suppliers, EU27 wood furniture import value in the first

eight months of 2021 was higher even than in 2019 before

the pandemic (Chart 5).

U27 imports of tropical sawnwood still below pre-

COVID level

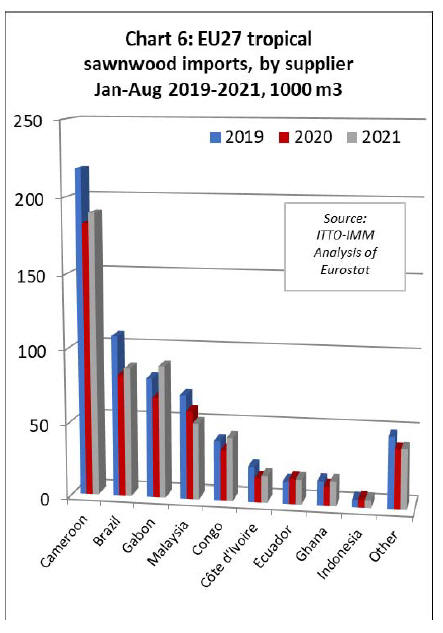

In the first eight months of 2021, EU27 import value of

tropical sawnwood was US$475 million, up 10% on 2020

but down 8% on 2019. In quantity terms, imports of

554,000 cu.m in the first eight months were 7% higher

than the same period in 2020 but still down 11% compared

to the same period in 2019 before the pandemic.

Imports of 189,500 cu.m from Cameroon in the first eight

months this year were 4% higher than the same period in

2020 and still 13% down compared to 2019. Imports of

86,500 cu.m from Brazil were up 5% compared to 2020

but down 20% compared to 2019.

Sawnwood imports from Gabon and Congo fared better

during the first eight months of this year. Imports from

Gabon, at 89,000 cu.m, were up 31% on 2020 and up 10%

compared to 2019. For the Congo, imports were 42,500

cu.m in the eight month period, up 26% on 2020 and 6%

on 2019.

Imports of sawnwood from Côte d'Ivoire were 17,750

cu.m in the first eight months of this year, up 13%

compared to 2020 but down 25% on 2019.

The long term decline in EU27 imports of sawnwood from

Malaysia continued in the first eight months this year, at

51,500 cu.m 14% less than the same period in 2020 and

27% down on 2019 (Chart 6).

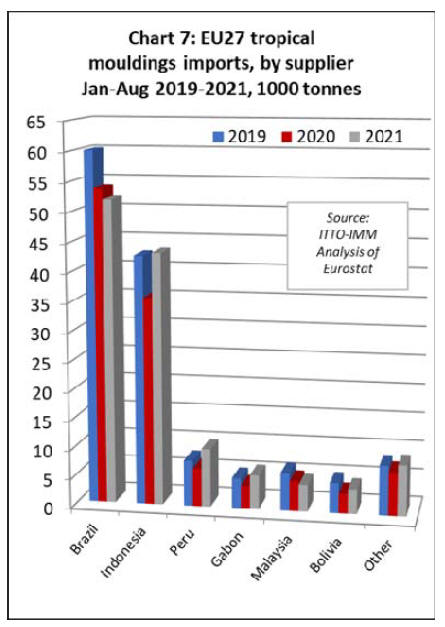

In the first eight months of 2021, EU27 import value of

tropical mouldings/decking was US$216 million, up 20%

on 2020 but down 5% on 2019. In quantity terms, tropical

mouldings/decking imports increased 11% to 128,500

tonnes in the first eight months of this year compared to

last.

However import quantity was still down 5% compared to

2019. Imports of 51,900 tonnes from the largest supplier

Brazil, were 3% down on the same period last year and

14% less than in 2019.

Despite widespread reports of supply shortages for

Indonesian bangkirai decking, imports of

mouldings/decking from Indonesia were 43,100 tonnes

during the first eight months of 2021, 21% more than the

same period in 2020 and 1% more than in 2019. Imports

of mouldings/decking from Peru were 10,000 tonnes, 54%

more than in 2020 and 28% up on 2019.

Sawnwood imports from Gabon were 5,900 tonnes in the

first eight months this year, 49% more than the same

period in 2020 and 13% more than in 2019. Imports from

Malaysia were 4,600 tonnes in the first eight months this

year, 10% less than in 2020 and 29% down compared to

2019. (Chart 7).

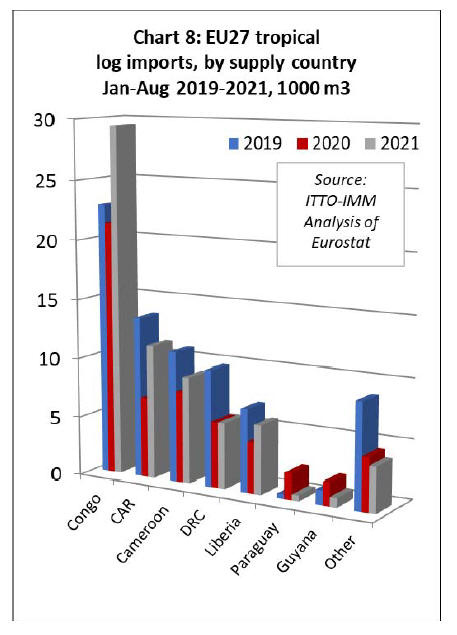

In the first eight months of 2021, EU27 import value of

tropical logs was US$36 million, 31% up on 2020 but still

3% less than 2019. In quantity terms, imports of 66,000

cu.m were 22% more than the same period in 2020 but

11% less than the same period in 2019. Imports of 29,400

cu.m from Congo, now by far the largest supplier of

tropical logs to the EU, were 38% more than the same

period in 2020 and 29% more than the same period in

2019.

Imports in the first eight months this year from all other

leading supply countries - CAR (11,300 cu.m), Cameroon

(9,000 cu.m), DRC (5,600 cu.m), Liberia (5,800 cu.m) -

were all more than the same period in 2020 but still down

on the level of 2019 before the pandemic.

Gabon leads slow recovery in EU27 imports of tropical

veneer and plywood

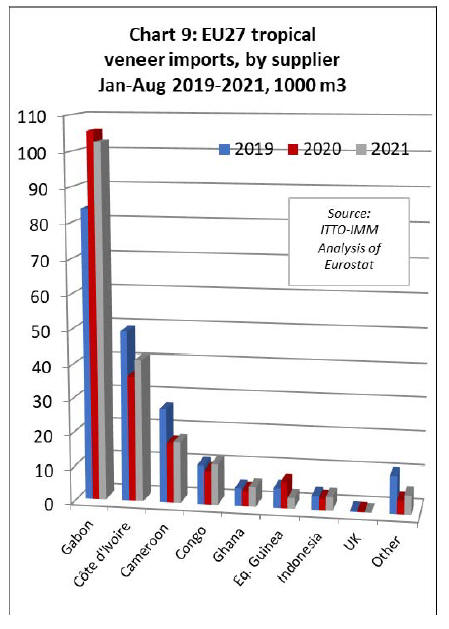

In the first eight months of 2021, EU27 import value of

tropical veneer was US$131 million, 9% more than in

2020 but 2% less than 2019. In quantity terms, imports

were 192,900 cu.m in the first eight months of this year, a

gain of 2% compared to 2020 and 3% less than in 2019.

After a rapid rise last year, veneer imports from Gabon

were 102,800 cu.m in the first eight months this year,

down 3% compared to 2020 but still 23% more than in

2019. At 41,300 cu.m, veneer imports from Côte d'Ivoire

were 13% more than in 2020 but still down 16% compared

to 2019.

Imports of 17,800 cu.m from Cameroon were 3% more

than in 2020 but 35% less than in 2019. Veneer imports

from Congo were 11,700 cu.m in the first eight months

this year, 20% and 4% more than the same period in 2020

and 2019 respectively (Chart 9).

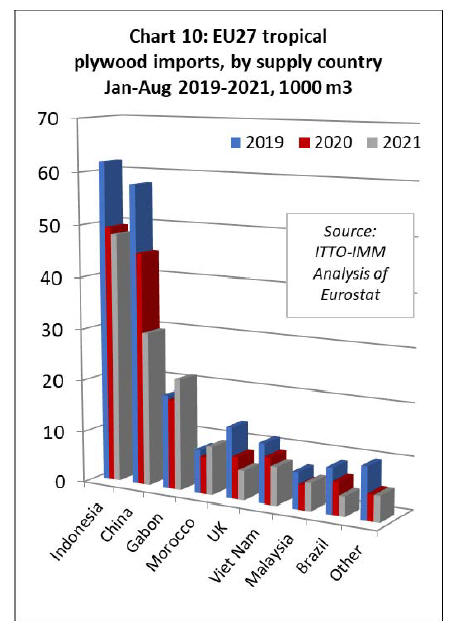

Overall the signs are that tropical hardwood plywood has

been a big loser in the competitive battle for dominance of

the EU plywood market, particularly against Russian birch

plywood. In the first eight months of 2021, EU27 import

value of tropical plywood was US$98 million, up 6%

compared to 2020 but down 18% on 2019. In volume

terms, imports of 135,500 cu.m in the first eight months

this year were 11% less than the same period in 2020 and

31% down compared to 2019.

EU27 plywood imports from Indonesia were 48,100 cu.m

in the first eight months this year, 3% less than the same

period in 2020 and 22% down compared to the same

period in 2019. Imports of tropical hardwood faced

plywood from China were 29,700 cu.m, 34% less than in

2020 and 49% down compared to 2019. EU27 imports of

tropical hardwood plywood from Vietnam and indirect

imports from the UK also continued to slide in the first

eight months of this year.

More positively, imports of tropical hardwood plywood

from Gabon and Morocco made more inroads into the

EU27 market in the first eight months of this year. Imports

from Gabon were 21,400 cu.m in the eight month period,

23% more than the same period in 2020 and 18% more

than in 2019. Imports from Morocco were 9,400 cu.m,

29% and 11% more than the same period in 2020 and

2019 respectively (Chart 10).

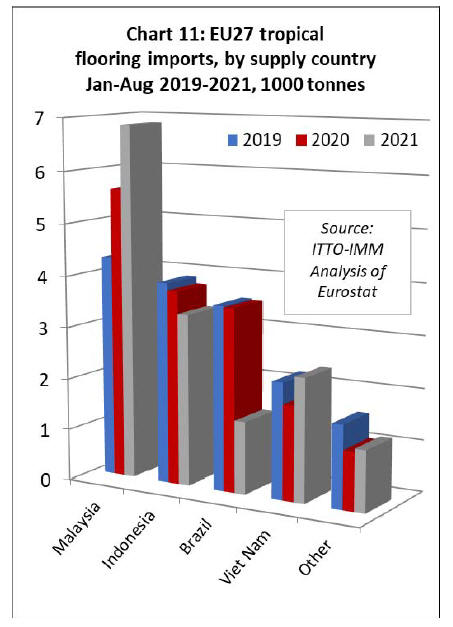

Rise in EU27 imports of tropical flooring from Malaysia

continues

In the first eight months of 2021, EU27 import value of

tropical flooring products was US$43 million, 7% higher

than the same period in both 2020 and 2019. However in

quantity terms, imports of 11,300 tonnes in the first eight

months this year were 5% down compared to 2020 and 3%

less than in 2019. The rise in EU27 wood flooring imports

from Malaysia, that began last year, has continued into

2021.

Imports of 6,850 tonnes from Malaysia in the first eight

months this year were 22% more than the same period in

2020 and 59% greater than in 2019. In contrast, flooring

imports from Indonesia of only 3,300 tonnes were 12%

less than in 2020 and 15% down compared to 2019.

Imports from Brazil have also continued to slide, at just

1,400 tonnes in the first eight months, 60% down

compared to both 2020 and 2019 (Chart 11).

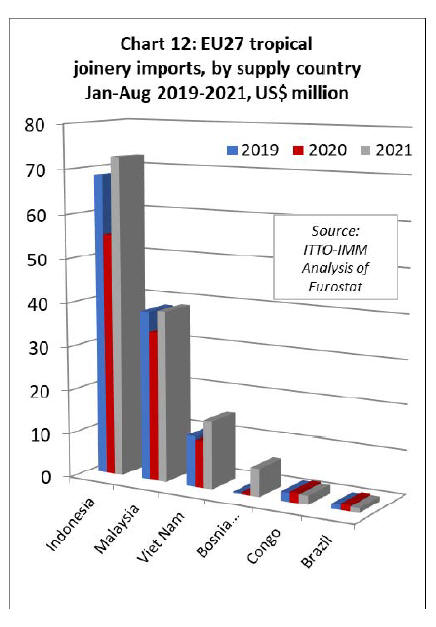

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors -

increased 31% to US$141 million in the first eight months

of this year. Imports were up 32% to US$72 million from

Indonesia, up 15% to US$39 million from Malaysia, and

up 44% to US$15 million from Vietnam.

This year the EU27 has also begun to import joinery

products manufactured using tropical hardwood from

Bosnia. Import value from Bosnia was US$6.4 million in

the first eight months of 2021 (Chart 12).

Draft EU "global deforestation" law

The much anticipated proposal for an EU legal framework

to "halt and reverse EU-driven global deforestation" is due

to be published by the European Commission on 17

November. The proposal follows a European Parliament

decision of 22 October 2020 calling on the European

Commission to draft such a legal framework.

This decision was backed by a resolution on 9 June 2021

on the EU Biodiversity Strategy for 2030 in which the

Parliament asked the Commission to urgently present a

proposal for an EU legal framework based on mandatory

due diligence that ensures that value chains are sustainable

and that products or commodities placed on the EU market

do not result in or derive from deforestation, forest

degradation, ecosystem conversion or degradation or

human rights violations.

The implications of the new legal framework are

potentially far-reaching, particularly for the future of the

existing framework of FLEGT Voluntary Partnerships

Agreements, FLEGT licensing and the EU Timber

Regulation.

Early indications are that the EUTR may be rolled into this

broader regulation imposing due diligence requirements

on a range of "forest-risk" commodities. Furthermore the

FLEGT licenses - so far only issued for Indonesian timber

products exports to the EU - while accepted as evidence of

legality under the new law may not necessarily be

accepted as fulfilling the "deforestation free" criteria.

Also, the EU may not seek to extend FLEGT licensing

into any other country once the new regulation is in place.

The Commission proposal to be issued on 17th November

will be a draft of the new regulation most likely adopted

using the ordinary legislative procedure. It will be subject

to review and possible amendment by both the European

Parliament (directly elected) and the European Council

(representatives of the 27 EU countries). Both the

Parliament and European Council must agree on the legal

text and any amendments before the draft can become law.

Further details of the content and implications of the draft

legislation and of the legislative process will be provided

in the next market report once the official draft is

available.

|