|

Report from

North America

Imports of tropical hardwood products slumped in

September

After US imports hit a number of post-pandemic highs in

August, imports of tropical hardwood and related products

retreated in September, including some dramatic losses in

certain categories.

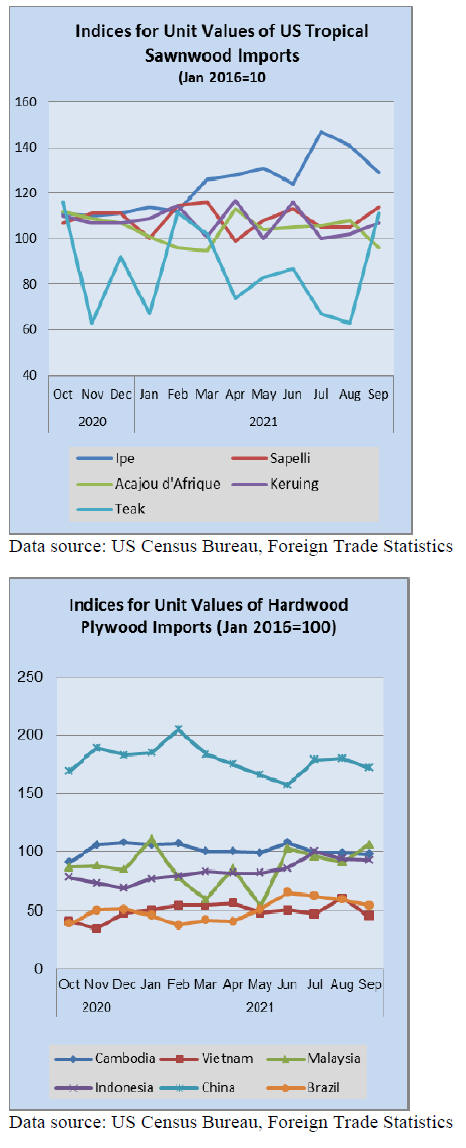

Imports of sawn tropical hardwood fell 30% in September,

while imports of wooden furniture fell 18%, and imports

of tropical hardwood veneer plunged 60%. Moulding and

flooring imports also fell slightly.

Sawn tropical hardwood imports tumble again

US imports of sawn tropical hardwood fell sharply for a

second straight month, declining by 30% in September.

The 6,407 cubic meters imported in September represents

the lowest volume imported since February and a far cry

from the more than 12,000 cubic meters imported in July.

Imports from Brazil were down 73% while imports from

Ecuador and Ghana both fell 62%.

Imports of Virola, Balsa, Sapelli, and Mahogany all

dipped sharply, falling from very strong summer volume.

Despite seeing its weakest month in more than three years

in September, Virola imports remain ahead of last year by

25% year to date. September Mahogany imports, while

down from August, still more than quadrupled September

2020 volume and are up 171% year to date over last year.

Balsa imports in September, however, were less than a

third of their September 2020 volume and are down 19%

year to date.

Ipe and Jatoba imports, which beginning this year are no

longer counted as part of the tropical hardwood totals in

the official US government figures, were mixed in

September. Ipe imports rose 31% in September and are

down 1% year to date versus 2020 volume, while Jatoba

imports fell 4% in September but are up 56% year to date.

If we count these two woods, September US sawn tropical

hardwood imports fell by only 13% in September and are

up 21% year to date.

Canadian imports of sawn tropical hardwood fell for the

fifth straight month in September. Monthly imports

declined 24% as imports from Cameroon, Indonesia, and

Malaysia all fell sharply. Even with the continued decline,

total imports are up 8% year to date through August.

Hardwood plywood imports cool, but remain at

elevated levels

US imports of hardwood plywood fell 7% in September

but remain at a high pace historically. The import volume

of 305,281 cubic meters is nearly 50% above that of the

previous September, keeping year-to-date volume up 34%

over 2020. While imports from Malaysia, Indonesia,

China, and Ecuador all declined in September, imports

from each of these countries are outpacing 2020 volume

year to date. Imports from Vietnam jumped 59% in

September, reaching its highest monthly level on record.

Veneer imports fall to record low

US imports of tropical hardwood veneer fell for the third

straight month, plunging 60% in September after a 12%

decrease in August. Monthly imports fell below US$1

million for the first time since we began tracking the

category five years ago.

Imports from China and India were non-existent and

imports from Italy fell by more than 99%.

While these imports historically tend to recede in

September, this decline was an outlier. The historically

poor month was 30% less than imports from last

September, pushing 2021 imports for the year behind 2020

totals by 4%.

Hardwood flooring imports pull back

US imports of hardwood flooring saw a modest retreat in

September, falling 3%but still to a level still 35% higher

than the previous September. A 265% increase in imports

from Vietnam made up for sharp decreases in imports

from Indonesia, Malaysia, and China. Imports from

Indonesia were the lowest since February and are down

51% year to date. Overall hardwood flooring imports are

up 39% year to date.

Imports of assembled flooring panels fell by 16% in

September, ending six months of continuous growth.

While imports from Canada and Indonesia both grew by

around 25%, imports from China, Vietnam and Thailand

all fell around 35%.

Imports from Brazil dropped by 54% but are still up nearly

500% year to date. Year-to-date imports are up sharply

from nearly all trading partners except Canada. Imports

from Canada are only up 2% year to date compared with

overall imports which are ahead 59% year to date.

However, all year-to-date numbers should be viewed as

inflated as the USDA added two additional categories to

the Assembled Flooring Panels category in May.

Moulding imports stay near post-pandemic record

US imports of hardwood moulding remained flat in

September falling less than 1% from the previous month to

stay at a level not seen since 2018. Imports from China fell

11% but came in more than 40% higher than the previous

September.

However, imports from China are still down 50% year to

date. Imports from Malaysia made up for the loss, gaining

43% in September to be ahead 44% year to date. Overall

US imports of hardwood moulding are up 23% year to

date over 2020.

Wooden furniture imports fell below US$2 billion in

September

US imports of wooden furniture fell by 18% in September,

dropping to their lowest level since February. Imports fell

to US$1.85 billion in September, only the second time this

year a month was below US$2 billion and the first time

this year a monthly total was below that of the previous

year.

Imports from Vietnam were down 35% while imports

from Indonesia and Malaysia were both down 13%.

Overall, US wooden furniture imports have been strong all

year and remain up 46% year to date with imports from all

major trading partners up at least 10% for the year so far.

Cabinet sales showed gains in August

According to the Kitchen Cabinet Manufacturers

Association¡¯s (KCMA) monthly ¡®Trend of Business

Survey¡¯ participating cabinet manufacturers reported an

increase in overall cabinet sales of 5.5% in

August, up 8.0% compared with August 2020. Custom

sales were up 5.7%, semi-custom sales increased 2.1% and

stock sales rose 7.5%.

Year-to-date sales remain strong across the board. Overall

cabinet sales are up 16.9% when compared to the same

period in 2020. Custom sales up 20.4%, semi-custom sales

increased 14.9% and stock sales increased 17.6%.

See:

https://www.kcma.org/news/pressreleases/August_2021_trend_of_busines_press_release

|