US Dollar Exchange Rates of

10th

Dec

2021

China Yuan 6.3699

Report from China

National standards on MDF and LVL released

National standards on Medium Density Fibreboard (GB/T

11718¡ª2021) and Laminated Veneer Lumber (GB/T

20241¡ª2021) will be effective as of 1 June 2022. The two

new standards are revisions of the standards (GB/T

11718¡ª2009) and (GB/T 20241¡ª2006).

Medium density fibreboard (MDF) is one of the main

types of fibreboard in China accounting for more than

80% of the national total output of fibreboards. The output

of MDF was 53.47 million cubic metres in 2020 in China.

Since the release of GB/T 11718-2009 MDF in 2009 it has

played an important role in regulating the production of

MDF in China and in improving the quality of MDF

products.

In order to promote further development of MDF industry

the GB/T 11718-2021 standard is partially revised

according to international standards for MDF and some

technical content has been revised.

Laminated Veneer Lumber (LVL) is an important

structural material widely used in building I-beams and

wood joists and for door frames and furniture framing.

Since the release of GB/T 20241-2006 LVL in 2006 the

standard has played an important role in standardising

production, improving product quality and promoting the

development of wooden structural and packaging industry.

In the revision of GB/T 20241-2021 the relevant standards

of ISO are adopted with full reference to the relevant

standards of Japan and the EU.

Merchants advised to stock up in advance

The Winter Olympic Games will be held soon and the

Chinese government has implemented environmental

control measures in many provinces where air pollution is

a problem such as in Northern Western China.

All heavy industries in these provinces will be shut down

before 1 January 2022 with a focus on Hebei Province

(Tangshan, Shijiazhuang, Zhangjiakou and Chengde

cities), Tianjin, Shandong province (Jinan, Weihai and

Weifang cities), Shanxi Province (Taiyuan, Datong and

Changzhi cities) and He¡¯nan Province (Luoyang and

Zhengzhou cities). The shutdown period is from January

1, 2022 to March 8, 2022.

Timber merchants have been advised to stock up in

advance to guarantee their production requirements can be

met during the shutdown.

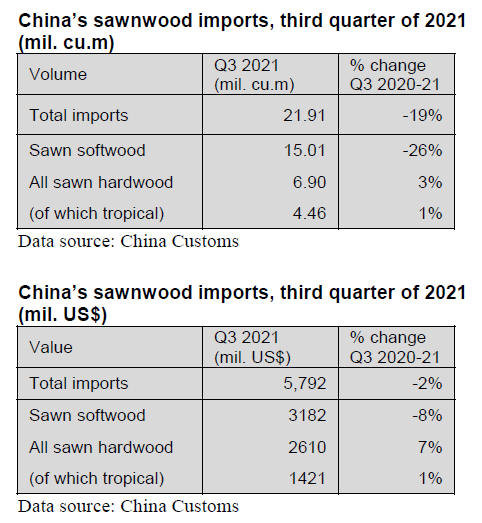

Decline in sawnwood imports in Q3 2021

According to China Customs in the third quarter of 2021

sawnwood imports totalled 21.91 million cubic metres

valued at US$5.792 billion, down 19% in volume and 2%

in value. The decline in sawnwood imports in the third

quarter of 2021 was because of a drop in supplies from

Russia, Canada, the USA, Finland and Germany (down

13%, 54%, 42%, 32% and 48% respectively). Imports

from these suppliers accounted for over 60% of the

national total.

The main reasons for the decline in sawnwood imports

were the impact of the pandemic control measures on

processing plants and the fact that these plants could not

secure adequate raw materials. The second factor was

logistic problems. Another factor was that there was strong

demand in the EU, US and Japanese construction sectors

where timber prices were rising.Sawn softwood imports

fell 26% to 15.01 million cubic metres, accounting for

69% of the national total.

A significant decrease in coniferous log imports was

responsible for the overall fall in total log imports in the

third quarter of 2021.

Slight increase both in sawn hardwood and

tropical

sawnwood imports

Sawn hardwood imports rose 3% to 6.9 million cubic

metres because of higher imports from the top sources

Thailand, Russia and the Philippines (up 6%, 25% and

93% respectively) however, sawn hardwood imports from

the US fell 16% in the third quarter compared to 2020.

Of total sawn hardwood imports tropical sawnwood

imports were 4.46 million cubic metres valued at

US$1.421 billion, up 1% both in volume and in value and

accounted for about 20% of all sawnwood imports.

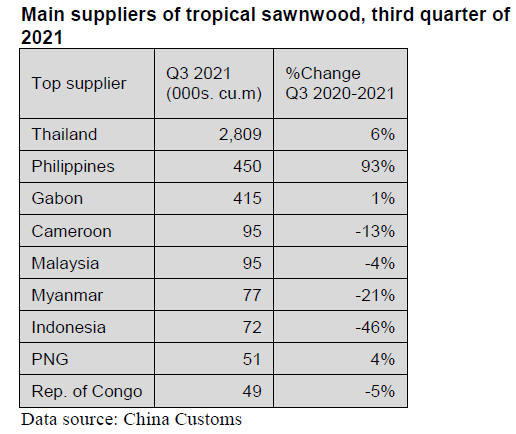

The main suppliers of tropical sawnwood imports in

the

third quarter were Thailand, the Philippines and Gabon.

The imports from these suppliers accounted for over 80%

of the national total.

The volumes from Thailand, the Philippines and Gabon

rose 6%, 93% and 1% respectively in the third quarter of

2021 and this was why tropical sawnwood imports rose in

the third quarter of 2021.

However, the volume from other suppliers, Cameroon,

Myanmar and Indonesia fell 13%, 21% and 46%

respectively in the third quarter of 2021. The Philippines

has seen a sharp jump in tropical sawnwood exports to

China surging to 450 000 cubic metres in the third quarter

of 2021.

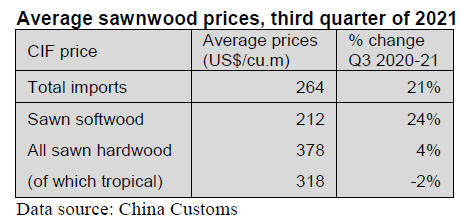

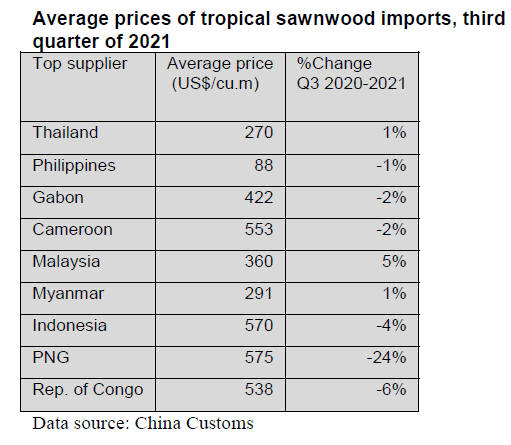

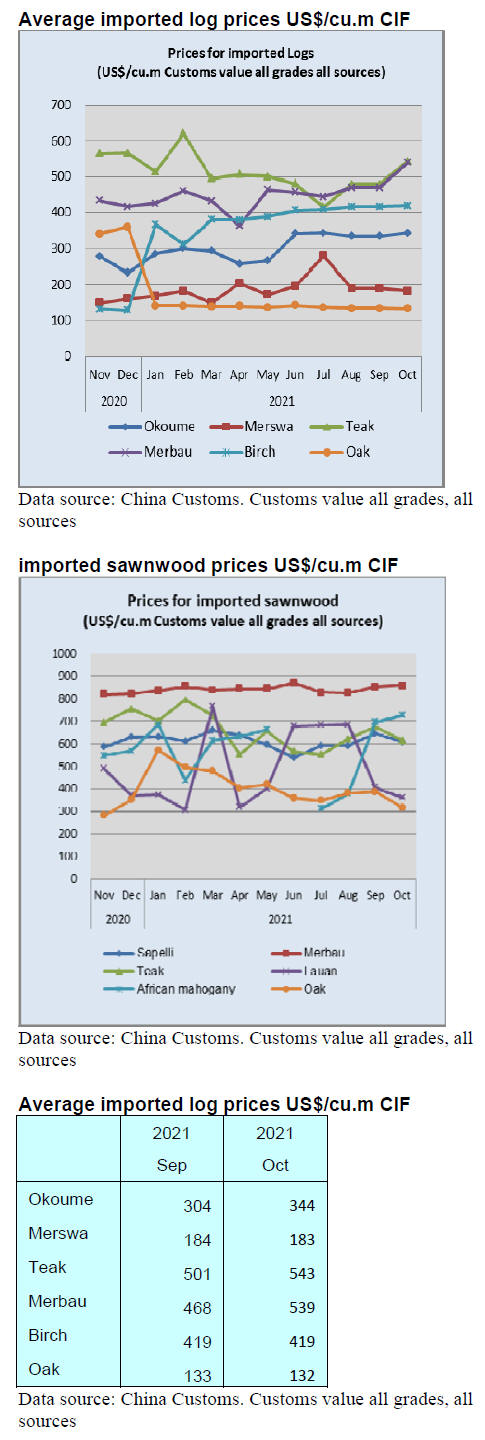

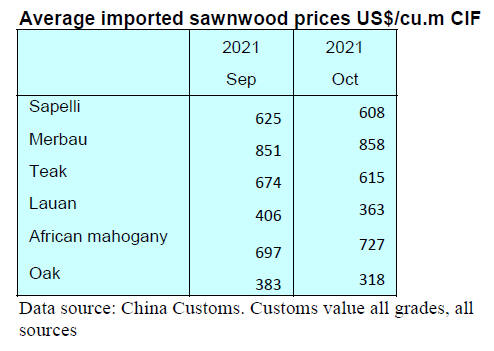

Rise in CIF prices for sawnwood imports but not for

tropical sawnwood

The CIF prices for imported sawnwood rose 21% to

US$264 per cubic metre in the third quarter of 2021. The

CIF prices for imported sawn softwood and sawn

hardwood increased 24% and 4% to US$212 and US$378

per cubic metre respectively over the same period of 2020.

However, the average CIF price for tropical sawnwood

imports did not rise but declined dropping 2% to US$318

per cubic metre. The CIF price for tropical sawnwood

imports from PNG fell the most, dropping 24% to US$575

per cubic metre, for the Republic of Congo and Indonesia

the decline was 6% and 4% respectively.

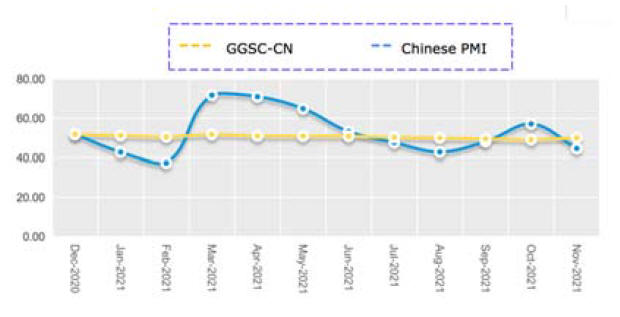

GGSC-CN Index Report (November 2021)

In November 2021, China's PMI index registered 50.1%,

an increase from the previous month. The index has been

above 50% for 2 consecutive months indicating that the

economy has stabilised after the corrections.

In November timber production and manufacturing of

wood products contracted compared with the previous

month. Orders and production fell and the inventory of

finished products declined.

It is worth noting that in November the price of raw

materials fell for the first time after rising for 11

consecutive months.

The GGSC-CN comprehensive index

for November registered 44.7% (53.3% for

last November and 55.6% for November 2019) and

was below the critical value of 50%. It shows that the

operations of the forest products enterprises represented by

GGSC-CN index declined from last month.

Challenges faced by GGSC enterprises

Products in short supply: Cumaru£¬Merbau£¬Oak£¬

Zingana

Commodity of which the price has been increased: fuel,

waterproof agent, base material, glue, formaldehyde

Commodity of which the price has been decreased:

Fibreboard, colored paper, eucalyptus board, eucalyptus

fuelwood, urea and melamine

Trend in sub- indices

In the GGSC-CN index for November 2021one subindex

increased, one was flat and three dropped.

The production index registered 33.3% down from the

previous month and below 50% for two months. This

indicates that the production of forest products enterprises

represented by GGSC CN is worse than that of last month.

The new order index registered 50.0%, a declines from the

previous month reflecting the ability of enterprises to

obtain orders is almost the same asOctober. The new

export order index reflecting international trade

registered fell as orders from abroad in November

declined.

The main raw material inventory index registered 44.4%, a

month on month decline signaling a drop in inventory.

The employment index registered the same as October but

the supplier delivery time index dropped even indicating

that the supply time for raw materials was slower than the

previous month.

|