4.

INDONESIA

Promote multi-business forestry

model to optimise

potential

The Indonesian Chamber of Commerce and Industry

(KADIN) launched the Regenerative Forest Business Sub

Hub (RFBSH) initiative to promote multi-business

forestry models in the management of production forest.

Director General of Sustainable Forest Management

Ministry of Environment and Forestry, Agus Justianto,

said that he appreciates this initiative as a step towards the

adoption of multi-business forestry concept.

Agus explained that the multi-business forestry concept

has the landscape as its basis.

This means that businesses in forest areas can not only

utilise wood and non-timber products but can develop and

generate income from environmental and other services.

He added, multi-business forestry will encourage

sustainable forest management and contribute to the

country’s climate change commitments.

Deputy Chairman of KADIN, Silverius Oscar Unggul,

said that RFBSH will create an opportunity for dialogue

between KADIN and KLHK and related parties.

See:

https://www.jpnn.com/news/kadin-gandeng-klhk-wujudkanprogram-multiusaha-kehutanan

Private sector collaboration on developing social

forest plantations

The Indonesian Forest Concessionaires Association

(APHI) signed a memorandum of understanding (MOU)

with Fairventure Social Forestry (FSF) to develop a social

forestry-based plantation forest.

The MoU was signed by APHI Chairman, Indroyono

Soesilo, and FSF Director, Hernica Rasan. The Germany

based FSF will work together to develop social forestry in

the Forest Utilization Permit (PBPH) concessions of APHI

members.

Indroyono said this collaboration is another APHI

membership contribution in support of job creation in the

forestry sector. Indroyono continued,” the second goal of

this collaboration is to create a pilot area that can be used

as a reference in the future on how to manage social

forestry-based plantation forest”. Another objective is

related to the commitment to reduce greenhouse gas

(GHG) emissions.

See:https://forestinsights.id/2022/05/28/aphi-collaborates-withfairventure-social-forestry-to-develop-social-forestry-basedplantation-forest/

President reports of fire management success

The Indonesian President reported achievements in

fighting forest fires at the 7th Global Platform for Disaster

Risk Reduction 2022 saying “Indonesia has succeeded in

reducing damage from forest fires from 2.6 million

hectares (in 2015) to 358,000 hectares in 2021.

He explained the efforts made to reduce the number of

forest fires. Up to 2021 Indonesia had restored 3.4 million

hectares of peatland as well as maintained and revitalised

3.3 million hectares of mangrove forest, around 20% of

the mangrove area.

See:

https://en.tempo.co/read/1595050/jokowi-indonesiamanages-to-reduce-forest-fire-to-only-358000-ha-in-2021

China/Indonesia cooperation in timber sector

The Chinese company Shandong Timber and Wood

Products Association and the management of the Sei

Mangkei Special Economic Zone, North Sumatra, signed a

Memorandum of Understanding (MoU) for the

development of an international industrial area.

The Indonesian Ambassador to China, Djauhari

Oratmangun, said this MoU was the result of intense

negotiations between the Indonesian Embassy in Beijing

and the Shandong Association for almost 3 years.

The Shandong Association, a major business player in the

timber sector in China is believed to be able to make a

significant contribution to improve the quality of wood

production in Indonesia. The chairman of the Shandong

Association, Yang Yuelu, said, "This investment will

strengthen cooperation between the two countries in the

context of the synergy between the Belt and Road

Initiative and the Global Maritime Fulcrum.

See:

https://dunia.rmol.id/read/2022/05/28/535097/dubesdjauhari-optimis-kerja-sama-investasi-industri-kayu-chinaindonesia-bisa-membawa-manfaat-kedua-negara

Regional FSC Standard for smallholders in Indonesia

approved

This standard is for the use by smallholders owning

plantations in Indonesia (Management Units smaller than

20 ha) and applies to rough wood and non-timber forest

products. The standard has been written in easy to

understand language and provides realistic and achievable

indicators relevant to the circumstances of smallholders in

Indonesia.

The Regional Forest Stewardship Standard (RFSS) in

Indonesia is an adaptation of the approved RFSS for Asia

Pacific for Smallholders in Indonesia, India, Thailand and

Vietnam.

See:

https://fsc.org/en/newsfeed/regional-forest-stewardshipstandard-for-smallholders-in-indonesia-approved

Indonesia's first wood pellet plant

Indonesian coal producer, Mitrabara Adiperdana, (MBAP)

will construct a wood pellet plant as part of its plans to

diversify into renewable energy production. The plant is

expected to be operational in the first quarter of 2024.

MBAP plans to export the bulk of the pellets from the

plant to Japan and will be applying for certification that

will qualify the pellets to be used in Japan's feed-in-tariff

scheme.

Indonesia exported 366,286 tonnes of wood pellets in

2021 up from 310,546 tonnes in 2020. Indonesia is Asia-

Pacific's biggest palm kernel shell exporter and the thirdlargest

wood pellet exporter after Vietnam and Malaysia.

See:

https://www.argusmedia.com/en/news/2339079-indonesiasmbap-to-build-its-first-wood-pellet-plant?backToResults=true

5.

MYANMAR

Reduce reliance on natural

resources - State

Administration Council

At a ceremony to mark the World Environment Day 2022

the Chairman of the State Administration Council and

Prime Minister, Senior General Min Aung Hlaing,

reported that 25.8% of Myanmar’s forests are reserved or

protected areas. He continued saying “Myanmar needs to

emphasise lessening environmental degradation and

adaption to avoid the negative impact of climate change”.

The environmental policy of the government appears

unchanged but critics have voiced concern over an

apparent shift from a conservation-oriented policy to one

of income generation.

see -

https://www.gnlm.com.mm/it-is-necessary-to-reducereliance-of-businesses-on-products-of-underground-and-aboveground-natural-resources-senior-general/#article-title

Harvesting ban could starve millers

The current government put a stop to timber extraction

from April to September 2022 and for the financial year

from October 2022 to September 2023. As a result of

such long logging ban commentators say log supplies may

not meet the demand of the manufacturers but it is not

clear how this will be addressed.

The supply issue has been exacerbated as the Myanma

Timber Enterprise, the sole and only legal supplier of logs,

is facing problems transporting logs from the remote

extraction sites to Yangon where the manufacturers have

their operations due to security concerns.

It is not possible to assess the current level of exports as

the the Ministry of Commerce has not updated statistics on

wood product export since December 2021.

Marketing plantation teak products will be tough

The local newspaper ‘Light of Myanmar’ has reported that

the forestry minister met with manufacturers and discussed

the market situation and the production of doors using the

teak from the plantation forests. For Myanmar, which

utilsed natural teak for decades, the introduction of

products made from the plantation teak will be a

challenging matter not only for the domestic but also

international markets.

Numbers of players in timber sector dwindles

The number of wood product exporters in Myanmar was

over 100 between 2010 and 2015 but has now declined to

around 50. It has been learnt two big factories, one local

and one Indian have recently stopped operations.

The timber industry was one of the top export sectors and

was included in the National Export Strategy, an initiative

aided by the World Bank. Before 2021 the World Bank

had tried to assist development of plantation and

community forestry but this has come to an end.

World Bank Survey and Forecast 2022

The latest World Bank comments on the Myanmar

economy are reproduced below:

“The combined effects of the February 2021 military coup

and of COVID-19 have deepened Myanmar’s economic

and humanitarian crisis. The World Bank’s January 2022

Myanmar Economic Monitor projects that following an

expected 18 percent contraction of the economy in the

year ended September 2021, Myanmar’s economy will

grow 1 percent in the year to September 2022.

While reflecting recent signs of stabilisation in some areas,

the projection remains consistent with a critically weak

economy, around 30 percent smaller than it might have

been in the absence of COVID-19 and the February 2021

coup.

Ongoing economic pressures are having a substantial

effect on vulnerability and food security, particularly for

the poor, whose savings have been drained as a result of

recent shocks. The share of Myanmar’s population living

in poverty is expected to have doubled compared to pre-

COVID-19 levels.

Combined with pressures on agricultural production, rapid

price inflation and reduced access to credit are expected to

further compound food security risks. An estimated one

million jobs are lost, and many other workers experience a

decline in their incomes due to reduced hours or wages.

With a low vaccination rate, inadequate health services

and recent trends of escalating conflict, Myanmar

continues to be highly vulnerable to the ongoing COVID-

19 pandemic.

Over the longer term, recent events have the potential to

jeopardise much of the development progress that has

been made over the past decade.

Significant impacts on investment, human capital

accumulation and the environment for doing business are

likely to impair prospects for economic growth.”

See:

https://www.worldbank.org/en/country/myanmar/overview#:~:text=The%20World%20Bank's%20January%202022,the%20year%20to%20September%202022.

6.

INDIA

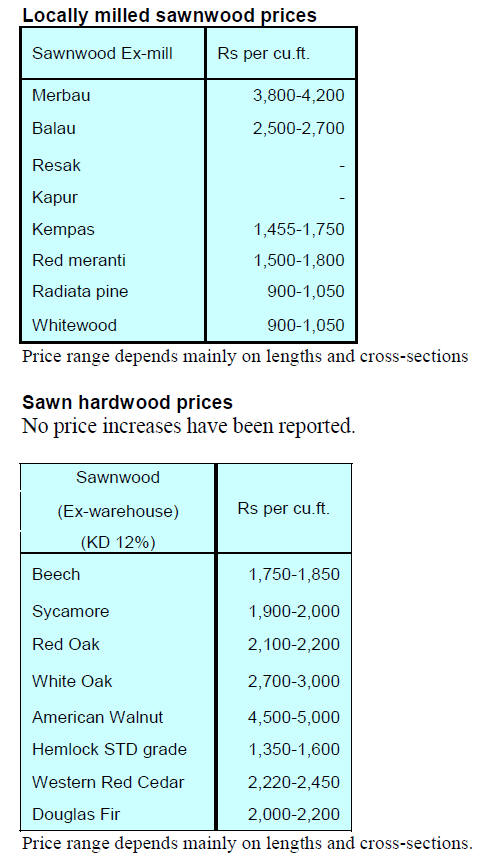

Strong growth but rising prices of

concern

Growth in India’s manufacturing sector remains positive,

growing at the fastest pace in more than 11 years in May

on the back of strong international demand. This was at a

time when concerns about the level of inflation dampened

business sentiment. The S&P Global India Manufacturing

Purchasing Managers’ Index (PMI) was at 54.6 in May,

well into postive territory.

However, rising prices dented consumer sentiment which

dropped sharply in May. The main impact was felt in rural

areas because of the export ban on wheat and sugar.

Analysts commented that what is most worrying is that the

recent weakening has moved at a fast pace, much faster

than the pace of the recent rise.

Ties with Africa – VP visits Gabon

The relationship between India and African countries is

strong and driven trade and investments as well as

cultural, historical and political engagements. Between 30

May and 3 June the Indian Vice President, Venkaiah

Naidu, visited Gabon and Senegal. In addition to official

meetings the Vice President met with the business

community in Gabon and addressed Indians living and

working in the country.

See:

https://gabonactu.com/signature-dun-memorandum-entrelanpi-et-la-confederation-de-lindustrie-indienne-en-prospectionau-gabon/

A number of bilateral agreements were discussed to

expand investment, trade and cooperation. Around 800

Indians are living in Gabon, engaged in infrastructure

projects, trading and exports of timber and metal scrap.

Around 50 Indian companies are established in the Gabon

Special Economic Zone (GSEZ).

India is making efforts towards strengthening ties with

Africa. In 2008 India introduced a duty-free tariff

preferential scheme for Least Developed Nations which

benefits 33 African states.

In related news, on the sidelines of the Gabon-India

Business Forum in Libreville the Director General of the

National Agency for the Promotion of Investments (ANPI)

signed, with the Confederation of Indian Industry (CII), a

memorandum of agreement to facilitate investment

between the two countries in priority sectors.

At the signing ceremony Ghislain Moandza Mboma said

the mission of ANPI is to promote investment

opportunities in Gabon, establish partnerships through

creating bridges for dialogue.

New timber research centre to be established

To promote the plywood industry, Haryana Chief

Minister, Manohar Lal Khattar, announced plans to

establish a forest research institute in the State. Khattar

said that the State Government is planning to create an

industrial zone to attract businesses specifically to provide

opportunities for young people.

Prices for recent shipments of teak logs and

sawnwood

Freight rates continue to be high leaving a only small

margin for importers. It has been reported that teak

shipments from Ghana, Brazil and South Sudan have

increased recntly but prices remain unchanged.

Illicit trade in subsidised urea

Officials have seized and made arrests as a large quantity

of urea was diverted illegally for non-agriculture purposes.

The urea fertilisers were seized in Haryana, Kerala, Uttar

Pradesh, Gujarat, Madhya Pradesh, Telangana, and

Andhra Pradesh. An official said, despite being neemcoated,

the urea meant for agricultural use was diverted to

manufacturers of dyes, plywood glue and cattle feed.

7.

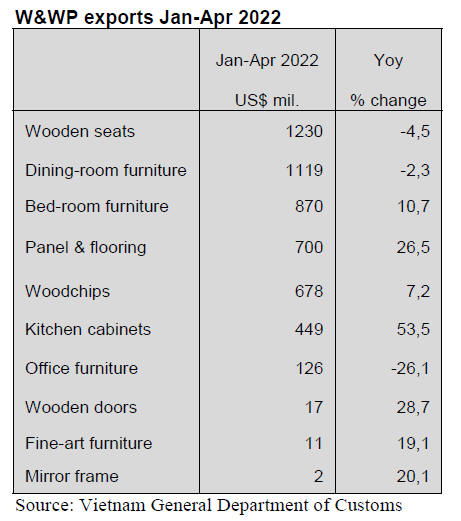

VIETNAM

Trade highlights

Vietnam's W&WP exports to the Chinese market in May

2022 are estimated at US$181 million, up 21.1%

compared to May 2021. In the first 5 months of 2022,

W&WP exports to the Chinese market were estimated at

US$722.1 million, up 5.3% over the same period in 2021.

In April 2022, exports of bedroom furniture reached

US$286.6 million, up 36% compared to April 2021. In the

first 4 months of 2022 exports of bedroom furniture

reached US$870.4 million, up 11% over the same period

in 2021.

Vietnam's poplar wood imports in May 2022 reached

35,500 cu.m, worth US$17.4 million, up 25% in volume

and 28% in value compared to April 2022, however

compared to May 2021 they were down by 3.4% in

volume and 15% in value. In the first five months of 2022

poplar wood imports reached 130,700 cum, worth

US$63.4 million, down 19% in volume and 7% in value

compared to 2021.

W&WP exports in May 2022 are reported at US$1.55

billion, a growth of 8% compared to May 2021. In the first

5 months of 2022 exports of W&WP are estimated at

US$7.15 billion, up 6.9% over the same period in 2021.

With the results achieved over the first 5 months of 2022,

the year-on-year growth is expected to reach 8%.

Despite positive export growth, Vietnam's wood and wood

products exports still face many challenges, including

unpredictable developments of the pandemic, risk of

supply chain disruption due to global trade uncertainties,

escalated freight rates and logistics and scarcity of

imported raw materials.

The opportunities that FTAs bring to businesses by cutting

tariff are immense. However, trade protection with new

technical barriers, including the imposition of antidumping/

anti-subsidy duties, among others may hamper

Vietnam’s export growth.

Exports in first five months

W&WP exports in May 2022 were reported at US$1.55

billion a growth of 8% compared to May 2021. In the first

five months of 2022 exports of W&WP were estimated at

US$7.15 billion, up 7% over the same period in 2021.

With the results achieved over the first 5 months of 2022

the year-on-year growth in the first half of 2022 is

expected to reach 8%.

Despite positive growth exporters face many challenges

such as unpredictable developments of the Covid-19

pandemic, risk of supply chain disruption due to global

trade uncertainties, escalated freight rates and logistics,

and scarcity of imported raw materials and fuel.

The opportunities that FTAs bring to businesses through

reduced tariff are immense. However, trade protection

through new technical barriers along with antidumping/

anti-subsidy duties may hamper export growth.

Over the last 5 months of 2022 exports of bedroom

furniture, flooring, woodchips, kitchen cabinets, wooden

doors, handicraft furniture, mirror frames all grew well. In

particular the exports of kitchen cabinets topped the

growth rate reaching US$447.9 million, up 54% over the

same period in 2021.

After cabinets was wood flooring where exports generated

US$700 million, up 27%; wooden doors brought in about

US$16.7 million, up 28%. This growth momentum is

expected to continue in the next months of the year.

Export markets

In the first 4 months of 2022, despite the pandemic

situation and the Russian invasion of Ukraine W&WP

export markets grew quite positively. In particular the US

continues to be the largest furniture market for Vietnam

with exports reaching US$3.34 billion in the first four

months of the year, up 6.6% compared to the same period

in 2021.

The second market was Japan at US$545.2 million, up

15%; China US$539.9 million, up 2%; South Korea

US$356.6 million, up 21%; and the EU US$263.5 million,

up 5%.

The W&WP exports to Japan, Australia and Malaysia

increased sharply in the first 4 months of 2022. These

countries are members of the Comprehensive and

Progressive Trans-Pacific Partnership (CPTPP). The new

FTAs, thus, has supported Vietnam's wood processing

industry to boost exports to many markets by increasing its

competitiveness over exporters from non-FTA countries.

See:

http://www.asemconnectvietnam.gov.vn/default.aspx?ZID1=8&ID1=2&ID8=120040

Directive to eliminate deforestation and encroachment

A recent government directive identifies serious violations

of regulations on forest protection in some provinces such

as large-scale illegal deforestation.

To effectively prevent deforestation and implement

international commitments made at the 26th United

Nations Climate Change Conference (COP26) the Prime

Minister instructed relevant ministries, sectors and local

authorities to tighten the management of forests

particularly limiting the change of purpose of forest land.

He added, investigations into illegal forest destruction

cases should be speeded up and violators punished.

Provinces and cities must direct forest rangers to examine

and evaluate the entire natural forest area under their

management so as to promptly detect, prevent and deal

with acts of encroachment on forest land according to the

directive.

See:

https://en.nhandan.vn/scitech/item/11561202-pm-requiresaction-be-taken-against-illegal-forest-destructionencroachment.html

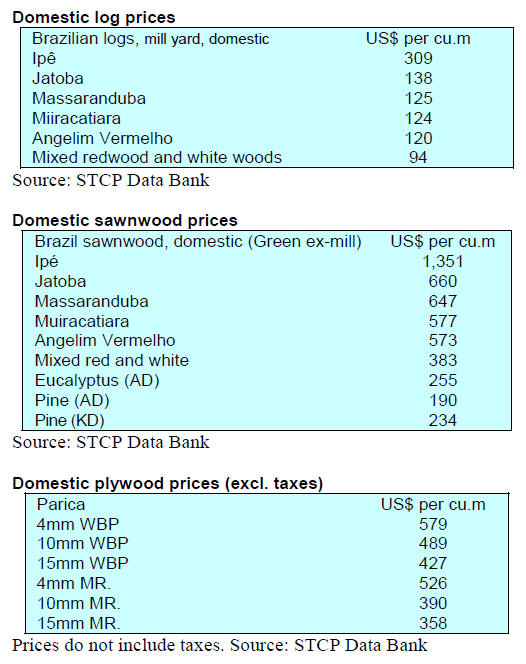

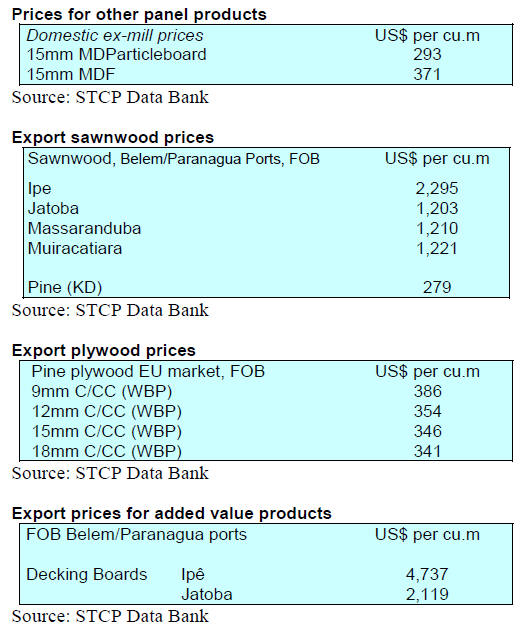

8. BRAZIL

Centres to combat

deforestation and fires in the

Amazon

In May the National Council of the Legal Amazon

(Conselho Nacional da Amazonia Legal - CNAL) that

coordinates and integrates the activities of ministries and

Federal agencies related to the Amazon Region hosted a

meeting to discuss the Brazilian Federal Government's

actions for the preservation and development of the

Amazon. The Ministry of Science, Technology and

Innovations (MCTI) attended the meeting and highlighted

the main initiatives in the Legal Amazon.

As a result it was decided to establish 6 centres to combat

illegal deforestation and forest fires in the region. These

bases are part of the Operation Guardians of the Amazon

Biome, a joint action with the Ministry of Justice and the

Ministry of the Environment. The eventual aim is to have

10 bases operating throughout the Amazon Region.

During the meeting the importance of combining

preservation and conservation along with the development

of the Legal Amazon was highlighted. Mention was made

of the investments in research and incentives for the

sustainable utilisation of the Amazon biodiversity, the

“Regenera Brazil” programme for the recovery of

degraded areas and international partnerships in projects

such as the ATTO Tower (Amazon Tall Tower

Observatory).

The CNAL meeting also dealt with the Strategic Plan of

the National Council for the Legal Amazon 2020-2030

and the “Our Amazon Plan”. These plans align and

integrate the actions planned by the Federal government

for the region.

CAD Madeira programme strengthened

The CAD Madeira programme has been upgraded in order

to ensure the registration of companies that sell timber and

other forest products coming from natural forests.

The programme is one of the modules of the Legal Wood

initiative which seeks to curb the illegal trade of timber

coming from the natural forest to the state of São Paulo

(main financial centre of the country).

Through the registration process the programme also has

an inspection component with the support from the

Environmental Police which is engaged in the monitoring

of logging, timber processing, transport,

commercialisation and storage of forest products.

Among the measures updated are the current rules, supply

chain analysis for the issuance of the programme's seal and

state certification for companies and traders that acquire

timber from suppliers registered in the programme.

The objective is to encourage the purchase of materials

from suppliers registered with the state to ensure

traceability and verification of the origin of timber based

on management plans registered with SINAFLOR

(National System of Control of the Origin of Forest

Products).

See:

https://www.infraestruturameioambiente.sp.gov.br/2022/06/governo-de-sao-paulo-amplia-programa-contra-madeira-ilegal/

“Casa Brazil” event in New York

The United States, one of the largest importers of

Brazilian furniture products, welcomed 65 Brazilian

companies to the “Casa Brazil” event in New York held at

the end of May. The event was promoted by the Brazilian

Trade and Investment Promotion Agency (Apex Brazil)

and was held in parallel to the International Contemporary

Furniture Fair (ICFF), the largest fair for contemporary

furniture design in North America.

The US is Brazil's biggest trading partner for furniture

accounting for 23% of Brazilian furniture exports which is

40% of the national production. According to Apex, Brazil

saw a 51% increase in furniture exports between 2020 and

2021. For 2022, according to the projections, the increase

should follow the trend and a 42% increase is estimated.

See:

https://pix11.com/news/local-news/manhattan/nyc-exhibitcasa-brasiloffers-an-immersive-brazilian-experience/

9. PERU

ADEX recommends tax rebate for SME

sub-contractors

According to an Association of Exporters (ADEX) press

statement Peru has 21 Free Trade Agreements with 54

countries which opens the possibility of accessing a large

international market.

Non-traditional exports (such as wood products) are

constantly growing in part due to the FTAs and this is

reflected in the fact that in the last two decades Peruvian

shipments abroad multiplied by seven times.

In addition, Peru has three million jobs associated with

export activity which contributes around 29% of

GDP. That is why ADEX is urging the government to

introduce measures so as not to lose what has been

achieved in the last 20 years.

Regarding this, the president of the ADEX, Julio Pérez

Alván, recalled that "among the short-term measures we

propose to restoring the drawback to the SMEs that are

part of the export chain."

The drawback is the Customs system that allows the return

of a percentage of the FOB value (balance in favor of the

beneficiary) thanks to the total or partial restitution of the

customs duties that have been levied on the import of

inputs that are incorporated or consumed in the production

of exported goods. From 2019 to date, the drawback rate is

3%.

"Currently only companies that sell in foreign markets

have this tax regime, however, these companies are

supported by suppliers and they must have this benefit

because their production is ultimately directed abroad "

Pérez added.

See:

https://vigilante.pe/2022/06/13/peru-adex-exportaciones-noperdamos-lo-avanzado/

High cost international maritime transport causing

cost overruns

In other news from ADEX, a letter has been sent to the

Minister of Foreign Affairs (RR.EE.), César Landa

Arroyo, by the Association of Exporters (ADEX)

suggesting seeking action by the World Trade

Organization (WTO) and UNCTAD in resolving the

serious problem of international maritime transport that

causes cost overruns, makes Peruvian foreign trade less

competitive and makes it difficult to reactivate the

economy.

The lack of space in the warehouses triggered the costs of

the containers, even paying a high freight does not

guarantee the shipment of the merchandise or its arrival at

the final destination in the established times.

The union argued that, given this unprecedented problem,

it is important to escalate it to the WTO and UNCTAD of

the United Nations, in order to have measures to improve

the conditions and flow of foreign trade.

See:https://www.adexperu.org.pe/notadeprensa/adex-pideescalar-a-la-omc-y-unctad-problema-del-transporteinternacional/

Chancay Port project – work to begin

The tender for the Chancay Port project, a multipurpose

terminal, was won by China Harbour Engineering

Company, a subsidiary of China Communications

Construction Company.

The complex will be north of Lima and when complete it

will be able to handle 1.5 million twenty-foot-equivalent

containers and 6 million tonnes of general cargo a year.

The client for the project is Peru’s Ministry of Transport

and Communications.

The port is seen as China’s gateway to Latin America as it

will improve links between Asia and Peru, Bolivia,

Uruguay, northern Chile, Colombia and Ecuador.

See:

https://www.globalconstructionreview.com/contractorchosen-to-build-perus-3bn-chancay-port/