Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jun

2022

Japan Yen 134.37

Reports From Japan

Plan for a ¡®new form of

capitalism¡¯

The Cabinet has approved plans for what the government

calls "a new form of capitalism." One of the cornerstones

of the plan will be strategies aimed at raising wealth

through investment of the huge savings held by Japanese.

At the same time there will be a focus on climate change

and digital transformation. The plan also calls for a big

increase in spending in science, technology and innovation

along with a public/private sector effort to increase the

number of business startups.

On the environment the government will work with the

private sector to invest about 100 trillion yen over the next

10 years to reduce Japan's carbon emissions.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20220607_35/

Supply shortages and rising prices hit manufacturers

Russia¡¯s invasion of Ukraine and sanctions by many

countries has disrupted energy and raw material supplies

causing prices to rise.

A survey of companies nationwide conducted by Teikoku

Databank from mid-to-late April focused on the impact of

sanctions and Russia¡¯s export bans on raw materials.

Among the companies that responded to the survey 51%

say they have been affected in terms of securing necessary

supplies and most said they are affected by price increase.

The ban on wood product exports by Russia has led to

what has been described in Japan as a ¡°wood shock¡± and is

seriously affecting the construction sector.

For the survey results see:

https://www.nippon.com/en/japandata/h01333/

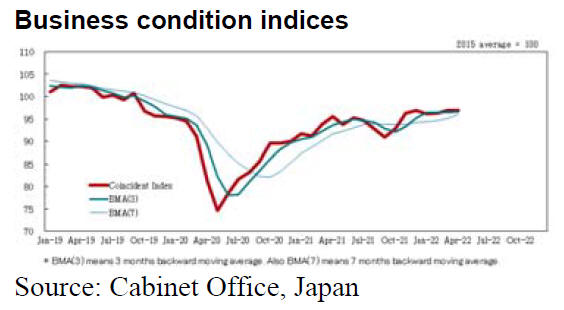

No more mention of pandemic impact on economic

prospects

Confidence among workers with jobs sensitive to

economic trends rose for the third straight month in May

on the back of the removal of anti-coronavirus restrictions.

The Cabinet Office upgraded its basic assessment of

economc prospects saying, "The economy is gradually

picking up". For the first time since February 2020 the

government statement dropped its reference to the

negative impact of the pandemic.

Emergency budget to help households

Soaring prices for consumer goods are hurting households

with prices for basics increasing and this is driving down

consumer spending. The government has drafted a

supplementary emergency budget designed to ease the

burden on households and it includes subsidies for petrol

wholesalers along with cash payouts to low-income

households with children.

In April, for the first time in seven years, consumer

inflation in Japan exceeded 2%, higher than the Bank of

Japan (BoJ) target and this will likely remain for a while.

The BoJ has indicated it will maintain the monetary easing

measures on the assumption that consumer price increases

are temporary and that the economy is not resilient enough

to endure fiscal tightening.

See:

https://www3.nhk.or.jp/nhkworld/en/news/backstories/2012/

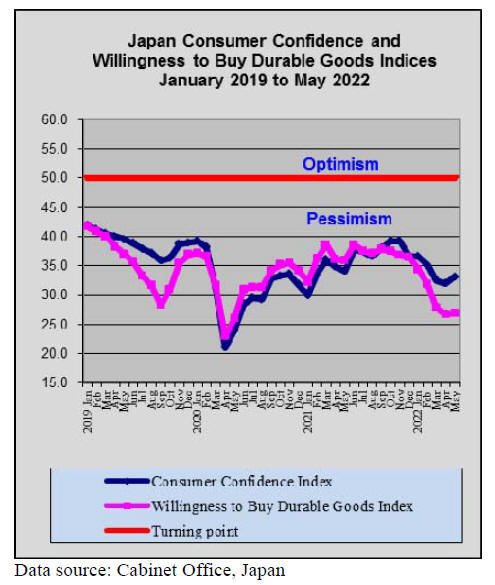

Spending during spring holidays good news for the

economy

After plummeting in the first three months of this year to

levels not seen for a long time, the consumer confidence

index flattened in April and showed a modest uptick in

May. The rise coincides with the lifting on covid control

measures which allowed people to travel and spend during

the May holidays.

Higher consumer prices inevitable

Wholesale price inflation accelerated in May to 9% from a

year earlier reflecting higher raw material prices and sharp

declines in the yen that pushed up the cost of imports.

Prices for goods traded between companies rose further

marking 15 consecutive monthly of increases. This raises

the prospect of higher consumer prices that will dent

private consumption.

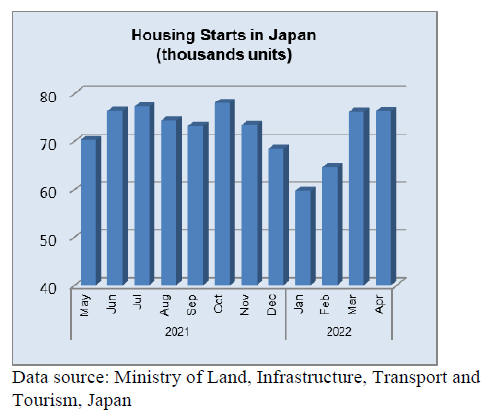

Profitability a major issue for house builders

The 2021 finacial reports by major house builders show

that orders in 2021 exceeded those in 2020 when the

covid infection rates and lockdowns were at a peak.

However, the Japan Lumber Reports says orders placed

with builders started to decline in the second half of fiscal

2021.

Profitability has become a major issue for house builders

because of the high and steadily rising costs of wood

products and other building materials. Builders anticipate

a tough year for profits in 2022.

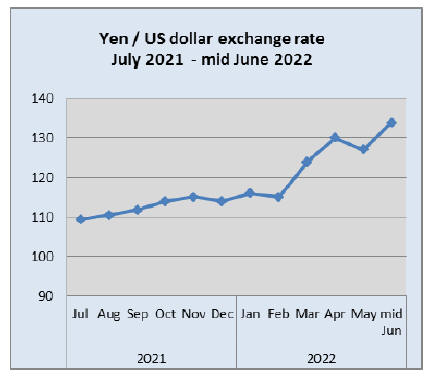

Danger that the yen could tilt to 150 to the

dollar

At one point in early June the yen weakened to 135 against

the US dollar, just short of the low seen in 2020, a slide

that threatens to turn into an economic and financial

headache for many financial markets.

Analysts write ¡°the danger is that the yen could tilt to 150

to the US dollar at which point intervention would likely

be the response or it could be that other Asian countries

would devalue their currencies to maintain export

competitiveness¡±.

See:

https://www.japantimes.co.jp/news/2022/06/09/business/economy-business/yen-drops-further/

Furniture imports

First quarter imports

Despite the pandemic, collapsed consumer confidence and

the disruption of the timber sector because of the Russian

invasion of Ukraine, imports of wooden bedroom furniture

just keep rising in contrast to the value of imports of

wooden office and wooden kitchen furniture which have

remained at around the same level as in the first quarter of

the past four years.

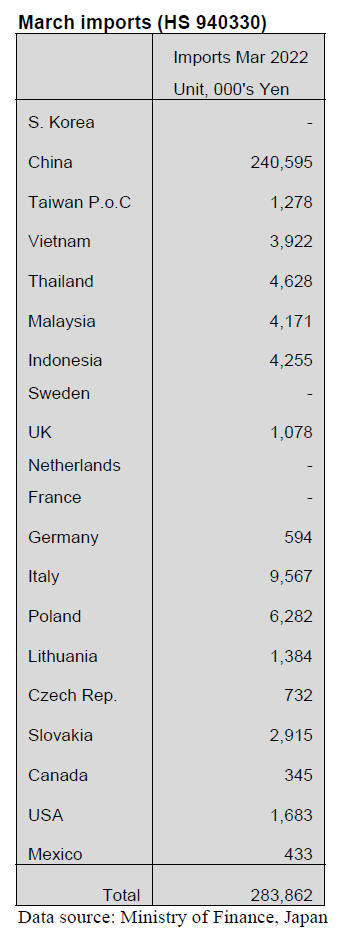

March office furniture imports (HS 940330)

February saw a correction in the value of wooden office

furniture imports but that was reversed in March bringing

the value of imports back up to the average for the year.

Year on year the value of March imports of wooden office

furniture (HS940330) declined by around 18%. The

downward trend in the yen dollar exchange rate and the

subdued business sentiment were the major factor behind

the decline.

As in previous months the top shipper of wooden office

furniture in March 2022 was China accounting for 85% of

total wooden furniture imports. The only other shippers of

note I March were Italy and Poland and the value of their

combined shipments in March was just less than 7% of all

March arrivals.

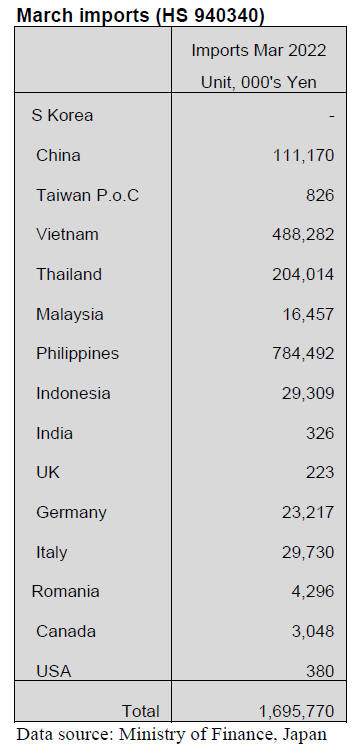

March kitchen furniture imports (HS 940340)

The value of Japan¡¯s March imports of wooden kitchen

furniture was up around 10% from February and added to

the upward trend noted in February.

There were two major shippers of wooden kitchen

furniture in March, the Philippines and Vietnam and

manufacturers in these two countries have a commanding

position in imports of wooden kitchen furniture.

The value of shipments from the Philippines little changed

from February but accounted for just under 50% of all

wooden kitchen furniture imports in March. Shipments

from Vietnam accounted for around 30% of wooden

kitchen furniture imports and were up about 15% from

February.

China was the third ranked shipper of wooden kitchen

furniture in March but accounted for around 6% of the

value of total March arrivals.

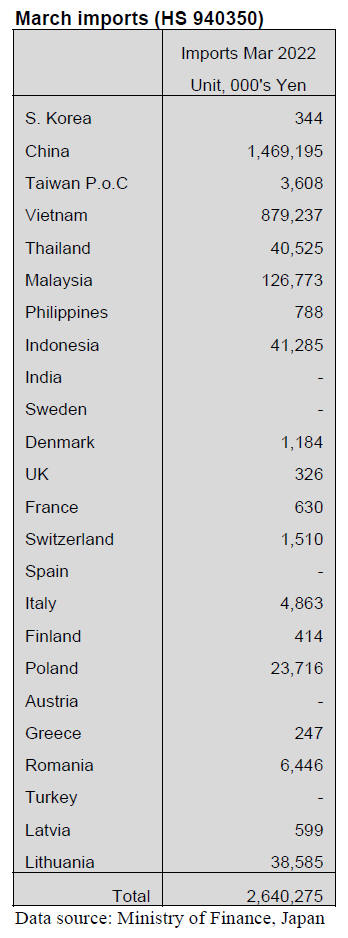

March bedroom furniture imports (HS 940350)

After three months of increases since January this year

there was a correction in February and March data shows

there was a modest increase in the value of imports in

March.

China remained the main supplier of wooden bedroom

furniture to Japan in March accounting for 56% of the

value of imports of HS 940350. The second ranked

shipper in terms of import value was Vietnam at 33%,

slight less than a month earlier.

Shippers in Malaysia did well in March lifting ther value

of shipments to around 5% of total arrivals, up from the

3% in February. Year on year, March 2022 imports were

some 20% higher than a month earlier but were flat month

on month.

Correction

In our previous report it was stated that Japan had banned

imports of sawnwood from Russia, this was incorrect. The

Japanese government has banned log, wood chips and

veneer imports from Russia.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

A price hike of softwood plywood

Major plywood companies in Eastern Japan raised the

prices of structural softwood plywood in June. The price

of 3 x 6 of 12mm is now 2,000 yen per sheet delivered,

which is 100 yen up from last month. Major plywood

companies in Western Japan also announced about a price

hike to the customers.

Since the prices of logs, glue and freight

increased, the

prices of softwood plywood climbed for straight 15

months. The bottom prices doubled or more and nearly

1,100 yen increase in total and it is 100,000 yen for per

cbm.

Prices of 3 x 6 24mm is 4,000 yen per sheet delivered and

it is 200 yen higher than before. Price of 3 x 6 of 28mm is

4,700 yen per sheet delivered and it is 250 yen higher than

last month. The prices of long plywood will increase but

not sure for how much would be. The prices of plywood

for floor will depend on each customer.

There is active demand for plywood and not enough

supply due to a big holiday at the end of April through

May. Some plywood companies had holiday a week

earlier because of machine maintenance. Some other

plywood companies put priority of supply for precutting

companies which had ordered directly to the plywood

companies.

The supply of cedar logs has been settled down but larch

and Douglas fir logs are still not enough supply. The

prices of domestic logs are still high and the prices of

imported Douglas fir logs are soaring. The influence of

banned importing Russian veneer will surface as an issue

in June. Even if working days become longer, there will be

reduced production.

It will be difficult to keep same production even though

using logs instead of veneers because there are a lot of

process to produce veneers from logs. On the other hand,

the volume of imported softwood plywood from China

keeps growing. It is concerned about a balance between

supply and demand. The prices are higher than the

domestic softwood plywood but the demand continues.

This situation might cause a relaxation of supply and

demand.

If the prices of 3 x 6 of 12mm reach to 2,000 yen per sheet

delivered then the price hike will calm down by several

plywood manufacturing companies. However, the prices

of logs are unsure in the future. Situation is unpredictable

because there are the price hike of freight charges and

glue.

A rise in price of imported plywood

The prices of 3 x 6 of coated plywood for concrete

forming at the Greater Tokyo Metropolitan area are 2,200

yen per sheet delivered. It is 200 yen higher than last

month. The reasons are that a price hike of plywood in

South Asia by the suppliers and a weak yen. The prices of

plywood have also skyrocketed. The structural South Sea

hardwood plywood has been used as substitution for

structural domestic softwood plywood. The prices are

2,100 yen per sheet delivered and it is 100 yen more than

last month.

Some construction firms were anxious about a sign of

rising prices and a lack of supply at the end of April so

they rushed to buy the product. The future prices are

2,300 yen on FOB truck per sheet.

This price hike is caused by structural plywood. There

will be a tight supply from Malaysia because there are still

not enough logs. Some Malaysian plywood companies

had to stop an operation due to a shortage of logs. It is the

best season to harvest the trees in April to June as usual,

but in this year log supply continues tight.

The export prices of 3 x 6 of coated plywood for concrete

forming are US$840 - 850, C&F per cbm. It is US$10

more than last month and new contracts are getting less. It

is hard to order specific plywood because there is limited

amount of producing plywood. Some distribution

companies hesitate to sign up new contracts because there

were fewer orders in Japan. There will be a big and serious

problem of a lack of coated plywood for concrete forming

if this situation continues.

Price increase of Vietnamese plywood

Market prices of Vietnamese plywood for crating in

Tokyo are climbing. Particularly lower grade prices. They

are up from May by 1,000 yen on 8.5 mm thick 4x8 per

sheet delivered. Main reason of price increase is recent

depreciation of the yen, which pushes the Yen cost

higher.

The February rate was about 115 yen per dollar then in

March it shot up to 120 yen so the products imported after

April are influenced by fluctuation of the yen rate. The

inventory has been dropping since last April so that the

dealers placed more orders to the suppliers. Production

and transportation cost is climbing with higher adhesive

cost by higher oil prices then container freight remains

high without any sign of softening.

Plywood

Softwood plywood production in last April exceeded the

shipment so the inventory increased over 100 M cbms

after a year but the shipment continues busy so that this is

temporary lull. Plywood manufacturers continue a full

production but it is hard to increase further because of

difficulty of having enough material logs and workers.

Large house builders are cautious about future demand

after house orders are declining but orders by precutting

plants and wholesalers continues active with little

inventory on hand.

Domestic plywood manufacturers raised the sales price of

12 mm thick 3x6 panel to 2,000 yen per sheet because of

higher cost of logs, adhesive and transportation. One

major concern is increasing import of Chinese made

softwood plywood. April supply was over 10,000 cbms

and this could disturb domestic plywood market if large

volume continues coming in.

Market prices of imported hardwood 12 mm panel are

climbing. In Tokyo market, 3x6 concrete forming panel

prices are 2,200 yen per sheet delivered, 200 yen from

May.

Higher export prices and weak yen make arrived cost

high.

Users made hasty purchase since last April and this made

speculative move and the dealers increased the sales

prices.

Imported structural panel prices climbed to follow higher

prices of softwood structural panel and this pulled

concrete forming panel prices up.

In Malaysia, log supply continues very low despite arrival

of dry weather so the supply of hardwood plywood for rest

of this year looks hopeless.

Housing demand ¨C profit margins slide

The closing accounts of 2021 of major house builders for

order made units exceeded the result of 2020. This is

because there were fewer orders due to a COVID-19 in

2020. However, the orders started to decrease at the

second half of the fiscal year of 2021. A profitability of a

house started decreasing slightly because of high-priced

lumber and building materials. This situation has been

continuing in this year. Some builders predict that the

profit will decrease in the 2022 fiscal year.

It was brisk for accepting orders and selling the detached

house for sale in the first half of the fiscal 2021. The

internet was used for promotion of a new style of houses.

A new system of storage of electricity, an airconditioning

system and a room arrangement made

people to buy houses. Some people who were thinking to

buy condos changed their minds to buy detached houses

due to high-priced condos.

The wood shock occurred in April, 2021 and there were

anxious about a shortage of lumber. The prices of lumber

were double compared to the year of 2020. However,

major house builders could avoid a long delay of

construction because they could buy the materials. Then

they made the profit. The demand started decreasing

since last September. One of reasons was that a housing

tax cut had ended. Other reason was that people started to

go outside after a removal of the state of emergency.

A profit of a house started to decrease because of the

wood shock, a lack of plywood and a price hike of

lumber, plywood and other building materials.

Many house builders struggle with accepting new orders

and high-priced materials. It is hard to make profit. A war

in Ukraine by Russia has been influencing a rise in prices

in Japan and people are losing their interests for buying

houses. Several companies will focus on promotion on

the internet.

Many house builders had good closing accounts of 2021

due to the wood shock. The supply of steel, chemical

synthesis materials, fuels, plywood and water heaters

were not enough before but now the inventory of lumber

are too much. It is said that the results will be different on

each type of business and company in this term.

Domestic logs and lumber

There are enough logs in Japan so far. Some logs are still left

in forest because there are too many logs at stock yards.

Usually, there are not enough logs in this season because

people start spending time for afforesting but in this year the

log prices are high so log suppliers keep harvesting trees.

There are enough cedar logs and cypress logs in

inventory, so the prices are falling down slightly. Cedar

logs for lumber are around 16,000 yen per cbm at

markets. There is a possibility that the prices would be

lower because the temperature and humidity make log

quality deteriorating. However, larch is popular as

substitution for Russian lumber. Plywood companies,

crating companies and laminated lumber companies are

struggling to buy larch and pine logs. Battle to buy logs

continue.

Larch logs in the Tohoku Region are 30,000 yen per cbm

at markets. Demand exceeded supply in this area. The

movement of lumber is calming down because move of

Russian or European lumber to domestic lumber had

calmed down. The current prices of KD cedar studs are

90,000 ¨C 100,000 yen of 3 m x 30 x 105 mm and KD

cedar posts are 100,000 ¨C 110,000 yen of 3 m x 105 mm.

|