|

Report from

North America

Hardwood plywood imports retreat, some products

return to record levels

Imports of wooden furniture topped US$2.5 billion for the

first time in May as imports of some items headed back

into record territory.

Imports of hardwood flooring hit a 10-year high while

imports of sawn tropical hardwood, hardwood veneer, and

hardwood moulding all rose to levels that challenge

historical highs. Yet not all is on the rise.

Hardwood plywood imports fell for the second straight

month as declining imports from Russia (to be expected)

were met by even sharper declines in imports from China

and Vietnam. Imports of assembled flooring panels also

retreated somewhat in May.

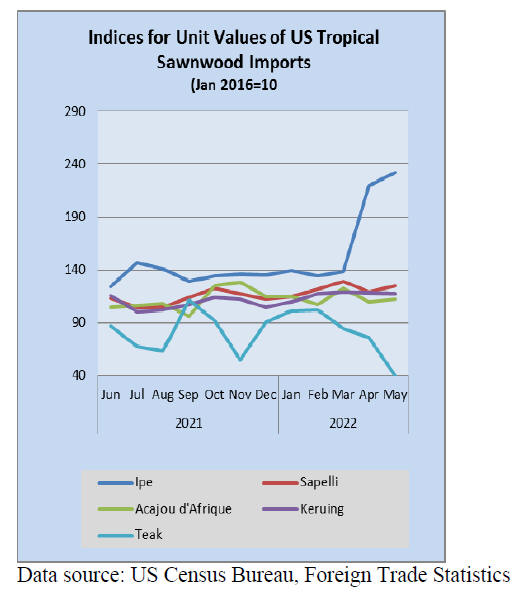

Tropical hardwood imports rise

Imports of sawn tropical hardwood rose 6% in May

returning to near historic levels. The 27,451 cubic metres

imported in May was the second highest monthly volume

on record, just short of the more than 28,000 cubic metres

imported in March.

Imports of Mahogany were particularly strong, rising

152% in May and up 66% for the year so far over 2021.

Imports of Padauk, Acajou d¡¯Afrique, and Iroko all

showed sharp gains in May and are each well outpacing

2021 totals so far this year. Imports of Virola fell 63% and

are down 29% year-to-date.

Imports from Peru fell back to more historic levels after an

April that saw imports surpassing all of 2021¡¯s volume.

Imports from Brazil and Indonesia continued to rise in

May and are maintaining a level 10-15 times that of last

year.

Imports from both Cameroon and Cote d¡¯Ivoire rose 32%

in May and are well ahead of last year¡¯s volume to date.

Total imports of sawn tropical hardwood are up 211% so

far this year although changes made this year by the US

government in how they are classifying tropical

hardwoods make direct comparison difficult.

Canada is also setting records for of sawn tropical

hardwood imports as totals rose for the fourth straight

month in May. Imports rose 32% in May with imports

from Cameroon, Indonesia, the United States and Congo

(formerly Brazzaville and formerly Zaire) all more than

doubling. Overall imports are up 32% year to date

through May over 2021 figures.

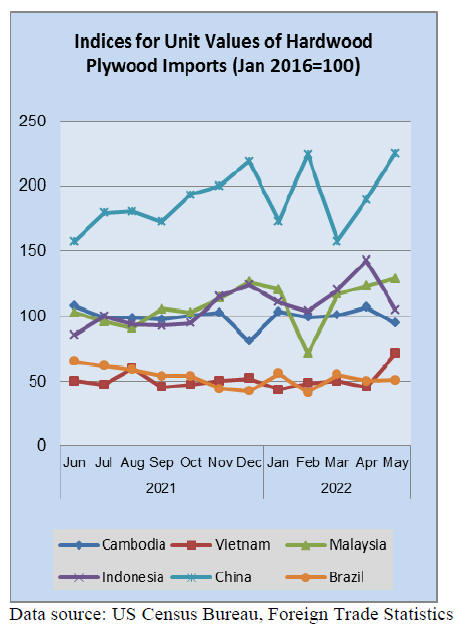

Hardwood plywood imports continue slide

Imports of hardwood plywood fell for the second month in

a row as volume retreated from a record high in March.

At 325,924 cubic metres, May volumes slid 18% from the

previous month to its lowest volume of the year. Imports

from Vietnam plunged 65% to their lowest level in more

than a year.

Despite the fall, imports from Vietnam are still more than

double 2021 volume year to date through May. Imports

from China fell 46% and imports from Russia sank 32% in

May, their lowest volume since May 2019.

While we may finally be seeing some impact from U.S.-

Russia trade tensions due to the invasion of Ukraine,

imports from Russia remain up 25% year to date. Overall

hardwood plywood import volume is up 50% year to date

over 2021.

Veneer imports bounce back

Imports of tropical hardwood veneer jumped 50% in May

after slumping in April. Much of the increase was due to

imports from Ghana which rose more than 500% in May

to their highest total since September 2019.

Imports from Ghana are now up 70% year to date.

Imports from Cote d¡¯Ivoire, Cameroon and India were also

up sharply, while imports from Italy (the top supplier to

the U.S.) fell 13%. Total tropical hardwood veneer imports

are ahead of last year by 47% through May.

Hardwood flooring imports set record high

Imports of hardwood flooring also rebounded in May,

rising 53% to their highest total in more than 10 years at

more than US$8.4 million. Imports from Malaysia jumped

115% in May to their highest level of the year and are up

31% year to date.

Imports from Indonesia rose 79% in May and now double

last year¡¯s imports so far this year. Imports from Brazil

(the top U.S. supplier) fell 5% in May but are up 19% year

to date. Total imports are ahead of 2021 by 17% so far this

year.

Imports of assembled flooring panels, however, fell by 5%

in May as imports from China, Indonesia, and Vietnam all

fell by more than 20%. Imports from Canada rose 17% in

May and are up 38% year to date.

Total imports are ahead of last year 65% to date with

imports from most trade partners up by at least 30%. The

exception in China, where imports are down 4% year to

date.

Moulding imports grow

US imports of hardwood moulding rose 6% in May

despite sharp decreases in imports from Brazil and China.

A gain of 19% in imports from the U.S. top supplier

Canada offset a decline of 45% in imports from China and

34% from Brazil. Despite the weak May numbers,

imports from Brazil are ahead 71% year to date over 2021

while imports from China are up 54% year to date.

Overall imports are up 40% year to date.

Wooden furniture imports back into record territory

Imports of wooden furniture rose 8% to set a new record,

breaking the one set in March. Imports from Vietnam

alone came just under the US$1 billion mark as the US

imported more than US$2.51 of wooden furniture in May.

Imports from Vietnam jumped 17% in May and moved

ahead of 2021 year to date by 1%. Imports from China,

Mexico and Canada also saw increases but of less than

10%. Total imports of wooden furniture remained up 11%

year to date.

Housing starts fall again

After reporting a steep drop in new residential

construction in the US in the previous month the

Department of Commerce released a report unexpectedly

showing a continued decline in housing starts in the month

of June. The report said housing starts slumped by 2% to

an annual rate of 1.559 million after plunging by 11.9% to

a revised rate of 1.591 million in May.

Single-family housing starts, which account for the biggest

share of homebuilding, tumbled 8% to a rate of 982,000

units in June, the first time that category has dropped

below the 1 million mark in two years. Single-family

homebuilding rose in the Midwest, but fell in the

Northeast, South and West, where a 25.4% drop was the

largest since January 2021.

Building permits for single-family homes,an indicator of

future construction, declined 8% to a rate of 967,000 units,

the lowest since June 2020. Meanwhile, a survey showed

the National Association of Home Builders/Wells Fargo

Housing Market Index suffering its second-largest drop on

record in July, with a gauge of prospective buyer traffic

falling below the break-even level for a second straight

month.

Canadian housing starts in June fell 3% from the previous

month on a decline in both multi-unit urban and singledetached

starts according to data from the Canadian

Mortgage and Housing Corporation. The seasonally

adjusted annualized rate of housing starts was 273,841

units in June, beating analyst predictions of 265,000 but

coming in below a revised 282,188 units in May.

Existing home sales drop for the fifth straight month

Sales of previously owned homes declined for the fifth

straight month in June falling 5.4% from May according to

a monthly report from the National Association of

Realtors, as prices set records and rates surged. The sales

count declined to a seasonally adjusted annualized rate of

5.12 million units last month. Sales were 14.2% lower

compared with June 2021. This is the slowest sales pace

since June 2020, when sales dropped very briefly at the

start of the pandemic. Outside of that, it is the slowest pace

since January 2019, and below the annual 2019 total, prepandemic.

Existing home sales decreased by 11% in the West, 6.2%

in the South, and 1.6% in the Midwest while sales in the

Northeast were unchanged from the previous month. The

median existing-home sales price climbed 13.4% from one

year ago to US$416,000, a new record high.

Sales will likely fall more sharply in the coming months as

more recent indicators point to much weaker buyer

demand. Mortgage applications fell to a 22-year low in

mid-July, with demand from homebuyers down 19% from

the same week one year ago, according to the Mortgage

Bankers Association.

Jobs market holds firm despite economic fears

The economy added 372,000 jobs in June, an unexpected

boost in hiring and a signal that the labour market remains

robust despite recession fears, according to the monthly

jobs report from the Bureau of Labor Statistics. The

unemployment rate held steady at 3.6%, still close to the

52-year low last reached in the months before the

pandemic hit. The June job total, slightly down from

May's revised 384,000 jobs added, far surpassed

expectations.

The strongest job gains for June came from the

professional and business services, leisure and hospitality

and health care industries, with notable increases in areas

such as food services and warehousing and storage.

Transportation and warehousing added 36,000 jobs in June

while employment in manufacturing increased by 29,000.

Wood Products and furniture sectors continued to

contract in June

For the second straight month the wood and furniture

sectors reported contraction while nearly all other

manufactures saw growth according to the latest

Manufacturing ISM Report on Business. ISM reported that

economic activity in the manufacturing sector grew in

June, with the overall economy achieving a 25th

consecutive month of growth. Fifteen of the 18

manufacturing industries tracked by ISM reported growth

in June. The exceptions were Paper Products, Wood

Products, and Furniture and Related Products.

See:https://www.ismworld.org/supply-management-newsand-reports/reports/ism-report-on-business/pmi/june/

Consumer sentiment rises slightly from June low

The consumer Sentiment Index increased 2.2% on a

monthly basis to 51.1 points in July, still near record lows,

according to a preliminary report published by the

University of Michigan. The index has plummeted 37.1%

year over year.

Current assessments of personal finances continued to

deteriorate, reaching its lowest point since 2011. The share

of consumers blaming inflation for eroding their living

standards continued its rise to 49%, matching the all-time

high reached during the Great Recession of the 1930s.

These negative views endured in the face of the recent

moderation in gas prices at the pump.

See:

http://www.sca.isr.umich.edu/

Government to help end freight railroad and union

dispute

President Biden named the members of an emergency

board tasked with helping resolve disputes between freight

rail carriers and their unions. Biden signed an order on 15

July ahead of a deadline to intervene in nationwide

railroad labour talks covering 115,000 workers or open the

door to a potential strike or lockout that could threaten an

already fragile economy and choke supplies of food and

fuel.

See:https://www.reuters.com/world/us/biden-names-board-helpend-freight-railroad-union-contract-disputes-2022-07-17/

|