4.

INDONESIA

Lightwood-Hub creates new

opportunities

The Association of Indonesian Forest Concession Holders (APHI)

welcomed the new ‘Lightwood-Hub’ to promote lightwood for building

construction. The chairman of APHI, Indroyono Soesilo, stated that,

currently, the world is entering the era of a Green Economy including the

building of ‘Green Buildings’ which use a lot of wood products in the

construction process.

To further encourage the use of light wood Indroyono stressed the need for

synergy between three parties; forestry businesses as providers of wood raw

materials, architects as designers of buildings with light wood materials

and construction engineers who understand how to use wood.

Indroyono also called on APHI members to be more courageous in exploring

opportunities to use lightwood.

See:

https://forestinsights.id/2023/05/12/aphi-sambut-kehadiran-lightwoodhub-buka-potensi-pasar-kayu-rimba-campuran/

First Quarter 2023 furniture exports

Furniture exports earned US$501 million in the first quarter of

2023. The Director General of Agro Industries in the Ministry of Industry,

Putu Juli Ardika, said the expansion of furniture exports was reflected in

the Industrial Confidence Index (IKI) which reached a level of 51.38 in

April 2023 signaling expansion.

The Ministry of Industry has implemented several policies to support the

growth of the furniture industry including facilitating the ‘Raw Material

Logistics Center’ in an effort to improve the supply of raw materials for

the furniture industry, the establishment of the ‘Furniture and Wood

Processing Polytechnic’ in Kendal to train workers for the furniture

industry, the machine/equipment restructuring programme for the wood

processing industry and empowerment of SMEs through SMEs centers.

See: https://akurat.co/furnitur

and

https://www.viva.co.id/siaran-pers/1599690-kemenperin-upayakan-industri-furnitur-terus-berekspansi?page=all

In related news, the Minister for Cooperatives and Small and Medium

Enterprises, Teten Masduki, has urged furniture and craft manufacturers to

seek new alternative markets in response to changes in traditional markets.

He noted that over the next few years the sector has to target alternative

markets, not just America and Europe. Echoing this sentiment, Agro-Industry

Director General, Putu Juli Ardika, said Indonesian furniture products are

frequently exported to Europe and the United States, which are currently

experiencing economic stagnation.

He reported that an export task force has been formed and it is currently

investigating new markets for furniture one of which would be member

countries of ASEAN, Middle Eastern countries and non ASEAN Asian countries.

See:

http://bisnisbali.com/industri-furnitur-lokal-didorong-bidik-pasar-ekspor-alternatif/

Interzum 2023 exhibition

Indonesian wood products recorded potential transactions worth

US$3.1 million at the May Interzum 2023 exhibition. Didi Sumedi, Director

General of National Export Development in the Ministry of Trade said that

Indonesian wood products are appreciated by European consumers because of

the quality and style.

The Acting Director of Manufacturing Export Development, Ganef Judawati,

added that the exhibition was a prestigious international event that

attracted around 70,000 visitors and exhibitors and became a business

opportunity for around 1,800 exhibitors from Europe, Asia and America.

In 2022, exports of Indonesian wood products to

Germany were recorded at US$95 million, down 4% compared to the previous

year. Meanwhile, exports of Indonesian wood products to the European Union

in 2022 were recorded at US$389 million, down 3% in 2022 compared to 2021.

See:

https://swa.co.id/swa/trends/economic-issues/produk-kayu-olahan-ri-mampu-bukukan-transaksi-rp-46-miliar-di-pasar-eropa

Strategies for sustainable forest management

The Indonesian government presented three strategies for

sustainable forest management on the first day of the 18th session of the

United Nations Forum on Forests (UNFF18) at the United Nations (UN)

Headquarters.

The Director General of Sustainable Forest Management Ministry Environment

and Forestry (KLHK), Agus Justianto, mentioned Indonesia's three

contributions to realising the United Nations Strategic Plan for Sustainable

Forest Management. Implementation of Indonesia's FOLU Net Sink 2030 agenda,

implementation of multi-business forestry and the active involvement of

communities in forest management through the Social Forestry programme.

On the multi-business forestry scheme utilisation is no longer focused only

on wood but also on optimising the potential of non-timber forest products,

ecotourism and environmental services.

See:

https://www.antaranews.com/berita/3529572/indonesia-paparkan-strategi-pengelolaan-hutan-lestari-dalam-sidang-pbb

and

https://www.msn.com/id-id/berita/nasional/klhk-beberkan-3-kontribusi-indonesia-wujudkan-rencana-pbb-untuk-pengelolaan-hutan/ar-AA1aYtKu

President seeks forestry partnership with Brazil

On the sidelines of the G7 Summit President Joko Widodo sought a

strengthened partnership between Indonesia and Brazil on forestry. Forestry

related issues are a priority for both countries as Indonesia and Brazil are

among the countries with the largest area of tropical forests.

The two leaders came to an agreement to convince developed countries to

realise their commitments to provide funds for tackling issues related to

climate change.

See:

https://en.antaranews.com/news/282333/president-seeks-to-intensify-forestry-partnership-with-brazil

Indonesia and EU complete 14th IEU-CEPA negotiations

Indonesia and the European Union (EU) completed the 14th round of

the Indonesia-EU Comprehensive Economic Partnership Agreement (IEU-CEPA)

negotiation in Brussels, from May 8–12, 2023. According to a statement

published the two parties managed to achieve significant progress on the

development of the agreement in the negotiation round.

The Director of Bilateral Negotiations at the Indonesian Ministry of Trade,

Johni Martha, has been reprted as saying with this progress we are

optimistic that we can achieve the determined targets in this negotiation

process.

18 substantive primary issues were negotiated in the 14th round including

trade in goods, rules of origin, trade in services, trade security,

investment, government procurement, transparency and regulatory practice,

dispute resolution, institutional provisions as well as intellectual

property rights.

Other issues discussed were state-owned enterprises, economic cooperation

and capacity building, investment court system, subsidies, anti-fraud

policies, energy and raw materials, small and medium enterprises as well as

trade technical barriers.

See:

https://en.tempo.co/read/1725637/indonesia-eu-complete-14th-ieu-cepa-negotiations-round

Strengthening economic fundamentals

Indonesia continues to strengthen economic fundamentals in support

of economic growth according to the Minister of Finance, Sri Mulyani

Indrawati, In the post pandemic era Indonesia is focusing on how to

strengthen economic fundamentals.

The Minister explained that, even during the pandemic, Indonesia continued

highly ambitious reforms, including the tax harmonisation law, alignment of

central and regional fiscal policies, financial sector reform and a job

creation law. Financial sector reforms included the integration and adoption

of financial technology (fintech), strengthening efforts for small and

medium enterprises (SMEs) and consumer data protection.

See:

https://en.antaranews.com/news/281208/indonesia-continues-to-reform-to-boost-economic-fundamentals-minister

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Indonesia.

https://www.itto-ggsc.org/list_52/439.html

5.

MYANMAR

-

6.

INDIA

High interest rates and weak

international demand could dampen prospects for exports

India's economy is projected to expand by almost 6% in 2023 driven

mostly by domestic demand according to the latest UN World Economic

Situation and Prospects report. However, high interest rates and weakening

international demand could dampen prospects for exports and investment.

See:

https://www.livemint.com/economy/indias-economy-backed-by-domestic-demand-but-high-cost-of-funds-hinders-investments-un-report-11684340454975.html

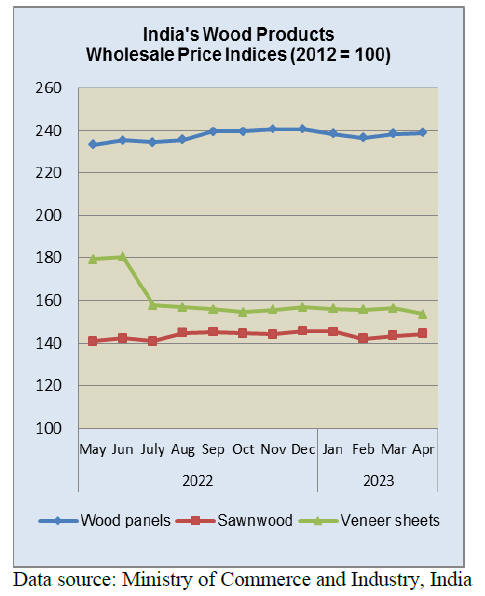

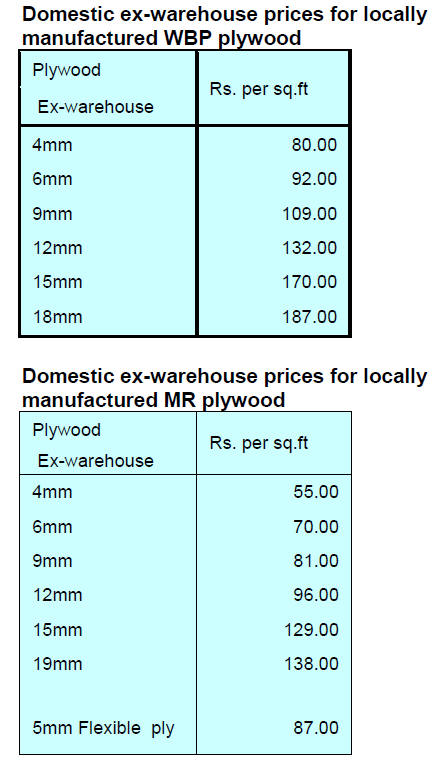

Wood products price indices

The annual rate of inflation based on all India Wholesale Price

Index (WPI) in April was 0.92% compared to 1.34% recorded in March 2023. The

decline in the rate of inflation in April 2023 was mainly due to a fall in

prices of basic metals, food products, mineral oils, textiles, non-food

articles, chemical products, rubber and plastic products and paper.

Out of the 22 NIC two-digit groups for manufactured

products, the price index for 14 groups increased while for 8 groups there

was a decline. Some of the groups that recorded a drop in prices were

chemicals; basic metals; food products; fabricated metal products (except

machinery and equipment) leather and related products; paper and paper

products.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

EU and India Trade and Technology Council (TTC)

A press release from the EC has announced the first meeting of the

new trade council which is seen key deepen the strategic partnership on

trade and technology. The TTC is a coordination platform to address key

trade, technology and security challenges.

The ministerial meeting reviewed the work of three workings groups:

Strategic technologies, digital governance and digital connectivity

Green and clean energy technologies

Trade, investment and resilient value chains

The EU and India enjoy a robust trading relationship. The EU is India's 2nd

largest trading partner accounting for Eur120 billion worth of trade in

goods in 2022 or 10.8% of total Indian trade. India is the EU's 10th largest

trading partner accounting for 2% of EU total trade in goods. Trade in

services between the EU and India reached Eur40 billion in 2021.

See:

https://ec.europa.eu/commission/presscorner/detail/en/ip_23_2728

2,000 rupee notes to be removed from circulation

The Reserve Bank of India has announced it will take out of

circulation its highest denomination currency note, the ,2000-rupee note.

The 2,000 rupee notes were introduced immediately after the demonetisation

exercise. This move will affect small businesses in many sectors and could

be a major challenge for these businesses.

See:

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12506&Mode=0

Heatwave in parts of north and central India

Only towards the end of May did the heat wave in parts of northwest

India ease. With temperatures rising to 45 Celsius the Meteorological

Department (IMD) issued heatwave warnings over Delhi-NCR and adjoining

areas. However, the IMD indicated that the worst of the hot weather had

passed by 24 May with the arrival of light rain and cloudy weather.

See:

https://indianexpress.com/article/india/india-heatwave-weather-update-may-22-8621988/

JICA loan for forestry

On behalf of Japan, JICA signed a loan agreement with the Government of

India to provide loans of up to a total of Yen 426,814 million for four

projects, one of which is for Forest and Biodiversity Conservation for

Climate Change Response in West Bengal.

The object of this forestry project is to mitigate and adapt to climate

change, conserve, and restore ecosystems by ecosystem-based climate change

measures, biodiversity conservation and restoration, livelihood improvement

activities and institutional strengthening thereby contributing to

sustainable socio-economic development in West Bengal. The Executing Agency

will be the Department of Forests, Government of West Bengal.

See:

https://www.jica.go.jp/english/news/press/2022/20230329_33.html

7.

VIETNAM

Highlights of Wood & Wood Product

(W&WP) Trade

According to the General Department of Customs in April 2023 W&WP exports

were valued at US$1.09 billion, down 4.3% compared to March 2023 and down

32% year-on-year.

In particular WP exports stood at US$777 million, up 0.5% compared to March

2023 but down 33% compared to April 2022.

In the first 4 months of 2023 W&WP exports amounted to US$3.9 billion, down

31% over the same period in 2022. The WP exports alone accounted for US$2.6

billion, down 38% over the same period in 2022.

W&WP exports to the Japanese market in April 2023 were valued at US$126.9

million, down 17% compared to April 2022. In the first 4 months of 2023 W&WP

exports to Japan reached US$556.3 million, up 1.8% over the same period in

2022.

In April 2023 Vietnam’s exports of kitchen furniture were valued at US$82

million, down 40% compared to April 2022. In the first 4 months of 2023

exports of kitchen furniture reached US$295 million, down 34% year-on-year.

W&WP imports into Vietnam in April 2023 stood at US$169.1 million, down 13%

compared to March 2023 and down 39% compared to April 2022.

Vietnam's W&WP exports to South Korea in April 2023 were valued at US$66

million, down 39% compared to April 2022. Over the first 4 months of 2023

W&WP exports to South Korea totalled US$273.5 million, year-on-year down

23%.

Vietnam’s wood pellet exports in April 2023 earned US$60 million, down 27%

compared to April 2022. In the first 4 months of 2023 wood pellet exports

generated US$260 million, year-on-year rise of 10%.

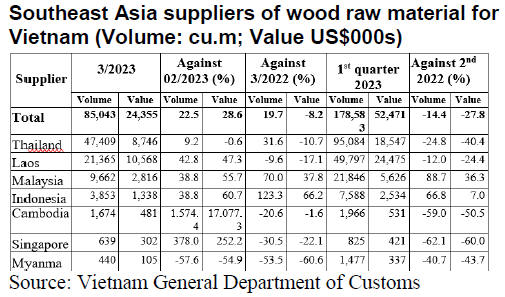

Wood raw material imported into Vietnam from Southeast Asia in April 2023

stood at 71,000 cu.m, worth US$21.0 million, down 17% in volume and down 14%

in value compared to March 2023.

The total amount imported from this source into Vietnam in the first 4

months of 2023 stood at 248,580 cu.m valued at US$73.5million, down 18% in

volume and 30% in value compared to the same period in 2022.

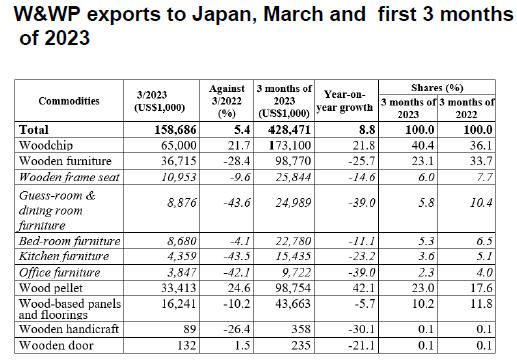

Vietnam’s W&WP exports to Japan

The main products exported to Japan in the first 3 months of 2023 were wood

chips (US$428.5 million, year-on-year up 8.8%), followed by wood pellets

(US$98.8 million, up 42% over the same period in 2022).

Vietnam is emerging as a top supplier of wood chips and pellets to Japan.

The pace of growth in wood pellet exports from Vietnam to Japan, is

declining. In contrast, Japan’s imports of wood pellets from the US have

been rising. Japan consumes around 30-35% of the woodchips produced in

Vietnam.

After chips and pellets is wooden furniture. In the first 3 months of 2023

wooden furniture shipped to Japan from Vietnam was valued at US$98.8

million, down 26% year-on-year.

Wooden chair frames were the top export item at US$25.8 million, down 15%,

followed by living and dining room furniture, US$25 million, down 39%,

bedroom furniture US$22.8 million, down 11%.

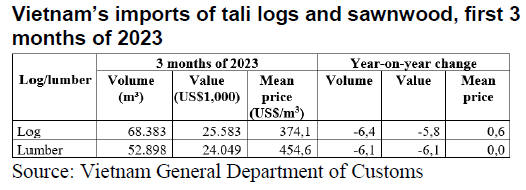

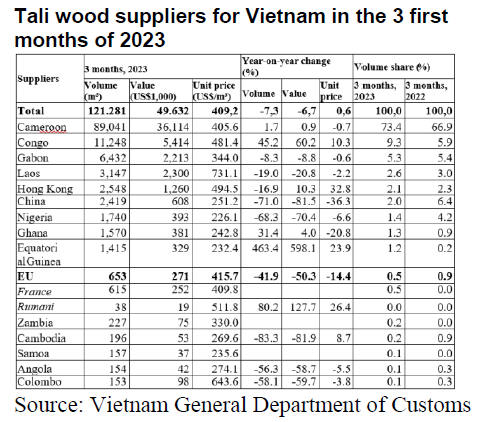

Vietnam’s imports of tali decreasing

With a supply of 89,000 cu.m (worth US$36.1 million) Cameroon accounted for

a 73% share of total imports of tali in the first 3 months of 2023.

According the General Department of Customs, Vietnam's imports of tali from

all sources in April 2023 totalled 32,400 cu.m worth US$13.6 million, down

12% in volume and 13% in value compared to March 2023. Compared to April

2022 imports decreased by 24% in volume and 23% in value.

In the first 4 months of 2023, tali wood imports reached 158,500 cu.m worth

US$65.3 million a year-on-year drop of 8% in volume and 7% in value.

The average price of tali imported into Vietnam in

the first 3 months of 2023 reached US$409/cu.m, a slight increase over the

same period in 2022. In particular, the price for tali imported from Congo

increased by 10% over the same period in 2022 to US$481/cu.m.

Vietnam’s imports of wood raw material from

Southeast Asia dropping sharply

In the first quarter of 2023 imports of wood raw material from Southeast

Asia to Vietnam amounted to 95,080 cu.m, worth US$18.55 million, down 14% in

volume and down 28% in value over the same period in 2022.

Supply by country

In the first quarter of 2023 Vietnam imported mainly particleboard,

fibreboard and sawnwood from Thailand. Imports of particleboard and

fibreboard decreased significantly over the same period in 2022 with

particleboard imports falling 21% in volume and 44% in value. Fiberboard

imports were down by 41% in volume and 50% in value. Sawnwood imports soared

by 200% in volume and 100% in value in the same period.

In the first quarter of 2023 imports of wood raw material from Laos to

Vietnam amounted to 49,800 cu.m worth US$24,475 million, down 12% in volume

and 24% in value over the same period in 2022.

Logs and sawnwood were the two main wood categories imported from Laos in

the first quarter of 2023. While sawnwood imports from Laos decreased by 15%

in volume and 25% in value compared to the same period in 2022, log imports

increased by 24% in volume and 13% in value.

The volume of wood raw material imported from Malaysia and Indonesia to

Vietnam in the first quarter of 2023 increased sharply compared to the same

period in 2022, up 89% and 67%, respectively.

The wood products imported from the Malaysia were sawnwood, logs and

particleboard while from Indonesia the increased imports relied on flooring,

particleboard and sawnwood.

Vietnamese timber exporters facing a sharp

decline in orders

Vietnamese wood and wooden furniture enterprises have been facing many

difficulties as export orders have dropped 50-60% since the beginning of

this year, pushing firms to cut off at least half of their production

capacities. Data from the General Department of Customs showed that the

export turnover of wood and wooden products reached US$3.9 billion in the

first four months, down 30.6% year-on-year. The export of wooden goods saw a

yearly decline of 38% to $2.6 billion.

At the same time, the import value of wood and wooden products also

decreased significantly to US$634 million, down 33.6% over the same period

last year.

During the four months, Vietnamese exports of these goods to major markets

all decreased sharply such as the US (US$2.02 billion, 38%); Japan US($556

million, 1.5%); South Korea (US$274 million, 22%) and China (US$481 million,

13%).

Analysts and businesses have said that the decrease in wood and wooden goods

exports was foreseeable. They attribute the decline to inflation surges in

some countries, which were also major importers of Vietnam's wood and wooden

goods, resulting in sluggish demand for these products. For example, the US

imported US$1.24 billion worth of timber and wooden products from Vietnam in

the first three months, a year-on-year drop of 42%.

In the context of inflation and the banking crisis, US banks have tightened

credit, making importers unable to finance import goods in large quantities.

The demand for US wooden furniture imports has plummeted, analysts said.

According to wood exporters, their export orders from the US market have

decreased between 50% and 55% depending on the type of wood products.

Meanwhile, orders from the EU - another key export market, also dropped 60%.

The Chairman of the Woodworking Association Nguyễn Liêm said “amid the

current difficult context the provincial wood enterprises had slashed their

production capacities by 60%.

The current global economic situation is very unpredictable," said Liêm "All

market signals are not bright and it is hard for wood enterprises to draw up

their business plans.”

Liêm also predicted that when the market situation improved and the

inventory decreased, foreign customers would continue to order but not

sooner than early 2024.

Around the beginning of 2024, the market would be less difficult, and

businesses would have export orders again. Still, only small ones, he said,

forecasting that the market would likely recover at the end of 2024.

However, the recovery growth would depend on the world's economic and

political situation.

Despite a sharp slump in orders, trade experts said the US remained a key

export outlet for Vietnam’s wood industry. Therefore, businesses needed to

maintain the US market by updating information and converting production

according to the market's consumption trends.

In addition, management agencies needed to support businesses to bring

Vietnamese wooden goods into large distribution systems such as Walmart,

Costco and Amazon.

This was an effective way for the firms to develop their brands, avoiding

relying too much on intermediaries, trade experts said.

In the current context, the Ministry of Industry and Trade and the Ministry

of Foreign Affairs should continue to help businesses find out information

about the market situation of products, consumer demand and tastes, Liêm

suggested.

They should also support the enterprises in updating the national mechanisms

and policies of importing countries on quality, design, legality and

sustainability of imported wood products and providing them with information

on requirements as well as changes in the trade policy of key markets such

as the US, the EU and Northeast Asia, he said. The chairman added that early

warnings from the ministries to help the firms minimize commercial disputes

should also be included.

The chairman of the Vietnam Timber and Forest Products Association Đỗ Xuân

Lập proposed to the Ministry of Foreign Affairs and the Vietnamese embassies

in foreign countries to better promote international furniture fairs in Việt

Nam.

It was recommended that embassies should also provide information and

support Vietnamese businesses to participate in international furniture

fairs, Lập said. He also petitioned the embassies to assist wood enterprises

in opening companies, representative offices and stores in potential export

markets.

See:

https://vietnamnews.vn/economy/1541027/timber-exporters-face-a-sharp-decline-in-orders.html

EU regulations to combat deforestation and possible impact on

Vietnam

The implementation of new EU regulations aimed at combating deforestation

could have a significant impact on Vietnam’s forestry and agricultural

exports to Europe. However, the implications can be viewed from both

positive and negative perspectives.

See:

https://www.vietnam-briefing.com/news/eu-deforestation-regulations-vietnam.html/

8. BRAZIL

Accounting for carbon in wood products

A study by the Brazilian Agricultural Research Corporation (Embrapa

Florestas) has started to measure carbon accumulation in sawnwood,

wood-based panels, paper as well as wood product residues. The first survey

was carried out in 2020 using 2016 data as a reference. For the final

estimate of the carbon stock of wood products fuelwood and charcoal are not

included as, according to the Intergovernmental Panel on Climate Change

(IPCC) methodology, these categories generate immediate carbon emissions.

According to the IPCC methodology estimates of carbon in wood products can

be made through 3 different approaches (stock-change, atmospheric flow and

production) and it is up to each country to decide which is the most

appropriate to prepare its emissions inventory. The approach used by Brazil

for estimating the contribution of timber forest products is that of

atmospheric flow which favors large timber producing and exporting

countries.

See:

https://www.poder360.com.br/meio-ambiente/brasil-passa-a-contabilizar-carbono-de-produtos-florestais/

In other news, Embrapa has made available a range of technologies for the

development, innovation and sustainability of strategic production chains

for the local and regional economy in the state of Acre, one of the main

tropical timber producing states in the Amazon Region.

The adoption of digital technologies has made forest management more

productive and sustainable. The Digital Logging Model (Modeflora) made

available 15 years ago, is used in 100% of the management plans in the state

of Acre and by forestry companies in other states (Amapá, Roraima, Rondônia,

Amazonas and Pará) in the Amazon region.

The technology provides highly precise information on the managed area,

facilitates the planning, execution and monitoring of field operations and

reduces production costs by a third.

Impact studies show that in 2021 alone the management of 40,000 hectares of

forests using Modeflora generated savings of approximately R$11 million.

Modeflora, which integrates the Global Positioning System (GPS), Geographic

Information System (GIS) and Remote Sensing (RS) tools, among other

technologies, has enhanced scientific innovations such as the Lidar (Light

Detection and Ranging) laser profiling system, which allows 3D mapping of

the forest and state-of-the-art drones. These studies involve the training

of artificial intelligence algorithms to carry out 100% automated forest

inventories and identify forest species of economic value.

See:

https://www.embrapa.br/busca-de-noticias/-/noticia/80662895/uso-de-tecnologias-agropecuarias-e-manejo-florestal-de-precisao-promovem-o-desenvolvimento-sustentavel-no-acre

Export update

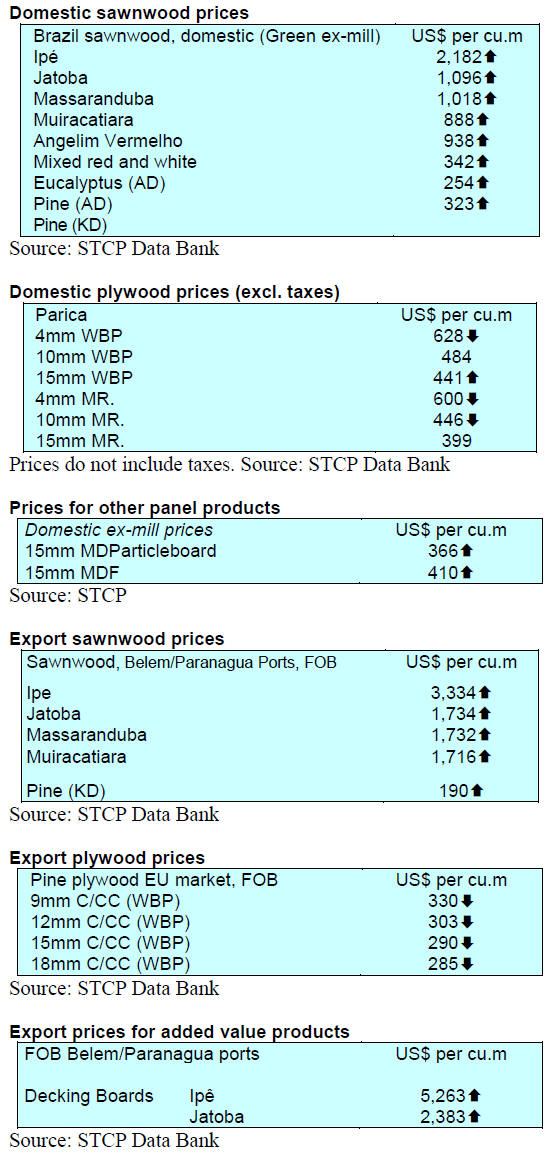

In April 2023 Brazilian exports of wood-based products (except pulp and

paper) declined 29% in value compared to April 2022, from US$470.2 million

to US$336.1 million.

Pine sawnwood exports declined 23% in value between April 2022 (US$77.3

million) and April 2023 (US$59.5 million). In volume, exports declined 6%

over the same period, from 281,200 cu.m to 264,000 cu.m.

Tropical sawnwood exports declined 29% in volume, from 40,900 cu.m in April

2022 to 29,000 cu.m in April 2023. In value, exports declined 17% to US$ 8.7

million from US$15.5 million over the same period.

Pine plywood exports faced a 41% decrease in value in April 2023 compared to

April 2022, from US$100.3 million to US$59.4 million. In volume, exports

declined 23% over the same period, from 234,200 cu.m to 179,900 cu.m.

As for tropical plywood, exports declined in volume by 64% and in value by

64%, from 8,400 cu.m and US$4.7 million in April 2022 to 3,000 cu.m and

US$1.7 million in April 2023.

As for wooden furniture, the exported value declined from US$52.8 million in

April 2022 to US$47.2 million in April 2023, an 11% fall in the total

exports of the product during the period.

Growth in the furniture sector in Southern Brazil

The furniture sector in the state of Rio Grande do Sul, one of the main

furniture clusters in Southern Brazil, went through a difficult period

between 2019 and first half of 2020, followed by atypical growth until the

end of 2021 but began to stabilise in 2022.

According to the State Department of Finance, the turnover of 2,409

furniture manufacturers in Rio Grande do Sul was above R$2.7 billion in the

first three months of 2023, a nominal increase of 7.4% compared to the same

period of the previous year. The Federal Government's Comex Stat portal

indicates that, from January to March 2023, furniture exports from Rio

Grande do Sul totalled almost US$52 million, a 21% retraction compared to

the same period in 2022.

The five main importers were the United States, Uruguay, Peru, Chile and the

United Kingdom.

According to the Association of Furniture Industries of the State of Rio

Grande do Sul, the inconsistent international sales were related to

short-term economic factors in the purchasing countries. The Association

believes this scenario could improve during this year, especially with the

international fairs, Fimma (International Fair of Suppliers of the Wood and

Furniture Production Chain) and Movelsul (Furniture Fair of Latin America)

to be held in August bringing together importers from the main target

markets.

See:

https://emobile.com.br/site/industria/setor-moveleiro-gaucho-no-1o-trimestre-de-2023/

‘WoodFlow’ technology streamlines wood export

‘WoodFlow’, a Brazilian wood export startup has launched two new features on

its sales platform; the first is an application that allows quality

inspection of exported products and the second is a digital panel with

statistical data on volumes, prices, shipments and other information.

The company anticipates WoodFlow's new features will bring more quality and

confidence in the process of wood exports from Brazil. The first new

function is an application that will make it possible to inspect the quality

of the exported product.

For example, if a company in Brazil is exporting pine sawnwood to the United

States it will make it possible to take photos of the lots that will be

shipped, certifying the quality, such as checking the measurements, density,

humidity and other data, depending on each product.

The second new feature is a virtual panel with statistical data of the

shipments made through the platform, for example, data such as shipment

volume, average price paid, shipping locations and other information about

the negotiations.

By recognising that technology can improve and speed up the export process,

WoodFlow has introduced a new way of doing business that ensures

traceability of documents and processes as it concentrates all the data in

one location.

See:

https://www.portaldoagronegocio.com.br/florestal/mercado-florestal/noticias/tecnologia-woodflow-agiliza-negocios-de-exportacao-de-madeira

9. PERU

Export earnings declined in early

2023

Acccording to the Management of Services and Extractive Industries Division

of the Exporters Association (ADEX) exports of primary wood products in the

first two months of this year totalled US$16.8 million, down on the US$22.4

million exported in the same period in 2022.

Exports to France were significant in early 2023 and accounted for 21% of

all wood product exports. China was the second largest buyer, accounting for

18% of exports but exports to China were down 37% compared to the same

period in 2022. Other markets of note were Mexico and the Dominican Republic

with a participation of 14% and 12% respectively.

Exports of semi-manufactured wood products earned US$7.8 million during the

first two months of the year, a decrease of 42% compared to the same period

in 2022, the main market was France. The second most important market for

semi-manufactured products was Belgium with a 16% share of exports along

with China in third place with a 15% share.

During the first two months of the year the sawnwood subsector exported

US$6.3 million, growing 1.3% over the previous year. The three main

destinations were the Dominican Republic, China and Mexico.

In the furniture and parts subsector exports amounted to US$0.49 million, up

around 6% year on year. The main destination for these products was the US

with a 77% share, up 9% year on year followed by Trinidad and Tobago (10%

share) and Ecuador (5% share).

Minam opposes changes to Forestry Law

The Ministry of the Environment (Minam) expressed its opposition to the

request raised in Congress to consider signing into law legislation that

some modifies articles of the Forestry and Wildlife Law (Law 29763). From

the perspective of Minam this could accelerate deforestation in the Peruvian

Amazon.

Minam urged the Congress to reject the proposed reconsideration so that the

regulatory proposal is maintained as it is, adding that Minam considers

"developing activities such as agriculture on forest land is neither

economically competitive nor sustainable over time”.

See:

https://agraria.pe/noticias/minam-se-opone-a-insistencia-del-congreso-en-aprobar-cambios-31917

Casacor Peru 2023, SERFOR presents Amazon hardwoods

The largest architecture, interior design and landscaping exhibition in the

Americas, Casacor Peru 2023, which runs from May 23 to July 2, showcase a

National Forestry and Wildlife Service (SERFOR) ‘sustainable wooden terrace

project built on an area of 120 sq.m.

The project demonstrates the wide diversity of Amazonian timber species from

legal, sustainable and certified sources. Timbers such as ishpingo,

mashonaste, ana caspi and shihuahuaco are included in the engineered

products.

The wooden terrace is divided into two zones. On the first is an exhibit of

a selection of 40 species of wood provided by SERFOR. On the second is a

lounge area where tiered seating allows visitors to relax, admire the

project and become familiar with the forestry sector.

The exhibition seeks to promote the use of wood for interior architecture

and construction. The importance of making responsible purchases of wood

products from legal and well-managed sources is emphasised.