US Dollar Exchange Rates of

25th

May

2023

China Yuan 6.93

Report from China

Investment in real estate development

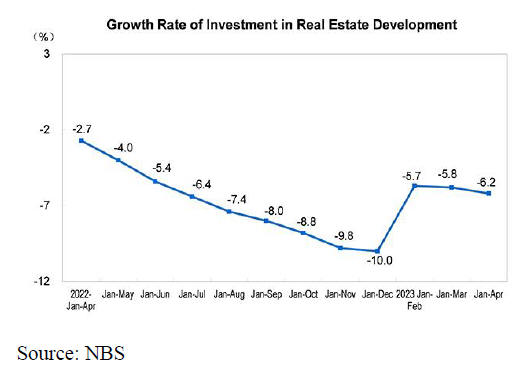

The National Bureau of Statistics (NBS) has reported nvestment in

real estate saying between January and April this year there was a year on

year decline of just over 6% in investment real estate development.

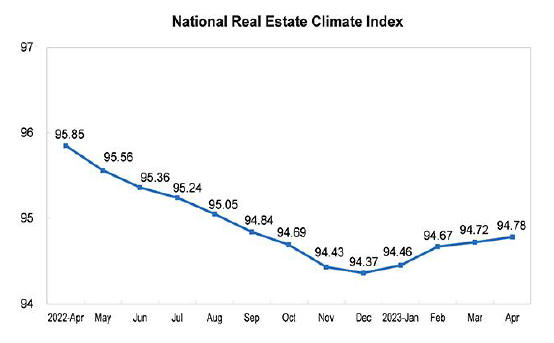

In related news the NBS has reported the National

real estate climate index in April was 94.78.

See:

http://www.stats.gov.cn/english/PressRelease/202305/t20230519_1939833.html

Retail sales

In April retail sales of consumer goods reached 3,491 billion yuan,

a year-on-year increase of 18.4% of which retail sales of consumer goods,

other than motor vehicles, expanded 16.5%.

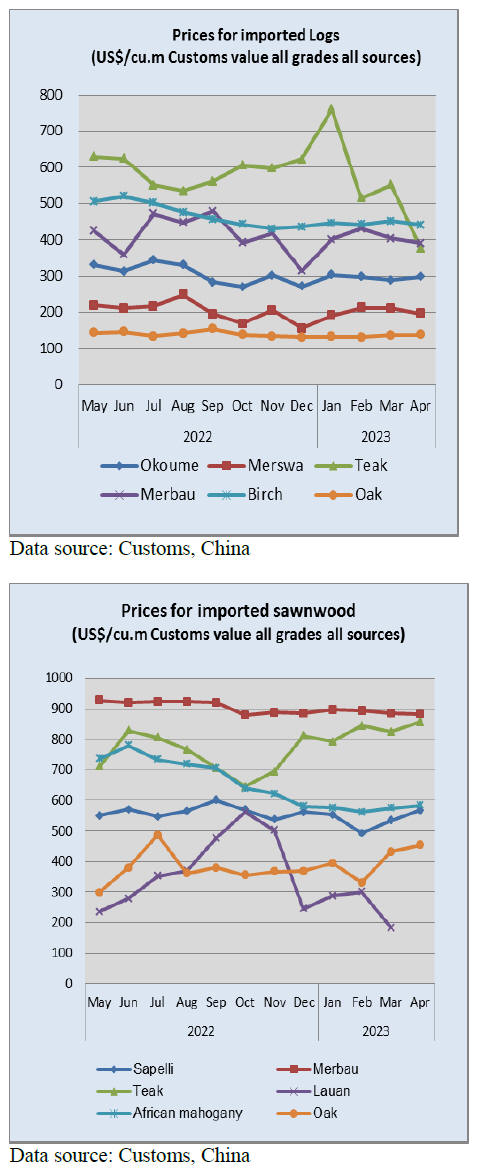

Decline in tropical sawnwood imports

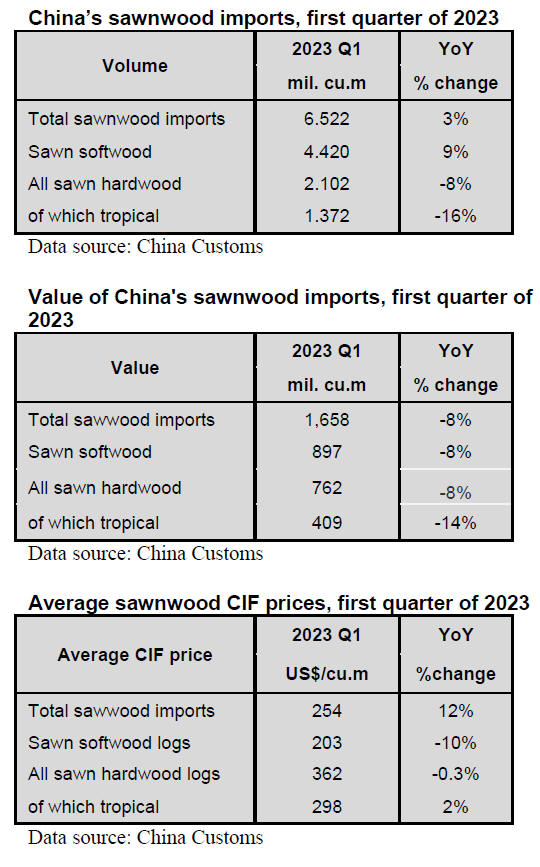

According to China Customs, sawnwood imports in the first quarter

of 2023 totalled 6.522 million cubic metres valued at US$1.658 billion, up

3% in volume but down 8% in value compared to the first quarter of 2022. The

average price for imported sawnwood in the first quarter was US$254 (CIF)

per cubic metre, up 12% from the same period of 2022.

Of total sawnwood imports, sawn softwood imports

rose 9% to 4.42 million cubic metres, accounting for 68% of the national

total. However, the average price for imported sawn softwood fell 10% to

US$203 (CIF) per cubic metre over the same period of 2022.

Sawn hardwood imports dropped by 8% to 2.102 million cubic metres,

accounting for 32% of the national total. The average price for imported

sawn hardwood fell by 10% to US$362 (CIF) per cubic metre over the same

period of 2022.

Of total sawn hardwood imports, tropical sawnwood imports were 1.372 million

cubic metres valued at US$409 million CIF, down 16% in volume and 14% in

value from the same period of 2022 and accounted for 21% of the national

total import volume. The average price for imported tropical sawnwood was

US$298 CIF per cubic metre, up 2% from the same period of 2022.

Major suppliers of sawnwood imports

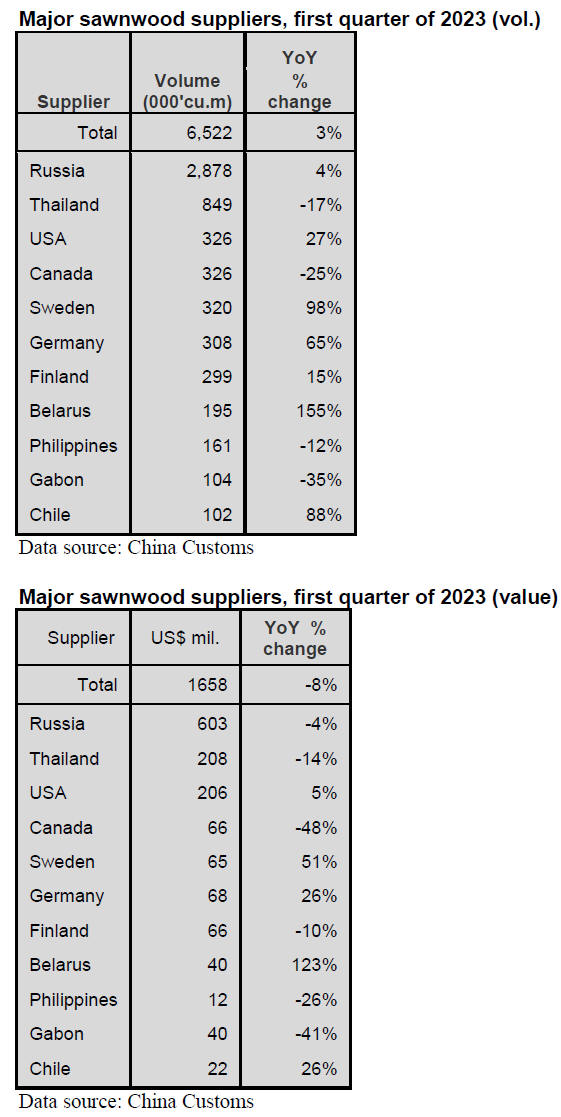

Russia was the largest supplier of sawnwood imports to China in the

first quarter of 2023. The proportion of China’s sawnwood imports from

Russia accounted for 44% of the total sawnwood imports volume. China’s

sawnwood imports from Russia rose 4% to 2.878 million cubic metres.

Shipments from the second largest supplier, Thailand, fell 17% to 849,000

cubic metres.

China's imports of US sawnwood have grown. China’s sawnwood imports from the

US rose 27% to 326,000 cubic metres in the first quarter of 2023. In

contrast, China’s sawnwood imports from Canada dropped 25% to 326,000 cubic

metres in the first quarter of 2023.

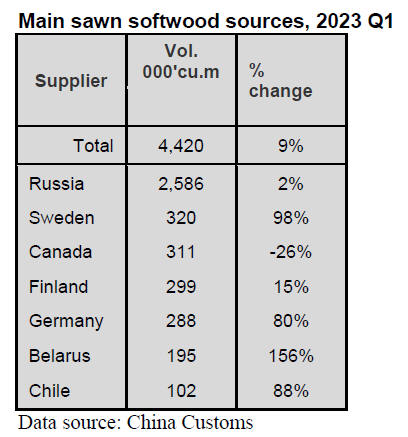

Main sawnwood softwood sources, first

quarter of 2023

Russia was the largest supplier of sawn softwood imports. Nearly

60% of China’s sawn softwood imports were from Russia in the first quarter

of 2023. China’s sawn softwood imports from Russia rose 2% to 2.586 million

cubic metres, from Sweden, the second largest supplier of China’s sawn

softwood, imports surged 98% to 320,000 cubic merets in the first quarter of

2023.

China’s sawn softwood imports from top suppliers increased except for

shipments from Canada which fell 26% in the first quarter of 2023.

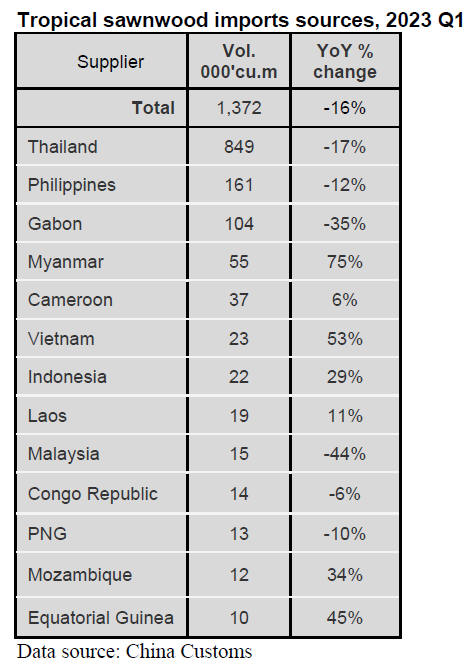

Decline in tropical sawnwood imports

China’s tropical sawnwood imports fell 16% to 1.372 million cubic

metres in the first quarter of 2023. The top three suppliers were Thailand

(62%), Philippines (12%) and Gabon (8%). 82% of China’s tropical sawnwood

imports were from these three countries in the first quarter of 2023.

China’s tropical sawnwood imports from Thailand, Philippines and Gabon

dropped by 17%, 12% and 35% respectively to 849,000 cubic metres, 161,000

cubic metres and 104,000 cubic metres respectively in the first quarter of

2023.

In contrast, China’s tropical sawnwood imports from Myanmar, the fourth

largest supplier, rose 75% in the first quarter of 2023.

Surge in CIF price for sawnwood imports from

Myanmar

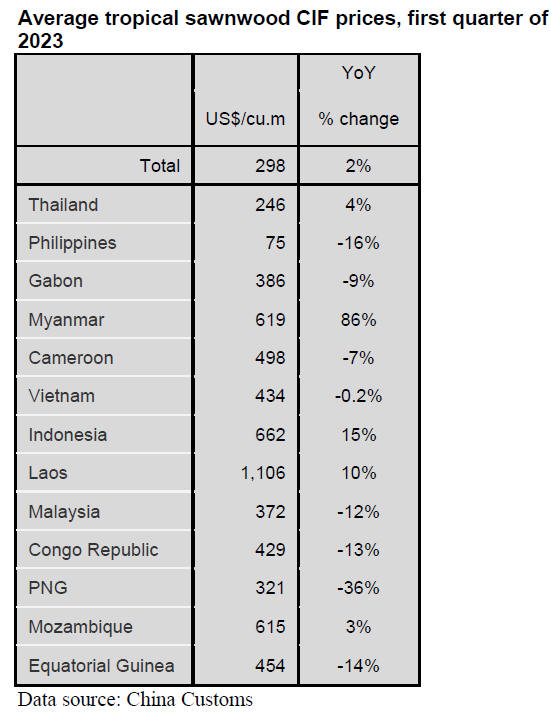

The average price of China’s tropical sawnwood imports rose 2% to

US$298 per cubic metres in the first quarter of 2023. CIF prices of top

suppliers for China’s tropical sawnwood imports vary considerably. The CIF

price of China's tropical sawnwood imports from Myanmar surged 86% and the

volume of sawnwood imports from Myanmar grew 75% in the first quarter of

2023.

April business conditions

In April weak market demand and high interest rate aimed at cooling

the rapid recovery of the manufacturing sector in the first quarter dragged

down China's manufacturing PMI to below the critical value signaling that

the manufacturing industry is struggling.

In April China's domestic demand for wood products remained strong and the

number of new orders from within China had increased for three consecutive

months and this lifted the GTI-China Index. However, international demand in

April was low and export orders declined.

In April the GTI-China index for new orders registered 55.8%, an increase

from the previous month and has been above the critical value (50%) for 3

consecutive months indicating that the business prosperity of the timber

enterprises represented by the GTI-China index has expanded.

Manufacturers commented on delays in procurement of raw material and its

generally poor quality. They added it was difficult to purchase high-grade

raw material and the quantity was insufficient.

In April the existing orders index registered 48.8%, an improvement from the

previous month but still below the critical value of 50% where it has been

for 2 consecutive months.

The new orders index registered 59%, a drop from the previous month but has

been above the critical value for 3 consecutive months signaling

improvement.

The export orders index registered 42.9%, a further drop from the previous

month and below the critical value indicating that the number of export

orders held by enterprises represented by the GTI-China was less than that

of the previous month.

|