US Dollar Exchange Rates of

25th

Apr

2024

China Yuan 7.24

Report from China

Home furnishing enterprises relocating

overseas

China's home furnishing manufacturing industry has been

steadily relocating overseas, in the past it was mainly

based on contract manufacturing for export back to China.

More and more of China’s home furnishing enterprises

have begun to expand and diversify their overseas

operations in recent years. Many well-known domestic

home furnishing companies announced that they would

open stores overseas with their own brands targeting the

Indian and Southeast Asian markets with mid-to-high-end

products.

The driving force behind the trend in relocating is the

weak domestic demand and a real estate market that will

take years to recover.

On the down side some overseas countries have low

urbanisation rates, an undeveloped real estate sector with

diminished potential and a weak domestic industrial base

whereas Chinese brands have begun to have international

competitiveness in design, production and marketing after

years of development.

The biggest issue for the long term for Chinese home

furnishing industries is that growth in domestic demand is

forecast to continue to decline due to the aging population,

falling birth rate and weakness in the housing sector.

According to data recently released by the National

Bureau of Statistics, retail sales of consumer goods in

2023 reached RMB47.15 trillion, an increase of 7% over

2022. After the epidemic containment measures were

lifted many sectors saw a rise in consumption for example

catering which increased by 21% year on year, jewelry

sales which increased by 13% and clothing, which

increased by 139%. However, furniture consumption only

increased by 3% and the consumption of construction and

decoration materials recorded a decline of 8%.

Many institutions predict that the annual transaction

volume for new homes will be only be maintained at about

1 billion square metres, down by about 40% compared to

the high point in 2018. This will affect the manufacturing

sector such as home furnishing. Businesses have assessed

there is no chance of expansion in the domestic market.

National policies have promoted the pace of home

furnishing enterprises relocation overseas. The

government encourages enterprises to "go global" and

provides a series of supportive policies and measures such

as tax incentives and financial support creating favorable

conditions for enterprises to expand overseas.

In late 2000 many Chinese home furnishing enterprises

chose to set up businesses in Europe and America but

more recently companies have vigorously targeted the

Indian and Southeast Asian markets. This is because these

countries have a large population and growing consumer

demand. As these economies expand and people's living

standards rise the demand for household products

increases.

These new target markets have cultures and consumption

habits closer to those in China which is conducive to the

rapid adaptation and integration of domestic household

enterprises into the local market.

In addition, the policy environment in India and Southeast

Asian countries is also relatively open providing a good

investment and development environment for domestic

household enterprises. Some countries, in order to attract

foreign investment and promote economic development,

provide tax incentives, land leasing and other preferential

policies reducing the establishment cost of incoming

enterprises.

Vietnam largest supplier for China’s woodchips

imports

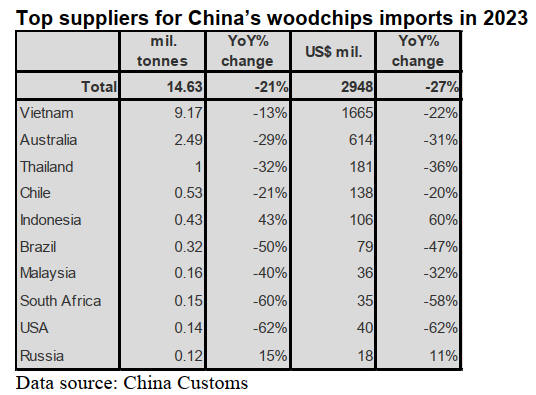

According to China Customs, woodchip imports in 2023

totalled 14.63 million tonnes valued at US$2.948 billion,

down 21% in volume and 27% in value. The decrease in

woodchip imports was because imports from all the top

suppliers fell, except for Indonesia.

Vietnam was the largest supplier of woodchips imports in

2023, shipping 9.17 million tonnes, down 13% year on

year and accounted for 63% of total woodchips imports in

2023.

In contrast, China’s woodchips imports from Indonesia in

2023 rose 43% to 430,000 tonnes valued at US$106

million, surging 60% year on year.

Surge rise in China’s woodchips exports

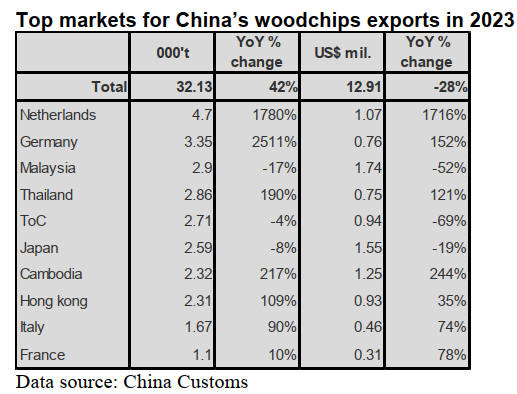

China's exports of woodchips are very small but in 2023

there was a sharp rise in exports. China Customs ha

reported woodchip exports in 2023 totalled 32,130 tonnes

valued at US$12.91 million, surging 42% in volume but

down 28% in value over 2022.

The Netherland and Germany were the largest and the

second largest markets for wood chipsfrom China in 2023.

China’s woodchips exports to the Netherland and

Germany surged year on year and accounted for 15% and

10% of China’s woodchips exports in 2023. In addition,

China’s woodchips exports to Thailand, Cambodia, Hong

Kong, Italy and France rose. In contrast, China’s

woodchips exports to Malaysia, Taiwan P.o.C and Japan

in 2023 fell 17%, 4% and 8% respectively over 2022.

Development trends in wood-based panel production

Plywood production is still the largest among wood-based

panels in China. At the beginning of 2024 there were

1,477 plywood plants under construction nationwide with

a total annual production capacity of about 29 million

cubic metres.

At this level it has been suggested the capacity of China's

plywood industry is greater than demand. While the

supply and demand of plywood for furniture production,

home furnishing and interior decoration is relatively

balanced there is over-capacity in plywood for concrete

formwork. In addition, demand in the packaging sector, is

affected by competition from oriented strand board (OSB).

It is expected that plywood production capacity in China

will shrink to about 200 million cubic metres annually by

the end of 2024.

Overheated investment in particleboard production

Particleboard production capacity of in 2023 exceeded that

of the fibreboard industry and became the second largest

among wood-based boards in China.

At the beginning of 2024 fifty eight particleboard

production lines were under construction nationwide with

a total capacity of 20 million cubic metres annually. Seven

regions in East, South, Central, North, Southwest,

Northwest and Northeast have particleboard production

lines under construction including 45 continuous flat-press

production lines with a capacity of 18 million cubic metres

annually and accounting for over 90% of the mills under

construction.

Investment in China's particleboard industry is seen as

overheated and there is a risk of imbalance between supply

and demand. Particleboard production lines under

construction will be put into operation from 2024 to 2025

and it is expected that the total capacity of particleboard in

China will exceed 65 million cubic metres annually by the

end of 2024.

Fibreboard supply exceeds demand

Fibreboard production is third largest among wood-based

panels in China. There were two production lines under

construction at the beginning of 2024 in China with a total

production capacity of 390,000 cubic metres annually.

These mills are in Shandong Province, eastern China and

all are continuous flat-press production lines. China’s

fibreboard production capacity exceeds current

consumption. The enduse where there is growth in demand

is the home furnishing and inner decoration market where

medium thick fibreboard is in demand. It is expected that

the production capacity of fibreboard plantss in China will

decline by the end of 2024 dropping to to less than 45

million cubic metres annually.

GGSC China indices for March

In the first two months of 2024 China's exports of

furniture and furniture parts surged by 36% year-on-year

to US$11.916 billion, making a good start for this year.

However, the country's cumulative imports of logs and

sawn timber in the same period were down 5% year-on-

year to 9.546 million cubic metres suggesting that the

recovery had taken hold.

In March China accelerated the elimination of restrictive

measures implemented for many years in the property

market as many cities adjusted their real estate policies

and it is hoped this move will drive a new round of home

building and furniture consumption. For example,

Shenzhen terminated the 18-year-old "70/90 Policy" on

residential housing.

Under this policy 70% of housing units in any new

residential building project shall be below 90 square

metres. In Beijing the government abolished the policy

that prohibited certain divorced persons from purchasing a

residential property in the city within three years after their

divorce.

Shipping disrupted

As the Red Sea transport crisis continues China's timber

shipping routes to Europe have been disrupted. In

addition, a number of shipping companies, including

Maersk, CMA CGM, Hapag-Lloyd and Wan Hai recently

announced that they would increase freight rates for Asian

export routes.

For example, Wan Hai, which started primarily as a raw

log shipping company, announced that, due to rising

operating costs, it would increase freight rates for cargo

from China to Asia. It is reported that beginning March

this year, there has been a US$50 increase for small

containers and a US$100 increase for large containers.

Impressive business expansion

In March, the GTI-China index registered 66.8%, an

increase of 35 percentage points from the previous month

and rose above the critical value (50%) after 3 months

indicating that the business prosperity of the enterprises

represented by the GTI-China index expanded from last

month.

The dramatic increase is due, in large part, to the fact it

grew from low base value in the previous month when

there was a long holiday break.

After enterprises resumed production and operation in

March both the new orders index and the production index

increased significantly and the overall performance of the

timber industry in China picked up. As for the 11 sub-

indexes, only the inventory index of main raw materials

was below the critical value of 50%, while the remaining

10 sub-indexes were all above the critical value.

See:

https://www.itto-ggsc.org/static/upload/file/20240418/1713424567120852.pdf

|