|

Report from

North America

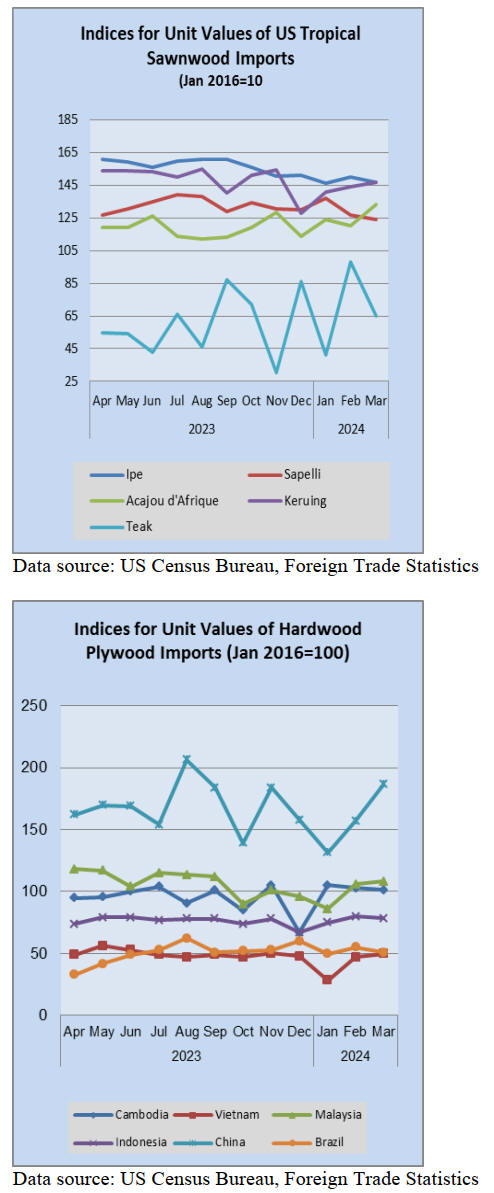

Sawn tropical hardwood imports gain 13%

US imports of sawn tropical hardwood rose 13% in April.

Notable gains were made in imports from Brazil (up 35%),

Cameroon (up 125%), and Ghana (up 120%). Imports

from Malaysia and Cote d’Ivoire both fell substantially for

the month.

Imports of Ipe, Mahogany, and Virola all made

considerable gains in April and are well ahead of last

year’s volume for the year so far. Imports of Keruing were

down 67% in April and are off by 39% for the year to

date. At 15,897 cubic metres, imports for the month were

3% less than the previous April, but still enough volume to

stay ahead for the year so far. Total imports through April

are up 2% over last year.

Canada’s imports of sawn tropical hardwood fell 7% in

April but were still 40% higher than in April 2023.

Imports from Congo (formerly Brazzaville) more than

tripled in April and are up 182% for the year so far.

Imports to Canada from the US were down 22% for the

month and are off by 55% for the year through April.

Total imports to Canada are ahead of last year to date by

19%.

US Department of Agriculture, Foreign Trade Statistics,

US hardwood plywood imports edged up

The volume of US imports of hardwood plywood rose 4%

in April as imports from Indonesia remained strong. The

240,719 cubic metres imported in April was 50% more

than last April’s volume. However, the dollar value of

imports fell 6% in April to US$138 million from US$146

million in March.

Imports from Indonesia are up 56% in volume year to date

after rising 1% in April while imports from Malaysia rose

11% for the month and are ahead 147% for the year so far.

Imports from Vietnam are also well ahead of last year, up

163% despite a 17% slide in April. Total imports of

hardwood plywood are up 63% versus last year through

April.

Cameroon increases its share of US tropical hardwood

veneer market

US imports of tropical hardwood veneer continued their

comeback in April, rising 13% from the previous month.

Despite the gain, the April total was 17% less than that of

April 2023. Imports from Italy continued their slide,

falling 25% in April and down 82% compared to the first

four months of the year. Conversely, imports from

Cameroon keep growing.

For the year so far, imports from Cameroon have grown

88% over last year while imports from all other major

trading partners have shrunk. The trend accelerated in

April as imports from Cameroon increased 81% over the

previous month. In April Cameroon supplied the US with

more than four times the tropical hardwood veneer than

any other country. Total imports of tropical hardwood

veneer are down 18% versus last year through April.

Flooring panel imports trending up - hardwood flooring

trending down

US imports of hardwood flooring more than gave back

their March gain, falling 15% in April as imports from

Brazil fell by nearly 50% and imports from Vietnam

reverted to normal levels after a one-month bonanza in

March. A gain in imports from top trader Indonesia made

up for some of the deficit, rising 28% over the previous

month, while imports from Malaysia recovered their

weakness of the last few months.

Despite the improvement, imports from Malaysia are

down 70% versus last year through April while imports

from Indonesia are off by 46% over the same period. Total

imports of hardwood flooring are down 21% so far this

year versus 2023.

Imports of assembled flooring panels rose 7% in April.

The uptick was helped by a 41% increase in imports from

Indonesia as well as gains in imports from Brazil and other

countries not seen as major suppliers. Imports from most

of the major supplying nations were down in April except

for Indonesia, which is the exact opposite of the trend for

the year so far.

Despite falling more than 10% in April, imports from

Thailand are up 210% for the year so far, imports from

Vietnam are up 80%, and imports from Canada are up

44%. And despite the boost in April, imports from

Indonesia are still 43% behind last year through April.

Total imports of assembled flooring panels are up 32%

versus last year for the first four months of the year.

Moulding imports drop

US imports of hardwood moulding ended their climb in

April, falling 9% from the previous month. Despite the

drop, imports were 18% higher compared with April 2023.

Imports fell among all major trading partners with imports

from Malaysia falling 20%, imports from China falling

15%, and imports from Brazil falling 22%.

Imports from each of these sources were down sharply for

the year so far, while imports from Canada (which were

flat in April) are up 7% year to date. Total imports of

hardwood moulding are ahead of last year by 17% through

April.

US wooden furniture imports slip again

US imports of wooden furniture fell for a second

consecutive month in April, dropping 6% from the

previous month. At US$1.57 billion, imports were 2% less

than last April—the first time this year monthly imports

were below that of the previous year.

A 12% decline in imports from Vietnam accounts for most

of the shortfall, as imports from nearly every other country

moved less than 5% either way. Imports from Mexico fell

only 1% in in April but are now down more than 10% for

the year so far. Total imports are up 7% versus last year

through April.

As for the overall furniture market, Smith Leonard reports

that new orders were up 2% in March 2024 compared to

March 2023, continuing the streak of nine out of the last

10 months with overall order growth over the prior year.

New orders for March were flat compared to February.

Year to date through March 2024, new orders are up 5%

compared to 2023.

However, shipments in March 2024 were down 17% from

March 2023, and also down 4% from February 2024. Year

to date through March 2024, shipments are down 12%

compared to 2023.

Inventories and employee levels are again materially in

line with recent months, but down from 2023, indicating

that furniture companies have substantially adjusted levels

to match current operations.

See:

https://www.smith-leonard.com/2024/06/03/may-2024-furniture-insights/

Cabinet Sales fall behind last year for Q1

First quarter sales of cabinets in the US were down more

than 7% in 2024 versus the previous year, reported the

Kitchen Cabinet Makers Association (KCMA). Sales

from KCMA survey participants came in at just under

US$685 million compared with US$738 in Q1 of 2023.

Custom sales were down 19.2% from the previous year

and semi-custom sales were down 3.7%. Stock sales rose

1.6% in Q1 2024 versus Q1 2023.

See:

https://kcma.org/insights/march-trend-business-report-0

Interest rate stagnation impacts wood products

markets

Fastmarkets, a cross-commodity price reporting

agency in the agriculture, forest products, metals and

mining and new generation energy markets has a

report on how interest rates are impacting US home

buyers and the timber sector. Fastmarkets says “The

ongoing Federal Reserve rate stagnation is having a ripple

effect across the wood products market and the broader

economy, affecting everything from home buying to the

timber industry. Persistently elevated rates have made it

nearly impossible for lower-income mortgage applicants

to qualify for financing”.

See:https://www.fastmarkets.com/insights/federal-reserve-rate-stagnation-impacts-wood-products-markets/

|