Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jul

2024

Japan Yen 161.70

Reports From Japan

Tapping vitality of the ASEAN market

The government has announced that specialised staff at

diplomatic missions will be charged with of supporting

Japanese companies engaged in business in Asia.

Dedicated offices will be established in Singapore,

Thailand, Indonesia, Vietnam and India.

The Japanese Foreign Minister said at a news conference

that it is essential for Japan's economy to take in the

vitality of the ASEAN market by backing up Japanese

businesses playing a role of expediting regional trade

growth in the designated countries.

See: https://mainichi.jp/english/articles/20240723/p2g/00m/0na/065000c

Japan and Pacific island agree host of new initiatives

In mid-July the Tenth Pacific Islands Leaders Meeting

(PALM10) was held under the co-chairmanship of the

Prime Minister of Japan and Hon. Mr. Mark Brown, Prime

Minister of the Cook Islands with the participation of

leaders and representatives from 19 countries and regions

including Japan, 14 Pacific Island countries, New

Caledonia, French Polynesia, Australia and New Zealand

along with the Secretary General of the Pacific Islands

Forum (PIF).

Japan and Pacific island countries agreed on a host of new

initiatives designed to boost economic and security

cooperation. The participants agreed on an action plan that

will see Japan boost engagement in seven fields, including

technology and connectivity, climate change, people-

centered development and security.

See:

https://www.mofa.go.jp/a_o/ocn/pageite_000001_00481.html

and

https://www.mofa.go.jp/mofaj/files/100214244.pdf

SMEs hit hard by challenging business conditions

The number of bankruptcies in Japan, especially amongst

the SMEs, has risen so far this year as companies are hit

by soaring costs, labour shortages, the end of pandemic-

related financial support and fewopportunity to raise

prices. In the first half of 2024 the number of companies

filing for bankruptcy rose 22% year-on-year to 4,887, the

highest since 2014. At this rate Japan could see 10,000

bankruptcies by year end.

See:https://www.japantimes.co.jp/business/2024/07/18/economy

/japan-bankruptcies-

rising/?utm_source=pianodnu&utm_medium=email&utm_camp

aign=72&tpcc=dnu&pnespid=_ujngodu56nf8lwgv0c8oviy9a8pp

crogqaqt08subgvuj4jictxindr7zrncae3xd24pq

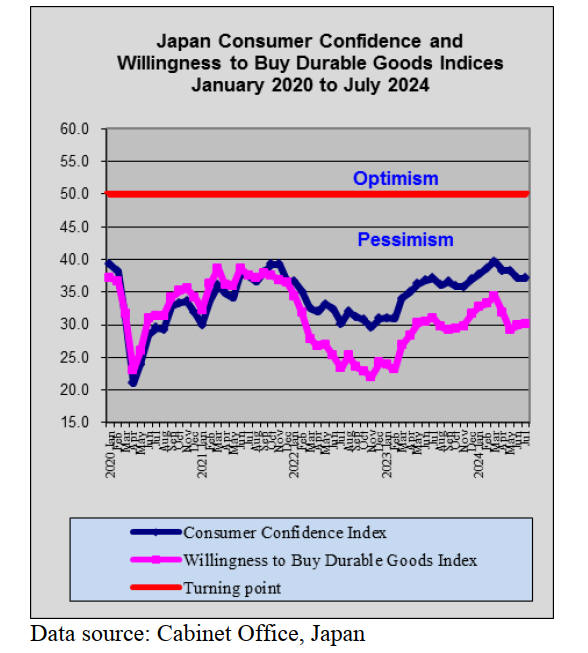

Real incomes to rise when yen strengthens

Inflation rose for the second straight month in June pushed

higher by rising electricity costs staying above the 2%

target adopted by the Bank of Japan. The consumer price

index, which excludes fresh food, rose 2.6% from a year

earlier following a rise of 2.5% in May.

The increase in inflation is partly due to the ending of

government subsidies for electricity and gas. It has been

reported that June utility bills rose 13%, while

nonperishable food prices climbed almost 3%.

The Japan Research Institute has suggested incomes in

Japan are likely to rise once again in inflation-adjusted

terms if the yen continues to strengthen bringing to an end

the continual and demoralising decline in real pay.

The Institute anticipates real wage growth turning positive

in the July-September quarter assuming yen 155 to the

dollar.

The real rise in wages is expected to continue in the

October-December quarter if the yen hits 151 and into the

January-March quarter next year if the yen goes to 148.

See: https://asia.nikkei.com/Economy/Inflation/Japan-s-inflation-

rate-rose-for-second-consecutive-month-in-June

and

https://asia.nikkei.com/Economy/Japan-forecasts-income-

growth-to-outstrip-inflation-in-fiscal-2024

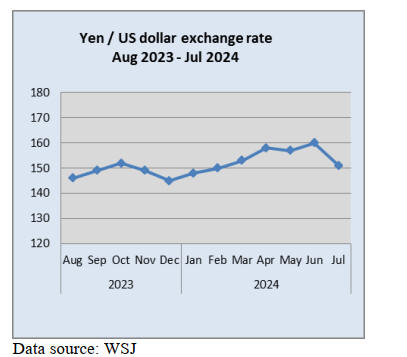

Yen strengthens

The Bank of Japan (BoJ) has raised its policy interest rate

to around 0.25% and decided to slow the pace of its

government bond buying to 3 trillion yen (US$20 billion)

in a further shift toward policy normalisation. The July

was the first major change in policy since the March. The

yen jumped to the 150 level against the U.S. dollar after

the BOJ decision following hawkish remarks by the BoJ

governor who said” an additional interest rate hike may be

possible”.

See: https://mainichi.jp/english/articles/20240731/p2g/00m/0bu/032000c

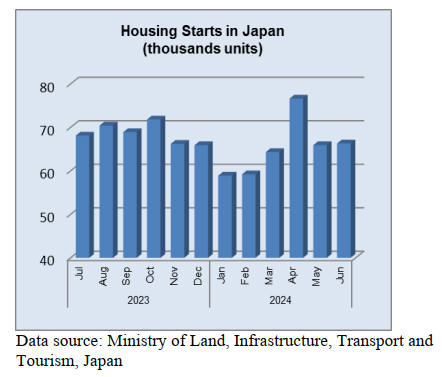

Need for dedicated housing for single seniors

A recent analysis of the housing sector has said there is an

urgent need to secure housing that will allow elderly

people in Japan to live without worry even if they live

alone.

It is estimated that around 20% of households in Japan

will consist of single senior citizens by 2050. It has been

reported that the rate of home ownership is decreasing

among those in their 50s and younger which will result in

higher numbers of elderly people in need of rental housing

which could result in a problem as it is difficultfor such

people to find a rental home as landlords are worried about

rent payments and the consequences of unattended deaths.

To address this, the government adopted legislation for a

system provides financial aid to landlords for renovations

of vacant homes and encourages them to rent to seniors

but the support for landlords is not being fully utilised.

See:

https://mainichi.jp/english/articles/20240722/p2a/00m/0op/010000c

Zero-energy homes not truly self-sufficient

A Ministry of Economy, Trade and Industry report

suggests around a third of Japanese homes labelled as

‘zero-energy’ are not truly self-sufficient in power. The

government offers subsidies for ‘zero-energy’ homes but

the gradual relaxation of criteria for subsidies has led to an

increase in homes that do not effectively reduce

greenhouse gas emissions.

The media report that the number of ‘zero-energy’ homes

of questionable efficiency is rising.

To be classified as ‘zero-energy’ homes there must be as

much renewable power generated as consumed and have

good insulation . Households currently account for 15% of

the country's greenhouse gas emissions.

See: https://asia.nikkei.com/Spotlight/Datawatch/Over-30-of-

Japan-s-zero-energy-homes-fall-short-of-requirements

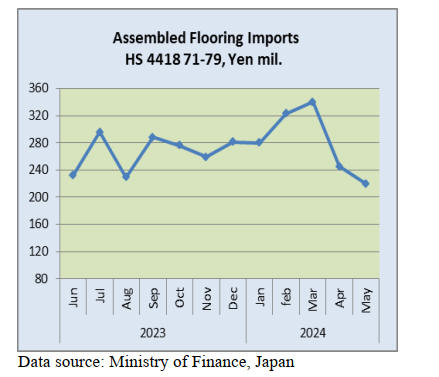

Import update

Assembled wooden flooring imports

May marked the second consecutive decline in the value

of assembled wooden flooring (HS441871-79) imports.

There was a 28% month on month decline in April

followed by a further 10% drop in May.

However, year on year May 2024 imports were at around

the same level as in May2023. Given the pace at which the

yen has depreciated over the past 12 months the overall

area (sq.m) of imports must have fallen.

In May the main category of assembled flooring imports

was HS441875, accounting for 68% of the total value of

assembled flooring imports, this was down from the 75%

recorded for April. The second largest category in terms of

value was HS441879 followed by HS 441874.

Shippers in China accounted for almost 70% of Japan’s

imports of assembled wooden flooring in May with

shippers in Vietnam accounting for another 15%.

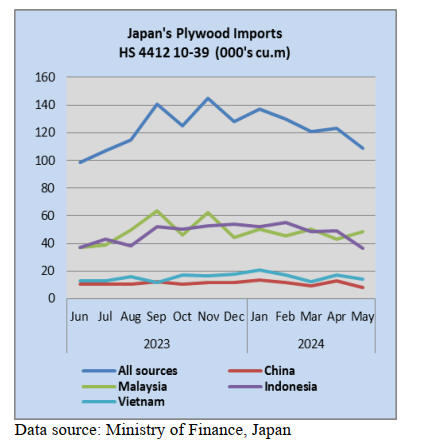

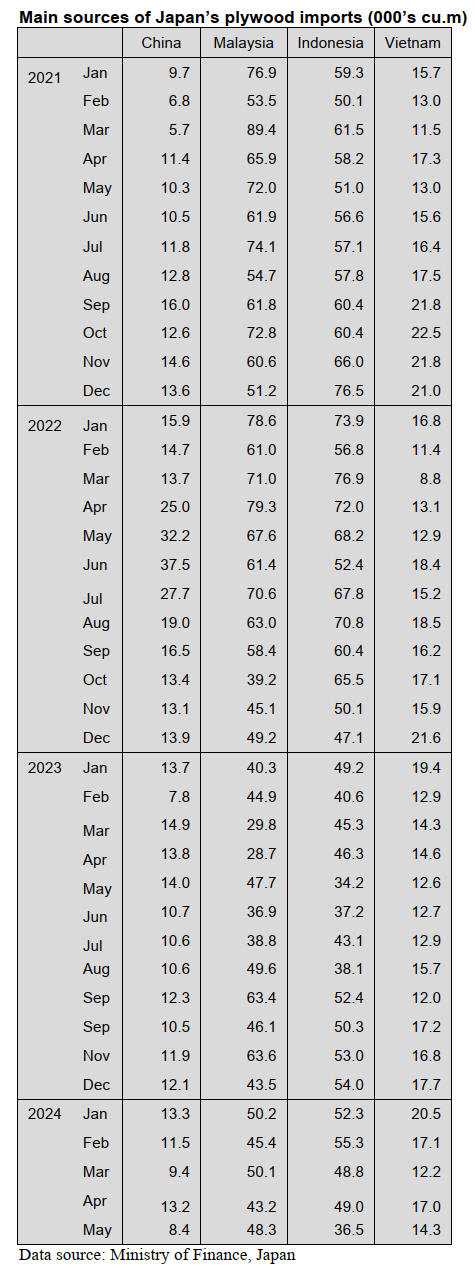

Plywood imports

Of the various categories of plywood imported, 86% was

HS441231 in May with HS441233 and HS441234 each

accounting for around 5.5% of the balance. The four main

shippers of plywood to Japan; Indonesia, Malaysia,

Vietnam and China consistently account for over 90% of

plywood imports.

Year on year, the volume of May plywood imports

(441210-39) was 109,788 cu.m which was at around the

same level as in May 2023, however, month on month

there was an 11% decline in the volume of imports with

only shippers in Malaysia recording a rise from a month

earlier.

In May there was month on month a decline in the volume

of plywood imports from China, Vietnam and Indonesia

which accounted for the overall decline in May import

volumes.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see: https://jfpj.jp/japan_lumber_reports/

Prototype plywood

Niigata Gohan Shinko Co., Ltd. in Niigata Prefecture has

been developing plywood made of hardwood. The

hardwood will be used on the front and back of the

plywood. This is to use more domestic resources and to

find outif the hardwood would be used instead of South

Sea species.

Niigata Gohan Shinko has been collecting hardwood logs

from Fukushima Prefecture and Nagano Prefecture. Also,

the firm has been purchasing about 100 cbms of hardwood

logs in a month from Iwate Prefecture since February,

2024. The thickness of a hardwood board is 0.8 mm.

Magnolia and pterocarya rhoifolia are very promising for

the front and back of the plywood. Both kinds of

hardwood are very distributed in Japan. The company

makes plywood on an experimental basis by all hardwood

layers, hardwood on the front and back and 4 mm cedar

layer for center of plywood or 12 mm cedar layer.

Nisshin started selling long plywood

Nisshin Co., Ltd. in Tottori Prefecture developed 7.5 mm

long plywood and started to sell the samples to spread the

long plywood. The length of the plywood is 8, 9 and 10

shaku. A shaku is about 30.3 cm.

The company is the only company producing long

structural plywood such as 3 x 10 in Western Japan. The

long plywood is used as bearing walls of a house. The

price of the long plywood rose suddenly when the wood

shock occurred and consumers started purchasing

particleboards or gypsum boards instead of the long

plywood due to the lower cost at that time.

However, there was a fire at one of Nisshin’s product lines

for plywood two years ago and the pant stopped producing

the long plywood. Then, the company restarted producing

the long plywood in June, 2023 but demand for houses

were low so the company struggled with it. Since the

selling price of a house soared due to the high-priced

materials, demand for houses decreased. Housing

companies strengthened in reducing the material costs.

To get back market share of the long plywood, Nisshin

reduced the thickness of the long plywood to 7.5 mm from

9mm. Strength of the 7.5 mm plywood is almost same as

the 9 mm plywood. The price of 7.5 mm plywood is 220

yen.

Sekisui House aims to build 20,000 detached houses in U.S.A.

Seisui House Ltd in Osaka Prefecture showed its goal of

supplying 20,000 units of detached house in the U.S.A. in

the fiscal 2031.

The company completed buying a house builder in the

U.S., M.D.C Holdings, Inc, in April, 2024 and will expand

its original construction method with M.D. C’s 2 x 4

construction method. Sekisui aims to increase overseas

sales coming years, so that the overseas ratio will get

higher. The original construction method and 2 x 4

construction method are used for its house brand called

“New 2 x 4 by Sekisui House”. This brand is good at its

high durability in walls, roofs, thermal insulation,

airtightness, energy saving, energy creation and store

energy.

Also, there is another house brand, “life knit design” and

this is Sekisui House’s design concept for interior. Sekisui

House plants to supply 17,000 units of this brand by the

fiscal2031.

The company puts a goal of supplying 3,000 units of

“Shawood” by the fiscal 2031. The company will do

business not only building detached house but also

developing rental unit and developing communities.

Investment for detached house business will be expanded

to 70 % by the fiscal 2031 from 37 % in the fiscal 2023.

The sales of overseas business occupies 16 % of the sales

in Japan in the fiscal 2023. The sales of overseas business

will be expanded to 45 % in the fiscal 2031.

M.D.C aims to have 769 billion yen in sales in December,

2024 and aims to deliver 9,400 units. These plans are more

than December, 2023.

The consolidated financial statement of Sekisui House and

M.D.C will be 512.6 billion yen in sales and will be 1.7

billion yen in operating profit in the fiscal 2024. Sekisui

House revises up the financial forecast in January, 2025

South Sea Logs and Lumber

There are inquires to South Sea and Chinese lumber even

though there are not a certain amount of orders.

Distributors purchase a little bit of South Sea lumber and

Chinese lumber because demand is low.

When the yen appreciated to 155 to the dollar in the

middle of July 2024, distributors purchased laminated

boards and lumber for decks. Demand for truck body has

been rising due to the new rule in distribution business as

of April 2024.

Demand and supply of South Sea logs are balanced after

logs arrived to Japan from Papua New Guinea in March.

‘White Paper on forest and forestry’

The Ministry of Agriculture, Forestry and Fisheries has

released the White Paper on forest and forestry to the

public on its website. The White Paper shows measures of

forest, forestry and wood industry.

The theme of the White Paper is pollen and forest. It tells

the history of afforestation cedar trees after the war and

how the hay fever increased in Japan. There are also

measures for preventing hay fever in the future. For

forestry labor, there are more detailed information about

foreign workers and women workers than usual. It is the

first time for The Ministry of Agriculture, Forestry and

Fisheries to feature hay-fever on the White Paper.

To avoid giving a negative image of cedar trees, it tells us

the cedar tree is Japan’s endemic species and the cedar

trees have been used for structures since long time ago.

Then, the cedar trees became a main tree species to

afforest.

There is a topic for forest environmental tax starting this

fiscal year on the White Paper. Also, the details of revised

Clean Wood Act, digitalization of forestry bases with

strategy, G7 Hiroshima Summit 2023 and the earthquake

in Noto Peninsula are on the White Paper.

About foreign workers, forestry and forest industry have

been decided and added to the specified skilled worker

visa in March, 2024. 205 foreign workers had been hired

at the forestry offices as of October, 2023. It is specified

that development of working environment and working

styles for women and men will make women to be active

in companies.

The Ministry of Agriculture, Forestry and Fisheries

expects that the White Paper would be used widely in

people for understanding and using more timber.

Therefore, the White Paper will be sold as books and will

be seen on the website. The Ministry of Agriculture,

Forestry and Fisheries acknowledges for people to reprint

the details of the White Paper by specifying the source and

also provides the image data.

See: https://www.rinya.maff.go.jp/j/sin_riyou/kafun/hinsyu.html

|