|

Report from

Europe

Imports from tropical countries shifting away from

primary wood products

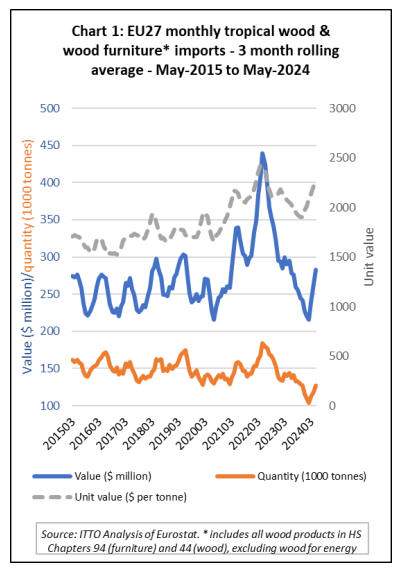

Total EU27 imports of tropical wood and wooden

furniture of 598,500 tonnes in the first five months of this

year were 16% down compared to the same period last

year. In value terms, EU27 imports were down 12% to

US$1296 million during the five-month period.

After falling to the lowest levels ever recorded in the first

quarter this year, EU27 imports of tropical products

recovered some ground in April and May. Import value

during those two months was back to the level typical

before the COVID pandemic, although import quantity

was still below that level.

Most of the recovery in EU27 imports of tropical wood

products in April and May this year was due to furniture

products. Imports of primary and secondary processed

tropical wood products remained at a very low ebb during

this period. This shift in the balance of imports from lesser

processed to more processed products has contributed a

significant rise in the unit value of tropical wood products

imported into the EU27 so far this year.

The average unit value of EU27 tropical wood product

imports was around US$2250 per tonne in the three

months to May 2024, not far short of the all-time high of

US$2450 per tonne during the pandemic and well above

average values of around US$1750 per tonne prevailing

before the pandemic (Chart 1).

Signs that EU economic recovery may be stalling

After economic stagnation in 2023, the EU economy

seemed to be recovering well in the first quarter of this

year.

But less encouraging data from the EU manufacturing

sector in the second quarter has since dampened

expectations of a swift rebound and led to more soul

searching about the global competitiveness of EU

industry.

According to Eurostat, seasonally adjusted GDP increased

by 0.3% in the EU in the first quarter of 2024 compared

with the previous quarter. Compared with the same quarter

of the previous year, seasonally adjusted GDP increased

by 0.6% in the EU in the first quarter of 2024.

However, manufacturing in Europe’s industrial heartland

has continued to weaken this year. Eurostat's industrial

production index for the eurozone remains below its 2021

level and it is currently trending lower. S&P Global’s

eurozone manufacturing purchasing managers index

(PMI), a rough real-time proxy for activity in the sector,

fell to a seven-month low of 45.6 in July.

In Germany the indicator came in at 42.6, a three-month

low, while in France it fell for a second straight month to

44.1. Anything under 50 is contractionary territory.

As for construction, the HCOB Eurozone Construction

PMI dropped to 41.8 in June from 42.9 in May, signalling

a marked contraction in output across the sector.

Construction production levels continued to fall across all

three of the major eurozone countries in June.

German firms faced the greatest slump in performance,

despite the contraction in output easing to the least marked

since August 2023. At the same time, faster reductions

were observed in the French and Italian construction

sectors, with the former seeing its sharpest fall in output

since March, and the latter posting its strongest drop in

nearly two years.

S&P’s composite PMI, which includes services, stayed

just above 50 in July, despite slowing from June. Overall,

the signs are that the EU’s economic development is

increasingly reliant on services while the situation of

industry remains gloomy.

The numbers underline the challenge faced by EU policy

makers in maintaining Europe’s competitiveness in the

global marketplace. The newly re-elected chief of the

European Commission, Ursula von der Leyen, put

restoring competitiveness front and centre in her political

priorities for her next mandate, while European Central

Bank President Christine Lagarde said in mid-July that

Europe’s competitive position vis-à-vis China is set to

have a growing influence on the Bank’s thinking.

A long-awaited report by former ECB president Mario

Draghi, now due in September, is expected to provide

more detail, and help set the EU’s economic agenda in the

next few years. In a recent speech in Spain, Draghi

underscored the importance of cheaper energy and

innovation as drivers of economic growth and increased

productivity.

He also noted that “successive layers of regulation have

created a burden on long-term investment”. While stating

that “we don’t want to become protectionist in Europe”, he

went on to suggest that “we cannot be passive if the

actions of others are threatening our prosperity” and

appeared to allow greater scope for state-driven

investment and trade protection measures.

See https://geopolitique.eu/en/2024/06/14/mario-draghi-grand-

continent-an-industrial-strategy-for-europe/

EU27 tropical wooden furniture imports rise after a

slow start to the year

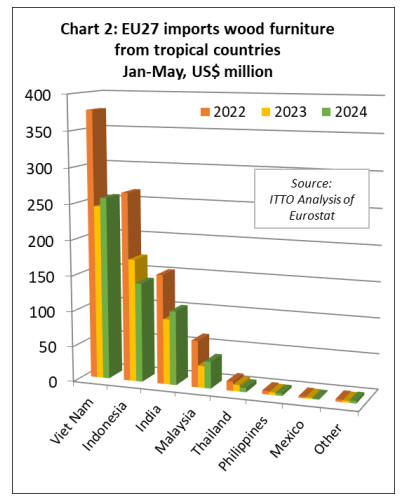

The EU27 imported 131,600 tonnes of wooden furniture

from tropical countries with a total value of US$553

million in the first five months of 2024. Tonnage was up

7% while value was down 1% compared to the same

period in 2023. EU imports of tropical wooden furniture

picked up a bit in April and May after a very slow start to

the year.

In the first five months of this year compared to the same

period in 2023, EU27 import value of wooden furniture

increased from Vietnam (+5% to US$256.7 million), India

(+13% to US$104.2 million) and Malaysia (+23% to

US$37.9 million). However, import value declined from

Indonesia (-19% to US$139.8 million) and Thailand (-

33% to US$6.1 million). Imports from all other tropical

countries were negligible during the period (Chart 2).

EU27 imports of tropical sawnwood at a low ebb this

year

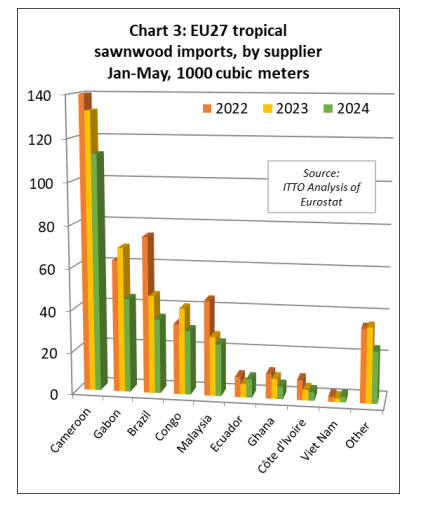

The EU27 imported 294,200 cu.m. of tropical sawnwood

in the first five months this year, 22% less than the same

period in 2023. Import value of this commodity was

US$270 million in the first five months this year, 23% less

than the same period in 2023.

Imports declined from all leading supply countries during

the period including Cameroon (-15% to 112,600 cu.m.),

Gabon (-35% to 44,700 cu.m.), Republic of Congo (-26%

to 30,600 cu.m.), Brazil (-24% to 35,600 cu.m.), Malaysia

(-12% to 24,700 cu.m.), Ghana (-37% to 5,900 cu.m.),

Côte d’Ivoire (-19% to 4,000 cu.m.), and the Central

African Republic (-52% to 2,600 cu.m.).

However, imports increased from Ecuador (+41% to 8,800

cu.m.) and Vietnam (+66% to 2,700 cu.m.) (Chart 3).

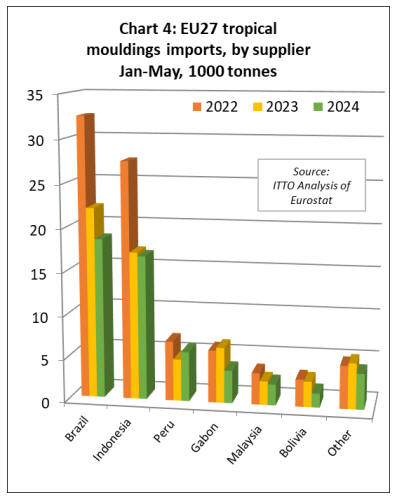

The EU27 imported 53,000 tonnes of tropical

mouldings/decking in the first five months of this year,

14% less than in the same period in 2023. Import value of

this commodity was down 22% to US$93 million in the

same period. (Chart 4).

During the first five months imports increased year-on-

year from Peru (+19% to 5,800 tonnes) but fell from all

other leading supply countries including Brazil (-16% to

18,500 tonnes), Indonesia (-2% to 16,700 tonnes), Gabon

(-41% to 3,800 tonnes), Malaysia (-11% to 2,400 tonnes),

and Bolivia (-45% to 1,600 tonnes.

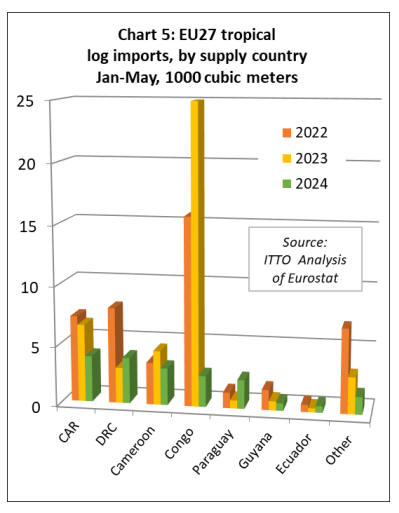

The EU27 imported 18,400 cu.m. of tropical logs with a

total value of US$10.9 million in the first five months of

this year, respectively 58% and 61% less than in the same

period last year. The decline was driven mainly by an 90%

decline in imports from the Republic of Congo to 2,600

cubic metres. This follows the ban on exports of most logs

from the country since 1st January 2023.

EU27 imports of logs in the first five months of this year

were also down compared to the same period last year

from the Central African Republic (-41% to 3,900 cubic

metres), Cameroon (-32% to 3,100 cubic metres), and

Guyana (-19% to 600 cubic metres).

However, EU27 log imports increased from the

Democratic Republic of Congo (+29% to 3,800 cubic

metres), Paraguay (+260% to 2,400 cubic metres), and

Ecuador (+65% to 500 cubic metres) during the five-

month period (Chart 5).

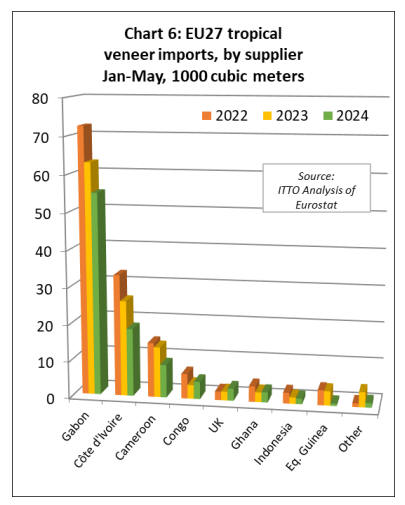

EU27 imports of tropical hardwood veneer down 20%

in January to May period

The EU27 imported 96,400 cu.m. of tropical veneer with a

total value of US$65 million in the first five months of this

year, down 20% and 21% respectively compared to the

same period last year.

Imports of tropical veneer from Gabon, by far the largest

supplier to the EU27, were 54,900 cu.m. in the first five

months of this year, 13% less than the same period in

2023.

EU27 imports of this commodity also decreased during the

period from Côte d'Ivoire (-29% to 18,400 cu.m.),

Cameroon (-35% to 8,900 cu.m.), Indonesia (-14% to

1,500 cu.m.), and Equatorial Guinea (-84% to 600 cu.m.).

However, imports increased during the period from the

Republic of Congo (+25% to 4,700 cu.m.), the UK (+37%

to 3,300 cu.m.), and Ghana (+5% to 2,800 cu.m.) (Chart

6).

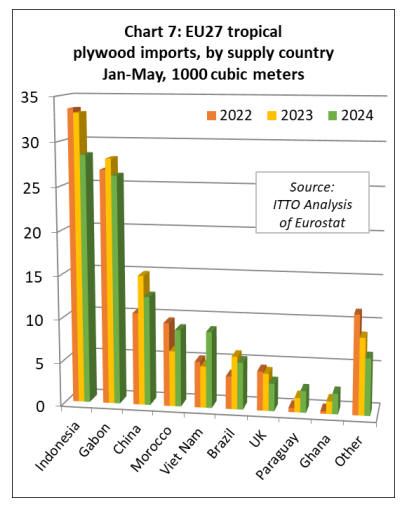

The EU27 imported 105,000 cu.m. of tropical plywood

with a total value of US$78 million in the first five months

of this year, respectively 4% and 7% less than the same

period last year.

Imports fell from all the leading supply countries during

the period including Indonesia (-14% to 28,500 cu.m.),

Gabon (-7% to 26,200 cu.m.), and China (-16% to 12,600

cu.m.).

Imports from Brazil were also down, by 11% to 5,400

cu.m., while indirect imports from the UK fell 26% to

3,200 cu.m. These losses were partly offset by rising

imports from Morocco (+39% to 8,900 cu.m.), Vietnam

(+84% to 8,800 cu.m.), Paraguay (+49% to 2,500 cu.m.),

and Ghana (+63% to 2,400 cu.m.) (Chart 7).

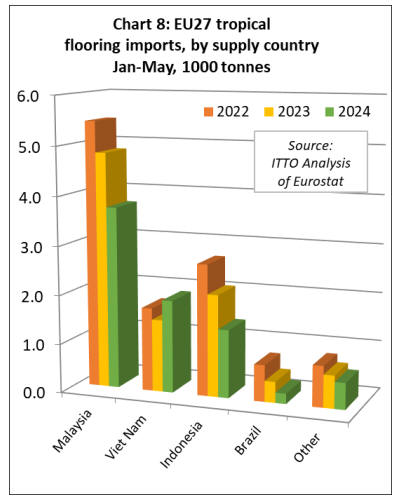

EU27 tropical wood joinery imports still very slow

The EU27 imported 7,800 tonnes of tropical wood

flooring with a total value of US$20 million in the first

five months of this year, down 18% and 27% respectively

compared to the same period in 2023.

Imports of 3,700 tonnes from Malaysia in the five-month

period this year were 23% less than the same period last

year. Imports also fell from Indonesia (-33% to 1,400

tonnes) and Brazil (-51% to 200 tonnes). However,

flooring imports from Vietnam increased by 28% to 1,900

tonnes during the period (Chart 8).

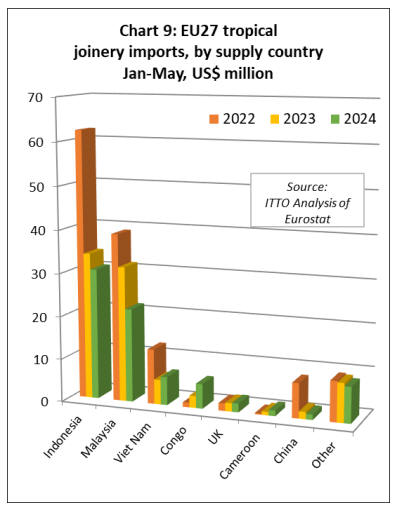

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors – was

US$77 million in the first five months this year, down

12% compared to the same period in 2023. Import

quantity fell 2% to 33,900 tonnes during the same period.

Imports were down 11% to US$30.4 million from

Indonesia, down 31% to US$21.7 million from Malaysia,

and down 25% to US$1.2 million from China.

Of all Asian countries, only Vietnam increased exports of

joinery products to the EU in the first five months of this

year, by 13% to US$6.5 million.

With on-going efforts in the Republic of Congo to shift up

the value chain as log exports are banned, EU imports of

laminated joinery products from the country were valued

at US$5.7 million in the first five months of this year, up

106% compared to the same period last year.

Imports of these products also increased from Cameroon

in the first five months of this year, by 57% to US$1.3

million. (Chart 9).

Further calls to delay EU Deforestation Regulation

Pressure on the EU to delay implementation of the EU

Deforestation Regulation (EUDR) has continued to mount

from commodity producing countries worldwide

according to leading international media.

Most recently, supplier country governments have

questioned the accuracy of, and definitions used in

mapping undertaken for EUDR enforcement by the EU

Observatory to identify areas of deforested and degraded

forest land.

The EUDR is set to come into force at the end of 2024. It

will require all operators and non-SME traders to

undertake due diligence to ensure no timber and six other

so-called forest and eco-risk commodities (FERCs) that

are placed on or exported from the EU market are

implicated in deforestation or forest degradation that has

taken place since 2020. It also stipulates that businesses

must provide the geolocation coordinates of the plot of

land from which commodities originate. The Regulation

will extend to SME traders six months later.

Australia and Brazil are ‘stepping up demands for the

[EUDR] to be delayed’, according to a report by the

Financial Times (FT). Their latest contention is that the

mapping undertaken by the European Observatory to

identify deforested and degraded forest land, and which

will be one of the pillars of EUDR enforcement, cannot be

taken as definitive.

“The EU’s map is not a single source of truth but acts as

one possible source of information for EU operators and

competent authorities to determine if deforestation has

occurred,” a spokesperson for the Australian embassy in

Brussels told the FT.

The Australians point out that there are differences

between their 2023 Forests of Australia map and that of

the European Observatory as they use different definitions

of forested areas.

Pedro Miguel da Costa e Silva, Brazil’s EU ambassador,

also picked up this theme. He said the Brazilian private

sector had identified multiple cases of cocoa, coffee and

tree plantations that have been misidentified as forests in

the European Observatory mapping. Canada and

Columbia have also questioned the validity of the

mapping.

“European operators and competent authorities should co-

operate with producer governments to use local

monitoring systems that have much higher precision

rates,” Da Costa e Silva told the FT. He added that Brazil

has a free-to-use ‘state of the art’ monitoring system. He

said the EU was imposing European standards and norms

on other countries without collaboration and that

producers would have to spend millions of euros on

private sector compliance systems.

Columbia’s Institute of Hydrology, Meteorology and

Environmental Studies said its deforestation mapping was

similar to the EUs, but the latter’s definition “would also

include areas not considered as deforestation in Colombia,

for example conversion of areas of secondary vegetation”.

The Australian embassy in Brussels also highlighted that

clarification is needed from the EU on what constitutes

‘predominantly agricultural land use’ under the EUDR. It

said it had requested a delay in introduction of the

Regulation ‘until all required arrangements are understood

and effectively in place’, pointing out that several EU

member states had not yet appointed Competent

Authorities to police the new rules.

On the issue of mapping, the EC has emphasised that the

European Observatory maps were ‘a tool to help

companies to ensure compliance’. They were not

mandatory, and other ‘more granular or detailed’

information could be used as a guide.

An article in The Economist titled ‘How EU do-goodery

risks harming Africa’s small farmer’ focuses on the

challenges posed by EUDR to the African coffee industry.

It quotes representatives of the Ethiopian and Ugandan

sectors saying that they were struggling to provide

geolocation coordinates for the millions of plots of land

where coffee was grown for the EU market. Adding to the

complexity of the situation, the African supply chains in

coffee and cocoa (another commodity covered by the

EUDR) are highly complex, pooling and mixing beans

from multiple sources.

Enveritas, a sustainability assurance specialist, is putting

forward an alternative approach, using satellite imagery to

identify fields here trees have been cut down, without

requiring geo-locating every farm. The Economist report

Ethiopia and Uganda backing this model. The question is

whether the EU will accept it.

The FT reported that the then Environment Commissioner

Virginijus Sinkevičius said there were no plans to delay

implementation of the EUDR. He has since resigned to

take up a seat in the European parliament. The

Environment role has been temporarily taken over by

Maroš Šefčovič, Executive Vice-President of the EC for

European Green Deal.

In another FT article, Senior Trade Correspondent Alan

Beattie said that ‘irritation’ with the EUDR within the EC

has ‘now broken into the open’. It quotes Sabine Weyand,

director-general of the trade directorate, as saying; “I think

we have to recognise that we have pushed away a number

of partners we need through our increased use of

autonomous trade measures. We hear that increasingly on

measures like the deforestation regulation.”

She suggests widening EU support to the developing

world, including via its ‘Global Gateway’, strategy for

increasing investment, particularly for the climate

transition and especially in Africa.

The article also quotes Odrek Rwabwogo, senior adviser

to the president of Uganda on trade. He urged more

support for Uganda’s wish to move up the value chain into

further processing, rather than stay an exporter of

unprocessed commodities and, for instance, roast coffee

in-country rather than use more land simply to expand the

production of low-value green coffee beans. “[But] our

conversations with Europe are not on the level we would

like,” he said. “We want them to be about growth, but they

are just about compliance.”

The FT article concludes that a delay in introducing the

EUDR ‘seems wise’.

“But the EU should use the time not just to iron out the

obvious compliance wrinkles, but to give some thought to

how climate, trade and development policies might be

combined into a more coherent strategy,” it says.

Sources:

https://www.ft.com/content/8dab4dc6-197b-4a2f-86f0-

d5e83ce00b09

https://www.ft.com/content/ab2aabbc-8978-444b-844b-

3d0d70553266

https://www.ft.com/content/03ce886b-c110-45fd-bc56-

0254daa75969

https://www.economist.com/middle-east-and-

africa/2024/07/04/how-eu-do-goodery-risks-harming-africas-

small-farmers

EU implements eco-design regulation

A new regulation setting out to make sustainable products

the norm in the EU market has implications for

manufacturers, importers, distributors, retailers and sellers

worldwide, according to a report from

www.sustainablebrands.com. The new Ecodesign for

Sustainable Products Regulation (ESPR) came into force

in July and, says the article, sets out environmental design

requirements for almost all products, with a few

exceptions, including food and medicines.

“We’re setting the bar higher to ensure that resource- and

energy-efficient products become the norm on the EU

market,” Maroš Šefčovič, Executive VP for the European

Green Deal is quoted as saying.

The idea, says Sustainable Brands, is to ‘make sure the

products being put on the market are easier to repair,

recycle and reuse as part of a circular economy’.

“According to policymakers, around 80% of a product’s

environmental impact is determined by how it is

designed,” it says. “The legislation includes criteria

centred on improving product durability, reducing energy

consumption, increasing recycled content, facilitating

remanufacture and recycling, and increasing the

availability of information on just how sustainable a

product might be.”

The European Commission is set to adopt the first working

plan for the ESPR, outlining the initial set of products for

which eco-design requirements will be developed, in

March 2025. These will then be adopted towards the end

of 2026 and will apply from 2027 onward. The

preliminary list of products the legislation will cover first

includes furniture and textiles. The ESPR also introduces

the concept of a Digital Product Passport, likely to be a

QR code linked to a database, to give consumers

information about the journey of a product to market.

See: https://sustainablebrands.com/read/espr-sustainable-

products-norm-eu-consumers

and

https://commission.europa.eu/energy-climate-change-

environment/standards-tools-and-labels/products-labelling-rules-

and-requirements/sustainable-products/ecodesign-sustainable-

products-regulation_en

|