Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Aug

2024

Japan Yen 146.20

Reports From Japan

Mega-quake advisory

A mega-quake advisory by Japan's Meteorological Agency

remained in place five days after it was issued on 8

August. Agency officials report they have not observed

any changes in the earth's crust where the jolt is expected

to occur. The agency put out the advisory after a

magnitude-7.1 earthquake struck off Miyazaki Prefecture

in southern Japan.

Officials say the probability of a massive earthquake is

higher than usual along the Nankai Trough which runs

from Shizuoka Prefecture west of Tokyo to the southern

tip of Kyushu.

See: https://www3.nhk.or.jp/nhkworld/en/news/20240813_01/

First quarter disappointment

According to an estimate released by the Japan Center for

Economic Research (JCER), Japan's the economy shrank

month on month by an annualised 0.3% in June pushed

down by increased imports. Private consumption, which

accounts for more than half of Japan's GDP, picked up in

June after a decline in May. The rise in June was the result

of the higher bonuses and the consequent increase in real

disposable income said the research centre.

In contrast, the JCER estimated corporate investment fell

2.8% in June and imports increased by 2.1%, exceeding

the small increase in exports. The JCER now estimates the

Japanese economy grew 2.8% in the April-June

quarter from the previous quarter on an annualised basis.

In related news, in a rare unscheduled revision to gross

domestic product (GDP) the government said the economy

shrank more than initially reported in the first quarter,

darkening prospects for a fragile recovery.

The downward revision is likely to lead to a cut to the

Bank of Japan's growth forecasts in further quarterly

projections and could affect the timing of its next interest

rate rise.

See: https://www.jcer.or.jp/en/economic-forecast/monthly-gdp

and

https://www.asahi.com/ajw/articles/15327146

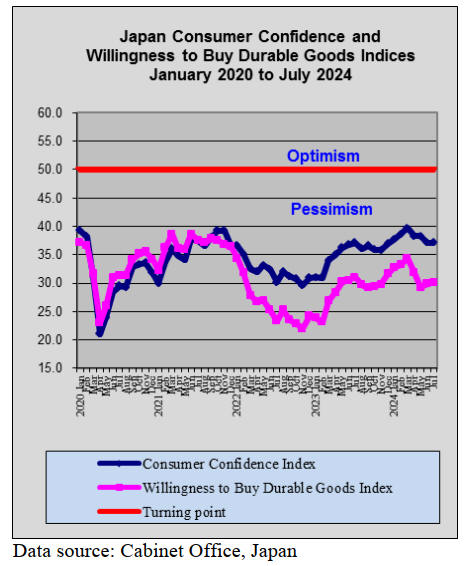

Weak yen and inflation undermining household

confidence

A recent government report has said the weak yen is

hurting Japanese households' sentiment and eroding their

purchasing power, a signal of the government’s concern

over the negative economic impact of the exchange rate.

In 2013 expectations that inflation was rising helped

improve household spending but now the prospect of price

inflation against the back drop of the weak yen which has

pushed up prices for imports has undermined householder

confidence.

See:

https://www.japantimes.co.jp/business/2024/08/02/economy/japa

nese-economy-weak-yen/

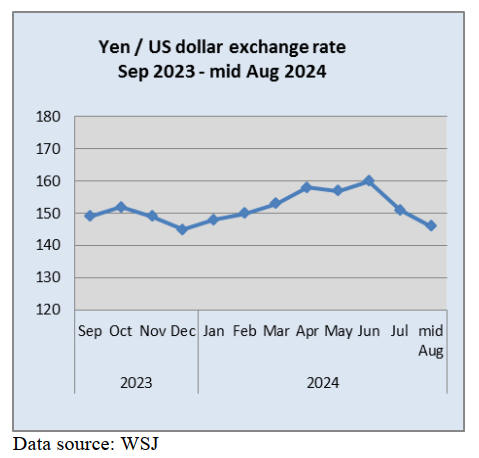

Strengthening yen could dent exports

The Finance Ministry announced that Japan spent over yen

5.5 billion on foreign exchange market interventions

between June 27 and 5 August. This lifted the yen to

below 150 to the dollar. The sharp move up in the yen was

helped by the release of the US consumer price index for

June and the US producer price index both of which were

interpreted as signaling a cooling of the US economy.

In early August stock markets around the world lost

considerable valuations with the Japanese market dropping

around 12% in a day, the worst ever seen.

For Japan there are two main issues, the strengthening yen

could dent exports and the fear that the US economy is not

as strong as previously believed.

See;

https://japannews.yomiuri.co.jp/business/economy/20240801-

202239/

Yen at 140 to the US dollar at year end -

forecast

A media survey of currency strategists reveals that many

are predicting the yen to end the year in the mid-140

range to the dollar stronger than initially expected. As of

mid-August the yen has gained around 10% against the

dollar with the rate around 147.5. In July the rate was

close to 160 to the US dollar.

See:

https://asia.nikkei.com/Business/Markets/Currencies/Currency-

strategists-see-yen-closing-out-the-year-in-the-mid-140s

The lost generation - difficult to find stable

employment

Japanese in their 40s or early 50s, representing the so-

called lost generation, are struggling to secure pay growth

and career advancement, an issue more commonly seen

the older and younger age groups.

The lost generation graduated when Japan was suffering

the worst of the economic downturn after the bubble

economy years with many finding it difficult to find stable

employment. While Japan's overall wage level has started

to pick up data shows that there are still noticeable

disparities among different age groups.

A government survey shows that the average monthly pay

for full-time employees in their 20s and 30s increased by

more than yen 10,000 over the decade through 2023 while

workers in their late 40s experienced a rise of just over yen

1,000 and those in their early 50s saw a decline.

See: https://asia.nikkei.com/Spotlight/Datawatch/Japan-s-lost-

generation-faces-slow-pay-growth-lack-of-

promotion#:~:text=But%20another%20survey%20by%20the,earl

y%2050s%20saw%20a%20decline.

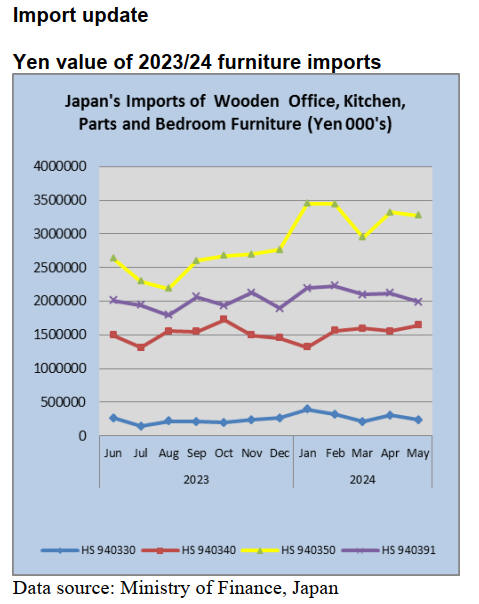

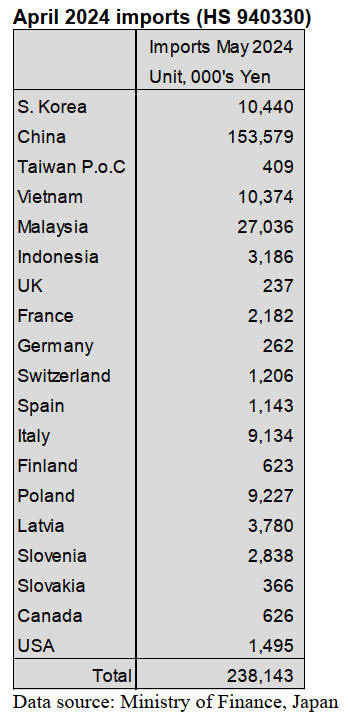

May 2024 wooden office furniture imports (HS

940330)

The value of HS940330 exports from China to Japan in

May were slightly down from a month earlier. In April

shippers in China accounted for around 70% of Japan’s

imports of wooden office furniture but this dropped to

65% in May but the second largest shipper, Malaysia,

almost doubled the value of shipments in May compared

to April.

The other main suppliers in May were South Korea and

Vietnam at around 4% each of total May imports.

Year on year, the value of Japan’s imports of wooden

office furniture in May 2024 increased by over 50% but

the value of month on month imports was down over 20%.

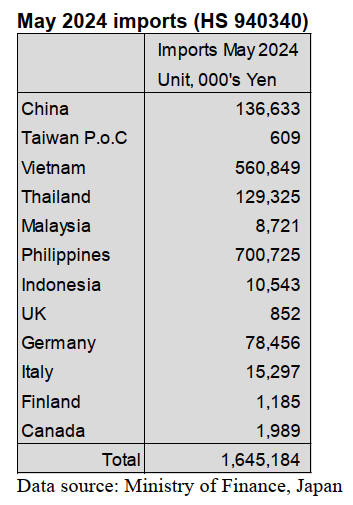

May 2024 kitchen furniture imports (HS 940340)

Year on year, the value of imports of wooden kitchen

furniture items (HS940340) in May was up 10% and

compared to April there was a 6% increase in the value of

May imports.

The top shippers in May were the Philippines, accounting

for about 42% of the value of May imports followed by

Vietnam at 34% with shippers in Germany contributing

another 5% of the value of imports.

In the first five months of 2024 there have been month on

month increases in the value of wooden kitchen furniture

except for the slight dip in April.

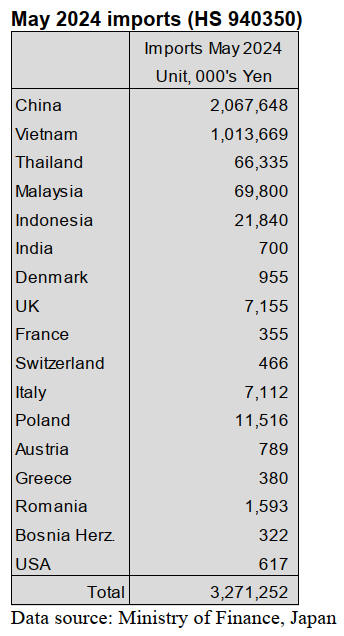

May 2024 wooden bedroom furniture imports (HS

940350)

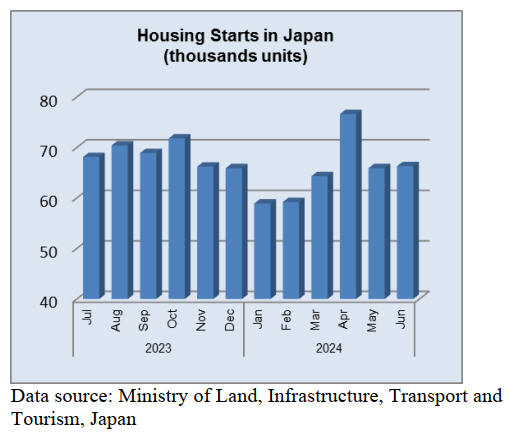

Over the twelve months since June 2023 there has been a

remarkable upward trend in the value of wooden bedroom

furniture imports. While some of the increase in the value

of imports can be attributed to the weakening of the yen of

the period that does not explain the trend. Residential

housing starts have not increased enough to account for

the rise in wooden bedroom furniture which suggests

much of the demand was from the hospitality sector.

Shippers in China and Vietnam continue to account for

over 90% of the value of Japan’s wooden bedroom

furniture imports with 63% coming from China in May

and a further 31% from Vietnam. Shipments from

Malaysia and Thailand combined accounted for just 45 of

the value of May imports

Year on year, the value of May imports was up 23% and

there was a 6% month on month increase in the value of

imports.

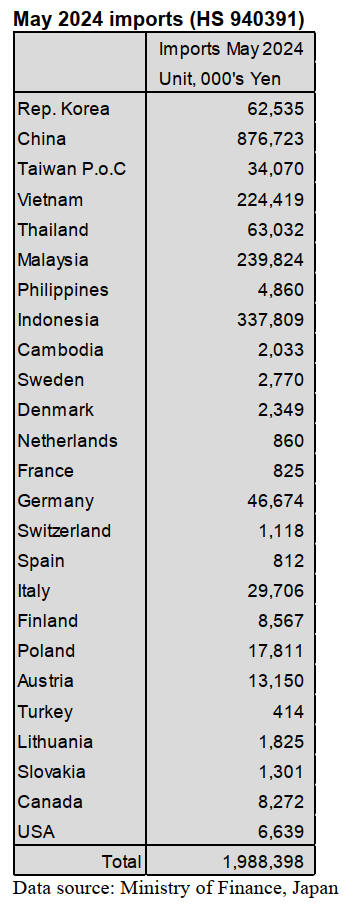

May 2024 wooden furniture parts imports (HS 940391)

Japan imports wooden furniture parts from a wide range of

countries. Shippers in China, Indonesia, Malaysia and

Vietnam supplied most with only around 7-8% of the

value of May shipments originating in Europe and N.

America.

In May the value of arrivals of HS940391 to Japan from

the top four shippers accounted for over 80% of the total

value. May arrivals from China were down from a month

earlier, the value of imports from both Indonesia and

Vietnam were around the same level as in April with only

Malaysia posting gains in May.

Year on year the value of May arrivals of wooden

furniture parts was up 10% but compared to the value of

April imports there was a 6% decline.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR) closed its office in early

August so staff could participate in the Obon festival (also

known as Bon festival). This is an annual unofficial

holiday that commemorates deceased ancestors. It is

believed that their spirits return at this time so people visit

family tombs.

These days many people take advantage of the long break

to travel and enjoy a holiday.

News from the JLR will resume at the end of August.

For more see: https://japantoday.com/category/national/People-

start-to-return-home-for-Obon-holidays-amid-megaquake-

advisory

|