|

Report from

Europe

Weak start to the year for UK tropical wood imports

but outlook improving

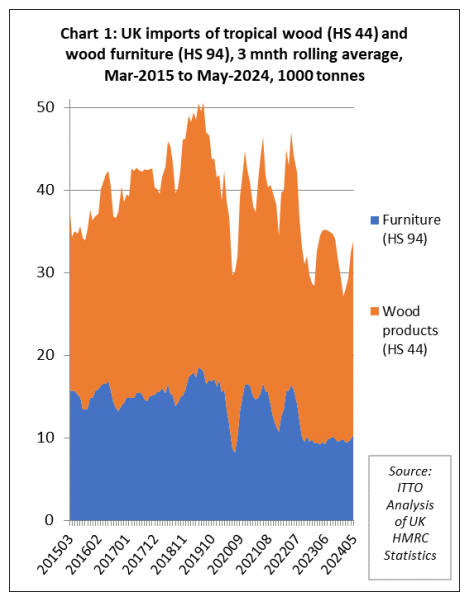

After hitting an all-time low in 2023 and starting this year

very slowly, UK imports of tropical wood products

showed some early signs of recovery in April and May.

This mirrors trends in the UK construction sector and in

the wider economy which have gained a little momentum

this year.

The UK imported 159,600 tonnes of tropical wood and

wood furniture products with a total value of US$408

million in the first five months of this year.

In tonnage terms, this was 5% less than the same period

last year, but gains were made in March and April after

imports fell to an all-time low in the previous three month

period (Chart 1 above). Import value in the first five

months of 2024 was marginally up - by 0.4% - compared

to the same period in 2023.

UK imports of tropical wood furniture rise from the

depths of last year

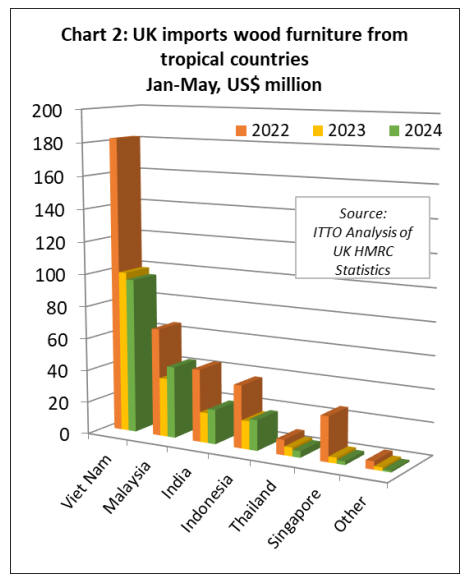

UK imports of wood furniture products from tropical

countries in the first 5 months of 2024 were a marginal

improvement on the same period in 2023. The UK

imported US$187 million of these products between

January and May this year, 2% more than the same period

in 2023. In quantity terms, wood furniture imports were

49,700 tonnes in the first five months of 2024, 4% more

than the same period in 2023.

In the five months this year compared to the same period

in 2023, UK wood furniture import value increased from

Malaysia (+22% to US$44.2 million), India (+14% to

US$21.2 million), and Indonesia (+8% to US$18.8

million).

However, imports were down from the largest supplier

Vietnam (-4% to US$95.6 million), as well as from

Thailand (-25% to US$4 million), and Singapore (-40% to

US$2.1 million). UK wood furniture imports were

negligible from all other tropical countries during the

period (Chart 2).

UK imports more tropical hardwood joinery from the

EU

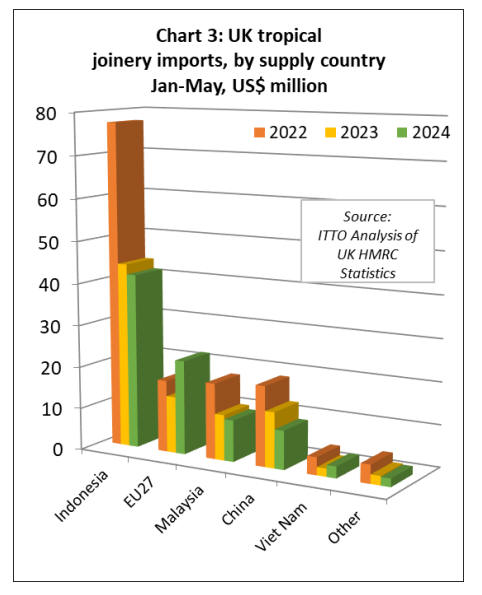

In the first five months this year, the UK imported 29,700

tonnes of tropical joinery products with value of US$87.9

million. Compared to the same period in 2023, import

quantity was 3% less while import value increased by 3%.

A very large rise in the value of imports of joinery

products made with tropical wood from the EU (+66% to

US$22.4 million) and a recovery in imports from Vietnam

(+43% to US$2.8 million) offset falling imports from

Indonesia (down 5% to US$41.7 million), Malaysia (down

9% to US$9.9 million) and China (down 30% to US$9.2

million) (Chart 3).

UK imports of tropical plywood shift from China and

Indonesia to Malaysia

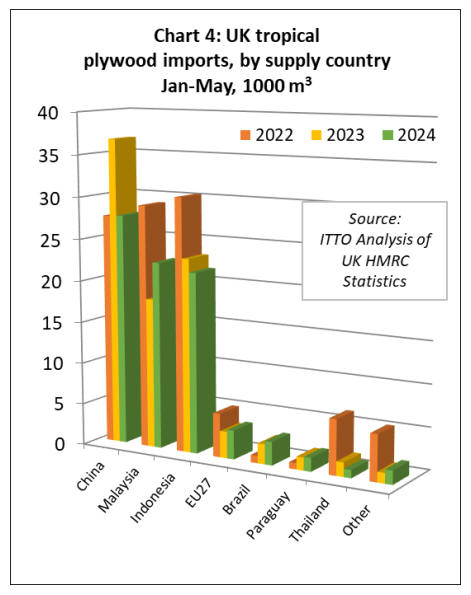

In the first five months of 2024, the UK imported 82,300

cu.m. of tropical hardwood plywood, 7% less than the

same period last year. Import value also declined 7% to

US$49.2 million.

UK imports of plywood with a tropical hardwood face

veneer from China were 27,700 cu.m. in the first five

months of this year, 25% less than the same period in

2023.

Tropical hardwood plywood imports fell by 7% from

Indonesia to 21,600 cu.m. and by 43% from Thailand to

1,000 cu.m. during the five-month period. However,

hardwood plywood imports increased from Malaysia

(+25% to 22,400 cu.m.), Brazil (+16% to 2,800 cu.m.),

and Paraguay (+7% to 1,600 cu.m.) between January and

May this year. Indirect imports from the EU also

increased, by 8% to 3,500 cu.m. during the five-month

period (Chart 4).

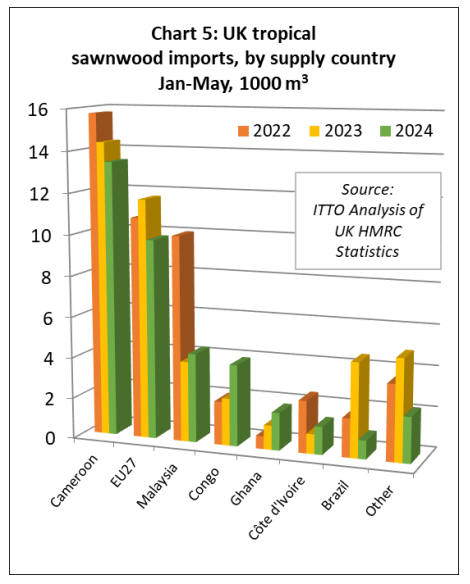

Sharp drop in UK imports of tropical sawnwood from

Cameroon and the EU

UK imports of tropical sawnwood were 37,900 cu.m. in

the first five months of 2024, 14% less than the same

period last year. Import value was US$46.5 million in the

January to May period, 2% less than the same period in

2023. However, the pace of imports did pick up pace in

the April and May after a very slow start to the year.

In the first five months of this year compared to the same

period in 2023, UK sawnwood imports from Cameroon

were down 7% to 13,400 cu.m, while indirect imports

from the EU fell 17% to 9,800 cu.m. Imports from Brazil

also fell sharply, by 80% to 900 cu.m.

However, there were gains in UK imports of sawnwood

from Malaysia (+11% to 4,400 cu.m.), Republic of Congo

(+73% to 4,000 cu.m.), Ghana (+56% to 1,800 cu.m.), and

Cote d’Ivoire (+42% to 1,400 cu.m.) (Chart 5).

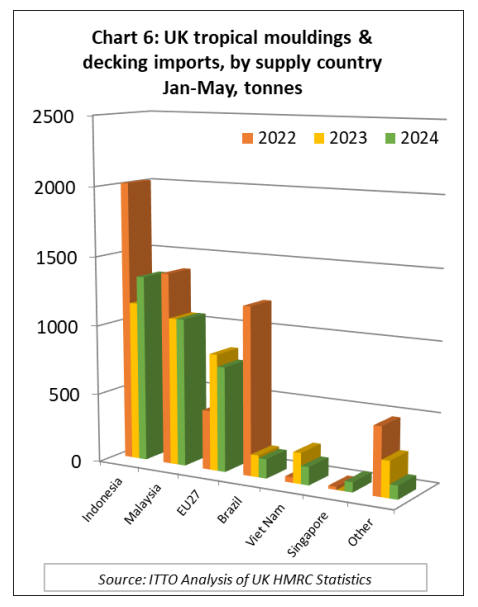

The UK imported 3,600 tonnes of tropical hardwood

mouldings/decking with a total value of US$10 million in

the first five months of 2024, respectively 2% and 9% less

than in the same period last year. Imports of this

commodity recovered ground from Indonesia, the UK’s

largest supplier, in the first five months of this year (+17%

to 1,345 tonnes).

However, imports were down from the EU (-10% to 756

tonnes), Brazil (-12% to 140 tonnes), and Vietnam (-41%

to 130 tonnes). Imports from Malaysia were unchanged at

1,100 tonnes during the five-month period (Chart 6).

Hints of UK construction recovery, but true turnaround

not expected until 2025

The Glenigan Construction Index for August 2024

provides an analysis of UK construction activity for the

three months ending in July 2024, focusing on projects

valued at £100m (USD$128 million) or less. The report

offers insights into the construction sector's performance

over the past year, with findings seasonally adjusted.

The construction sector has seen a modest improvement

despite being down 11% compared to 2023. There was a

2% increase in starts for the three months ending July

2024, marking the first industry-wide uptick in months.

This improvement is largely driven by private

housebuilding growth.

The report notes that increased private housing starts

reflect growing market confidence. However, social

housing and non-residential sectors remain subdued due to

political changes and government reviews of major

programmes.

Overall, residential construction increased by 12% during

the three months to July 2024, despite being 17% lower

than a year ago. Private housing starts rose by 25%,

reflecting improved market sentiment, although they

remain 12% below last year's levels. Social housing starts

fell by 23% from the previous three months and 32% from

last year.

Civil construction rose by 9% over the last three months

and 14% year-on-year, driven by a 21% increase in

infrastructure project starts. The utilities sector fell by 8%

from the previous three months and 16% from last year.

The industrial sector decreased by 10% in the past three

months and 34% year-on-year.

The UK Construction Products Association’s (CPA) latest

state of the market report takes a more downbeat

perspective. Its summer forecast published end of July

downgrades the building sector’s near-term growth

prospects. Output is forecast to fall by 2.9% this year,

steeper than the 2.2% contraction forecast three months

ago.

“This is primarily due to recovery in the two largest

construction sectors, private housing new build and repair,

maintenance and improvement (rm&i), being pushed back

until the Bank of England begins cutting interest rate cuts

and consumer confidence strengthens,” says the CPA. “In

addition, increasing concerns about the potential impact of

uncertainty around responsibilities throughout the whole

construction supply chain from the Building Safety Act

may also delay delivery of some larger, high-rise projects.

The sector’s recovery, it states, is now forecast to be in

2025, with growth of 2.0% and a further rise of 3.6% in

2026 as the lagged impacts of lower interest rates combine

with sustained real wage growth, improving consumer and

business confidence, as well as greater economic and

political certainty as the new government develops its

spending plans.

After last year’s double-digit fall, the CPA forecasts UK

private housing output will fall by a further 7.0% in 2024,

followed by a rise of 6.0% in 2025.

Private housing repair, maintenance and improvement is

forecast to fall by 6.0% this year, with 2.0% growth in

2025. However, energy-efficiency retrofit, and solar

photovoltaic work has continued to remain strong, whilst

building safety activity continues to provide a steady

pipeline of activity.

Despite the overall construction decline forecast for 2024,

the outlook for construction sectors outside of housing

remains similar to three months ago, with many firms

operating in commercial refurbishment and fit-out or

working on major infrastructure projects continuing to

experience robust activity.

Commenting on the Summer Forecasts, CPA Head of

Construction Research, Rebecca Larkin said it was still too

early to say what the impact of the recent election of a

Labour government on construction would be or when its

commitment to new house building will start to impact the

market.

“Off the back of the election there have been clear signs of

intent from the new government, particularly around

potential changes to planning policy to improve housing

and infrastructure delivery,” said Ms Larkin. “However,

with little detail at this stage, it is difficult to see any near-

term uplift, whilst long-running concerns over skills

shortages and the loss of construction workers, which has

worsened dramatically in recent years, present the biggest

risk to longer-term growth.”

See: https://www.glenigan.com/market-analysis/industry-

news/

and

https://www.constructionproducts.org.uk/news-media-

events/news/2024/july/cpa-summer-forecasts/

New government commits to housing drive

The King’s Speech to parliament, laying out the new

Labour government’s policy plans, included the pledge to

increase social and affordable housing, with a target of 1.5

million new dwellings in five years.

Promising “the biggest increase in social and affordable

housebuilding in a generation,” the government pledges

to:

Immediately update the National Policy Planning

Framework restoring mandatory housing targets

Ensure that planning authorities have up-to-date

Local Plans and reform and strengthen the

presumption in favour of sustainable

development

Take a “brownfield” first approach, prioritising

the development of previously used land

wherever possible, and fast-tracking approval of

urban brownfield sites

Prioritise the release of lower quality ‘grey belt’

land, as well as introducing ‘golden rules’ to

ensure greenbelt development benefits

communities and nature

Creating several new towns, as previously

announced in late May

Further reform compulsory purchase

compensation rules to speed up delivery

Strengthen planning obligations to ensure new

developments provide more affordable homes

and prioritise the building of new social rented

homes

Source https://www.pbctoday.co.uk/news/planning-construction-

news/kings-speech-signals-next-wave-construction/142733/

|