US Dollar Exchange Rates of

25th

Aug

2024

China Yuan 7.12

Report from China

Real estate investment down over 10%

China’s National Bureau of Statistics has, in a press

release, reported that in the period January to July 2024,

investment in real estate development decreased year on

year by 10% and investment in residential buildings was

down by 11%.

In the same period the floor space of real estate under

construction was down by 12% year on year and for

residential buildings it was down around 13%.

The floor space of newly started buildings was down by

23%, of which floor space of newly started residential

buildings was down by 24%. The floor space of completed

buildings was down by 22% of which the floor space of

residential buildings was also down by 22%.

See:

https://www.stats.gov.cn/english/PressRelease/202408/t2024082

2_1956035.html

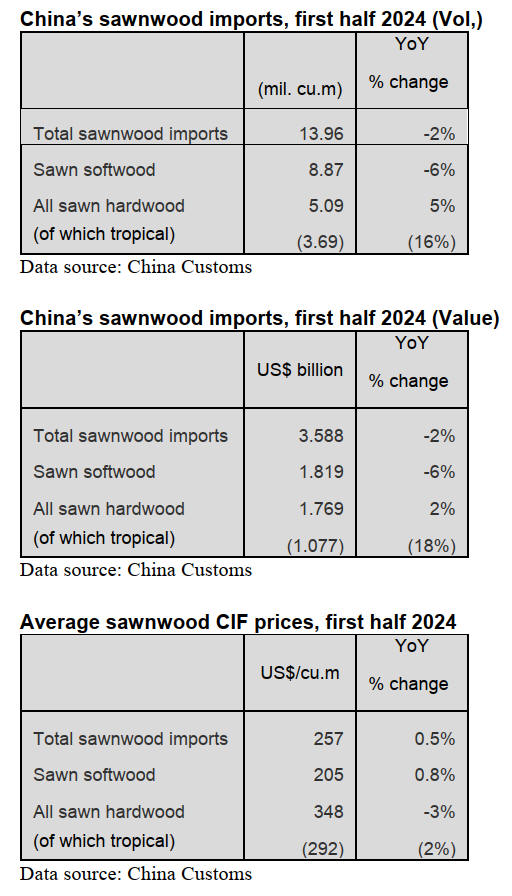

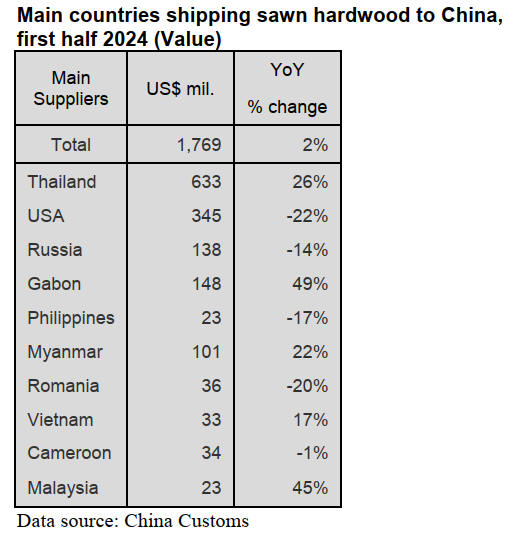

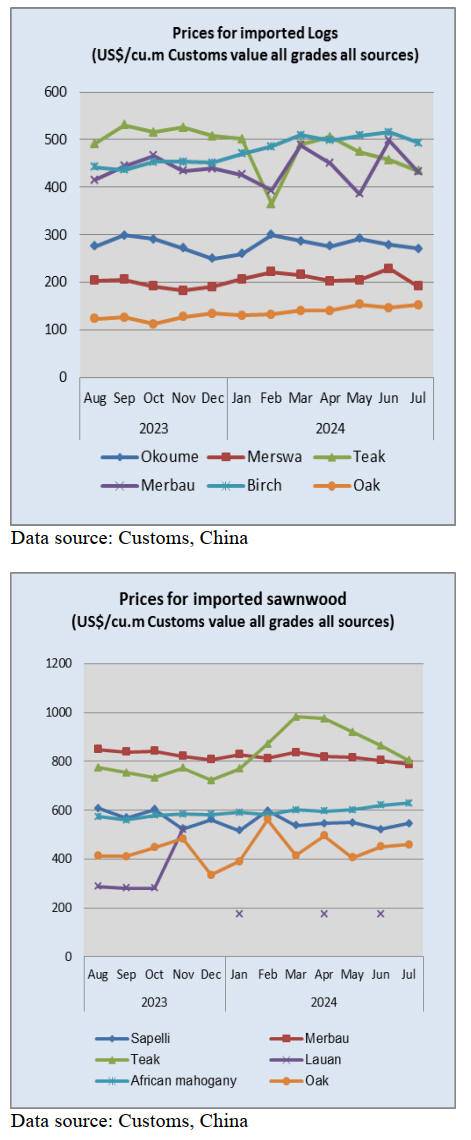

Slight decline in total sawnwood imports

According to China Customs data, in the first half of 2024

China’s sawnwood imports totalled 13.96 million cu.m,

worth US$3.588 billion, down 2% both in volume and in

value. CIF prices for sawnwood imports rose 0.5% slightly

to US$257/cu.m compared to the same period of 2023.

Of total sawnwood imports, sawn softwood imports fell

6% to 8.87 million cu.m, accounting for 64% of the

national total, down 2 percentage points over the same

period of 2023. The CIF prices for sawn softwood imports

rose 0.8% to US$205/cu.m over the same period of 2023.

Sawn hardwood imports grew 5% to 5.09 million cu.m.

CIF prices for sawn hardwood imports dropped 3% to

US$348/cu.m over the same period of 2023.

Of total sawn hardwood imports, tropical sawnwood

imports were 3.69 million cu.m valued at US$1.077

billion, up 16% in volume and 18% in value and

accounting for about 26% of the national total. CIF prices

for tropical sawnwood grew 2% to US$292/cu.m over the

same period of 2023.

The main reasons for the decrease in China’s sawnwood

imports mainly resulted from the slump in construction

industry which has weakened China's overall demand for

imported timber.

A seasonal slowdown caused by the rainy season in

southern China also contributed to slower overall timber

demand. China’s sawnwood imports from its lead

suppliers, reduced generally in the first half of 2024,

especially from the largest, Russia.

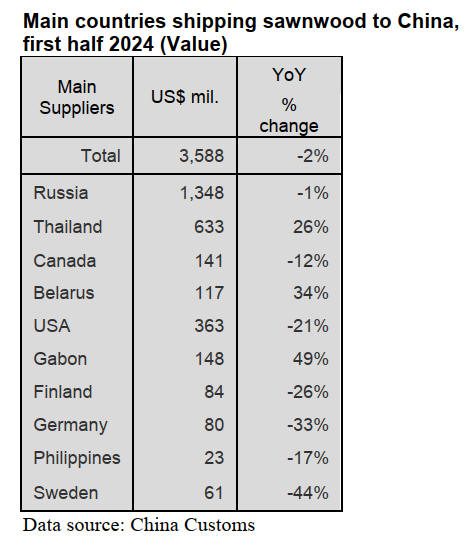

Imports from Russia down 4%

Russia remains the largest supplier of sawnwood to China

and imports in the first half of 2024 accounted for 65% of

the total. However, Russian imports fell 4% to 6.242

million cu.m and contributed to the downturn in China’s

overall total sawnwood imports.

At the same time, China’s sawnwood imports from the

main supply countries also decreased and at a faster pace,

in the first half. Imports from Canada, USA, Finland,

Germany, Philippines and Sweden dropped 8%, 18%,

27%, 31%, 15% and 44% respectively over the same

period compared to 2023. In contrast, China’s sawnwood

imports from Thailand, Belarus and Gabon rose 21%, 44%

and 58% respectively.

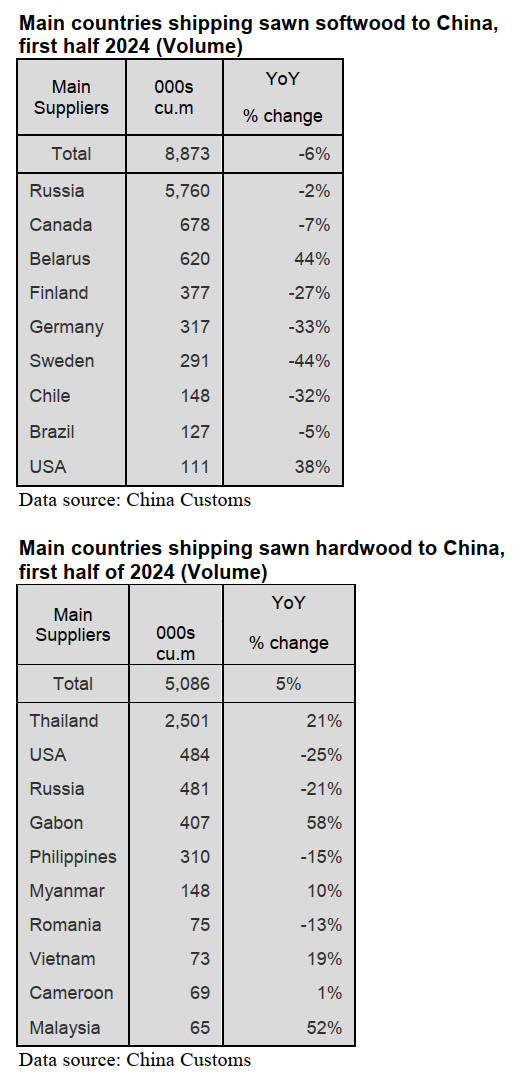

Jump in sawn softwood imports from US

In the first half of 2024, China’s sawn softwood imports

from the USA rose 38% to 111,000 cu.m, accounting for

1.3% of the national total sawnwood imports. This did not,

have much affect on the overall trend of decline in the

total sawn softwood imports in the first half of 2024.

In the first six months China’s total sawnwood imports

from USA totaled 596,000 cu.m, down 18% over the same

period in 2023. This decrease in the overall sawnwood

total is because of the decline in China’s sawn hardwood

imports from USA. 80% of China’s sawnwood imports

from USA are of sawn hardwood and these fell 25% to

484,000 cu.m in the first half of 2024.

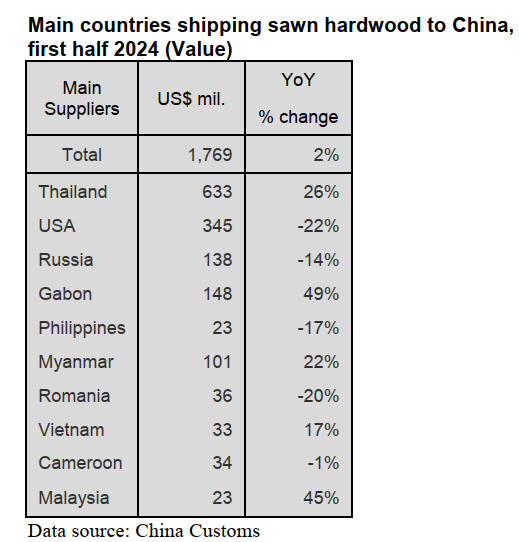

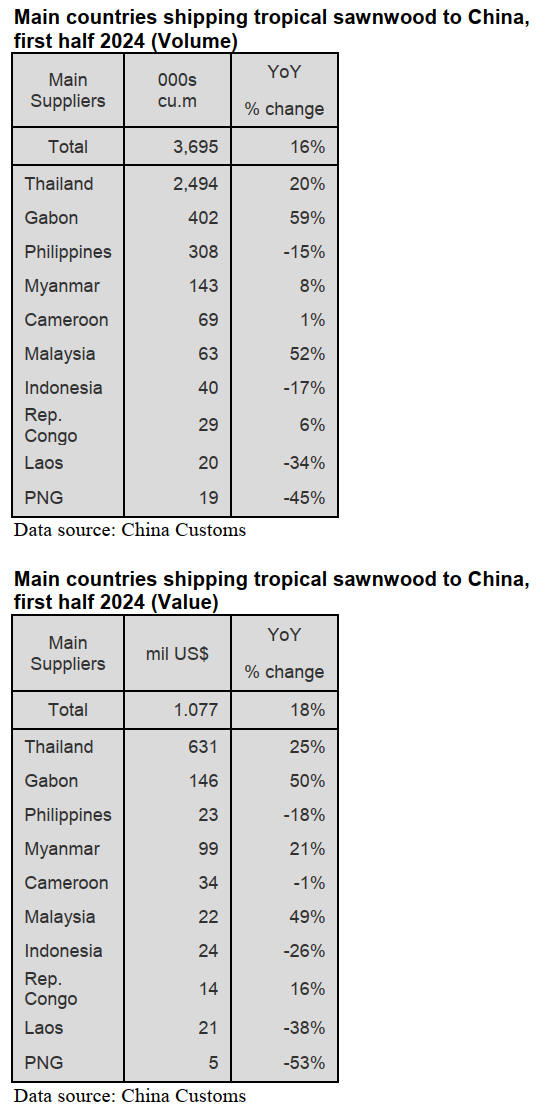

Tropical sawnwood imports rise

China’s tropical sawnwood imports in the first half of

2024 reached 3.69 million cu.m, worth US$1.077 million,

an increase of 16% in volume and 18% in value on the

same period of 2023. They accounted for about 26% of its

national sawnwood import total for the six months. CIF

prices for tropical sawnwood grew 2% to US$292 per

cu.m compared to 2023.

Thailand has been China’s largest tropical sawnwood

supplier for many years. In the first half of 2024 its

shipments to China rose 20% in volume over the same

period in 2023 to 2.49 million cu.m and 25% in value to

US$631 million. They accounted for 68% of China’s total

tropical sawnwood imports, an increase in share of 4%

over 2023. The CIF price for China’s tropical sawnwood

imports from Thailand was US$253 per cu.m, up 4%.

Surge in tropical sawnwood imports from Gabon

Gabon’s tropical sawnwood exports to China rose sharply

in the first half of 2024, making it the country’s second

largest supplier, ahead of the Philippines in third place.

The two countries accounted for for 11% and 8% of

China’s total tropical sawnwood imports respectively in

the period. Imports from Gabon were up 59% to 402,000

cu.m and the Philippines’ 15% to 308,000 cu.m.

China’s top 10 countries tropical sawnwood suppliers

provided 97% of its total first half imports, namely

Thailand (68%), Gabon (11%), Philippines (8%),

Myanmar (4%), Cameroon (1.9%), Malaysia (1.7%),

Indonesia (1.1%), the Republic of Congo (0.8%), Laos

(0.55%) and PNG (0.51%).

Tropical sawnwood imports rise

China’s tropical sawnwood imports in the first half of

2024 reached 3.69 million cu.m, worth US$1.077 million,

an increase of 16% in volume and 18% in value on the

same period of 2023. They accounted for about 26% of its

national sawnwood import total for the six months. CIF

prices for tropical sawnwood grew 2% to US$292 per

cu.m compared to 2023.

Thailand has been China’s largest tropical sawnwood

supplier for many years. In the first half of 2024 its

shipments to China rose 20% in volume over the same

period in 2023 to 2.49 million cu.m and 25% in value to

US$631 million. They accounted for 68% of China’s total

tropical sawnwood imports, an increase in share of 4%

over 2023. The CIF price for China’s tropical sawnwood

imports from Thailand was US$253 per cu.m, up 4%.

Surge in tropical sawnwood imports from Gabon

Gabon’s tropical sawnwood exports to China rose sharply

in the first half of 2024, making it the country’s second

largest supplier, ahead of the Philippines in third place.

The two countries accounted for for 11% and 8% of

China’s total tropical sawnwood imports respectively in

the period. Imports from Gabon were up 59% to 402,000

cu.m and the Philippines’ 15% to 308,000 cu.m.

China’s top 10 countries tropical sawnwood suppliers

provided 97% of its total first half imports, namely

Thailand (68%), Gabon (11%), Philippines (8%),

Myanmar (4%), Cameroon (1.9%), Malaysia (1.7%),

Indonesia (1.1%), the Republic of Congo (0.8%), Laos

(0.55%) and PNG (0.51%).

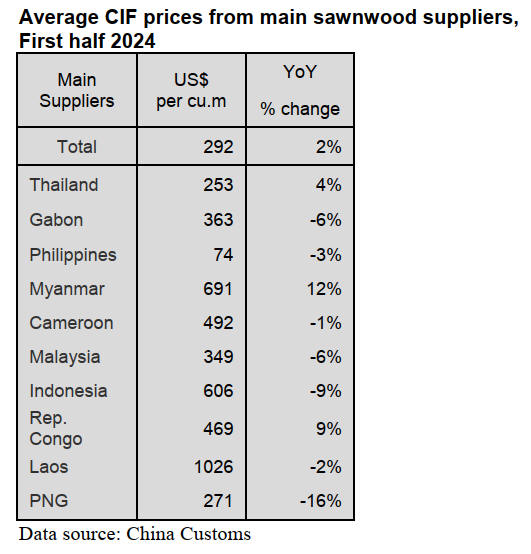

Imported tropical sawnwood CIF prices rise

marginally

Average CIF prices for China’s tropical sawnwood

imports rose 2% to US$292/cu.m in the first half of 2024.

CIF prices for tropical sawnwood from Thailand, the

Philippines and the Republic of Congo grew 4%, 12% and

9% respectively. In contrast, CIF prices for most of

China’s other lead tropical sawnwood suppliers declined at

different rates over the same period in 2023. The price

decrease of imports from PNG was largest, down 16%.

GTI-China Index down in July

In July, the GTI-China Index registered 43.5%, a decrease

of 3.2 percentage points from June, according to the latest

Global Timber Index report. The further drop meant the

index was below the critical value of 50% for three

consecutive months, indicating shrinkage of leading

timber enterprises it represents.

Summer is the traditional off-season for the Chinese

timber market, says the report, but enterprises were

concerned about issues such as blue stain and cracking in

wood, leading to a reduction in production activities.

Typically, the production cycle for the second half of the

year begins in September.

As for the GTI-China Index’s 11 sub-indexes, two

(inventory of finished products, and delivery time) were

above the critical value of 50%. One index (import) was at

the critical value, and the remaining eight were all below.

Compared to the previous month, the indexes in July for

existing orders, inventory of finished products, purchase

quantity, import, inventory of main raw materials, and

delivery time increased by 0.2-3.0 percentage points. The

indexes for production, new orders, export orders,

purchase price, and employees declined by 0.1-8.0

percentage points.

In the first half of 2024, according to the GTI July report,

China's cumulative exports of furniture and furniture parts

reached US$35.379 billion, representing a year-on-year

increase of 14.8%, according to China’s customs statistics.

During the same period, affected by previous high

inventory and still unclear market demand, China's total

import volume of wood was 32.77 million cu.m,

representing a year-on-year decrease of 5.32%.

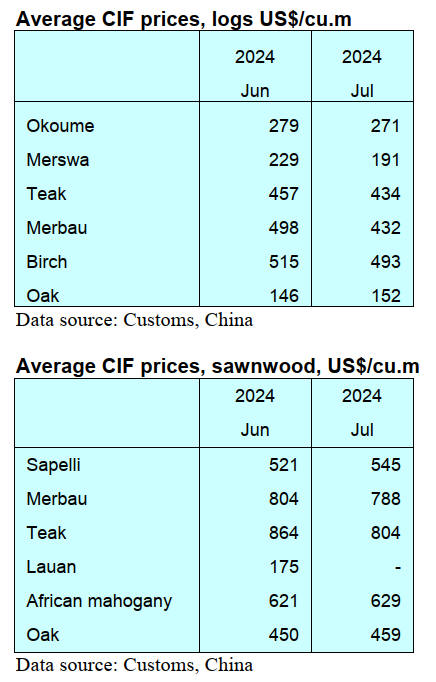

However, China's demand for tropical sawnwood had

increased significantly. For example, from January to May

2024, China’s import volume of sapelli sawnwood surged

to 45,000 cu.m, a 1.5 times increase compared to the same

period last year.

In terms of freight, with new routes and new shipping

capacity coming on stream, the shipping rates of several

routes departing from China began to show a declining

trend in July.

On July 21, states the GTI report, China, South Africa,

Brazil, and India jointly held the 2024 BASIC Ministerial

Meeting on Climate Change in Hubei Province, China.

The Ministerial Joint Statement on Climate Change

released at the meeting called on developed countries to

end trade distorting subsidies, including those in the

agricultural, forest and energy sectors as they adversely

impact sustainable development in developing countries.

See: https://www.itto-

ggsc.org/static/upload/file/20240822/1724289606498649.pdf

|