|

Report from

North America

US building permits fall sharply

New residential construction in the US saw a steep drop in

July, according to the latest US Department of Commerce

report.

The report said housing starts fell 6.8% to an annual rate

of 1.238 million after jumping 1.1% to a revised rate of

1.329 million in June. Single-family housing starts, which

account for the bulk of homebuilding, fell 14.1% to a

seasonally adjusted annual rate of 851,000 units last

month. Homebuilding has now declined for five straight

months.

The Commerce Department said building permits also

dropped 7% to an annual rate of 1.396 million in July after

rising 3.9% to a revised rate of 1.454 million in June.

Though mortgage rates have since retreated amid

optimism that the Federal Reserve will cut interest rates, a

jump in new housing inventory to levels last seen in early

2008 could limit any rebound in starts.

A National Association of Home Builders survey showed

homebuilder sentiment fell to an eight-month low in

August. Builders blamed "challenging housing

affordability conditions" for the fourth straight monthly

drop in confidence.

The news was much better in Canada as housing starts

climbed 16% in July compared with the previous month.

Groundbreaking increased on multiple unit and single-

family detached urban homes, data from the national

housing agency showed.

The seasonally adjusted annualized rate of housing starts

increased to 279,509 units from a revised 241,643 units in

June, the Canadian Mortgage and Housing Corporation

(CMHC) said. Economists had expected starts to rise to

245,000.

Existing-home sales increase for first time in five

months

US existing home sales rose more than expected in July,

reversing four consecutive monthly declines, as improving

supply and declining mortgage rates offered hope that

activity could rebound in the months ahead.

Home sales rose 1.3% last month to a seasonally adjusted

annual rate of 3.95 million units, the National Association

of Realtors (NAR) said. Economists polled by Reuters had

forecast home resales would edge up to a rate of 3.93

million units. But year-over-year, sales fell 2.5% (down

from 4.05 million in July 2023).

"Despite the modest gain, home sales are still sluggish,"

said Lawrence Yun, the NAR's chief economist. "But

consumers are definitely seeing more choices, and

affordability is improving due to lower interest rates."

Single-family home sales grew 1.4% to a seasonally

adjusted annual rate of 3.57 million in July, down 1.4%

from the previous year. Existing condominium and co-op

sales in July were identical to June at a seasonally adjusted

annual rate of 380,000 units.

Sales rose 1.1% in the US South, and they were

unchanged in the Midwest, which is considered the most

affordable region. Sales advanced 4.3% in the Northeast

and increased 1.4% in the West.

See: https://www.nar.realtor/research-and-statistics/housing-

statistics/existing-home-sales

Economy expanded in the second quarter

First half economic growth in the US was solid, with the

economy expanding at a robust 2.8% annualized rate in

the second quarter, according to figures released by the US

Department of Commerce, which are adjusted for inflation

and seasonal swings.

Gross domestic product (GDP), the broadest measure of

economic output, was much stronger in the second quarter

than economists predicted. The GDP report showed that

businesses are continuing to invest, and consumers are still

opening their wallets. That’s key, because consumer

spending is America’s economic engine, accounting for

about two-thirds of US economic output.

As the economy continued to expand from April through

June, inflation resumed a downward trend and seems to be

on track to slowing further toward the Federal Reserve’s

2% target.

America’s economy is set for a ‘soft landing’, which is

when inflation returns to the Fed’s target without a

recession, something that’s only happened once, during

the 1990s, according to some economists.

But even as the broader economy remains robust,

Americans are still downbeat. Inflation is an economy-

wide problem, so pessimism has been felt broadly.

Purchasing a home in many markets across the country

remains out of sight, with home prices at a record high and

mortgage rates still painfully elevated.

The booming job market in the aftermath of the Covid-19

pandemic has recently returned to normal and it’s

becoming a lot tougher to find a new job.

See: https://www.bea.gov/news/2024/gross-domestic-product-

second-quarter-2024-advance-estimate

US job gains revised downward

US hiring slowed substantially in July as employers added

a disappointing 114,000 jobs amid historically high

interest rates, persistent inflation and growing household

financial stress. Construction added 25,000 of those jobs

in July while manufacturing employment remained flat.

The unemployment rate rose from 4.1% to 4.3%, the

highest since October 2021, the Labor Department

reported. The rise, along with the pullback in payroll gains

and slowing wage growth, is stoking recession fears and

bolstering the Federal Reserve's case for cutting interest

rates, possibly sharply, in September.

Compounding the picture of a flagging job market,

employment gains for May and June were revised down

by a total of 29,000. And while a feeble jobs report could

always be a one-month blip, gains over the past three

months averaged 169,000, down from 218,000 the

previous three months.

US employment overall has stayed remarkably resilient,

largely because companies have been hesitant to lay off

workers after severe COVID-related labor shortages. But

that appears to be shifting. Jobless claims, a gauge of

layoffs, are still low by historical standards, but in August

rose to the highest level in more than a year.

There is also new data showing that the job growth over

the last year was not as strong as believed. The Bureau of

Labor Statistics (BLS) reported that the economy created

818,000 fewer jobs from April 2023 through March 2024,

representing the biggest revision to federal jobs data in 15

years.

The revisions could add to pressure on the Federal Reserve

to cut interest rates, because they indicate the labor market

wasn’t quite as strong as it looked during this period. The

BLS releases revisions to data all the time, but it’s unusual

for revisions to be this large. This set of revisions is

considered preliminary; the figure will be finalized in

February.

See: https://www.bls.gov/news.release/empsit.nr0.htm

Election impacting consumer sentiment

A surge in optimism by Democrats over the prospects of

Vice President Kamala Harris being elected President

lifted US consumer sentiment slightly this month. The

University of Michigan's consumer sentiment index edged

up to 67.8 from 66.4 in July. Americans' expectations for

the future rose, while their assessment of current economic

conditions sank slightly.

Joanne Hsu, the university's director of consumer surveys,

said she expects the index to bounce with changing poll

results as the November election nears. Consumers on

both sides of the political divide say their economic

outlook "depends on who's going to win the election,'' she

said.

The Michigan index has rebounded after bottoming out at

50 in June 2022 when inflation hit a four-decade high, but

it remains well below healthy levels.

http://www.sca.isr.umich.edu/

and

https://www.msn.com/en-us/money/markets/us-consumer-

sentiment-rises-slightly-on-democratic-optimism-over-

harris-presidential-prospects/ar-

AA1oVdeR?ocid=BingNewsVerp

US manufacturing continues to shrink

A key barometer for US manufacturing fell in July for the

fourth consecutive month and hit an eight-month low — a

sign that an ongoing slump has deepened.

The Institute for Supply Management’s manufacturing

index slid to 46.8% last month from 48.5% in June.

Numbers below 50% signal the manufacturing sector is

shrinking.

“US manufacturing activity entered deeper into

contraction,” said Timothy Fiore, chairman of the ISM

survey. “Demand remains subdued, as companies show an

unwillingness to invest in capital and inventory due to

current federal monetary policy and other conditions.”

One survey respondent, an executive from the wood

products industry, agreed that high interest rates are

hindering manufacturing. “Elevated financing costs have

dampened demand for residential investment,” they wrote.

“This has reduced our need for component products and

inventory.”

Five of the 18 manufacturing industries surveyed by ISM

reported growth in July, including the Furniture & Related

Products sector. The Wood Products sector was among 11

industries reporting contraction for the month.

See: https://www.msn.com/en-us/money/markets/slump-goes-on-

manufacturing-contracts-for-fourth-month-in-a-row-ism-finds/ar-

BB1r1Mn4?ocid=BingNewsVerp

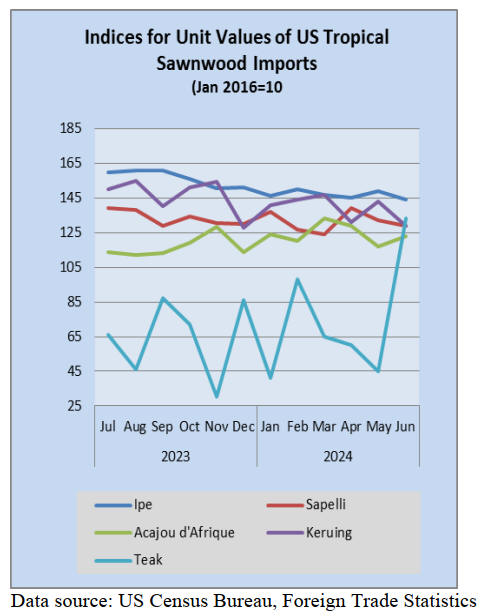

Note: the doubling of the unit value for teak may be a statistical

error. Use with caution.

|