Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Sep

2024

Japan Yen 144.37

Reports From Japan

No clear path forward for

Bank of Japan

The Cabinet Office has reported the economy grew at an

annual rate of 2.9%, slower than the earlier report of a

3.1% growth in the April-June quarter. The lower rate

suggests that risks remain, especially because trends in US

economic growth affect export-reliant Japan.

Political uncertainty in Japan is another risk as the ruling

political party picks a new leader. Nine candidates are

seeking to succeed Fumio Kishida as head of the Liberal

Democratic Party and automatically becomes Prime

Minister.

See: https://japantoday.com/category/business/japan's-economy-

is-growing-but-political-uncertainty-is-among-the-risks

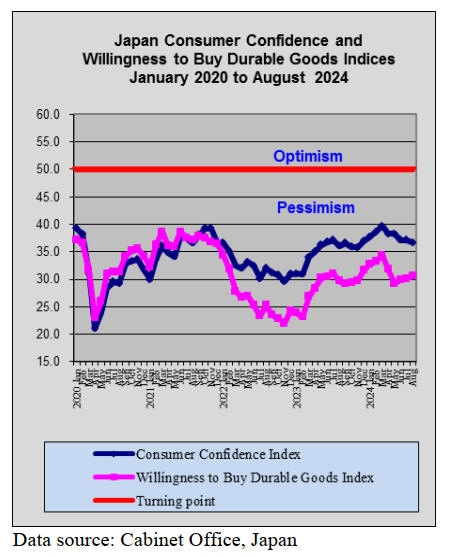

Household spending signals cautious consumers

Household spending rose less than expected in July as

consumers remain cautious in the face of rising prices for

every day goods, including food. The sentiment could

complicate any decision by the Bank of Japan on raising

interest rates again.

On a brighter note, Japan's inflation-adjusted take

home

pay rose for the second consecutive month in July. Base

pay increased at the fastest pace in over 30 years in July.

Despite this consumer willingness to purchase durable

goods has remained subdued since the beginning of the

year.

See: https://www.reuters.com/markets/asia/japan-july-household-

spending-edges-up-01-yy-2024-09-05/

Pace of ‘real’ wage growth slows

Real wages rose for a second consecutive month in July

according to the Ministry of Health Labour and Welfare

which is viewed as supporting another interest rate

increase by the Bank of Japan (BoJ). It is reported that

‘real’ earnings for workers climbed 0.4% in July from a

year earlier. While the pace of gains slowed from the

previous month the result beat the consensus projection for

a decline.

The ministry attributed the continued rise in real wages to

more companies paying bonuses compared with a year

earlier.

See:

https://mainichi.jp/english/articles/20240905/p2g/00m/0bu/0170

00c

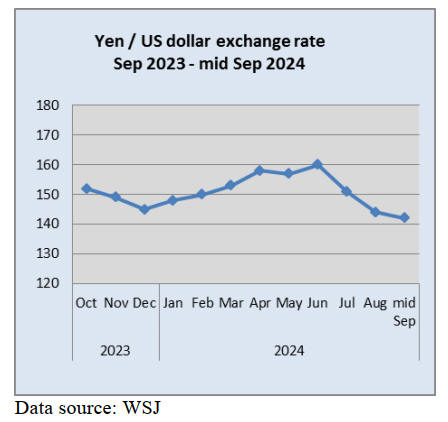

Decision on interest rates hinges on yen movement

The Bank of Japan might find it difficult to raise rates

again this year if the risk of a strengthening yen makes it

imprudent to stick to the plan. An economist at the Dai-

Ichi Life Research Institute has pointed out that the BoJ’s

monetary policy management is increasingly influenced

by foreign-exchange rates.Many anticipate the BoJ aims to

raise rates in December but if the yen retains it stronger

position the need for another rate increase will diminish

which would mean the next rate rise will be in March or

April.

See:

https://www.japantimes.co.jp/business/2024/09/02/economy/boj-

rate-hike-yen-strength/

Cashing out real estate holdings

A trend has been observed where Japanese companies

with large real estate asset are cashing out if the land is no

longer central to their business thus freeing up capital to

invest in digital infrastructure and other opportunities.

Some of this momentum stems from investors from

around the world putting pressure on companies to

manage assets more effectively.

See: https://asia.nikkei.com/Spotlight/The-Big-Story/Japan-Inc.-

s-25-trillion-yen-opportunity-cashing-in-on-real-estate

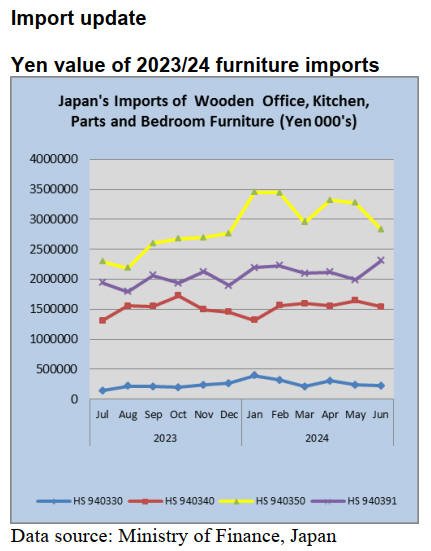

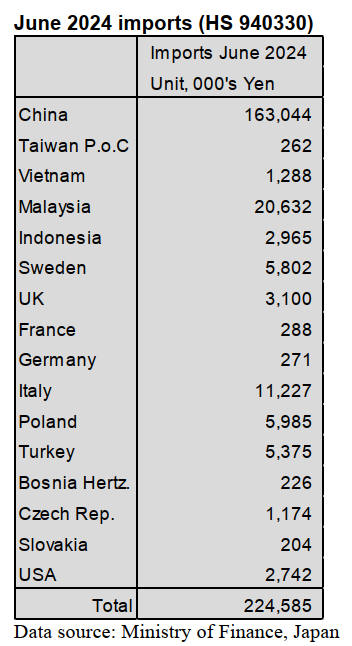

June 2024 wooden office furniture imports (HS

940330)

Year on year, the value of Japan’s imports of wooden

office furniture in June fell 15% and there was a 5%

decline compared to the value of May imports.

As in previous months, shippers in China accounted

for

the bulk of wooden office furniture imports at just over

70%. The other main shipments in June were from

Malaysia (9% of June imports) down from a month earlier

and Italy (5%) for which there was a rise in the value of

arrivals. In May there were substantial shipments from

Vietnam but this was not the case in June.

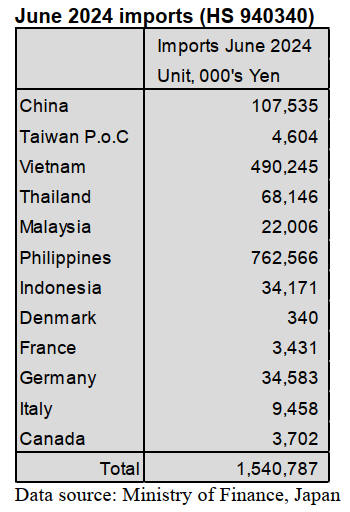

June 2024 kitchen furniture imports (HS 940340)

Between February and April this year the value of wooden

kitchen furniture imports were around the same level. In

May, however, there was an uptick in the value of imports

even as the yen strengthened against the US dollar but the

upward movement was not maintained into June as there

was a6% decline in the value of imports compared to a

month earlier.

Year on year, the value of imports of wooden kitchen

furniture items (HS940340) in June little changed,

however, but there were some changes in the shipments

from the main suppliers.

Shippers in the Philippines accounted for around 50% of

June arrivals and did particularly well seeing the value of

shipments to Japan rise. On the other hand, shipments

from the other main shipper, Vietnam, which accounted

for 32% of June arrivals in Japan, saw the value of

shipments drop.

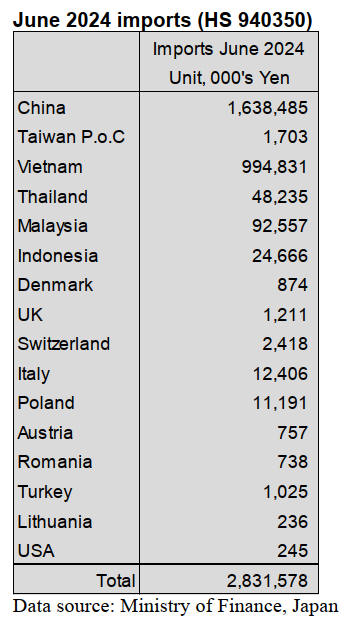

June 2024 wooden bedroom furniture imports (HS

940350)

After the steady increase in the value of imports of

wooden bedroom furniture seen in 2023 things have

hanged.

In the first two months of this year the upward momentum

in the value of imports continued only to stall in March

when there was a sharp downturn followed by an upward

correction which was not sustained into June when there

was a 13% decline in the month on month value of

imports.

Despite the downturn at the end of the second

quarter year

on year, the value of arrivals of wooden bedroom furniture

was up 8%.

Shippers in China and Vietnam accounted for over 90%

of

the value of Japan’s wooden bedroom furniture imports in

June with 58% coming from China and a further 35%

from Vietnam.

Shipments from Malaysia and Thailand combined

accounted for just 6% of the value of June imports.

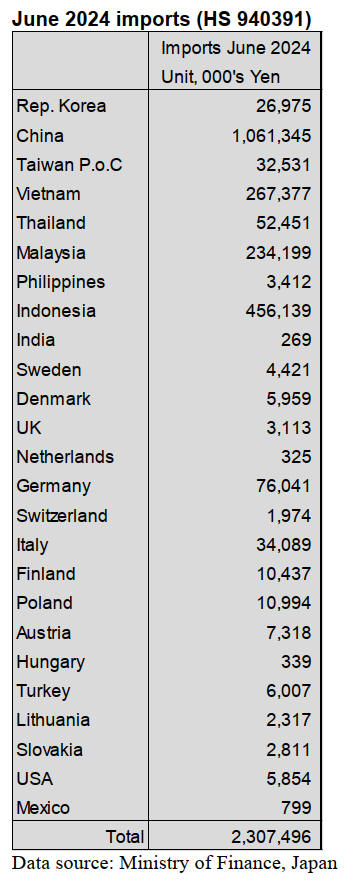

June 2024 wooden furniture parts imports (HS 940391)

Over the past 12 months there appears to have been a

modest and discernable upward trend in the value of

Japan’s imports of wooden furniture parts. Year on year,

the value of June imports was up 15% and month on

month there was a 16% increase.

Arrivals of wooden furniture parts in June were from a

large number of suppliers particularly those in SE Asia.

However, shippers in Poland and Italy also feature as

significant suppliers. Shippers in China, Indonesia,

Vietnam and Malaysia supplied around 90% of June

arrivals with China topping the list at 46%, Indonesia

20%, Vietnam 12% and Malaysia 10%.

In June the value of shipments of HS940391 to Japan from

China were up sharply as they were also from the other top

shippers with the exception of Vietnam where the June

increase in shipments was more modest.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Housing starts for first half of 2024

Total starts during January to June, 2024 are 391,089

units, 4.5 % less than January to June, 2023. Floor areas of

starts decrease to 300,008,000 square meters, 7.2 % less

than the same period last year as the stats decrease. There

is a possibility that the annual starts would be below

800,000 units this year. The decrease in the starts and the

floor areas influence demand for lumber, building

materials and processing precutting lumber.

Owner’s during January to June, 2024 is 102,066 units, 7.4

% less than the same period last year. Rental during

January to June, 2024 is 167,842 units, 0.6 % down. Unit

built for sale is 60,386 units, 12.4 % down.

Total units of wooden frame construction method for the

first half of 2024 are 162,459 units, 4.7 % less than the

first half of 2023. Prefabricated house is 4,810 units, 4.3 %

less than the same period last year. On the other hand, total

units of 2 4 construction method are 45,874 units, 9.0 %

more than the first half of 2023. Owner’s of 2 x 4

construction method is 13,574 units, 0.8 % up and rental

of 2 x 4 construction method is 28,069 units, 20.6 % up

from the first half of 2023.

Starts of wooden house are 213,143 units, 2.1 % less than

during January to June, 2023. Rental wooden house is

62,568 units, 18.1 % more than the same period last year.

Total floor areas of wooden house are 18,990 square

meters, 6.2 % less than the same period last year. Thus, the

ratio of wooden house during January to June, 2024 is

54.5 %, 1.4 % more than the same period last year.

Total starts in June, 2024 are 66,285 units, 6.7 % less than

June, 2023 and this is straight 2 months for not exceeding

the results of June, 2023. Owner’s is 19,181 units, 5.6 %

less than the same month last year and this is 31 months

decreasing continuously.

Unit built for sale is 10,007 units, 13.8 % less than the

same month last year and this is declining for straight 20

months. Rental is 28,233 units, 6.2 % down and this is

straight 2 months decreasing. SAAR (Seasonally Adjusted

Annual Rate) of unit is 765,000 units, 5.9 % less than

May, 2024.

Orders for house builders

Many housing companies and house builders exceed the

last July’s results. It is hard to say that the demand for

houses had recovered because the orders for houses in

July, 2023 were very low. According to housing

companies, consumers started to purchase houses during

June to July, 2024.

Consumers still take a long time to sign a contract for a

house but a number of contracts is increasing from spring.

There are some consumers, who are in their 40s and

worried about payment period of housing loan, bought

houses. However, it is hard to predict that whether the

housing market would recover fully or not.

There are many orders for apartment buildings and unit

built for sale at the major housing companies. The orders

for apartment buildings are more than unit built for sale.

The price of an apartment building is high due to its high

value-added. The orders for unit built for sale at the major

housing companies are firm and the price of unit built for

sale is still high. The companies have good results in

renovations.

Also, there are many orders from people, who have

already bought houses in the past, and there is a subsidy

for renovations from the government.

Import of North American logs and lumber for 1st half

of 2024

The volume of North American logs at the first half of

2024 was 13.5 % less and North American lumber is 31.7

% more than the first half of 2023. One of reasons for a

decrease in North American logs is the fire occurred at

Chugoku Lumber Co., Ltd.’s plant last August. Then, the

inquiries for imported lumber for wooden framework

construction method rose. Other reasons for the decrease

in Douglas fir logs are low demand, not enough old

Canadian Douglas fir logs and low demand for Canadian

Douglas fir logs for plywood due to a reduction of

producing plywood at Japanese plywood manufacturers.

Some Japanese distributors purchased imported lumber

instead of Chugoku Lumber’s products because the

company had stopped an operation due to the fire. Then,

the volume of Douglas fir lumber was 67.8 % more than

the same period last year. Western hemlock lumber also

increased by 30.1 % from the same period last year.

However, volume of Douglas fir lumber did not decline as

consumers expected due to low demand so small sized

Douglas fir lumber is overstocking.

SPF lumber for wooden framework construction method is

29.8 % more than the same period last year because

demand for rental unit is firm. Also, there had been a

shortage of some kinds of SPF lumber and consumers

purchased a certain number of SPF lumber.

The volume of hardwood logs and lumber decrease around

30% from the first half of 2023. There are enough

inventory of hardwood logs and lumber at manufacturers

and they shy away from high-priced products. As a result,

they started to purchase domestic hardwood lumber.

Domestic lumber and logs

Demand and supply for domestic lumber are different at

the lumber auction market and the precutting market.

Operations at some precutting plants increased in August,

2024.

Therefore, the orders increased for cedar pillar angles at

lumber plants or wholesalers in Kanto region. However, as

the lumber auction market was not lively, many lumber

plants in Tohoku region and Kyushu region control

production.

In the Kanto region, there are not enough cedar pillar

angles due to less supply of logs from Tochigi Prefecture

but the lumber auction market is dull so there is no

problem. The price of KD 105cedar post is around 50,000

– 55,000 yen, delivered per cbm and this is leveled off.

KD 3 m x 105 mm cedar stud is around 58,000 – 60,000

yen, delivered per cbm. The log price fell before the

summer holiday in Easter Japan because there would be

insect damages on logs and consumers reduced purchasing

the logs. The log price in Western Japan is high due to a

lack and a shortage of logs.

The price of cypress log in the northern part of Kanto

region is high. The price of cedar log in Tohoku region

and the northern part of Kanto region kept falling and the

price was under 13,000 yen at the end of August, 2024.

The medium sized larch log for lumber was 18,500 yen,

delivered per cbm.

In Western Japan, a cypress log for a post is around 22,000

yen in Chugoku region and for a sill is around 22,000 yen,

delivered per cbm in Chugoku region, Shikoku region and

Kansai region.

The cypress log for a post and a sill is 20,000 – 20,500

yen, delivered per cbm in Kyushu region. The cedar log

for a post is 14,000 – 15,000 yen, delivered per cbm.

The log price in Eastern Japan did not increase like last

year and the log price in Western Japan is almost flat from

last year. However, the lumber price declined widely from

previous year and there is less profits at the lumber

plants.The log price in Western and Eastern Japan at the

end of this year will become the focus whether up-turn or

not.

Plywood

Sluggish movement of domestic softwood plywood

continues in September, 2024. The price of 12 mm 3 x 6

domestic structural softwood plywood dropped to around

1,180 yen at the end of July, 2024.

As plywood manufacturers or distribution companies

announced to raise the price and the price was about to

reach the bottom. However, low demand for houses,

requests for lowering the price from precutting plants and

the mid-term settlement at the distribution companies have

influenced the price. Consumers do not buy plywood.

Movement of imported plywood is also sluggish in

September. The yen appreciated to 145 yen from 160 yen

at the end of August to September. Malaysian and

Indonesian plywood manufacturers expect to raise the

price and they showed the price by US$20 – 30, C&F per

cbm higher than before.

In South East Asia, 12 mm 3 x 6 painted plywood for

concrete form is US$600, C&F per cbm. Plywood form is

US$510, C&F per cbm and structural plywood is US$520,

C&F per cbm. 2.4 mm 3 x 6 plywood is US$950, C&F per

cbm. 3.7 plywood is US$880, C&F per cbm. 5.2 mm

plywood is US$850, C&F per cbm.

In Japan, 2.5 mm plywood is 780 yen, delivered per

sheet, in Tokyo metropolitan area. 4 mm is 1,000 yen,

delivered per sheet and 5.5 mm is 1,170 – 1,200 yen,

delivered per cbm.

12 mm 3 x 6 painted plywood for concrete form is 1,950

yen, delivered per sheet but some other wholesalers sell it

under 1,900 yen, delivered per sheet.Form plywood is

1,700 – 1,750 yen, delivered per sheet. Structural plywood

is 1,650 yen, delivered per sheet.

|