US Dollar Exchange Rates of

10th

Sep

2024

China Yuan 7.12

Report from China

Surge in plywood exports to Taiwan P.o.C

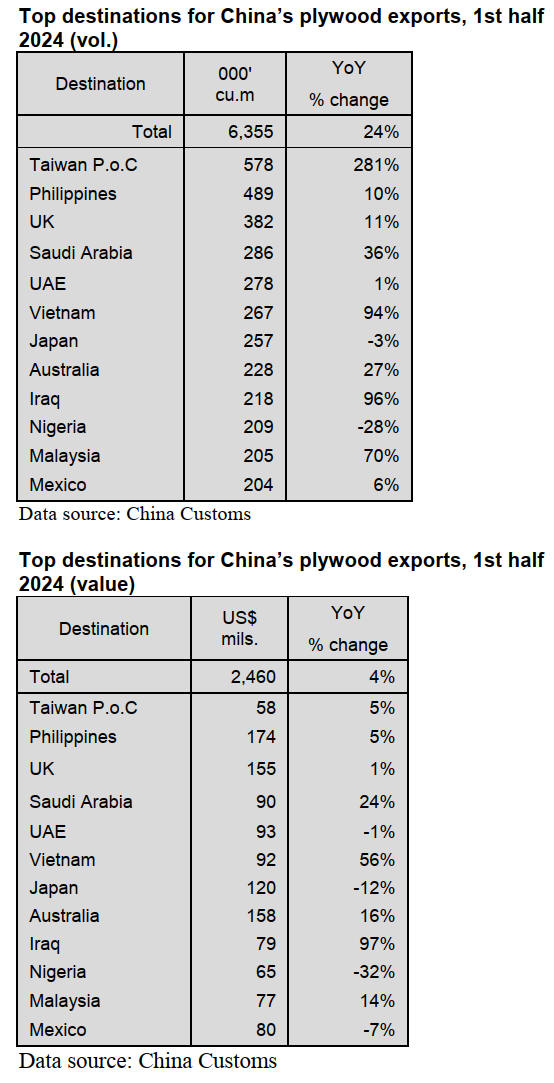

According to China Customs, plywood exports to Taiwan

P.o.C surged over 200% to 578,000 cubic metres in the

first half of 2024, overtaking exports to the Philippines. In

the first half of 2024 China’s plywood exports totalled

6.35 million cubic metres valued at US$2.46 billion, up

24% and 4% respectively.

The destinations for China’s plywood exports are

numerous and the proportion of China’s plywood exports

to the top 12 destinations accounted for 57% of the

national total in the first half of 2024.

China’s plywood exports to most markets have been rising

at different rates and to each of the top 12 destinations

volumes exceeded 200,000 cubic metres in the first half of

2024.

The Philippines, UK and Saudi Arabia were ranked after

Taiwan P.o.C in the first half of 2024. China’s plywood

exports to the Philippines and UK and Saudi Arabia grew

10%, 11% and 36% respectively which contributed to the

increase in the total volume of China’s plywood exports in

the first half of 2024.

In addition, China’s plywood exports to Vietnam, Iraq and

Malaysia also rose sharply by 94%, 96% and 70%

respectively in the first half of 2024. In contrast, China’s

plywood exports to Japan and Nigeria fell 3% and 28%

respectively in the first half of 2024.

China’s plywood exports to the USA rose in the first half

of 2024 and totalled 150,000 cubic metres valued at

US$88 million, up 5% in volume but down 15% in price.

The CIF price for China’s plywood exports to the USA

dropped 19% over the same period of 2023.

Decline in plywood FOB prices in all main markets

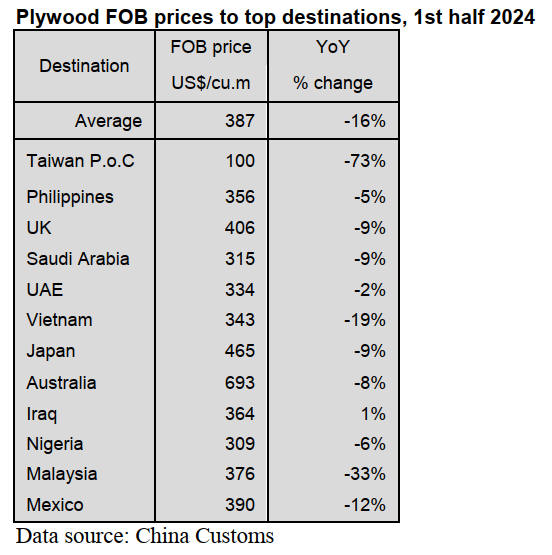

In almost all markets FOB prices for China’s plywood

exports declined in the first half of 2024. The average

FOB price for China’s plywood exports fell 16% over the

same period of 2023.

The rate of price decline for plywood exports to Taiwan

P.o.C was the largest at over 70% compared to the same

period in 2023 and it was one of the main reasons for the

surging of plywood exports to Taiwan P.o.C in the first

half of 2024.

In addition, the rate of FOB prices declines for China’s

plywood exports to Vietnam, Malaysia and Mexico were

large dropping 19%, 33% and 12% respectively over the

same period of 2023.

In contrast, the FOB price for China’s plywood exports to

Iraq alone rose 1% in the first half of 2024.

Russia largest supplier of plywood imports

According to China Customs, in the first half of 2024

China’s plywood imports rose almost 80% to 196,000

cubic metres valued at US$108 million, up 28% over the

same period of 2023.

In the first half of this year Russia was the largest supplier

of plywood imports and the volume of China’s plywood

imports from Russia surged over 100% to 173,000 cubic

metres, accounting for 88% of the national total plywood

imports.

China’s plywood imports from Indonesia and Malaysia, as

second and third largest suppliers, fell 7% and 31% in the

first half of 2024. Indonesia and Malaysia were the top

two suppliers for China’s plywood imports in the past. But

Russia is the largest supplier now.

China’s plywood imports from Vietnam surged in the first

half of 2024. Plywood imported from Vietnam to China

mainly included pine, eucalyptus and rubberwood

plywood. China also imports birch, walnut and maple

plywood from Vietnam. This imported plywood from

Vietnam is considered locally as being of good quality,

high strength and having long service life for a wide range

of applications such as architectural decoration, furniture

manufacturing and packaging industries.

Rise in wooden furniture exports

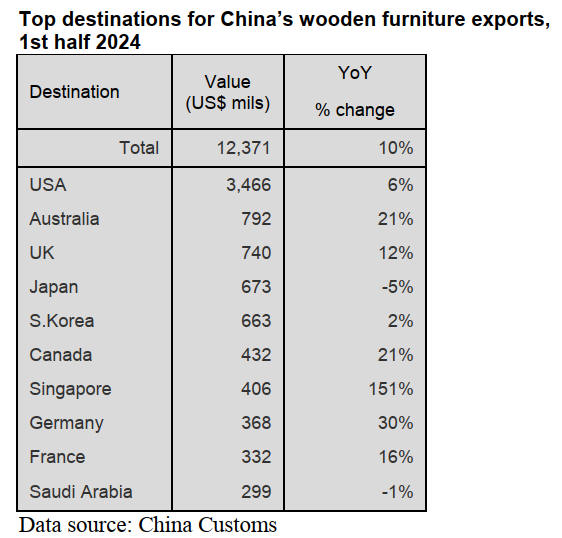

According to China Customs the value of China’s wooden

furniture exports rose 10% to US$12.37 billion in the first

half of 2024.

The markets for China’s wooden furniture exports are

scattered and China’s wooden furniture is exported to over

200 countries. The proportion of China’s wooden furniture

exports to the top 10 destination countries was 66% in the

first half of 2024.

The USA still is the largest market for China’s wooden

furniture exports. Some 28% of China’s wooden furniture

was exported to USA in the first half of 2024 and the

value of China’s wooden furniture exports to USA rose

6% to US$3.47 billion over the same period of 2023.

The value of China’s wooden furniture exports to

Singapore surged and to Australia, UK, Canada, Germany

and France also rose at faster rates in the first half of 2024.

In contrast, in the first half of 2024, China’s wooden

furniture exports to Japan and Saudi Arabia fell 5% and

1% over the same period of 2023.

Decline in wooden furniture imports

According to China Customs, in the first half of 2024 the

value of China’s wooden furniture imports fell 18% to

US$320 million over the same period of 2023.

Wooden furniture imports from the top 4 suppliers, Italy,

Germany, Vietnam and Poland dropped 13%, 28%, 12%

and 25% to US$155 million, US$45 million, US$30

million and US$14 million respectively in the first half of

2024. This directly resulted in the decline in the national

total value.

USA - largest market for bamboo furniture

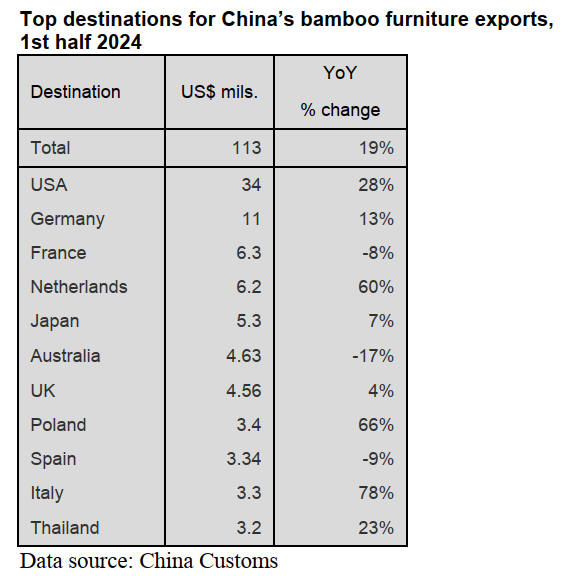

According to China Customs, the value of China’s

bamboo furniture exports rose 19% to US$113 million in

the first half of 2024.

There are multiple markets for China’s bamboo furniture

exports and bamboo furniture is being shipped to over

140 countries. The proportion of China’s bamboo furniture

exports to the top 11 destination countries was 75% in the

first half of 2024. The USA is the largest market for

China’s bamboo furniture exports. 30% of China’s

bamboo furniture was exported to USA in the first half of

2024 and the value of China’s bamboo furniture exports to

USA rose 28% to US$34 million over the same period.

Germany was the second largest market for China’s

bamboo furniture with around 10% of China’s bamboo

furniture going to this market in the first half of 2024. The

value of China’s bamboo furniture exports to Germany

rose 13% to US$11 million in the first half of this year

over the same period of 2023.

The value of China’s bamboo furniture exports to

Netherland, Poland and Italy also rose in the first half of

2024. In contrast, in the first half of 2024, China’s bamboo

furniture exports to France, Australia and Spain fell 8%,

17% and 9% over the same period of 2023.

Rise in bamboo furniture imports

According to China Customs, in the first half of 2024 the

value of China’s bamboo furniture imports rose 35% to

US$1.268 million over the same period of 2023.

China’s bamboo furniture imports from the top 3 supplier,

Indonesia, Vietnam and Italy, grew dramatically 33%,

204% and 93% to US$566,000, US$280,000 and

US$120,000 respectively in the first half of 2024. This

directly resulted in the increase of China’s bamboo

furniture imports.

Action Framework for legal and sustainable timber

supply chains

The Global Legal and Sustainable Timber Forum

(GLSTF) has launched the Action Framework for

Promoting Legal and Sustainable Timber Supply Chains to

strengthen international collaboration among stakeholders

in timber supply chains, promote the sustainable

development of the timber industry and contribute to the

Sustainable Development Goals and combating climate

change. The GLSTF is a collaborative platform of timber

industry stakeholders designed to strengthen networking

and business exchanges among timber industry

stakeholders to facilitate sustainable forest management

and the legal and sustainable use and trade of timber and

wood products.

The Action Framework sets out eight action areas—(1)

partnership networking; (2) information-sharing; (3)

market access facilitation; (4) certification and traceability

innovation; (5) innovative technologies and technology

transfer; (6) ways and means for sustainable finance and

investment; (7) industrial clusters and parks development;

and (8) capacity building and training.

One major challenge identified during discussions was the

lack of consumer awareness of the positive role that the

tropical timber industry is playing in helping to maintain

tropical forests and the contribution it makes to rural

livelihoods.

It was pointed out that there is little awareness outside the

forestry sector of the strong level of commitment to

development of national legal and sustainable forestry

systems and to the evolution of highly transparent supply

chains.”

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in China.

See: https://www.itto-

ggsc.org/static/upload/file/20240822/1724289606498649.pdf

|