|

Report from

Europe

EU tropical wood import quantity heading for an

historic low

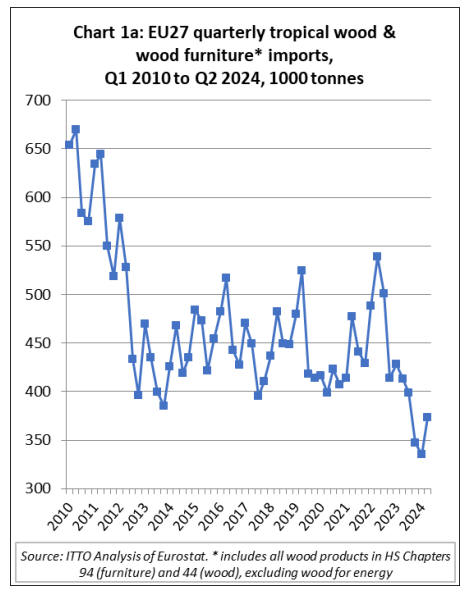

Total EU27 imports of tropical wood and wood furniture

of 373,500 tonnes in the second quarter of this year were

up 11% compared to the previous quarter but 10% less

than in the same quarter last year.

Although an improvement on the previous two quarters,

the second quarter figures remained well below the long-

term average (Chart 1a). In the first six months of 2024,

the EU27 imported 708,700 tonnes of tropical wood and

wood furniture, 16% less than the same period in 2023.

There are ominous signs that, in quantity terms, EU

imports of tropical wood and wood furniture products this

year may hit the lowest annual level ever recorded since

the EU was first formed (as the EEC) in 1957.

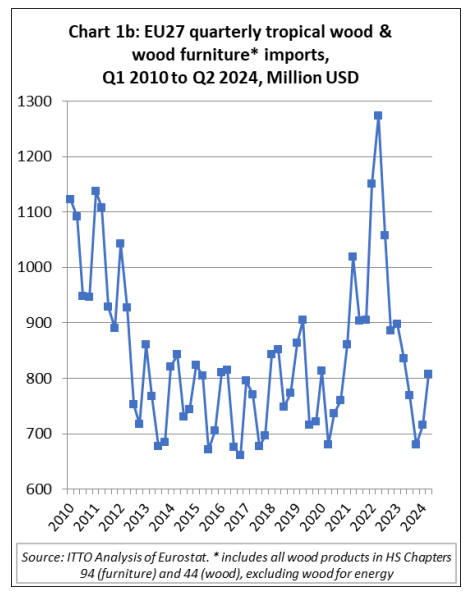

The trade figures look healthier when considered in value

terms. EU27 import value of tropical wood and wood

furniture in the second quarter this year was US$807

million, 13% more than the previous quarter and just 3%

down on the same quarter last year.

In value terms, EU27 tropical wood product imports are

similar to the low but stable level prevailing between 2013

and 2019 (Chart 1b). In the first six months of 2024, the

EU27 imported tropical wood and wood furniture with

total value of US$1523 million, 16% less than the same

period in 2023.

Soft landing for EU economy overall but construction

sector is very slow

The slow pace of tropical wood product imports into the

EU is occurring against the background of subdued and

uncertain economic conditions in the region. At first sight,

the EU seems to have managed a soft landing this year

after the COVID-driven boom and bust cycle that

characterised the previous three years.

The latest data from Eurostat indicates that seasonally

adjusted GDP in the EU in the second quarter of 2024 was

up 0.3% compared to the previous quarter. This followed

an equivalent 0.3% increase in the first quarter of the year.

Two consecutive quarters of solid, if unexciting, growth is

a relief after more than a year of stagnation.

GDP increased in the 2nd quarter of 2024 in seventeen EU

countries, remained stable in one and decreased in four

(2nd quarter data are not available for 5 countries at the

time of writing). Poland (up 1.5%) and Ireland (up 1.2%)

recorded the largest GDP increases.

There is also good news on employment, which is

growing, albeit more slowly than before. Wage growth is

outpacing inflation, too, leading to rising living standards.

Notwithstanding continuing concerns around inflation, the

European Central Bank felt confident enough to cut

interest rates in June and is expected to do so again in

September.

However, other aspects of the EU economy are more

problematic. A recent article in the Economist notes that

growth in incomes is not boosting consumption as much as

expected, noting that “households are mostly putting the

additional money from higher pay into their savings

accounts”, a sign of low consumer confidence. Eurostat

data confirms this. Following a dramatic fall in summer

2022, economic sentiment in the EU has been flatlining

for the last two years.

Following heavy expenditure on COVID recovery

measures between 2020 and 2023, European Governments

now have little room to support demand with extra

spending of their own. They are now more inclined to cut

expenditure to balance the books and meet EC

requirements to reduce deficits. According to the

Economist “fiscal policy will be a drag on EU growth in

the years to come”.

Much concern around the EU economy is now focused on

one country, Germany, traditionally the region’s industrial

powerhouse. Germany’s GDP declined by 0.1% in the

second quarter this year after achieving only 0.2% growth

in the first quarter. In fact, the German economy has

barely grown since 2019. Industrial production in the EU

was sliding in May and June, with Germany the principal

source of weakness.

Germany’s exports fell by 4.4% in June, compared with a

year earlier, and surveys indicate that worse is to come.

Germany’s car industry, globally dominant for so long, is

now coming under pressure as low-cost electric vehicles

(EVs) pour out of China’s factories. This is creating trade

tensions as China prepares to sue the EU at the World

Trade Organisation for raising tariffs on EVs.

The weakness of the EU construction sector is a particular

concern for the EU’s timber industry. Although Eurostat

data shows that the seasonally adjusted value of

construction activity in the EU increased by 1.1% in June,

this followed a long decline. Construction activity in May

was at the lowest level since December 2022.

Forward-looking indices suggest that EU construction

activity has continued to weaken. In August, the HCOB

Eurozone Construction PMI Total Activity Index - a

seasonally adjusted index tracking monthly changes in

total industry activity - was unchanged from July's six-

month low of 41.4, signalling a steep reduction in total

construction activity across the euro area. According to

this index, activity has now fallen in each of the last 28

months.

According to the HCOB PMI, the overall reduction in

construction activity in August reflected declines across

the three largest eurozone economies during the month.

Activity in Germany decreased at the sharpest rate in three

months, while there were slightly softer contractions in

France and Italy. The contraction was also broad based

across the three monitored segments of construction -

housing, commercial, and civil engineering – although it

was more pronounced in housing than the other sectors.

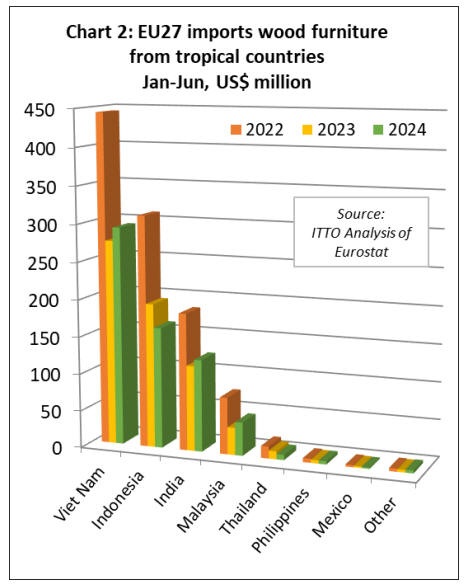

EU27 tropical wooden furniture imports make up for

some lost ground in Q2 2024

After a very slow start to the year, EU wooden furniture

imports from tropical countries made up for some lost

ground in the second quarter. In the first six months of the

year, the EU27 imported 153,200 tonnes of wooden

furniture from tropical countries with a total value of

US$641 million.

Import quantity was down 7% but import value was

unchanged compared to the same period in 2023. In the

first six months of this year compared to the same period

in 2023, EU27 import value of wood furniture increased

from Vietnam (+7% to US$293.3 million), India (+8% to

US$123.7 million), and Malaysia (+22% to US$44.6

million).

However, import value fell from Indonesia (-16% to

US$162.5 million), Thailand (-34% to US$7.1 million),

the Philippines (-1% to US$4.4 million), and Mexico (-

20% to US$1.7 million). EU27 wood furniture imports

from all other tropical countries were negligible during the

period (Chart 2).

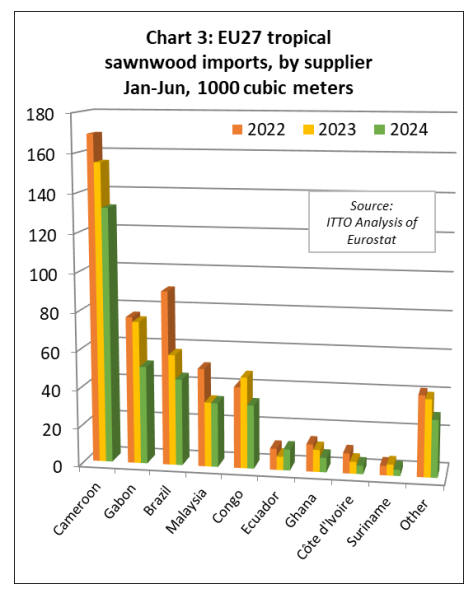

EU27 imports of tropical sawnwood down 20% in the

first half of 2024

The EU27 imported 350,500 cu.m of tropical sawnwood

in the first six months of this year, 20% less than the same

period in 2023.

Import value of this commodity was US$322.5 million in

the January to June period this year, 21% less than the

same period in 2023.

Imports declined from nearly all leading supply countries

during the period including Cameroon (-15% to 132,100

cu.m), Gabon (-31% to 50,800 cu.m), Brazil (-22% to

45,000 cu.m), Malaysia (-1% to 33,400 cu.m), Republic of

Congo (-30% to 33,100 cu.m), Ghana (-34% to 7,600

cu.m), Côte d’Ivoire (-30% to 4,400 cu.m), Suriname (-

43% to 3,300 cu.m) and the Central African Republic (-

54% to 3,100 cu.m).

Sawnwood imports from Ecuador bucked the overall

downward trend in the first half of this year, at 11,000

cu.m, up 57% compared to the same period in 2023 (Chart

3).

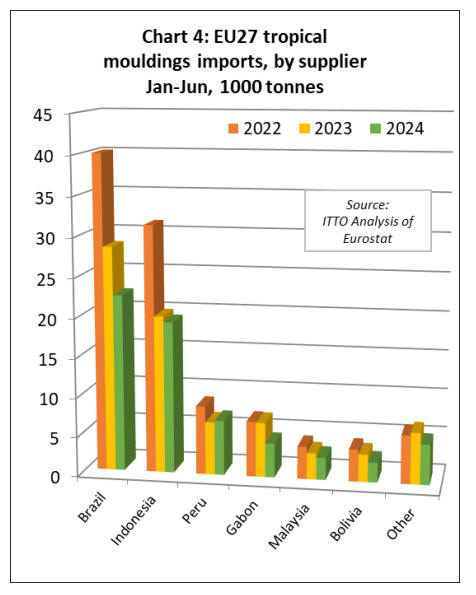

The EU27 imported 63,300 tonnes of tropical

mouldings/decking in the first six months of this year,

16% less than in the same period in 2023.

Import value of this commodity was down 24% to

US$110.6 million in the same period. During the first six

months, imports increased year-on-year from Peru (+4%

to 6,900 tonnes) but fell from all other leading supply

countries including Brazil (-21% to 22,400 tonnes),

Indonesia (-4% to 19,200 tonnes), Gabon (-37% to 4,300

tonnes), Malaysia (-16% to 2,800 tonnes), and Bolivia (-

28% to 2,500 tonnes) (Chart 4).

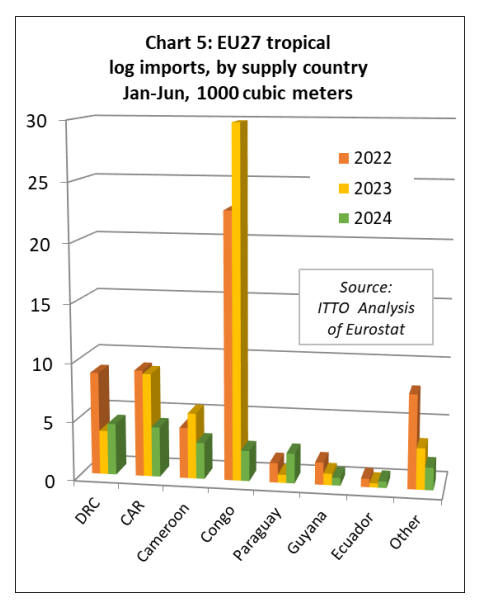

The EU27 imported 20,000 cu.m of tropical logs with a

total value of US$18.3 million in the first six months of

this year, respectively 63% and 65% less than in the same

period last year. The decline was driven mainly by an 91%

decline in imports from the Republic of Congo to 2,600

cu.m. This follows the ban on exports of most logs from

the country since 1st January 2023.

EU27 imports of logs in the first quarter of this year were

also down compared to the same period last year from the

Central African Republic (-52% to 4,300 cu.m), Cameroon

(-45% to 3,100 cu.m), and Guyana (-32% to 700 cu.m).

However, EU27 log imports increased from the

Democratic Republic of Congo (+17% to 4,400 cu.m),

Paraguay (+267% to 2,500 cu.m), and Ecuador (+54% to

500 cu.m) during the six-month period (Chart 5).

EU27 imports of tropical hardwood veneer, plywood

and joinery decline sharply

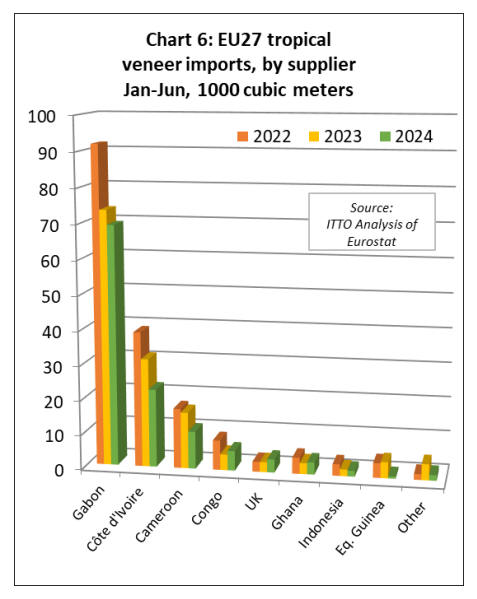

The EU27 imported 119,400 cu.m of tropical veneer with

a total value of US$80.5 million in the first six months of

this year, down 16% and 18% respectively compared to

the same period last year. Imports of tropical veneer from

Gabon, by far the largest supplier to the EU27, were

69,300 cu.m in the first six months of this year, 6% less

than the same period in 2023.

EU27 imports of this commodity also decreased during the

period from Côte d'Ivoire (-28% to 22,500 cu.m),

Cameroon (-34% to 10,800 cu.m), Indonesia (-15% to

1,600 cu.m), and Equatorial Guinea (-87% to 600 cu.m).

Veneer imports into the EU27 increased during the six-

month period from the Republic of Congo (+24% to 5,700

cu.m), the UK (+30% to 3,800 cu.m), and Ghana (+11% to

3,500 cu.m). (Chart 6).

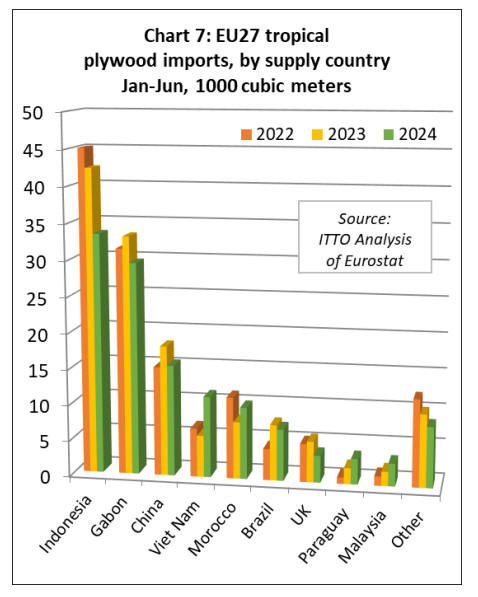

The EU27 imported 126,000 cu.m of tropical plywood

with a total value of US$91.5 million in the first six-

months of this year, respectively 7% and 10% less than the

same period last year.

Imports fell from the three leading supply countries during

the period including Indonesia (-21% to 33,400 cu.m),

Gabon (-11% to 29,600 cu.m), and China (-15% to 15,500

cu.m).

Imports from Brazil were also down, by 7% to 7,200 cu.m,

while indirect imports via the UK fell 34% to 3,800 cu.m.

However, these losses during the six-month period were

partly offset by rising imports from Vietnam (+95% to

11,300 cu.m), Morocco (+26% to 10,000 cu.m), Paraguay

(+59% to 3,600 cu.m), and Malaysia (+58% to 3,200

cu.m) (Chart 7 left).

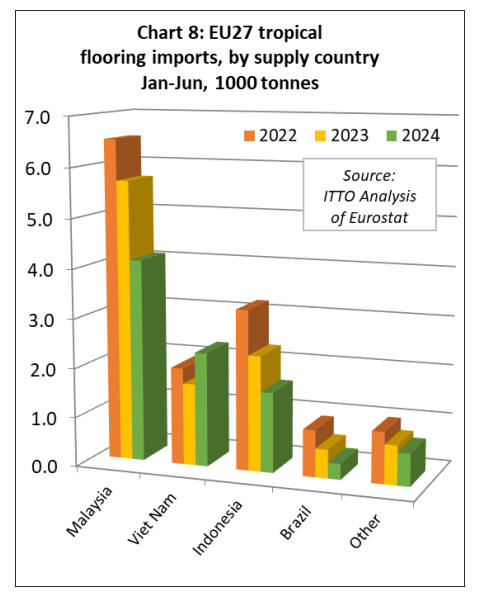

The EU27 imported 9,000 tonnes of tropical wood

flooring with a total value of US$23.1 million in the first

six months of this year, down 19% and 27% respectively

compared to the same period in 2023.

Imports of 4,100 tonnes from Malaysia in the first six-

months of this year were 28% less than the same period

last year. Flooring imports also fell from Indonesia (-39%

to 2,300 tonnes) and Brazil (-45% to 300 tonnes).

However, imports increased from Vietnam (+39% to 2,300

tonnes) (Chart 8).

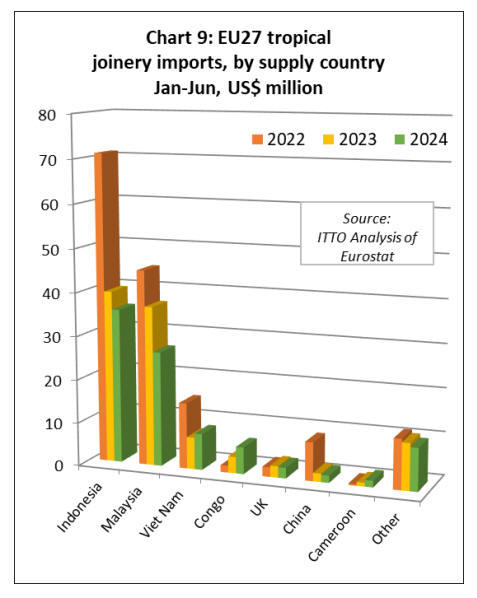

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors – was

US$91.8 million in the first six-months of this year, down

11% compared to the same period in 2023. Import

quantity fell 2% to 40,700 tonnes during the same period.

Between January and June this year, EU27 import value of

other joinery products was down 10% to US$35.6 million

from Indonesia and down 28% to US$26.4 million from

Malaysia.

However, import value from Vietnam increased 13% to

US$8.3 million during the six-month period. In a

potentially significant longer-term development, given

efforts in central Africa to shift up the value chain as log

exports are banned.

EU import value of laminated joinery products in the first

six months of 2024 was up 62% to US$6.1 million from

the Republic of Congo and up 74% to US$1.5 million

from Cameroon (Chart 9).

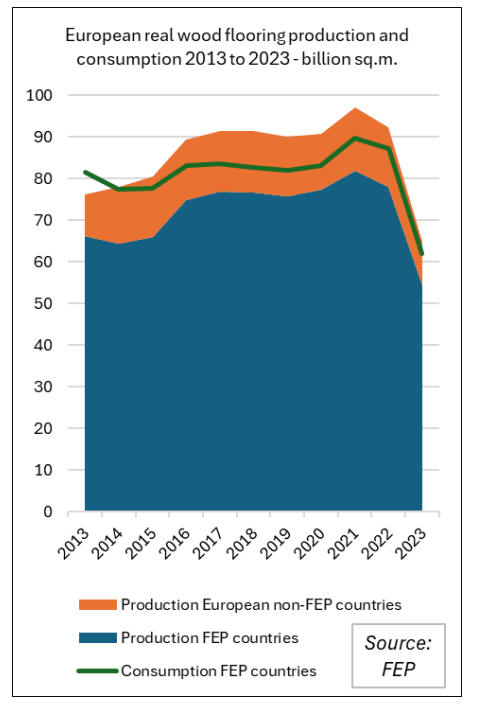

European parquet market hits bottom last year

According to data released by the European Parquet

Flooring Federation (FEP), after a good year in 2022

which consolidated the level reached during the boom in

2021, the European market for real wood flooring

experienced a significant 30.5% fall in 2023.

Decreases were observed in all European markets,

reflecting the decline in construction activity, high interest

rates, and lack of consumer confidence.

In 2023, real wood flooring production in FEP countries

fell by 30.5% in 2023 to 54.4 million square metres, while

consumption also fell by over 30% to 62 million sq.m.

FEP countries include Austria, Belgium, Croatia, Czechia,

Denmark, Estonia, Finland, France, Germany, Hungary,

Italy, Netherlands, Norway, Poland, Portugal, Romania,

Slovenia, Spain, Sweden, and Switzerland.

Real wood flooring production in European countries that

are not members of FEP is estimated to have reached 10.4

million sq.m. in 2023. This implies that total European

real wood flooring production fell nearly 30% to 64.74

million sq.m. last year.

In 2023, the proportion of real wood flooring production

in FEP countries by product type was largely unchanged

from that reported ever since 2010. Multilayer dominates

with 84% (compared to 83% in 2022), followed by solid at

14% (compared to 15% in 2022) and mosaic with a stable

2% of total production.

Oak is hugely dominant, with 83% of all real wood

flooring manufactured in FEP countries faced with this

species in 2023, up from 82% in 2022. 2% of real wood

flooring manufactured in the region comprised tropical

wood, although the category “other” at 3.2% may, partly,

be comprised of tropical wood. Ash and beech were two

other most common species, contributing 4.5% and 2.7%

respectively.

Poland remained the largest producer country, contributing

18% of total production in FEP countries, followed by

Austria (14%), and Sweden (12%).

Despite a decline in consumption last year, amongst FEP

countries Germany was the largest single market for real

wood flooring, accounting for 17% of total sales in the

region in 2023. The next largest markets were Italy (13%)

, Sweden (11%), and France (10%).

In terms of per capita real wood flooring consumption,

Austria, Switzerland, Estonia, Croatia, and Sweden are the

leading markets. Consumption per inhabitant fell

significantly in FEP member countries, from 0.20 sq.m. in

2022 to 0.14 sq.m. in 2023.

According to their mid-year forecast, FEP expect that the

year 2024 will be stable overall but at a low level of

consumption. The sector seems to have reached bottom

but may remain at this level for some time. Stocks are now

much lower and well balanced with demand, which is very

slow.

Delivery times in the European parquet industry have

returned to pre-Covid level. In general, the situation

remains difficult as interest rates are high and construction

activity is subdued. On 4 April this year, FEP lodged a

formal complaint with the EC on behalf of the EU

multilayered wood flooring industry alleging that EU

imports of this product originating in the People’s

Republic of China, are being dumped and “thereby

causing injury to the Union industry”.

The EC is investigating the complaint, the subject of

which is assembled flooring panels, multilayer, of wood,

currently falling under CN code 44187500. Panels of

bamboo or with at least the top layer (wear layer) of

bamboo, and panels for mosaic floors are excluded from

the complaint and the investigation.

See: https://www.parquet.net/2024/06/european-parquet-market-

bottom-2023.html

and

https://eur-lex.europa.eu/legal-

content/EN/TXT/HTML/?uri=OJ%3AC_202403186

|