Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Nov

2024

Japan Yen 154.19

Reports From Japan

Inflation slowed in

October

The Ministry of Internal Affairs reported consumer prices,

excluding fresh food, rose 2.3% in October from a year

earlier, down from 2.4% in September. That was above the

forecast 2.2%. The October data is likely to keep the Bank

of Japan (BoJ) on track to raise interest rates in December.

The BoJ has long held the view that its goal is a virtuous

cycle between wages and prices. However, the October

inflation figure could mean the Bank will not move too

fast or too far at once.

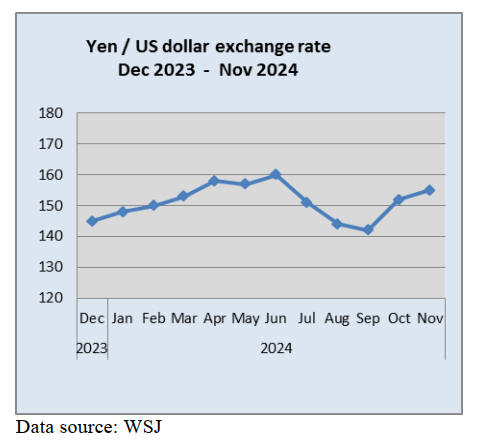

Most analysts expect the BoJ to continue with a “gradual

uptick” of interest rates as the Bank uses monetary policy

to keep the exchange rate from becoming volatile. The yen

weakened against the US dollar in November, hitting a

four month high of 156.74 on 15 November but has since

recovered slightly.

A leading indicator of service-sector inflation held near

3% in October offering further evidence that conditions

for another interest rate hike by the Bank of Japan were

falling into place.

While uncertainty over US president-elect policies clouds

the outlook, many analysts expect Japan's economy to

sustain a moderate recovery and help keep inflation

around the Bank’s 2% target.

See:

https://www.japantimes.co.jp/business/2024/11/22/economy/japa

n-october-inflation/

and

https://www.boj.or.jp/en/statistics/pi/cspi_release/sppi2410.pdf

Inflation triggered by a weaker yen weighs on

consumer spending

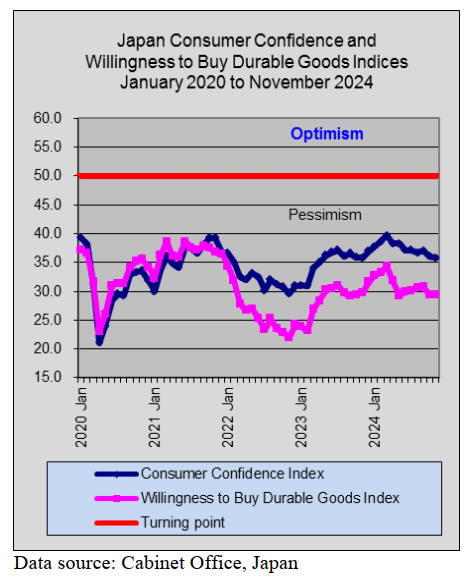

The Liberal Democratic Party-Komeito coalition reached

an agreement with the opposition Democratic Party for the

People (DPP) on an economic stimulus package which,

with opposition votes, secured parliamentary approval.

The DPP pushed for an increase of the limit for income tax

exemptions and temporary relief in the gasoline tax. The

package, worth 39 trillion yen (US$250 billion), features

energy subsidies and cash handouts to low-income

households as inflation triggered by a weaker yen

continues to weigh on consumer spending.

With inflation outpacing wage growth prompting

households to cut discretionary spending, the new package

aims to address the negative impact of inflation and

achieve the government’s goal of revitalising struggling

regional economies.

See:

https://mainichi.jp/english/articles/20241122/p2g/00m/0na/02900

0c

December interest rate increase anticipated

Many financial analysts anticipate the BoJoJ) will increase

interest rates in December as they see the impact of a

delay being a further weakening of the yen.

The Govenor of the BoJ said the Bank must phase down

stimulus in a measured fashion as keeping real interest

rates low for too long will accelerate inflation.

US/Yen exchange rate set to move

The likelihood of a progressive rise in interest rates by the

BoJ and the possibility of further reductions by the Federal

Reserve could drive a recovery of the yen to 130 against

the US dollar according to some writers.

Can economy transform to more ‘normal’ growth?

UBS, a multinational investment bank and financial

services company founded and based in Switzerland

recently published its ‘Japan Economic Outlook 2024-

2025’. This says Japan's economy is at critical moment to

transform from three decades of stagflation to "a mild

nominal growth" period.

UBS says Japan's economy has seen no nominal GDP

growth since the asset bubble burst in the early 1990s.

However, now UBS reports signs that nominal growth is

returning, with a shift in consumer expectations of wages

and price movements.

UBS point out " While this dynamic may not continue in

the event of unexpected negative shocks, such as a severe

recession in the US and/or China, our base case looks for

this transformation to be sustained despite global

headwinds (US mild recession and high uncertainties in

terms of geopolitical risk).”

See: https://www.ubs.com/global/en/investment-bank/insights-

and-data/2023/japan-economic-outlook-2024-2025.html

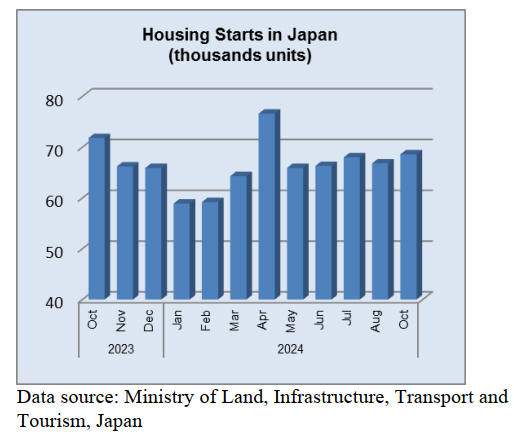

Hunting hidden property value

Global hedge funds and private equity firms are investing

in Japanese companies in a bid to unlock as much as yen

25 trillion (US$165 billion) in undervalued real estate held

by companies.

The hidden value of property on corporate balance sheets

is showing up as a theme behind some of the biggest

activist campaigns and mergers and acquisitions

announced in Japan this year.

See:

https://theedgemalaysia.com/node/735819?utm_source=Newswa

v&utm_medium=Website

Import update

Assembled wooden flooring imports

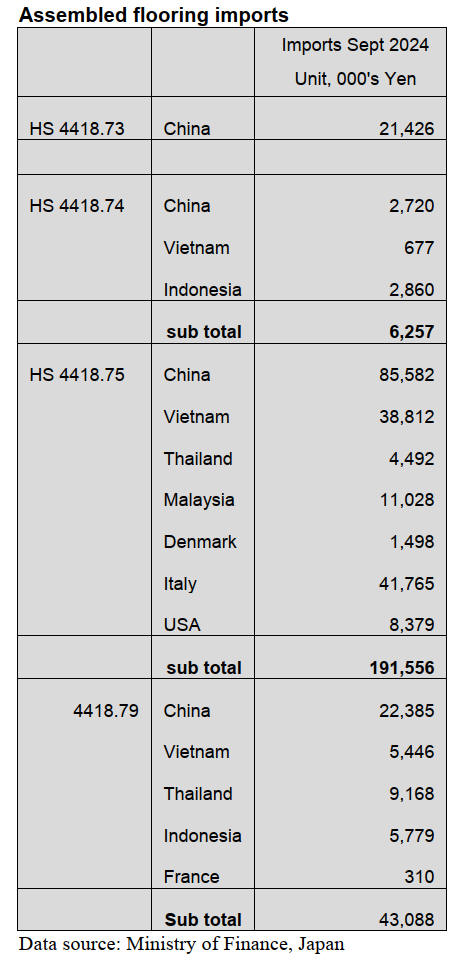

The value of assembled wooden flooring (HS441871-79)

in September recovered from the decline seen in August,

rising 14% but compared to a year earlier the value of

September imports of HS441871-79 were down 9%

As in previous months the main category of assembled

flooring imports was HS441875, accounting for 73% of

the total value of assembled flooring imports, the same

level as in August.

The second largest category in terms of value

was

HS441879 (16%) , a doubling of the value compare to

August and reflects higher imports rather than currency

weakness as the yen exchange rate was fairly stable in

September. The third category of import was HS441873

(9%) with the balance being HS441974.

Of HS441875 imports 45% was provided by shippers in

China, 22% by shippers in Italy and 20% from shippers in

Vietnam. The three other sources of assembled flooring

(HS441875) in September were the US, Malaysia and

Thailand.

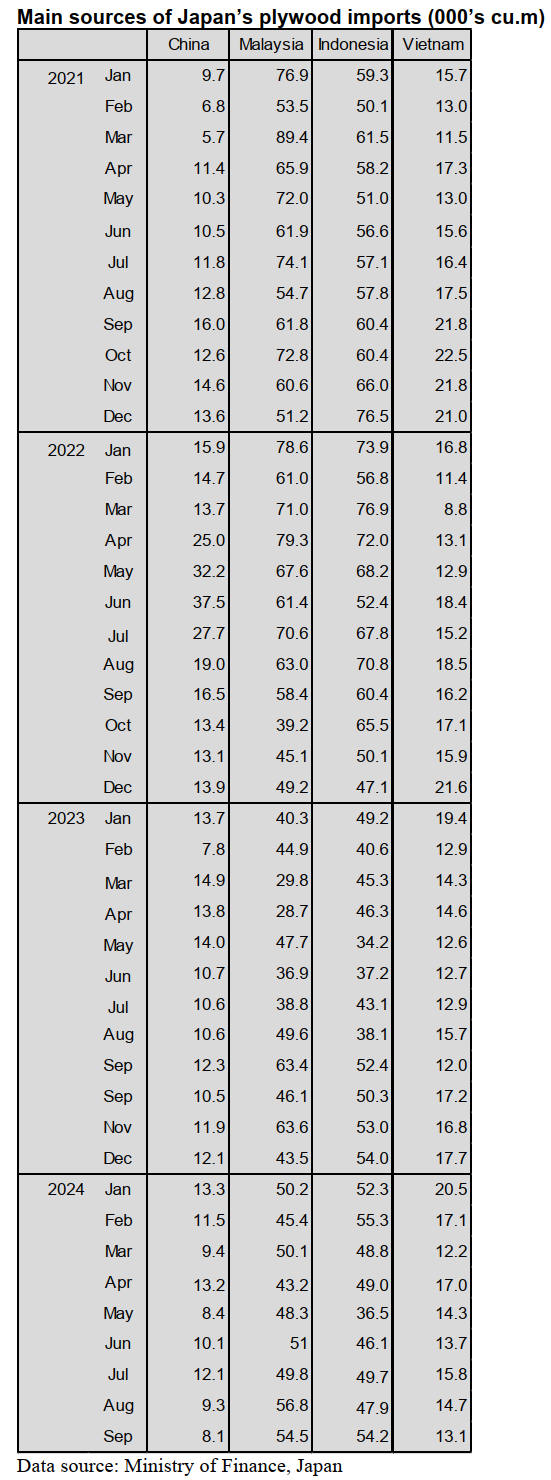

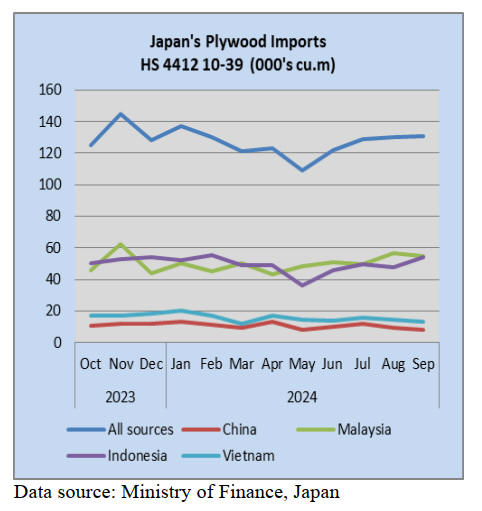

Plywood imports

The volume of September plywood imports (441210-39)

was 130.998 cu.m, almost the same as in the previous

month but this volume represented a decline (8%) on

levels a year earlier.

In September, once again, plywood arrivals from

China

and Vietnam were down compared to a month earlier.

Arrivals from Malaysia were almost the same as in August

so it was only shippers in Indonesia that saw a rise in

volumes in September.

As in previous months, of the various categories of

plywood imported in September HS441231 was the largest

accounting for 89% of the total volume of plywood

imports with the balance fairly evenly distributed across

the other HS codes.

Malaysia and Indonesia accounted for most of the

HS441231 arrivals. Shipments from Vietnam and China

were spread across the categories tracked except in the

case of HS4410 where China was the only shipper in

September. Other shippers appearing in Japan’s plywood

import statistics in September included Denmark, USA,

Thailand, Italy and France.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Operating conditions of Forest Management

It has been five years since the forest management control

system started by using the Forest Environmental Tax as a

financial resource.

The number of managers has increased but there are still

not enough workers. Japan Forest Products Journal held a

survey through municipalities. 277 municipalities had

answered to the survey. 45.5 % of 277 municipalities say

that an assumption and a plan are behind the schedule.

Many municipalities answered "uncertain" to the

questions, which are "do you grasp the current situation?"

or "what is your prospect?".

The forest management control system is about

maintenances of private and planted forest under the

control of forest managers, who are certified by the

prefectures, by using the transferred tax.

There were not enough staff, who had specialized

knowledge of forest managing control, at government

offices before the system began. However, there are more

staff at the government offices than before but still a labor

shortage.

Large diameter timber for producing plywood

Akita Plywood Corporation in Akita Prefecture upgraded

the facilities and now works on producing plywood using

large diameter timber.

The company installed a ring barker, which is able to peel

maximum 80 cm diameter timber, at Mukaihama Plant 2

in April, 2024 and installed a rotary peeling machine,

which is able to cut maximum 100 cm diameter timber, at

Mukaihama Plant 1 in August, 2024. They are in

operations smoothly.

The company is prepared to accept many sizes of logs

from loggers and is able to manufacture large diameter

timber, which used to be manufactured into wooden chips,

into plywood.

There had been two ring barkers at Mukaihama Plant 2

and one of them was renewed. The new ring barker is able

to peel 2 m or 4 m length and 80 cm diameter logs.

There had been one rotary peeling machine at Mukaihama

Plant 1 and it had been 24 years. Then, the machine’s

electric components was discontinued and this is the

reason for installing the new rotary peeling machine. The

old machine could cut 70 cm diameter timber but the new

machine is able to cut maximum 100 cm diameter timber.

The cutting speed of the new machine is changed to 160 m

per minute from 125 m per minute. The productivity is

improved by 20 %.

Logs are peeled at Mukaihama Plant 2 and are delivered to

Mukaihama Plant 1, which is neighbor to Mukaihama

Plant 2, for cutting.

Sometimes over 70 cm diameter timber is delivered to the

company’s plywood plant but it is not a lot. However,

large diameter cedar logs in Akita Prefecture has been

increasing every year. To make a good environment for

the loggers to cut down the large diameter timber, the

company decided to upgrade the facilities.

Mahogany plywood

Tokyo Shinjuku Mokuzai Ichiba Co., Ltd. in Tokyo

Prefecture started to sell mahogany plywood. Mahogany is

used as a core of plywood and falcata is used on face and

back of plywood. The pull-out strength of nails is two

times stronger than all falcata plywood. The proof stress is

about 85 % more than all lauan plywood. Mahogany and

falcata are both from a plantation in Indonesia. The sizes

of plywood are 2.5 – 24 mm x 910, 1,220 – 1,820 and

2,440 mm.

Mahogany is one of the world’s three major precious

woods and is used for luxury furniture, musical

instruments and floors. It is hard and is easy to process and

exhibits dimensional stability.

The company sells not only wood products but also

plywood and gypsum boards at the market every month.

Many buyers visit the market and are able to touch the

company’s products.

If the company could explain about the products well at

the market, the buyers would understand how good the

products are.

The company struggled with selling all falcata plywood at

first but the company explained about the falcata plywood

to buyers. Then, the buyers started to purchase the all

falcata plywood. The new plywood is sold at only Tokyo

Shinjuku Mokuzai Ichiba. The wholesalers of mahogany

consider that mahogany is familiar to lumber dealers so

the mahogany plywood would be accepted easily.

There are several kinds of plywood such as all lauan

plywood, all falcata plywood and combination of falcata

and other material plywood. Requests for the price and

performance from construction sites are different so the

lumber dealers might suffer with inventory. The branding

of mahogany plywood is the company’s goal.

South sea logs and products

Movement of South Sea and Chinese lumber is dull

due to the unclear foreign exchange rates

Demand for lumber is weak because the end of the year is

drawing near but there are some inquiries for lumber. The

yen depreciated to 150 yen against the US dollar in

October, 2024 and many Japanese distributors watched

carefully about results of the general election in Japan and

the US presidential election.

As for large laminated boards, Indonesian laminated

lumber manufacturers expected to raise the selling price

but they gave up because the yen was weak against the US

dollar. The price of large laminated board stayed the same.

The price of Chinese red pine lumber in Japan is 130,000

yen, FOB per cbm. Indonesian Merkusi lumber is

125,000yen, FOB per cbm. These prices are leveled off

from last time.

|