|

Report from

Europe

EU tropical wood imports at a low ebb in the first

quarter of 2025

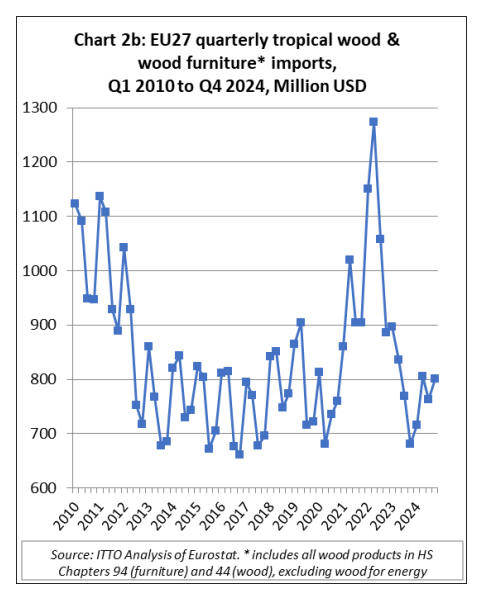

The EU27 imported 373,200 tonnes of tropical wood and

wooden furniture in the first quarter of 2025, 11% more

than the same quarter in 2024. This gain seems less

impressive when it is considered that EU imports were at

an all-time low at the start of 2024.

Imports in the first three months of this year were also

down 5% compared to the fourth quarter of 2024. Import

tonnage during the first three months of this year remained

well below quarterly trade figures typical during the pre-

pandemic 2013-2019 period.

EU27 import value of tropical wood and wooden furniture

in the first quarter of 2025 was USD809 million, 1% more

than the previous quarter and 13% up on the same quarter

in 2024. In value terms, imports during the first quarter of

2025 were more closely aligned with those of the pre-

pandemic 2013-2019 period (Chart 2b).

Some slight signs of warming in the European

economy

The slow pace of EU tropical wood and wooden furniture

imports in the first quarter of 2025 is disappointing after

such a long period of low trade and at a time when there

were emerging signs of economic recovery in the region.

The European Commission Spring Forecast published on

19 May reveals that the EU economy grew by 0.4% in the

fourth quarter of last year, slightly surpassing the EC’s

autumn projections. For the whole of 2024, GDP growth

in the EU reached 1.0%.

The volume of government consumption expanded

vigorously and provided a larger-than-expected

contribution to EU growth at the end of last year, mainly

through employment growth in the government sector.

Growth in private consumption also exceeded expectations

towards the end of the year, driven by solid increases in

disposable income as the economy added over 1.7 million

jobs, and nominal wages recovered the purchasing power

lost to surging inflation. Net exports also bolstered EU

growth, buoyed by a robust rise in services exports. The

EU's economic expansion continued in the first quarter of

this year, with real GDP growth increasing by 0.3%.

The EC’s expectations for GDP growth in the EU during

the rest of this year are now tempered by the impact of

increased tariffs and the heightened uncertainty caused by

the recent abrupt changes in US trade policy and the

unpredictability of the tariffs’ final configuration. GDP

growth in the EU in 2025 is currently projected at 1.1%,

only a marginal gain compared to 2024 and representing a

considerable downgrade compared to the Autumn 2024

Forecast.

This forecast assumes that the high tariffs announced on 2

April will not be reinstated and that US tariffs on imports

from the EU and nearly all other countries will stay at 10%

(the level generally applied on 9 April), except for higher

tariffs on steel, aluminium, and cars (25%), and

exemptions on some products like pharmaceuticals and

microprocessors.

There is a much uncertainty around these assumptions at

time of writing in the last week of May. There is a huge

amount at stake in on-going trade negotiations between the

US and EU which, if not successfully concluded by the 8

July deadline mutually agreed by the parties, could lead to

the imposition of tariffs as high as 50% for a large

proportion of bilateral EU-US goods trade.

Even more far-reaching and mutually destructive

restrictions could potentially be imposed on bilateral trade

in services. Given that total EU-US trade in goods and

services was valued at €1.6 trillion in 2023, the impact of a

breakdown in these on-going negotiations for the wider

global economy would be considerable.

Slow eurozone construction puts the brakes on wood

consumption

The weakness of the EU construction sector continues to

be a particularly significant drag on EU demand for all

timber products. Forward-looking indices show that EU

construction activity continues to decline. The HCOB

Eurozone Construction PMI Total Activity Index, a

seasonally adjusted index tracking monthly changes in

total industry activity, posted 44.8 in March and 46.0 in

April, both well below the boundary line (at 50) separating

growth from contraction.

The latest downturn extends the current sequence of

falling activity to 36 months. The only good news is that

the decline in April 2025 was the softest since February

2023. The slower decline largely reflected a softer

reduction in Germany, while the contraction in France

strengthened slightly. Meanwhile, activity in Italy broadly

stalled over the month.

Lower output was broad-based in nature across the three

monitored sectors covered by the report. Housing once

again posted the sharpest decline, though the latest

reduction was the softest in 26 months. Commercial and

civil engineering activity also saw softer contractions over

the month, though both remained solid overall.

Increase in EU27 tropical wooden furniture imports in

Q1 2025

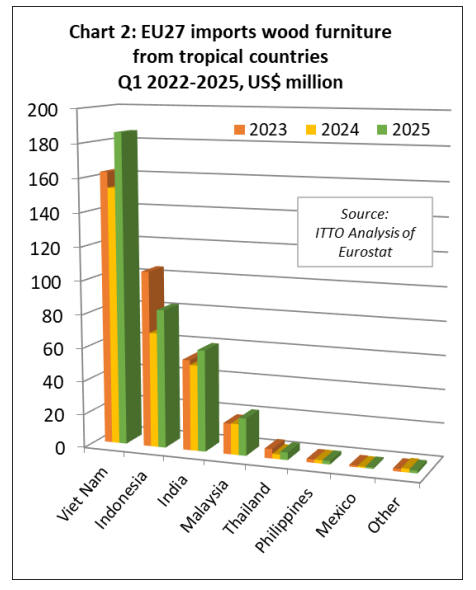

The EU27 imported 84,000 tonnes of wooden furniture

from tropical countries with a total value of USD361

million in the first quarter of 2025. Import quantity and

value were up 18% and 20% respectively compared to the

same period in 2024.

In the first quarter of 2025, EU27 import value of wooden

furniture increased from all major supply countries

including Vietnam (+21% to USD185.8 million),

Indonesia (+20% to USD82.8 million), India (+18% to

USD60.7 million), Malaysia (+20% to USD22.3 million),

Thailand (+59% to USD4.5 million), the Philippines (+2%

to USD2.1 million), and Mexico (+18% to USD0.9

million).

EU27 wooden furniture imports from all other tropical

countries were negligible during the quarter (Chart 2).

EU27 imports of tropical sawnwood just surpass last

year’s record low

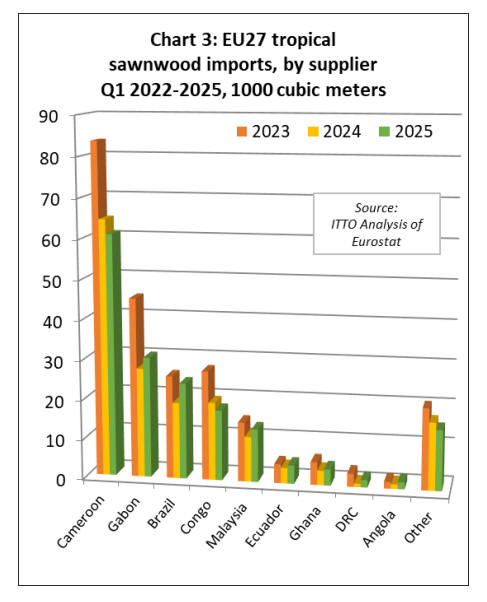

The EU27 imported 174,000 cu.m of tropical sawnwood

with a total value of USD158.3 million in the first quarter

of 2025, respectively 3% and 5% more than the same

period in 2024.

Tropical sawnwood imports were down in the first three

months of 2025 compared to the same period last year

from Cameroon (-6% to 60,900 cu.m), the Republic of

Congo (-10% to 17,700 cu.m), and Côte d'Ivoire (-43% to

1,400 cu.m).

However imports were up from all other major supply

countries including Gabon (+10% to 30,300 cu.m), Brazil

(+26% to 24,100 cu.m), Malaysia (+17% to 13,300 cu.m),

Ecuador (+19% to 4,600 cu.m), Ghana (+12% to 4,100

cu.m), the Democratic Republic of Congo (+126% to

1,900 cu.m), and Angola (+59% to 1,800 cu.m) (Chart 3).

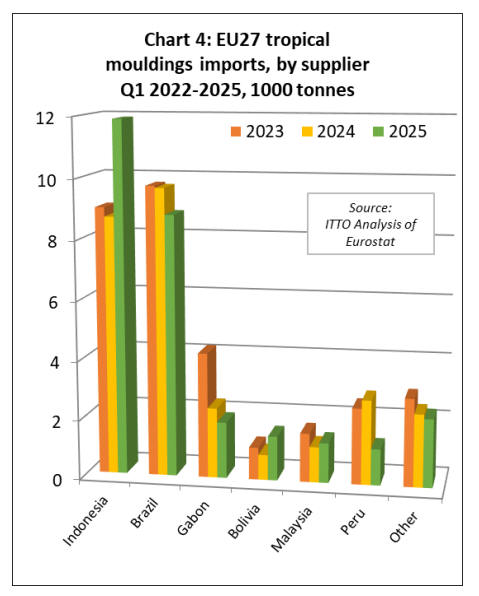

The EU27 imported 28,900 tonnes of tropical

mouldings/decking with a total value of USD51 million in

the first quarter of 2025, respectively 3% and 4% more

than the same period last year. The increase was driven by

a rise in imports from Indonesia (+37% to 11,900 tonnes),

Bolivia (+76% to 1,500 tonnes), and Malaysia (+13% to

1,300 tonnes). Imports declined from Brazil (-9% to 8,800

tonnes), Gabon (-203% to 1,900 tonnes), and Peru (-57%

to 1,200 tonnes) (Chart 4).

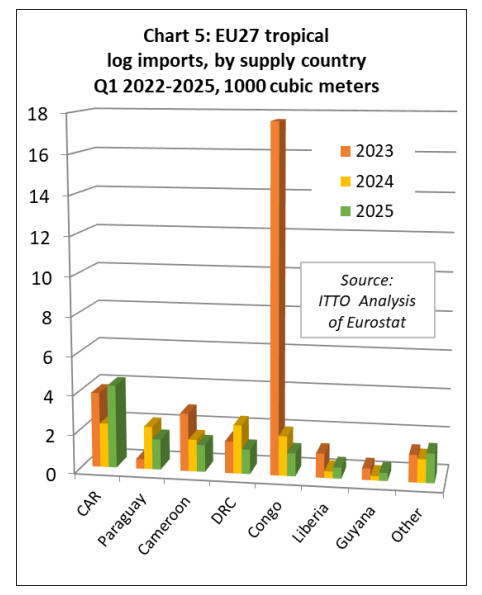

The EU27 imported 12,100 cu.m of tropical logs with a

total value of USD6.2 million in the first quarter of 2025,

respectively 2% and 14% less than the same period in

2024.

The decline in trade partly reflects progressively

tightening measures to curtail log exports from Central

Africa. In the first quarter of 2025, EU27 log imports fell

from Cameroon (-15% to 1,400 cu.m), the Democratic

Republic of Congo (-49% to 1,300 cu.m), and the

Republic of Congo (-42% to 1,200 cu.m).

Logs imports were also down from Paraguay, by 29% to

1,600 cu.m. However, these losses were partly offset by

increases from the Central African Republic (+88% to

4,300 cu.m), Liberia (+63% to 600 cu.m), and Guyana

(+88% to 400 cu.m) (Chart 5).

Slightly better start to the year for EU imports of

tropical panels and joinery products

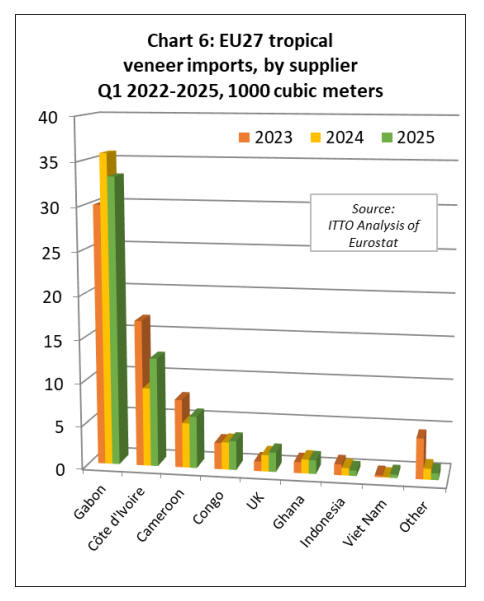

The EU27 imported 60,800 cu.m of tropical veneer with a

total value of USD40.9 million in the first quarter of 2025,

respectively up 3% and 1% compared to the same period

last year.

Imports of tropical veneer decreased 7% to 33,200 cu.m

from Gabon, the largest supplier, during the three month

period. They were also down from Ghana (-2% to 1,600

cu.m) and Indonesia (-28% to 600 cu.m) during the period.

However, EU27 imports increased in the first quarter of

2025 from Côte d'Ivoire (+39% to 12,600 cu.m),

Cameroon (+15% to 6,000 cu.m), the Republic of Congo

(+6% to 3,400 cu.m), the UK (+17% to 2,200 cu.m), and

Vietnam (+523% to 400 cu.m) (Chart 6).

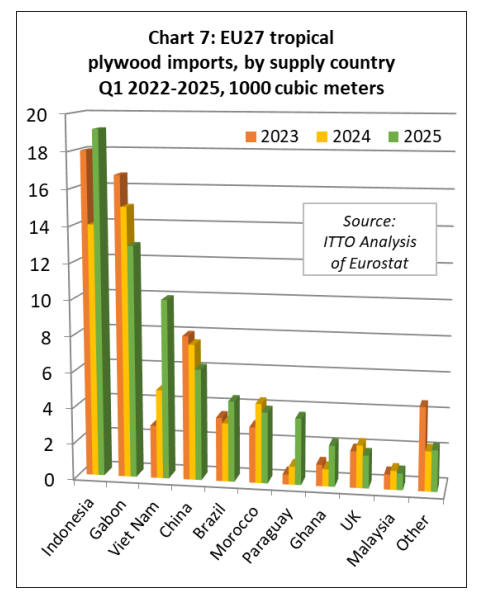

The EU27 imported 67,800 cu.m of tropical plywood with

a total value of USD47.4 million in the first quarter of

2025, up 19% and 11% respectively compared to the same

period in 2024. Imports increased during the three-month

period from Indonesia (+37% to 19,200 cu.m), Vietnam

(+101% to 10,000 cu.m), Brazil (+38% to 4,500 cu.m),

Paraguay (+267% to 3,700 cu.m), and Ghana (+139% to

2,300 cu.m).

However, these gains were partly offset in the first quarter

by declining imports from Gabon (-14% to 12,900 cu.m),

China (-18% to 6,200 cu.m), Morocco (-10% to 4,000

cu.m), the UK (-23% to 1,800 cu.m), and Malaysia (-12%

to 900 cu.m) (Chart 7).

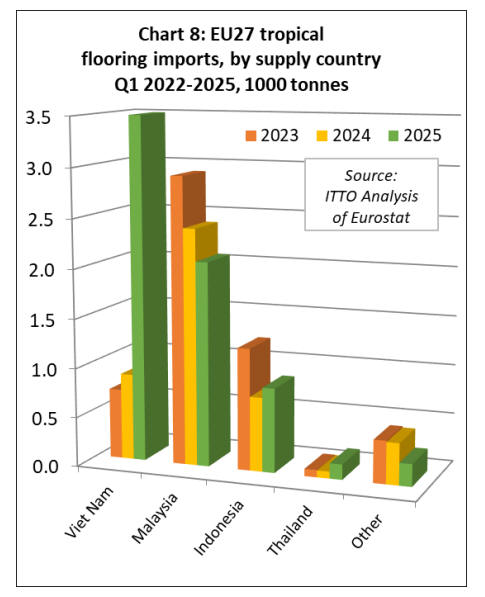

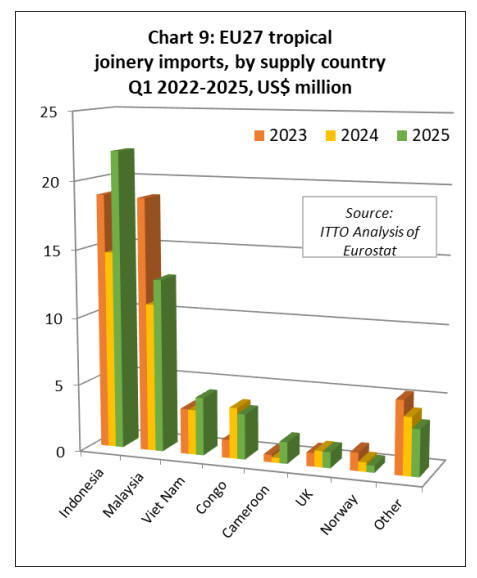

The EU27 imported 6,800 tonnes of tropical wood

flooring with a total value of USD15.5 million in the first

quarter of 2025, up 51% and 29% respectively compared

to the same period in 2024. Imports of 3,500 tonnes from

Vietnam in the first quarter this year were nearly 300%

more than the same period last year.

Imports also increased from Indonesia (+14% to 900

tonnes) and Thailand (+121% to 200 tonnes), but were

down from Malaysia (-14% to 2,100 tonnes) (Chart 9).

EU27 import value of other joinery products from tropical

countries - mainly laminated window scantlings, kitchen

tops and wood doors – was USD49.3 million in the first

quarter of 2025, 26% more than the same period last year.

Import quantity was up 31% to 21,800 tonnes in the same

period.

Import values increased from Indonesia (+51% to

USD22.1 million), Malaysia (+17% to USD12.8 million),

and Vietnam (+29% to USD4.3 million).

EU import value of laminated joinery products increased

from Cameroon in the first quarter this year, rising 324%

to USD1.6 million. However, imports from the Republic

of Congo began this year more slowly than last, being

down 11% at USD1.6 million. Indirect imports from the

UK also fell, by 2% to USD1.2 million (Chart 9).

EUDR updated guidance documents

On 15 April, the European Commission (EC) issued an

updated versions of the EUDR Frequently Asked

Questions (FAQ) and EUDR Guidance Document which

supersede the previous versions issued in October 2024.

The EC state that the main purpose of the latest guidance

is to provide “additional simplification measures”

including:

Allowing large companies to reuse existing due

diligence statements when goods, previously on

the EU market, are reimported.

Allowing an “authorised representative” to

submit a due diligence statement on behalf of

members of company group.

Allowing companies to submit due diligence

statements annually instead of for every shipment

or batch placed on the EU market.

Clarification of ‘ascertaining' that due diligence

has been carried out, so that large companies

downstream in the EU benefit from simplified

obligations.

The latest FAQ document and updated Guidance

document are available respectively at:

https://circabc.europa.eu/ui/group/34861680-e799-

4d7c-bbad-da83c45da458/library/e126f816-844b-

41a9-89ef-cb2a33b6aa56/details

https://environment.ec.europa.eu/document/5dc7aa19-

e58f-42a3-bbbe-f0eb2e5a1d3a_en

Results of EUDR country benchmarking released

On 22 May, the EU announced its classification of

countries into low, standard and high risk for purposes of

implementing EUDR ahead of its application at the end of

2025. According to the European Commission:

The benchmarking system classifies countries

according to the level of risk of producing

commodities covered by the scope of EUDR that

are not deforestation-free.

All countries have been assessed based on

quantitative criteria set out in Article 29(3) of the

EUDR and using the latest available data from

the Global Forest Resources Assessment dataset

of the Food and Agriculture Organization of the

United Nations (FAO FRA)

The benchmarking will facilitate EU operators'

due diligence processes and enable EU competent

authorities to effectively monitor and enforce

compliance. Additionally, it will incentivise

countries to improve the sustainability of their

agricultural production systems and minimise

their deforestation impact.

The risk classification defines the extent of

compliance checks that Member States’

competent authorities foresee among operators

sourcing from different countries (1% for ‘low

risk’, 3% for ‘standard risk’ and 9% for ‘high

risk’).

Sourcing from low-risk countries entails

simplified due diligence obligations for operators

and traders. This means that they need to collect

information for due diligence purposes but not

assess and mitigate risks.

The benchmarking process will be dynamic, with

a first review scheduled for 2026. This review is

intended to take account of the updated FAO

FRA data, expected to be published in October

2025.

The classification has been adopted through an

implementing act, accompanied by a Staff Working

Document outlining the benchmarking methodology. All

these documents, including the annex summarising the

risk rating of individual countries are available at:

See: https://environment.ec.europa.eu/publications/commission-

implementing-regulation-laying-down-rules-application-

deforestation-regulation_en

and

https://green-forum.ec.europa.eu/deforestation-regulation-

implementation/eudr-cooperation-and-partnerships/country-

classification-list_en

Selva Maya Tropical Timber Trade Mission 2024 – Final

report

In the early February ITTO Market Report the Selva Maya

mission was reported. The final report of the mission is

now available. The Selva Maya Tropical Timber Trade

Mission 2024 aimed to promote the international trade of

sustainably sourced tropical timber from forest

communities in the Selva Maya region spanning Petén,

Guatemala and the Yucatán Peninsula, Mexico, while

fostering strategic alliances and knowledge exchange

along the tropical timber value chain.

See:

https://docs.google.com/document/d/1cTqSJMtR6cJeC4fBh86d0

gFgF4q_toDfRcJnn_Zaw9Q/edit?tab=t.0

|