As a fresh, brand new year of 2023 got started, lumber sales continued with

the slow momentum which ended last year. This is normal for the season,

particularly given some very harsh winter weather across the continent.

Winter is not usually a good time for home building and construction.

Several large-volume operators, especially in British Columbia, had reduced

production and curtailed lumber manufacturing for a couple of months, and

are continuing to do so in early January. This slow-down is bringing supply

more in line with demand, and potentially preventing lumber prices for

falling further in a normally weak seasonal market.

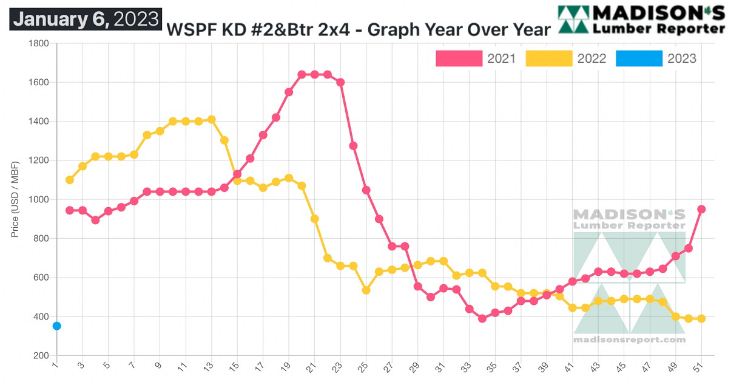

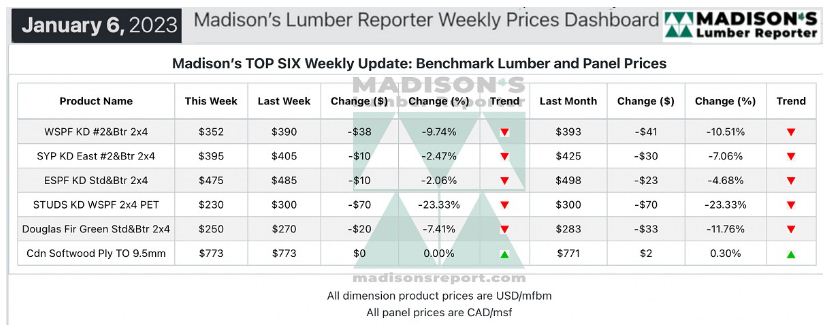

In the week ending January 6, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$352 mfbm, which is down by

$38 or 10 per cent, from the previous week when it was US$390 mfbm. This is

down by $41, or 11 per cent, from one month ago when it was $393.

Order files ranged between the weeks of January 9th and 23rd, with wide

widths and high-grade items out the furthest.

“The lumber market started off the New Year on a weak note in every

commodity group.” — Madison’s Lumber Reporter

Sales volumes of Western S-P-F lumber and studs started off the New Year on

a weak note, according to suppliers in the U.S. Asking prices were flat or

down from late December levels, and buyers were few and far between.

Sawmills didn’t have much accumulated material as they had been largely shut

down or running at reduced capacity over the past two weeks. Supply remained

slightly behind demand however, as the latter was practically nonexistent

over that same span. Stud producers reported sloppy sales no matter the

trim.

Western S-P-F purveyors in Canada noted a sputtering start to 2023. Buyers

remained cagey and hyper-aware of continually weakening prices, barely even

bothering to short-cover their inventory. Downstream construction activity

was dampened in most key regions by deepening winter weather, further

justifying buyers’ sitting on their hands. Producers had little to no

success finding trading levels, especially on 2×4 R/L items of all grades.

The moribund start to the New Year was perhaps best encapsulated by an

announcement from Canfor that it will extend curtailments at select BC

sawmills.

“

Green Douglas-fir commodities were on the ropes again according to

traders in the Western United States. Producers cut their asking prices on

every item and buyers were unmoved. Most players already had their early- to

mid-January needs covered, electing to wait for more potential 2corrections

as they felt no pressure from currently-quiet downstream target markets.

Suppliers were miffed with freight rates that continued to slowly rise, as

their wet wood got heavier and more costly to transport with each passing

soggy winter week. That concern would be more acute if greater volumes were

being moved.” — Madison’s Lumber Reporter

Compared to the same week last year, when it was US$1,100 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending January 6,

was down by $748, or 68 per cent. Compared to two years ago when it was

$944, that week’s price is down by $592, or 50 per cent.

More Reports: