January 2023 is ending, and with it the usual seasonal large-volume buying

by the big US home builders has begun. Because they want the wood needed for

their projects on the ground before spring building activity, customers make

their orders now to accommodate possibly extended delivery times. As such,

it is usual for lumber prices to start rising into the end of January. In

addition to that normal seasonal trend, there has been in the past couple of

months significant lumber production volumes taken offline due to various

downtime and curtailment announcements. The majority of these have been in

British Columbia, while other jurisdictions in North America have also

slowed manufacturing. Expectations are that these facilities will be coming

back online definitely during February, if they have not already.

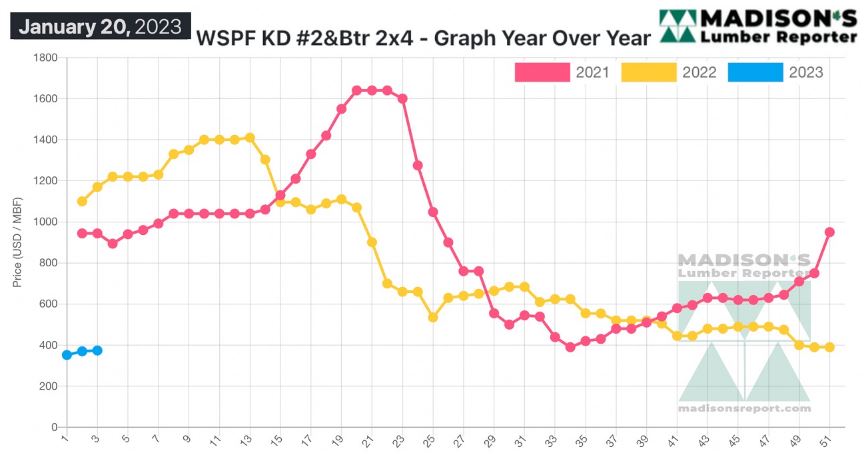

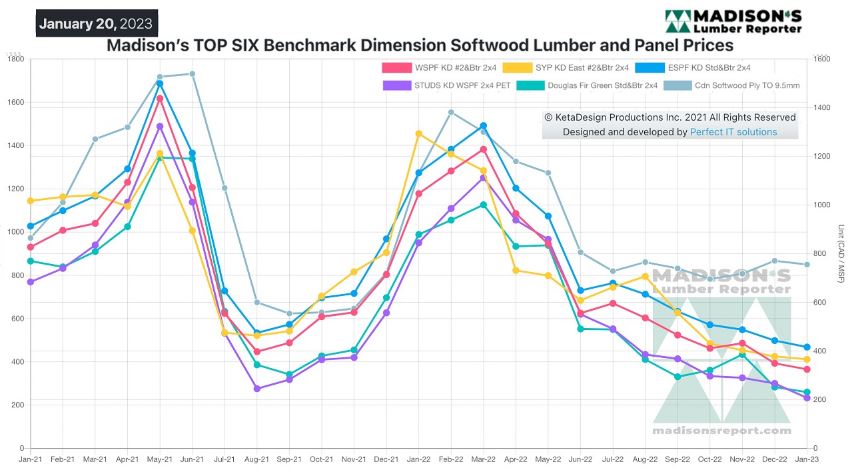

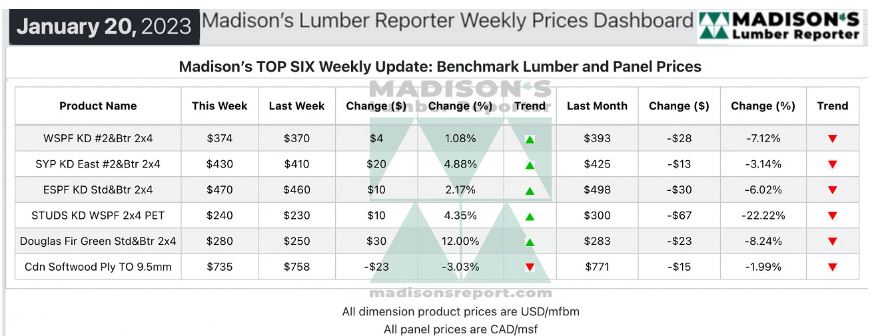

In the week ending January 20, 2023, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was US$374 mfbm, which is up

by +$4 or +1%, from the previous week when it was US$370 mfbm, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

This is down by -$19, or -5%, from one month ago when it was $393.

Sawmills extended their order files into early February in numerous cases.

Sales of lumber and stud markets took a palpable step forward while that of

panels continued to lag behind.

Demand for Western S-P-F jumped out of the gate this holiday-shortened week

in the United States. Buyers weren’t speculating or going after large

volumes just yet, but overall demand was noticeably up for the first time in

January 2023. Field inventories remained low, consistent with the time of

year. One experienced player noted that this was the most positive tone the

market has seen in the last several months. Producers were encouraged by

consistent sales and nudged their asking prices up on many key widths and

trims. Demand for WSPF studs was stronger than for dimension items. Players

were thankful that transportation was a non-issue, especially after the

challenges experienced last year at this time.

Canadian Western W-S-P-F producers boosted their asking prices and pushed

out their order files as promising demand came from buyers on both sides of

the border. Sawmills reported order files into late-January or

early-February, with sales of 2x4 and 2x6 R/L dimension leading the way.

Buyers were apparently reluctantly looking toward their spring requirements

instead of just replenishing immediate needs on a weekly basis. Overall

supply levels remained subdued thanks to recent curtailment announcements by

several major producers. As sales volumes got going, availability tightened

up commensurately.

Sales of kiln-dried Douglas-fir lumber and studs finally seemed to turn a

corner, with sawmill asking prices appearing to bottom out in most cases.

Secondary suppliers in the United States reported much better trading than

the previous week. Following the zeitgeist in the broader dimension lumber

market, 2x6 was one of the most sought-after and tightest widths min terms

of availability. Scant supply of wides was still significantly behind firm

demand. Log supply was an ongoing issue, especially with heavy and

relentless precipitation blanketing most of the Pacific Northwest. Hauling

water-laden Douglas-fir logs on mushy forest roads was essentially an

impossible task.

Compared to the same week last year, when it was US$1,170 mfbm, the price of

Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) for the week ending January 20,

2023 was down by -$796, or -68%. Compared to two years ago when it was $944,

that week’s price is down by -$570, or -60%.

More Reports: