Even in the middle of May the usual spring home construction did not

materialize. The harsh winter was a distant memory as normal seasonal

weather was upon North America, yet building activity did not increase.

Whether it was concerns over macroeconomic conditions, questions about

potentially low new home sales, or simply uncertainty in general; most

players were staying on the sidelines with their lumber purchases. It seemed

like everyone was waiting to see what everyone else would do.

Meanwhile, the wildfires in Alberta were somewhat reduced however still very

serious. It turns out that about half those forest fires were caused by

human activity, which is incredibly disappointing; specifically because

those could have been avoided. At this time in mid-May those fires burned

almost 900,000 hectares of Alberta forests.

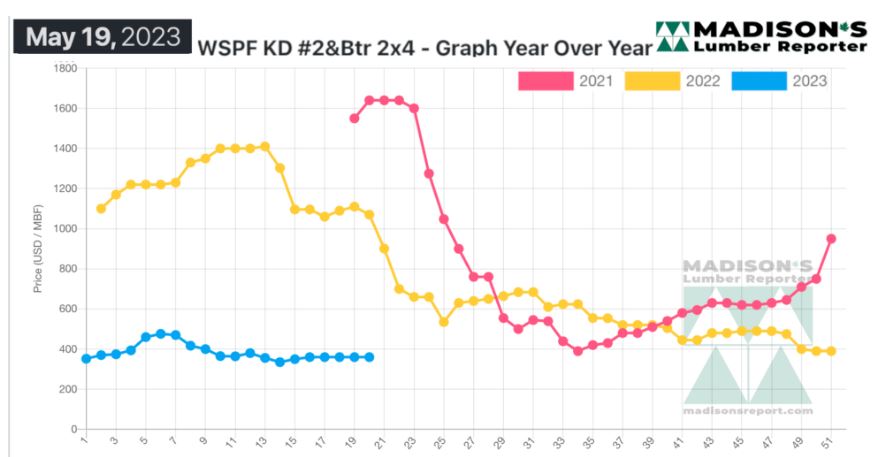

In the week ending May 19, 2023, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$360 mfbm, which is flat from the previous week. That

week’s price is up by $9, or two per cent, from one month ago when it was

$351.

Buyers were still extremely hesitant to take long positions and instead kept

to short-covering, leading to perpetually-low field inventories.

“

Wildfires in Western Canada were top of mind this week while the broader

North American solid wood commodities market continued to stumble slowly

into mid-Spring.” — Madison’s Lumber Reporter

Sales activity remained atypically lukewarm for the time of year according

to Western S-P-F traders in the United States. Most players agreed that the

upcoming Victoria Day and Memorial Day holiday weekends in Canada and the

U.S. respectively will be the next crucial litmus test for the North

American lumber market. For their part, U.S. sawmills established order

files around two weeks out, but many regional facilities continued to show

prompt availability on certain widths and trims. Steady inquiry and takeaway

from industrial buyers kept low grade material moving.

Wildfires continued to be a main topic of conversation this week among

Western Canadian S-P-F lumber traders. Many thousands more residents were

forced from their homes as ongoing hot and dry conditions fuelled blazes

across much of Western Canada, particularly in Alberta. Recent sawmill

curtailment announcements added another looming question mark to the state

of supply. Even though buyers remained circumspect and sales volumes were

still lacklustre for the time of year, promising signs of increasing future

demand were evident. Transportation appeared to be smooth for the time

being, as forest fires haven’t closed any major highway routes as yet. There

were pockets of slow-moving freight in Alberta due to the blazes, however.

“Traders of Southern Yellow Pine were beginning to sound like broken

records. Prices of narrow dimension R/L items were almost identical to last

week, while 2×12 remained the strongest seller and most scarce commodity.

Traders tried to impress upon their customers that 2×8 and 2×10 were a solid

value currently. Demand for SYP MSR was hopping as truss producers were

busier with each passing week. Low grade showed some hustle as that category

has been tight in supply lately.” — Madison’s Lumber Reporter

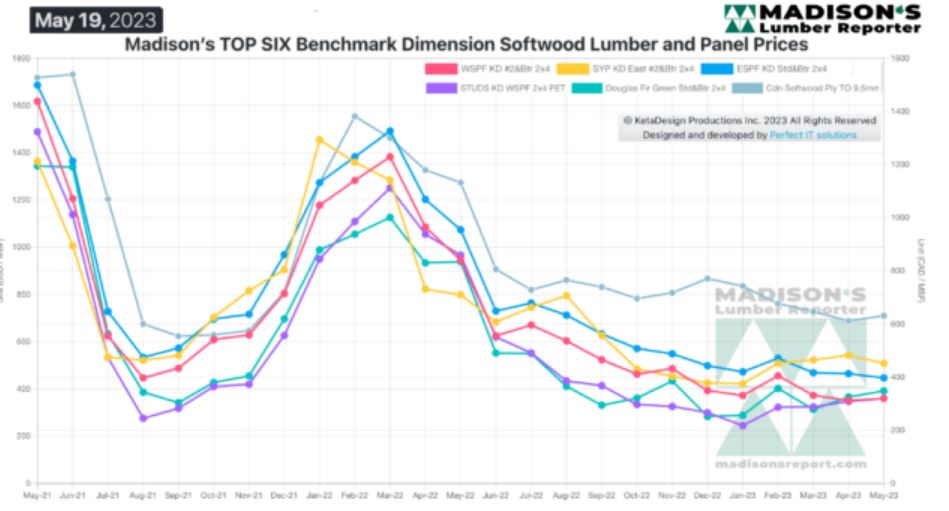

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,070 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending May 19, 2023

was down by $710, or 66 per cent. Compared to two years ago when it was

$1,640, that week’s price is down by $1,280, or 78 per cent.

More Reports: