Even As February Us And Canadian Housing Starts Data Showed Big Increases

Over January And Positive Growth Over February 2022, Lumber Buyers Across

North America Remained Cautious Toward The End Of March.

Customers continued their habit of making only highly-specified orders of

wood they needed for existing projects; still at this time there was no

inventory building or stocking up.

Suppliers were not in a position to complain as they picked through their

lumber yards to provide these custom-requested tallies.

All looked forward to true spring weather and the start of construction

season.

If this latest new home building data is any indication,

rightfully expectations should be that this year will be a good one for

residential construction.

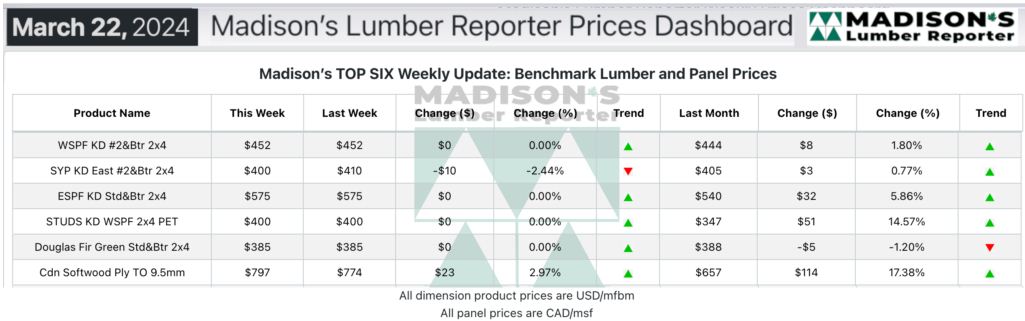

In the week ending March 22, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$452 mfbm. This is

flat compared to the previous week when it was $452. That week’s price is up

by +$8, or +2%, from one month ago when it was $444.

Panel prices jumped yet again. Most lumber buyers having covered

their most pressing needs and balking at current price lists, that market

entered a digestion phase.

Having built comfortable order files into April amid firm asking prices,

Spruce-Pine-Fir sawmills out West were unwilling to wheel

and deal on any orders. Inventories at supplier yards were almost as patchy

as those in the field. For now, the gambit of relying on secondary suppliers

to have quickly available material on hand appeared to be paying off. Some

sawmills started to show availability of items that had been off the market

last week, which indicated a potential shift in the supply-demand balance..

Demand and availability of Southern Yellow Pine varied

considerably from item-to-item. Buyers did their best to stand pat while

waiting for the spring sales surge to arrive. Inquiry and follow-through

were largely region-dependent, with the Western zone the most active.

Price levels on both OSB and plywood continued to surge as

order files with producers were into the end of April. Buyers went into a

digestion retreat even while overall supply remained low.

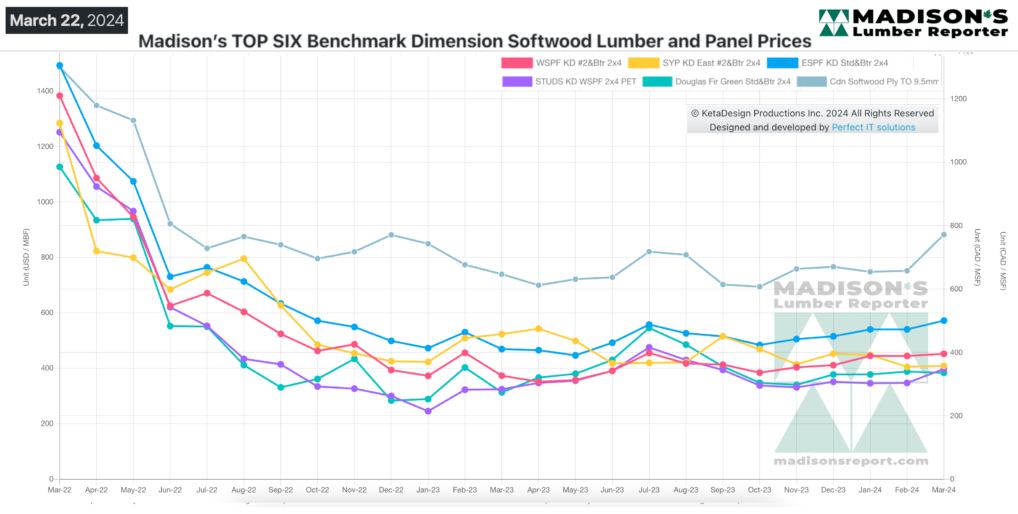

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

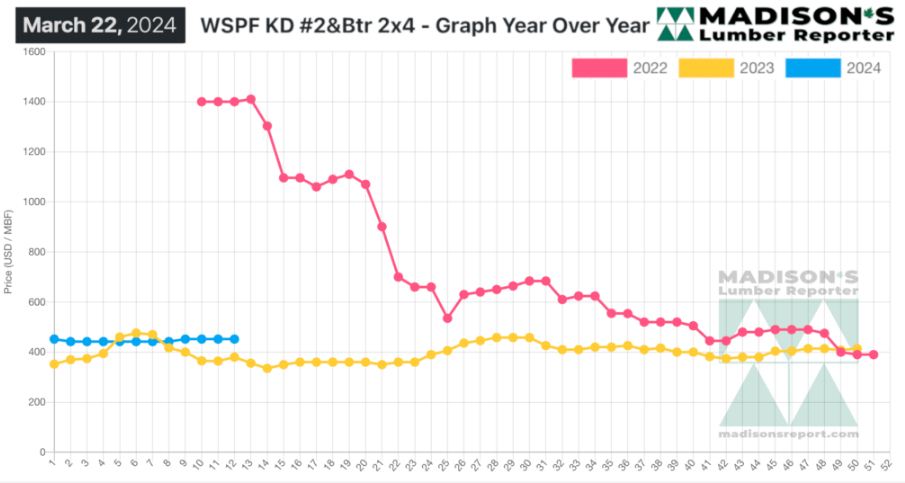

Compared To The Same Week Last Year, When It Was Us$380 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending March 22,

2024 Was Up By +$72, Or +19%.

Compared To Two Years Ago When It Was Us$1,400, That Week’S Price Is Down By

-$948, Or -68%.

More Reports: