At A Time Of Year When Home Building And Construction Is Usually Going

Strong, This Year That Has Not Yet Materialized.

Glimmers of improving inquiry and increased sales volumes were blunted by

an ongoing sense of oversupply and weak demand.

Glimmers of improving inquiry and increased sales volumes were blunted by

an ongoing sense of oversupply and weak demand.

As such, lumber sales have not picked up from the end of winter. After

succeeding in holding prices flat, mostly due to significant sawmill

curtailments and downtime, in the past two weeks the producers have not been

able to hold on and had to reduce their price levels. Even while field

inventories are incredibly low, secondary suppliers have been able to

undercut sawmill asking prices to sell enough wood at below replacement

levels.

As a result, producers were no longer able to hold off customer

counter-offers, as they had before. As well, order

files at sawmills were barely two weeks, which also weakened their

bargaining positions.

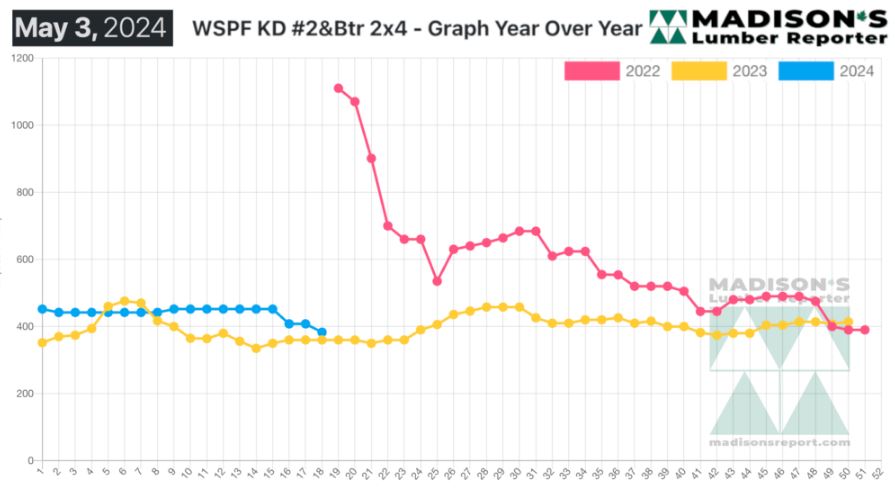

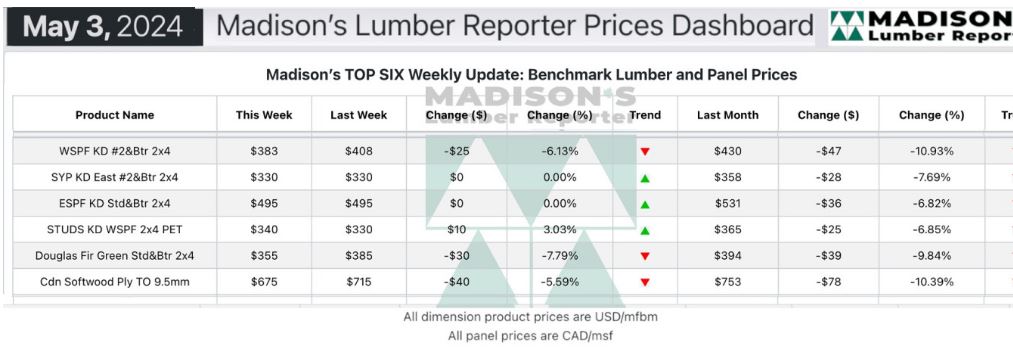

In the week ending May 3, 2024, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$383 mfbm. This is down by

-$25, or -6%, compared to the previous week when it was $408.

That week’s price is down by -$47, or -11%, from one month ago when it was

$430.

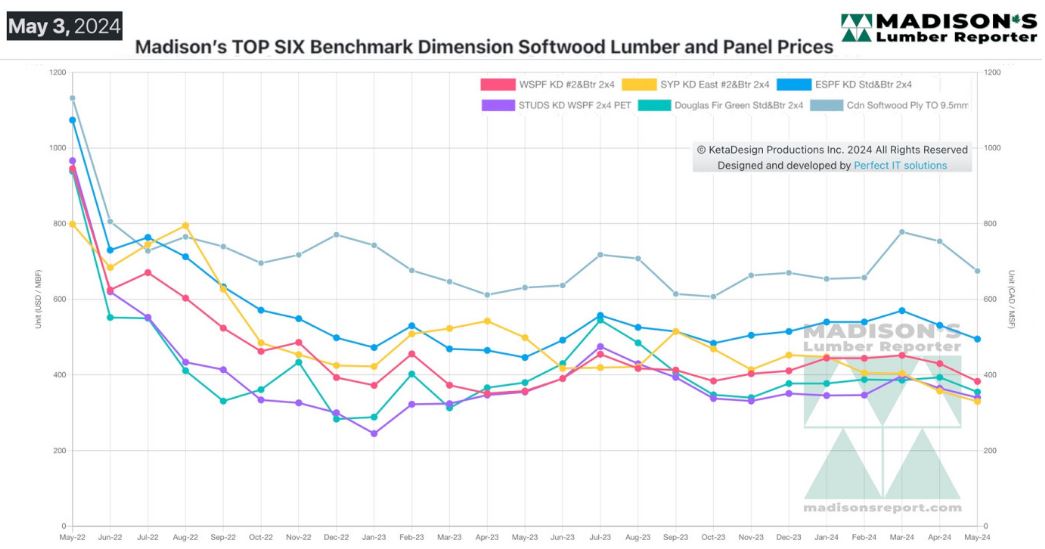

The quiet week capped off a muted month of April, as commodity prices were

flat to down. Plywood prices appeared to be approaching a bottom.

In the week ending May 3, 2024, the price of Southern Yellow Pine East

Side 2x4 #2&Btr KD (RL) was US$330 mfbm. This is flat from the previous week

when it was US$330 mfbm.

That week’s price is down -$28, or -8%, from one month ago when it was

US$358 mfbm.

Compared to the same week last year, when it was US$525 mfbm, that week’s

price is down -$195, or -37%.

KEY TAKE-AWAYS:

Wholesalers and distributors again sold below mill-replacement levels.

Dealers avoided hanging on to any low-priced material; supplier yard stock

was lean.

Sawmills were keen on moving accumulated material on their sales lists.

Lead times were extended into mid-May.

Players did not expect these low prices of 2x4s to persist.

Coastal species were stuck in price discovery mode.

There was not much follow-through to inquiries.

Oriented Strand Board prices were stagnant as minimal cash trading

persisted.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$360 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending May 3, 2024

Was Up By +$24, Or +6%.

More Reports: