As The End Of June Loomed And The Usual Summer Holiday Slowdowns Came Into

View, Prices Of Many Construction Framing Dimension Softwood Lumber

Commodities Across North America Dropped Further.

Veteran players shook their heads, questioning if the ongoing soft demand

meant this year will be a write off. Lumber traders in the east, west, and

south, were ready to hang “Gone Fishing” signs on their desks. Another round

of sawmill curtailment announcements did nothing to improve sentiment. While

the May US housing starts data was down slightly from the previous month and

from May 2023, the total number of starts year-to-date 2024 was the same as

last year.

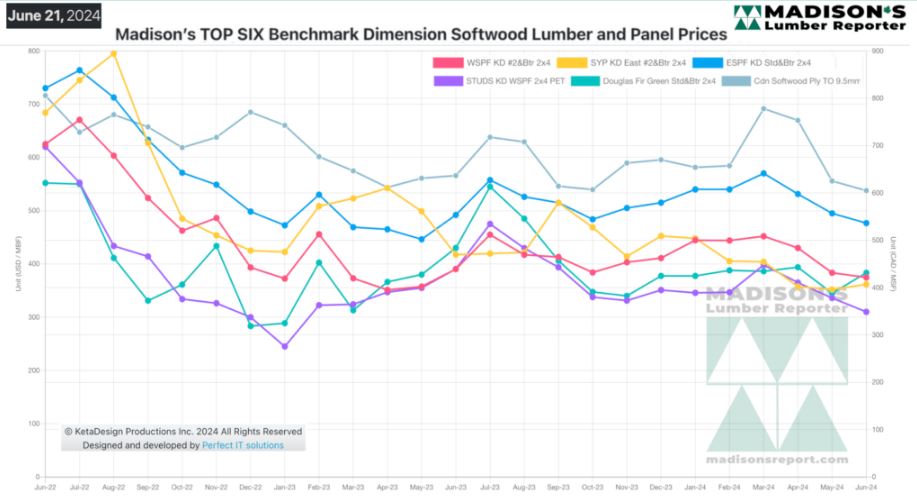

The generally stable trend line of the most commonly-traded lumber items

during that time confirms this steady march of new housing construction.

As both Canada and the US go into their respective national holidays, and

annual summer breaks arrive, many question if there will indeed be any

significant volume of lumber sales this year at all.

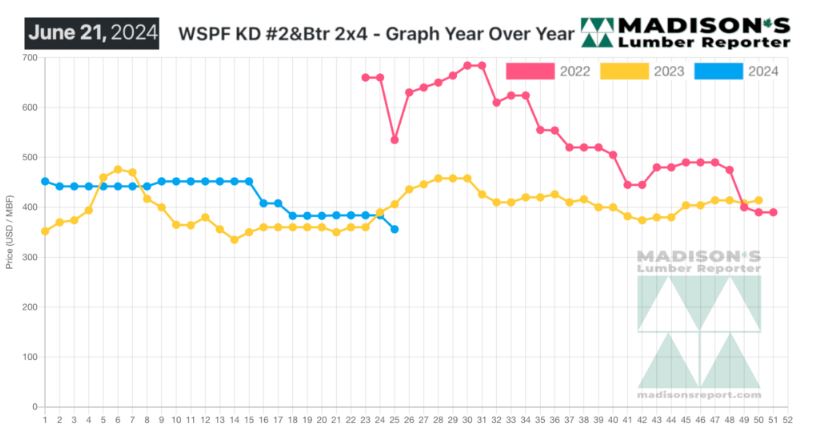

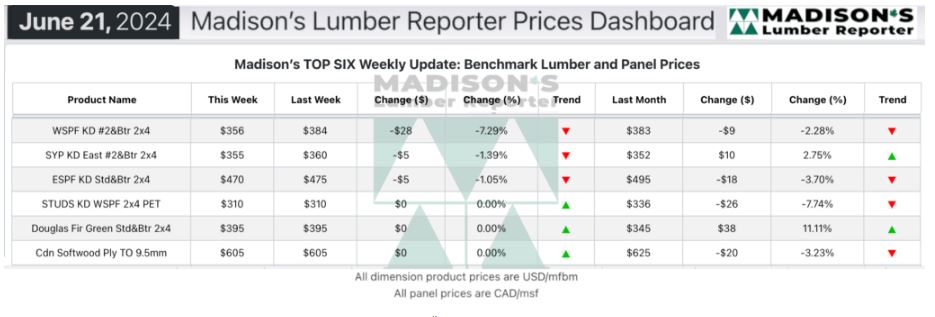

In the week ending June 21, 2024, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$356 mfbm, which is down -$28, or -7%, from the

previous week when it was $384.

That week’s price is down -$27, or -7%, from one month ago when it was $383.

Demand for North American lumber experienced little change from last week’s

tepid tone. Supply continued to outpace demand in most categories, while

prices of panels showed increasing vulnerability.

KEY TAKE-AWAYS:

Prices of many bread-and-butter commodities took another step back,

ensconcing reticent buyers on the sidelines.

Subpar demand was belied by good day-to-day sales volumes.

Frequent, small-volume purchases kept both primary and secondary suppliers

busy.

Buyers in all Southern Pine zones had plenty of opportunities to grab

same-day shipment when they felt the need.

Coastal sawmill asking prices remained flat while discounted material was

less abundant; many buyers found the price bottom and stepped in with

purchases.

Most producers maintained two- to three-week order files.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$406 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending June 21, 2024

Was Down -$50, Or -12%.

Compared To Two Years Ago When It Was $535, That Week’S Price Is Down -$179,

Or -33%.

More Reports: