Historically Labour Day Has Been A Marker Of How Robust Is Demand For

Construction Framing Dimension Softwood Lumber.

Demand was a jot slower following the frenzy generated by last week’s

short-lived Canada-wide rail strike. All eyes were on post-Labour Day long

weekend for indication of market conditions.

In times of a weak market, following this long weekend demand has been soft

and prices have fallen. During times of ongoing new home building activity,

demand has been strong and prices stay flat or might even increase. As

industry players are still waiting to find out what are the new market

conditions and annual price cycle of lumber, this year the week following

Labour Day will show a lot.

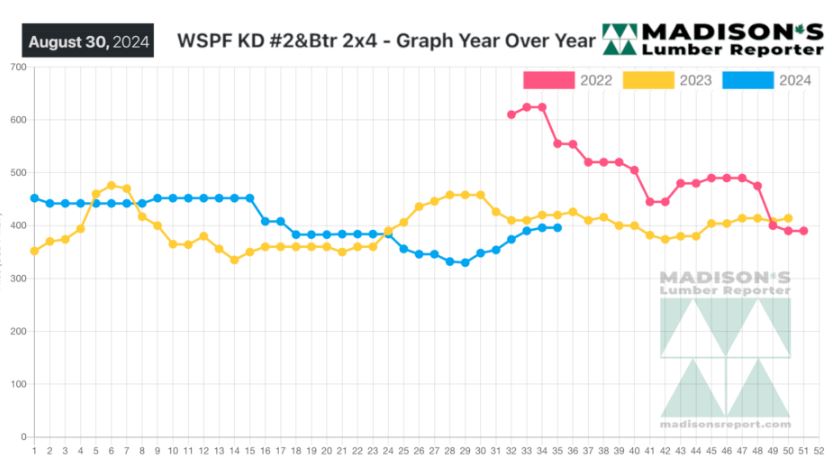

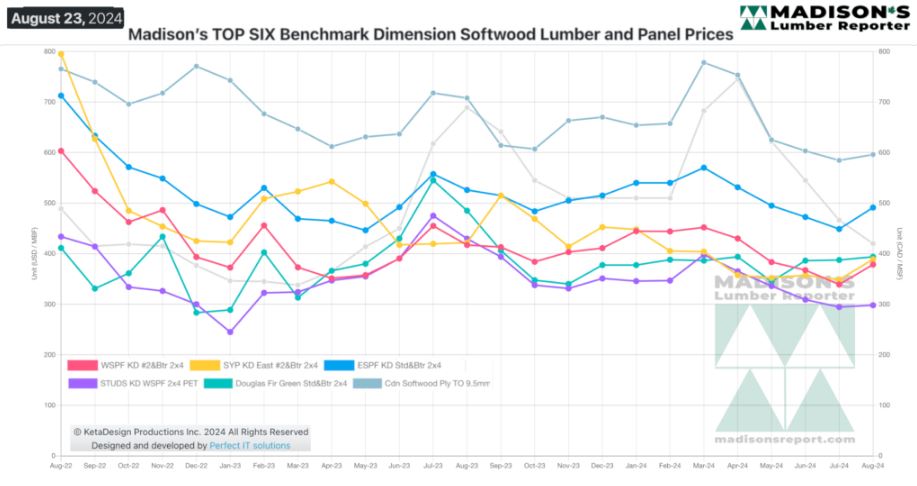

As demonstrated by the graphs here, most lumber prices did soften somewhat

during the summer, then firmed upward in August. Reduced supply and almost

total lack of inventory in the field are reasons why prices rose.

At the end of August they approach quite close to the same time last year,

which might indicate a good supply-demand balance for the remainder of 2024

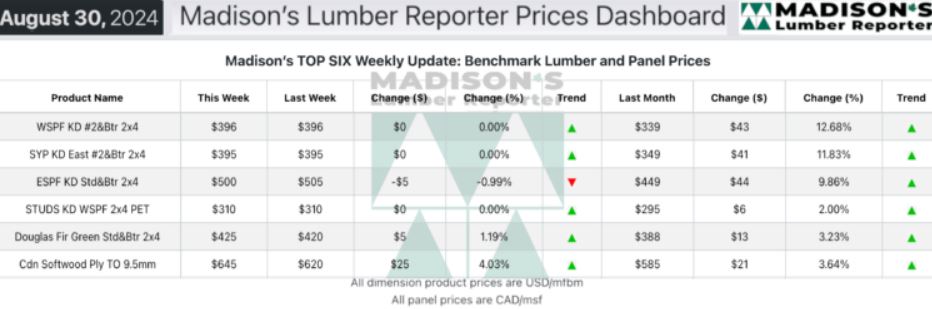

In the week ending August 30, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$396 mfbm. This is

flat from the previous week when it was $396.

That week’s price is up +$57, or +17%, from one month ago when it was $339.

Compared To The Same Week Last Year, When It Was Us$420 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending August 30,

2024 Was Down -$24, Or -6%.

Compared To Two Years Ago When It Was $555, That Week’S Price Is Down -$159,

Or -29%.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

There was a sense of cautious optimism as Labour Day approached.

Players reported an increasing pace to demand with each passing day.

After the frenzy of panic-buying created by the potential rail strike in

Canada, demand for WSPF lumber was a bit quieter.

Buyers paused to assess their inventory needs after the comparative chaos of

potential rail strike.

High log costs relative to market returns caused Eastern Canadian producers

to throttle production of certain items and widths.

Ongoing softness in OSB prices was staved off by the recent logistics

upheaval.

More Reports: