The Destruction Far Inland From Hurricane Helene In Locations Not Typically

Experiencing This Kind Of Severe Weather Was Nowhere Near Being Fixed More

Than A Week Later.

There was still significant areas without power, and work crews had not yet

begun to rebuild the large amount of road damage. Lumber customers and

resellers alike, who had long gotten into the habit of not stocking

inventory, all needed to call sawmills for whatever wood they needed for

ongoing projects.

This caused an immediate surge in Southern Yellow Pine prices, as

availability was non-existent as producers still struggled to get back to

basic functioning.

There was quite an increase in demand noted by suppliers of Eastern

Spruce-Pine-Fir, however those prices did remain flat. At least for now.

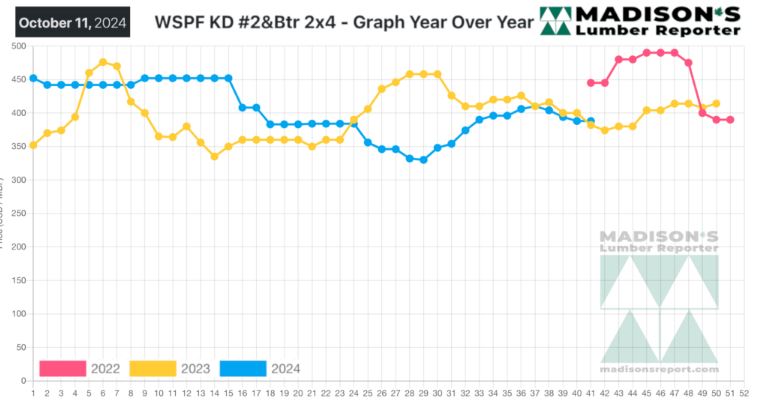

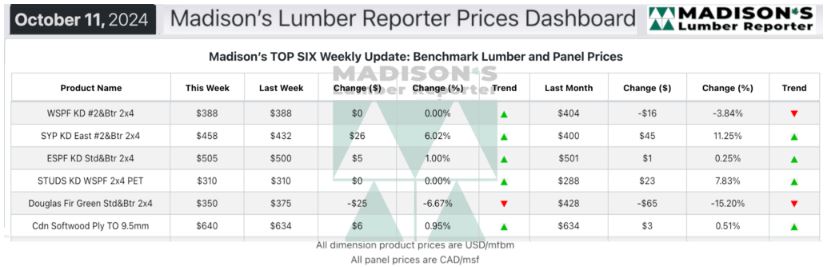

In the week ending October 11, 2024, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$388 mfbm, which is flat from the previous week,

said weekly forest products industry price guide newsletter Madison’s Lumber

Reporter. That week’s price is down -$16, or -4%, from one month ago when it

was $404.

Compared To The Same Week Last Year, When It Was Us$382 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending October 11,

2024 Was Up +$6, Or +2%. Compared To Two Years Ago When It Was $445, That

Week’S Price Was Down -$57, Or -13%.

In the week ending October 11, 2024, the price of Southern Yellow Pine

East Side 2x4 #2&Btr KD (RL) was US$458 mfbm. This is up +$26, or +6%, from

the previous week when it was US$432 mfbm.

That week’s price is up +$58, or +14%, from one month ago when it was US$400

mfbm.

When compared to the same week last year, when it was $480, that week’s

price is down -$22, or -5%. Compared to two years ago when it was $535, that

week’s price is down -$77, or -14%.

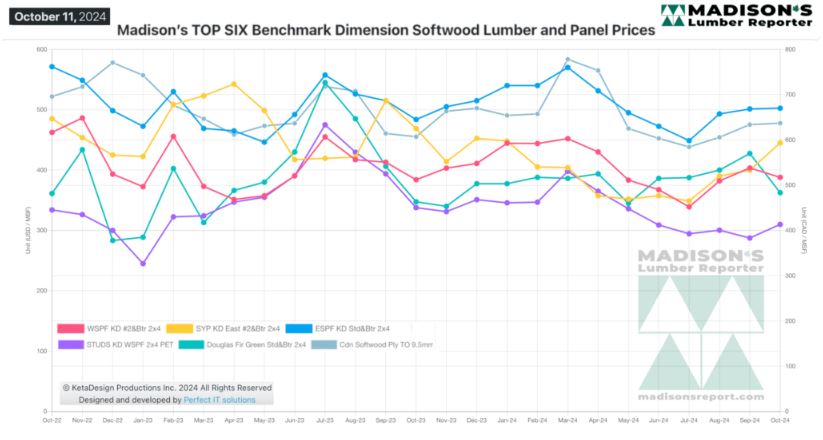

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

Western Spruce-Pine-Fir producers in the US held dimension asking prices at

or around the previous week’s levels.

Western Canadian and US sawmill order files were around two- to three-weeks.

Ongoing tight supply created the impression that increased buying would

quickly clean up available material.

Eastern Spruce-Pine-Fir prices climbed amid limited supply.

Disruptions to sourcing Southern Yellow Pine timber and shipping lumber were

significant as several facilities still didn’t have power.

Scarce Southern Pine supply flowed demand to Eastern SPF, thus suppliers

there turned down counteroffers and leaned on firm pricing.

More Reports: