Lumber Buyers Across North America Felt No Sense Of Urgency To Stock Up On

Solid Wood Products, Thus Into Mid-April Prices Softened Further.

Historically in the seasonal cycle, at this time of early spring there would

be an increase in lumber buying as builders and retailers make purchases for

the upcoming construction season. This year suppliers and customers alike

were very cautious, as continued and ongoing disruptions from political

leaders has made it difficult to plan.

Most players preferred to not increase inventory and take the chance of

getting caught short of the wood they will need, rather than buying in

advance only to suffer some penalty or increased charge later upon delivery.

This muted demand caused a drop in lumber prices even while inventory levels

across the US and Canada remain quite low.

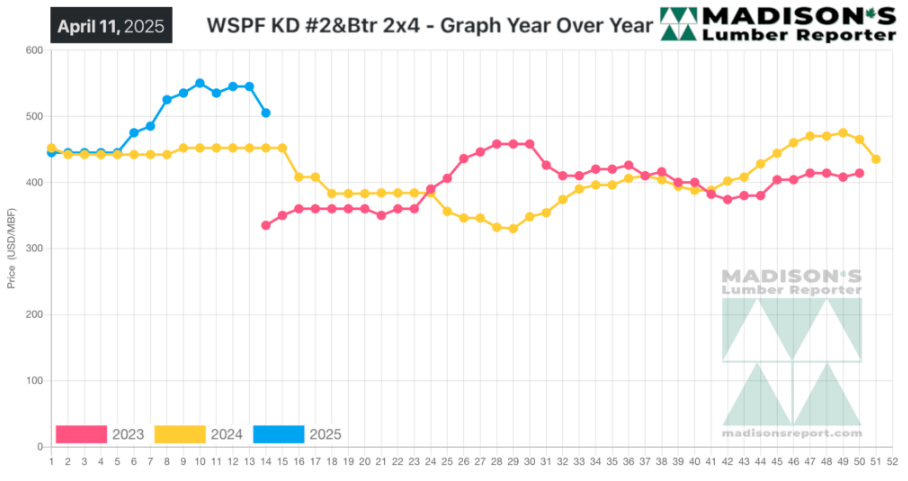

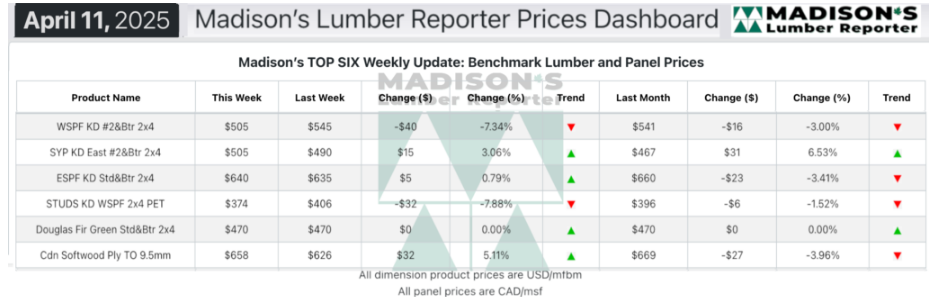

In the week ending April 11, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$505 mfbm, which is down -$40, or -7%, from the

previous week when it was $545, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$36, or -7%, from one month ago when it was $541.

Compared To The Same Week Last Year, When It Was Us$452 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 11,

2025 Was Up +$53, Or +12%.

Compared To Two Years Ago When It Was $335, That Week’S Price Was Up +$170,

Or +51%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

The North American lumber market recalibrated after 90-day reprieve on

reciprocal tariffs was announced.

Prices at sawmills varied considerably, as it did among distributers.

Customers found it challenging to determine what they were willing to pay.

Price lists and product accumulations differed from mill-to-mill, while

lumber futures reflected the market-wide confusion.

In Western Canada the majority of WSPF buyers were still reluctant to buy

while some found attractive price levels.

Virtually no one was willing to stake out anything resembling a long

position.

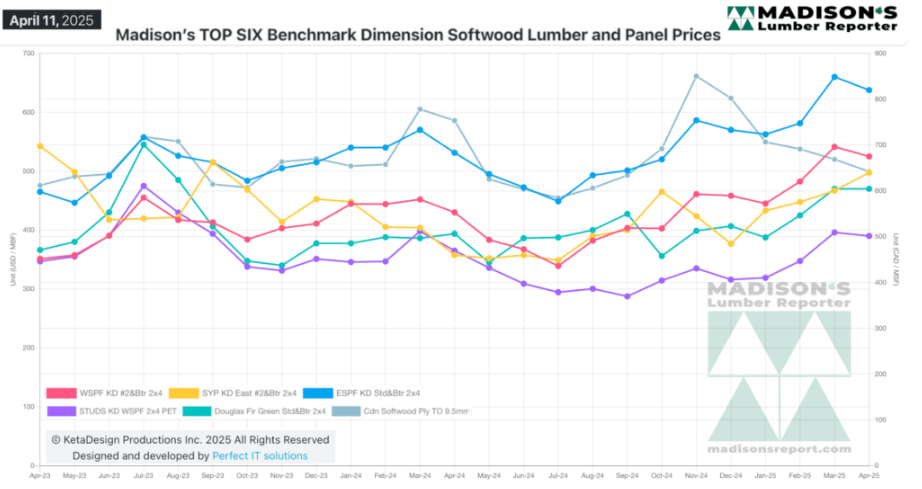

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: