The long-awaited announcement about tariffs on canadian lumber entering the

us was made; the solid wood manufacturing industry across north america

collectively breathed a sigh of relief to find there would not be such.

This uncertainty had brought many delays across the continent, as various

players responded differently to the potential threat. Some had held off

buying altogether, preferring to wait for clarity from capricious political

leaders. Others had ordered wood in advance in the expectation of delivery

prior to any possible tariff constraint.

Still others decidedly switched their purchasing to Southern Yellow Pine

materials from the northern species of Spruce-Pine-Fir. This palpable

increase of southern pine lumber prices vs SPF reached a top, as those

customers locally within the US received the lumber they needed for ongoing

projects.

In the greater scope, the entire industry was able to assess the current

situation; buyers and sellers worked together to determine where existing

price levels would land.

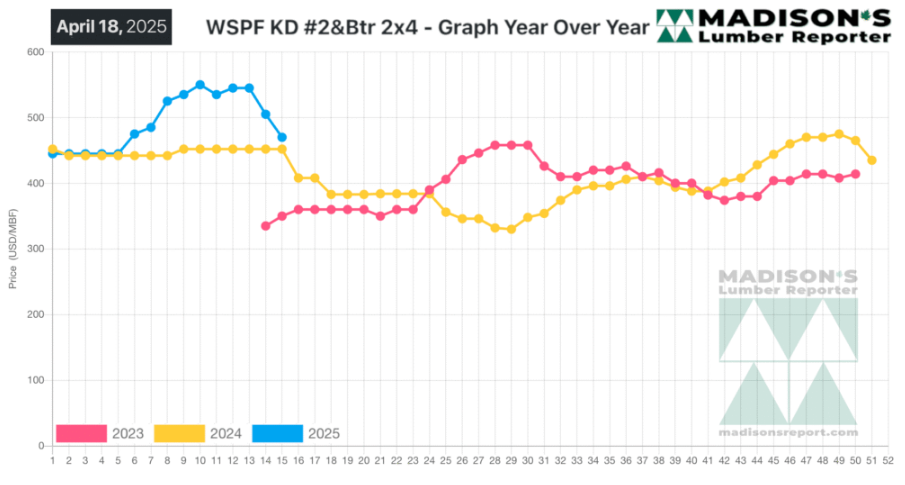

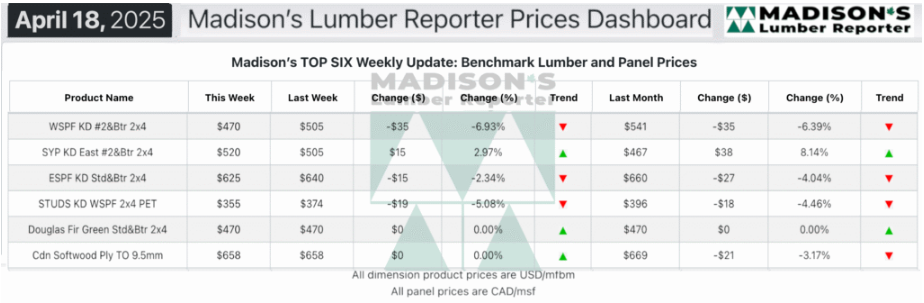

In the week ending April 18, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$470 mfbm.

This is down -$35, or -7%, from the previous week when it was $505, said

weekly forest products industry price guide newsletter Madison’s Lumber

Reporter.

That week’s price is down -$53, or -11%, from one month ago when it was

$467.

Compared To The Same Week Last Year, When It Was Us$452 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 18,

2025 Was Up +$18, Or +4%.

Compared To Two Years Ago When It Was $350, That Week’S Price Was Up +$120,

Or +34%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Commodity prices continued to vary considerably as price lists and

accumulations differed from mill-to-mill.

There were wide price-spreads reported at the sawmill level and among

distributers.

Canadian mills jumped in after a period of relative inactivity; there were

better sales of Western S-P-F on both sides of the border.

After getting whipsaw fatigue over the past two months, Western Canadian

suppliers hoped to see the market settle down.

Field inventories stayed thin.

Supply crept ahead of vacillating demand.

Eastern Canadian suppliers found themselves in price discovery mode.

Even after Wednesday’s tariff announcement, players would have to wait for

clarity as the market needed to digest this latest development.

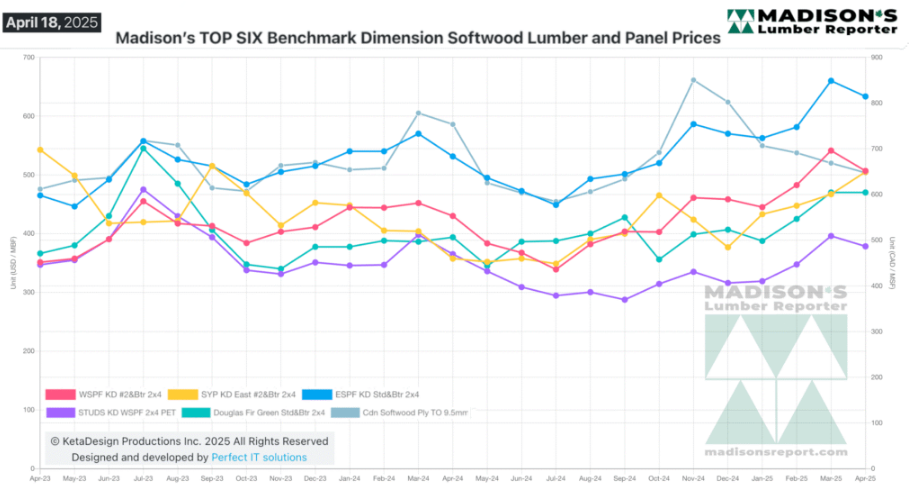

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: