The US-Canada lumber trade is a cornerstone of the North

American forest products industry, frequently spotlighted for

its tariff disputes and economic stakes. Recent policy shifts

have reignited discussions about supply chains, costs, and

market resilience, often casting the relationship as a

battleground of competing interests. Yet, beneath the headlines

lies a more intricate story—one of interdependence, mutual

benefit, and evolving global dynamics that shape the forest

value chain.

Summary: US Tariffs on Canadian Lumber – April 2025 Update

As of April 7, 2025, Canadian softwood lumber faces a 14.54% US

tariff rate, set by the Department of Commerce in August 2024,

supplying about 30% of US demand. A proposed 25% tariff on

Canadian goods, announced in March 2025, was delayed and

ultimately exempted for lumber on April 2, averting a jump to

39.5%.

However, the Commerce Department’s sixth review, due in late

2025, may raise duties to 27% or more, while a Section 232

national security probe could add further pressure. For the

forest value chain, this signals ongoing volatility—Canadian

producers face margin squeezes, US buyers brace for cost hikes,

and global suppliers may gain ground—underscoring the need for

strategic adaptability in this critical trade corridor.

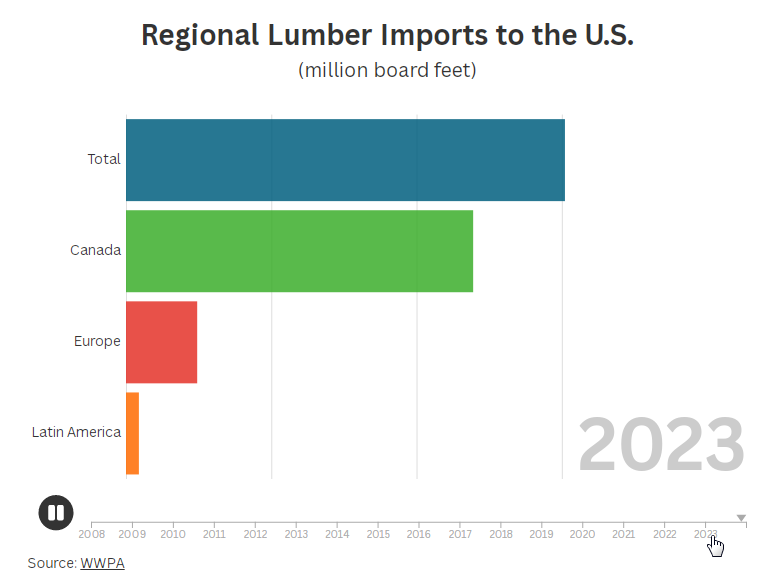

A Closer Look at Trade Flows

Canada remains the largest supplier of softwood lumber to the US

This volume, valued at $8-10 billion, accounts for 25-30% of US

consumption, driven primarily by residential construction

demand. In 2022, US housing starts, ranging from 1.4-1.6 million

units, underscored this need, supplementing domestic production

of 35-40 billion board feet. However, the US is not solely

reliant on Canadian imports; it also exports softwood lumber

back to Canada— often in species like Southern Yellow Pine,

which is not widely produced north of the border.

Yet, as Canada's ability to meet US demand faces challenges—such

as mill closures and tariff implications —Europe has

historically played a critical offsetting role. Since 2020,

European suppliers have increasingly stepped in during Canadian

supply disruptions, a trend that shows signs of accelerating.

This evolving dynamic introduces new competition into the North

American market and may increasingly influence pricing and

supply chain strategies.

Beyond raw lumber, finished forest products add another layer of

complexity to the trade relationship. In 2021, US exports of

paper, paperboard, and packaging to Canada totaled $10.3

billion, reflecting a 14.5% increase from the previous year amid

rising e-commerce demand. These goods—ranging from corrugated

boxes to industrial papers—illustrate the two-way nature of the

trade, where Canadian lumber is processed in the U.S. and

returned as higher-value products. If tariffs escalate, as seen

in previous tariff disputes, such dynamics could face

disruption, increasing costs across the supply chain.

The Utilization and Economic Impact of Trade

Most of the Canadian lumber entering the US supports domestic

construction, with an estimated 70-80% used in housing and

related projects. The remainder supports manufacturing,

including furniture, engineered wood products like plywood, and

residuals repurposed for pulp and paper. A portion—likely

10-15%—is transformed into goods for export, generating added

value. For example, US furniture exports to Canada totaled

$500-600 million in 2021, while global plywood exports reached

$1.2 billion, with Canada as a key market.

While tariffs can compress margins, it doesn’t fully halt trade.

The integrated North American supply chain—Canada providing raw

materials and the US leveraging manufacturing capacity—remains a

cornerstone of the industry, despite ongoing duties and proposed

increases in 2025.

Unpacking the "Trade War" Narrative

The US-Canada lumber relationship is often distilled into a

narrative of conflict, with historical disputes like the

Softwood Lumber Agreements and recent tariff announcements

fueling the perception of a "trade war." US producers point to

Canadian stumpage fee structures as a subsidy, while Canada

emphasizes its role in meeting US demand. But the data reveals a

more balanced exchange: Canada relies on the US for over 70% of

its lumber export market, while the US benefits from both

Canadian supply and export opportunities for finished goods.

This interdependence contrasts with calls for rapid US

production increases. While expanding domestic capacity could

offset imports, the scale and timeline of such efforts face

practical limits, leaving cross-border trade a critical factor

in meeting US demand.

Beyond the Headlines: A Nuanced Exchange

The US-Canada lumber trade is not a simple story of dependency

or rivalry but rather a multifaceted partnership shaped by

geography, economics, and market needs. While tariffs and policy

shifts continue to evolve, their impact will ripple through

construction costs, manufacturing profitability, and bilateral

flows. A closer look at the data offers a clearer understanding

of the industry at a pivotal moment.

The trade flows between the US and Canada are not purely

one-sided but reflect a long-standing and mutually beneficial

relationship. The US imports raw lumber from Canada but also

contributes significant exports of finished products back to

Canada. This ongoing exchange serves both countries' needs,

creating a balanced ecosystem in the North American forest

products industry.

While it is easy to oversimplify this relationship into a

narrative of conflict, the reality is much more nuanced. The two

nations depend on one another in ways that extend beyond just

raw lumber and include valuable finished goods that flow both

ways. Understanding the complexities of this trade allows for a

deeper appreciation of how vital US-Canada cooperation is in

sustaining the forest products industry.

Looking Ahead

As tariffs, regulations, and policy shifts continue to unfold,

they will undoubtedly have an impact on construction costs,

manufacturing profitability, and bilateral trade flows. However,

these shifts should not overshadow the deeper interdependencies

at play. The US and Canada are not engaged in a trade war, but

rather, a partnership marked by mutual benefit and economic

integration.

By moving beyond the simplified headlines, we gain a clearer

view of an industry that thrives on collaboration, not conflict.

Understanding these dynamics helps businesses in the forest

products sector navigate potential disruptions and make informed

decisions about their future strategies.

Source:

resourcewise.com