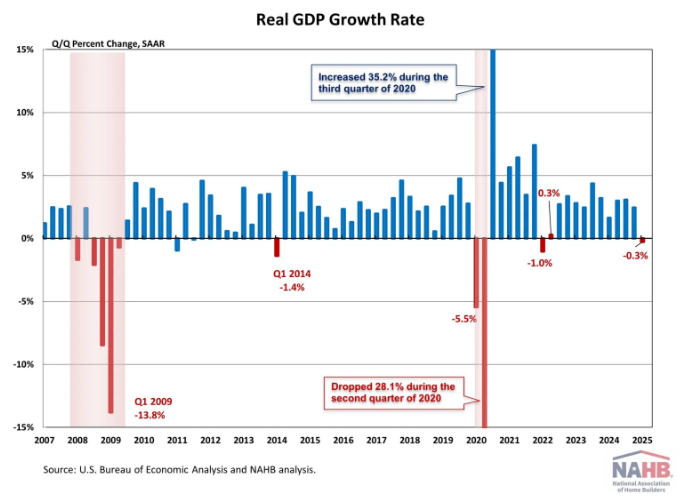

The U.S. economy contracted in the first quarter of 2025 for the

first time in three years, driven by a sharp surge in pre-tariff

imports, softening consumer spending, and a decline in

government spending.

According to the “advance” estimate released by the Bureau of

Economic Analysis (BEA), real gross domestic product (GDP)

decreased at an annual rate of 0.3% in the first quarter of

2025, following a 2.4% gain in the fourth quarter of 2024. This

marks the first quarter of economic contraction since the first

quarter of 2022. NAHB predicted a 0.2% increase for the first

quarter of 2025.

Furthermore, the data from the GDP report suggests that

inflationary pressure persisted. The GDP price index rose 3.4%

for the first quarter, up from a 2.2% increase in the fourth

quarter of 2024. The Personal Consumption Expenditures Price (PCE)

Index, which measures inflation (or deflation) across various

consumer expenses and reflects changes in consumer behavior,

rose 3.6% in the first quarter. This is up from a 2.4% increase

in the fourth quarter of 2024.

The contraction in real GDP primarily reflected a sharp increase

in imports and a decrease in government spending.

Imports, which are a subtraction in the calculation of GDP,

surged at an annualized rate of 41.3% in the first quarter, as

businesses rushed to stockpile goods ahead of implementing

tariffs. While goods imports spiked by 50.9%, services imports

increased by 8.6%. The import surge contributed to a record-high

trade deficit and subtracted more than five percentage points

from the headline GDP figure.

Private inventories were the largest contributor to the

increase in gross private domestic investment.

Nonresidential fixed investment increased by 9.8%, with notable

increases in equipment (+22.5%) and intellectual property

products (+4.1%). Residential fixed investment posted a 1.3%

gain, following a 5.5% increase in the previous quarter. Within

residential categories, single-family structures rose 5.9%,

improvements increased 3.6%, while multifamily structures fell

11.5%.

Source:

eyeonhousing.org