As May drew to a close the sales of lumber across North America remained

quite low for the time of year. Wildfires in Alberta decreased somewhat but

were still a huge problem, as major forest fires erupted in Nova Scotia.

Sawmill operators and forest technicians alike expressed great alarm at this

fierce and very early fire season. Indeed, those in Alberta say the fires

there will not be put out until the end of summer.

Meanwhile, lumber sales volumes remained quite low despite improved U.S.

home building data. Inventories in the field were robust, putting no urgency

on customers to stock up on wood not needed immediately.

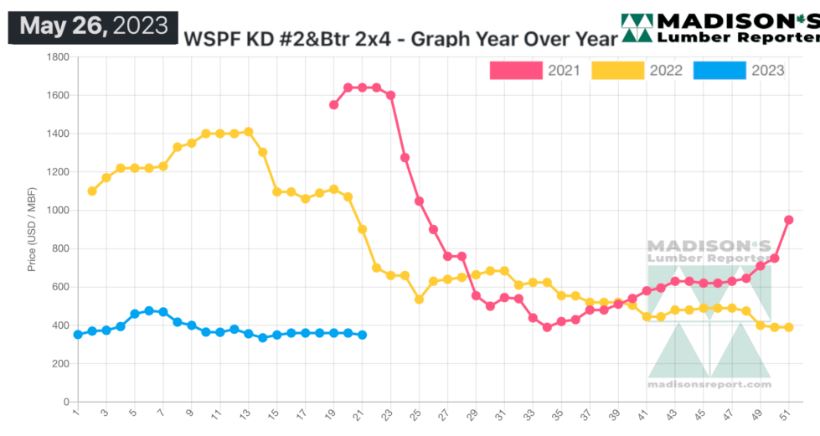

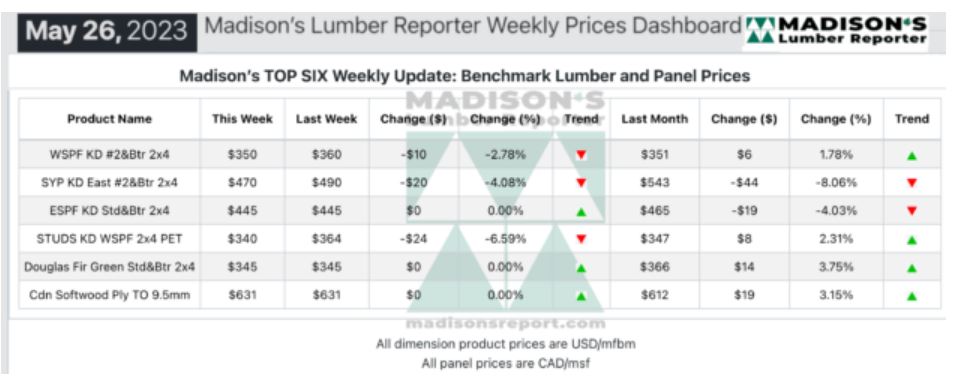

In the week ending May 26, 2023, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$350 mfbm, which is

down $10, or three per cent, from the previous week when it was $360. This

is down by $1 from one month ago when it was $351.

The level of supply was evenly matched with demand, resulting in a

relatively flat business week in terms of pricing and sales activity.

“

Overall demand remained subdued as the market waited for the

post-Memorial Day litmus test.” — Madison’s Lumber Reporter

Traders of Western S-P-F in the U.S. reported a subdued tone to inquiry as

holidaying Canadians returned to the market while players South of the

border looked toward the Memorial Day long weekend. Players told their

charges to take advantage of what they called an undervalued market,

particularly in the case of 2×10 dimension. Sawmill order files were into

early June and not much further. All eyes were on the following week and

what traders hoped would be the unofficial start to the building season

after Memorial Day.

The supply-demand equation in Western S-P-F dimension appeared to balance

out, with sawmills remaining firm on most of their asking prices. Prices of

narrows lost a little more ground, but it was in the single- or low

double-digit range. Sawmill curtailments and ongoing wildfires in Western

Canada barely registered in terms of generating demand, but there was

decidedly less material available overall than in previous weeks.

Transportation had been smooth of late, with a competitive field of

operators and stable fuel prices.

“Softening demand for green Douglas-fir lumber and studs continued apace.

Buyers were extra-quiet as the Victoria Day holiday weekend ended in Canada

while those in the U.S. geared up for their Memorial Day observations.

Transactions were fickle, with customers nickeling-and-diming suppliers to

the point of exhaustion, while keeping their sights trained on specific

products only. Secondary suppliers with cheaper offerings and quicker

shipment timelines continued to have the most success in this sluggish

market.” — Madison’s Lumber Reporter

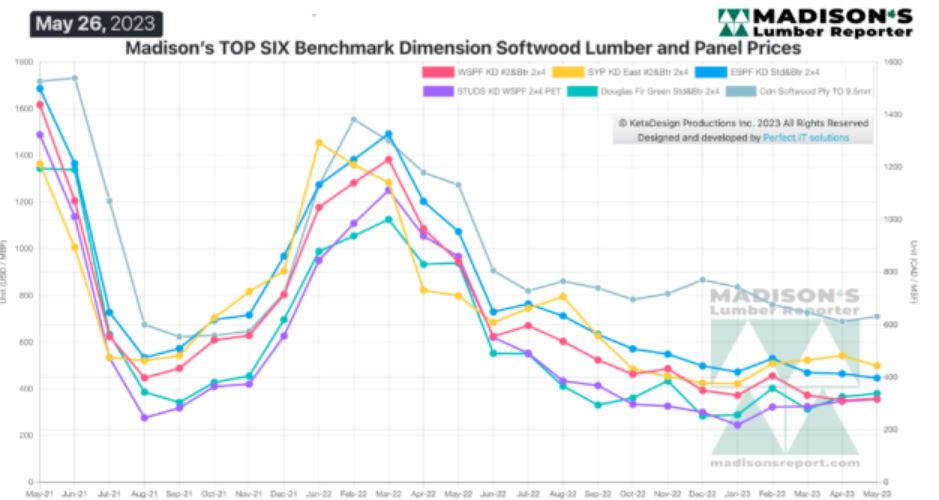

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$901 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending May 26, 2023

was down by $551, or 61 per cent. Compared to two years ago when it was

$1,640, that week’s price is down by $1,290, or 79 per cent.

More Reports: