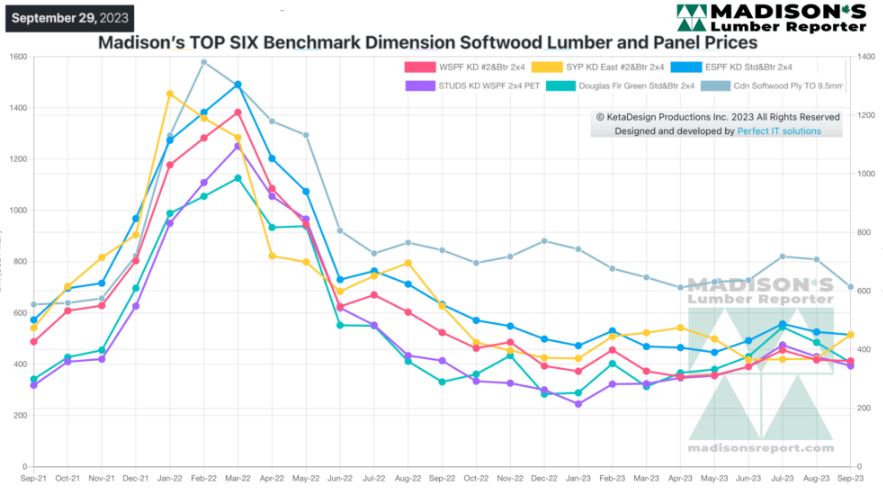

After Three Years Of Extreme Volatility And Many Unknowns, North

American Construction Framing Dimension Softwood Lumber Price Trendlines

Started To Normalize During 2023.

As winter will come on and home building will slow at the end of the year,

there will be good insight to be gleaned from the lumber prices annual

trend. Indeed, it may be wise to ignore the extreme highs — and following

corrections downward — of 2020 to 2022.

In a future post, Madison’s will take a good look at what happened with

lumber prices in 2019, compared to this year. Looking back over a previous

“normal” year will help inform about what to expect for 2024.

Sawmills continued to work within a narrow price range, turning away buyers

who requested steep discounts.

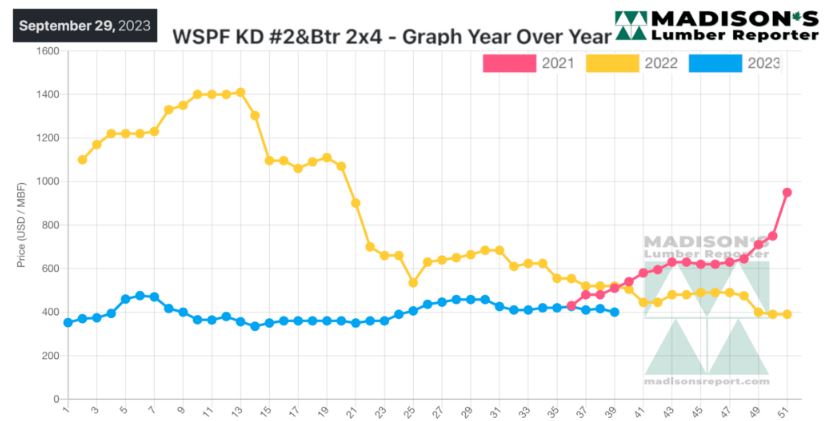

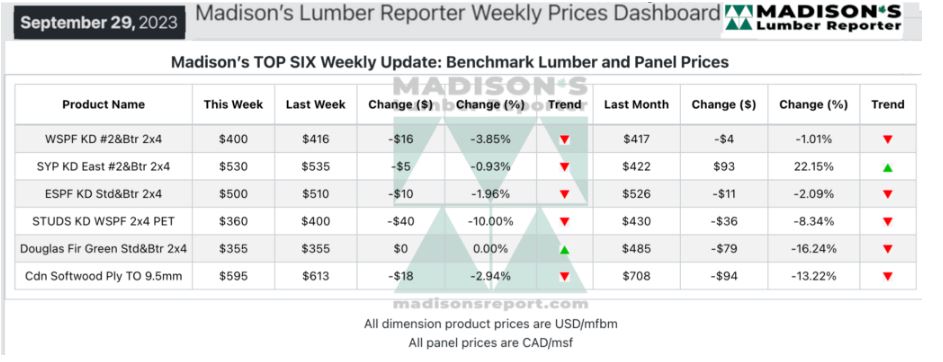

In the week ending September 22, 2023, the price of benchmark softwood

lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$416 mfbm. This

is up by +$6, or +1%, compared to the previous week when it was $410, said

weekly forest products industry price guide newsletter Madison’s Lumber

Reporter. That week’s price is down by -$1, or 0%, from one month ago when

it was $417.

Overall demand remained pokey in lumber, studs, and panels. There was an

uncertain tone to every transaction, and buyers stuck to just-in-time

purchasing.

The cautious tone among buyers was unabated, but tenacious traders of

Western S-P-F in the United States found pockets of amenable activity.

Players wondered whether the end of September will show some hustle.

Positive housing permit news gave producers something to hang their hats on

regarding potential upcoming business, though only time will tell.

With the lumber market in a flat, searching mode, players thought it was a

good time for their customers to cover some needs into October and maybe

even November.

Canadian purveyors of Western S-P-F lumber described a confused market as

autumn dawned. Buyers continued to rely on just-in-time purchasing. Flexible

secondary suppliers and a smooth transportation pipeline encouraged them to

stick to that strategy. Players warned their charges about sitting on lean

field inventories as cold weather and potential supply and logistical

disruptions loom.

For their part, Canadian sawmills reported a mixed bag of pricing and

availability. Order files were anywhere from prompt to two weeks out, mill-

and item-dependent.

The pace of demand and sales in Western S-P-F studs remained pokey to

hear Western Canadian suppliers tell it. Caution reigned among buyers, who

largely turned to the secondary market to find their preferred combination

of tally, price-point, and shipping timeline. While stud mills maintained

two- to three-week order files and firm numbers, players noted a

slow-but-steady increase in prompt offerings of late. Similar to many other

corners of the market, no one wanted to make the first move.

Compared To The Same Week Last Year, When It Was Us$520 Mfbm, The Price Of

Western Spruce-pine-fir 2×4 #2&btr Kd (Rl) For The Week Ending September 22,

2023 Was Down By -$104, Or -20%. Compared To Two Years Ago When It Was $480,

That Week’s Price Is Down By -$64, Or -13%.

More Reports: