It Is Normal That The Us Thanksgiving Holiday Marks The End Of True

Construction Season Across North America, Thus Also Lumber Sales, And This

Year Was No Exception.

It Is Normal That The Us Thanksgiving Holiday Marks The End Of True

Construction Season Across North America, Thus Also Lumber Sales, And This

Year Was No Exception.

However, given the discipline of sawmills over the past year to reduce

production volumes and curtail in an effort to keep supply in line with

demand, lumber prices actually strengthened somewhat as November drew to a

close. Now that 2023 is coming to an end, industry folks are able to look

back over the year and get a good view of what to expect for 2024.

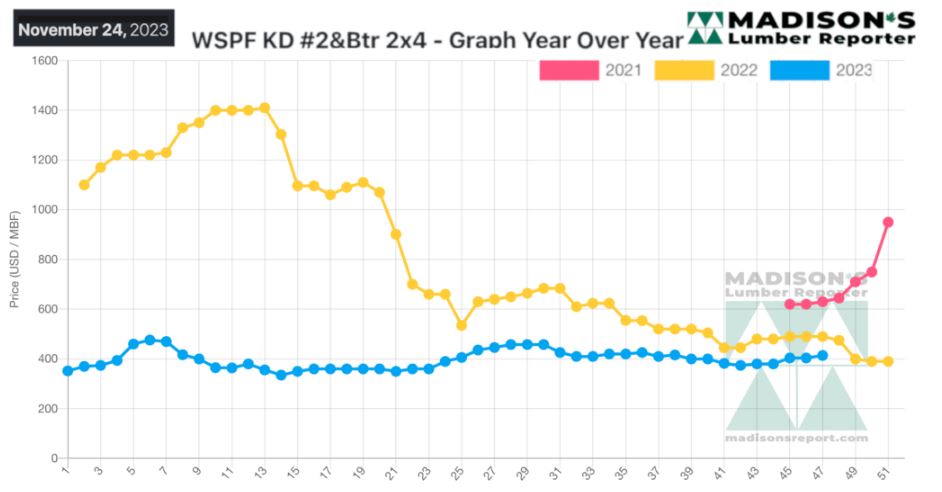

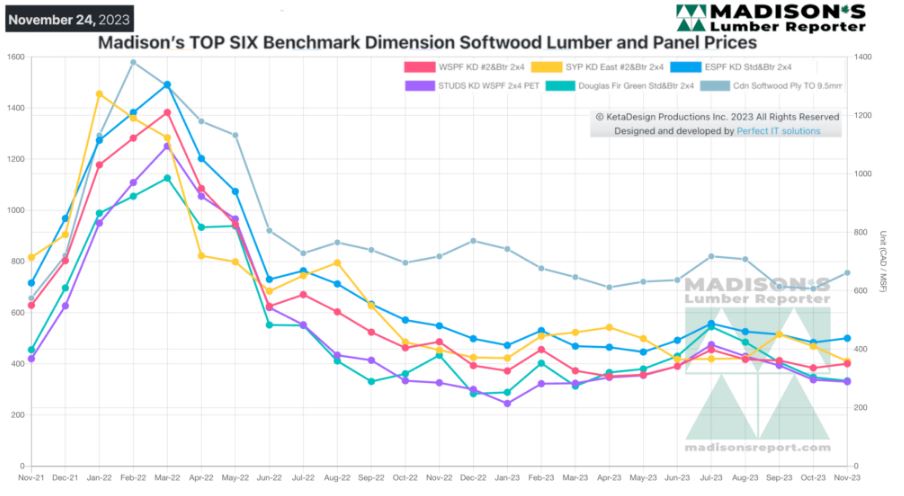

It is obvious from the graphs here that the extreme volatilty experienced

over 2020 – 2022 is behind us; indeed this year price trends are looking

extremely similar to 2019. Madison’s will be posting a direct comparison

between that year and this, coming up soon. Stay tuned!

Overall, a balanced pace to business emerged over the past several weeks,

with players expecting little change from here to year-end.

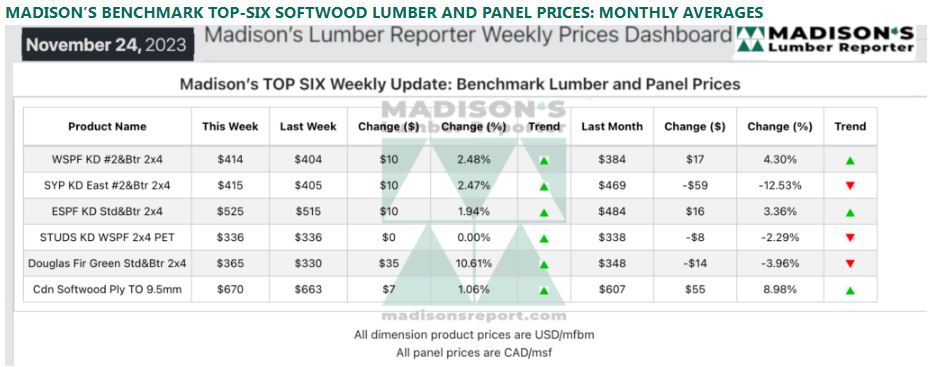

In the week ending November 24, 2023, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$414 mfbm. This is up

by +$10, or +2%, compared to the previous week when it was $404, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$20, or +5%, from one month ago when it was

$384.

Following a solid start to the week, the US Thanksgiving Holiday put a

predictable pause on sales of North American lumber from midweek-on.

Sales of Western S-P-F showed a firming trend early in the week before

players in the US headed out Wednesday for their Thanksgiving Holiday

breaks. Demand unsurprisingly slowed around midweek, but both primary and

secondary suppliers were content with their positions heading into the

pause.

Many distributors tried to convince their charges to cover their needs

before taking their holidays, warning those who preferred to wait that the

window of opportunity to buy would be gone in the following week. Time will

tell. Meanwhile, along with firmer pricing, sawmills established order files

into mid-December.

The Western S-P-F market had a feeling of tapering off according to

purveyors in Western Canada. That tone was only enhanced by the US

Thanksgiving Holiday, which took scads of buyers out of the game from

Wednesday-on.

Western Canadian producers were steadfast on their numbers. Standard- and

high-grade bread-and-butter dimensions even gained in pricing modestly over

the course of the holiday-shortened week. Prompt material was scarcely

available at the sawmill level. This lead those buyers in search of quick

shipment to turn largely to the distribution network, with mixed success.

As December approached, following roughly a month of meandering lower in

search of some price stability, the Southern Yellow Pine market appeared to

be firming up. Sawmills maintained asking prices at or on either side of the

previous week’s levels, as strong takeaway of 2×4, 2×6, and 2×8 #2&Btr

dimension was reported.

While buyer sentiment hadn’t changed much, the production side was showing

noticeably tighter supply overall. Meanwhile, secondary suppliers continued

to balance their immediate inventory needs with the directive to carry as

little stock as possible through year-end.

Compared To The Same Week Last Year, When It Was Us$490 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending November 24,

2023 Was Down By -$76, Or -16%.

Compared To Two Years Ago When It Was Us$630, That Week’S Price Is Down By

-$216, Or -34%.

More Reports: